Table of Contents

- Why Negative Gearing changes to Property in Australia shouldn’t hold you back from investing.

- 1. Negative gearing isn’t a wealth-building fundamental.

- 2. It’ll have transitional effects.

- 3. No policy change has stopped property value growth.

- 4. Negative gearing may not be the best solution for you.

- 1. The impact on house prices would be minimal.

- 2. It will further boost rental prices, extending the rental crisis.

- 3. The major problem is the supply shortage.

In late September, news shook many property inventors: the government asked the Treasury to model potential changes to negative gearing concessions.

However, by mid-October, it had been confirmed that negative gearing changes were ruled out.

While this result has relieved many investors, what if it’s the opposite?

In this article, let’s discuss if negative gearing restrictions should stop property investors in Australia.

Why Negative Gearing changes to Property in Australia shouldn’t hold you back from investing.

1. Negative gearing isn’t a wealth-building fundamental.

Before asking the “Should I stop investing” question, it’s important to ask another question: why property investment?

You invest in property because it’s a means of wealth-building. Believing in the growth of Australia’s property market and the power of leveraging, you put your money in properties and aim for reliable long-term capital growth, securing your retirement and/or build family wealth.

On your journey of building wealth, positive cash flow would be a great add-on, as that would help you save faster and complete your portfolio sooner. However, some investment properties cannot generate positive or balanced cash flow: according to ATO, in FY2021-22, 41.3% of property investors reported cash flow loss. For those investors, negative gearing is a helpful tool to reduce loss.

So, the wealth-building fundamentals here are the long-term compound capital growth and positive/increasing cash flow, while negative gearing is just a tool. Regardless of how the tool changes and shifts, we should always focus on the fundamentals.

2. It’ll have transitional effects.

No different from many other policy shifts, Changes in negative gearing have transitional effects. At the shock of the change(s), some investors would exodus the market because of low sentiment or cash flow pressure. That is more likely to happen in low-yield markets such as Sydney or Melbourne. As a result, rental supply would tighten. Given high rental demand, rents would rise, making landlords’ loss from negative gearing changes milder and milder.

3. No policy change has stopped property value growth.

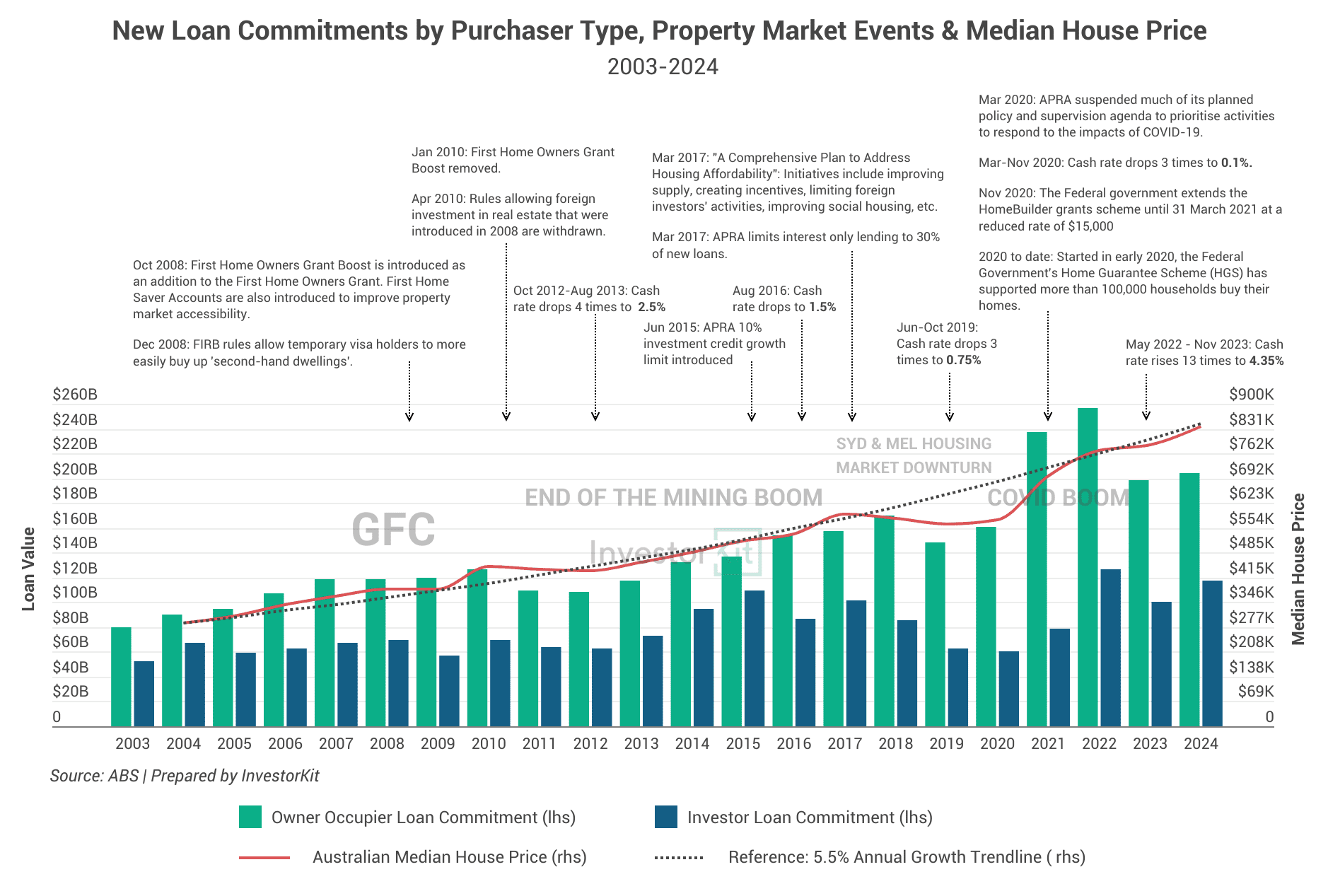

In the past 20+ years, there has been no shortage of tax and policy changes (chart below). However, one thing is certain: House values have increased by 188% on average across the country. Changes in cash rates, taxes, and policies might have impacted home buyer activities or investor activities for a while, but prices always return to growth, converging to the long-term average.

4. Negative gearing may not be the best solution for you.

While negative gearing is a good tool to reduce income loss, there may be better solutions for portfolio building. Most portfolio builders who grow a scalable portfolio working with InvestorKit buy in trusts, where negative gearing concessions don’t apply.

Why are they willing to give up the obvious benefits negative gearing offers? Well, for them, the benefits a trust can bring outweigh the negative gearing concessions.

So, consider your financial arrangement holistically: Work out a solution that works the best for you and your portfolio instead of chasing the most straightforward no-brain benefit.

Why cancelling negative gearing concessions is not the best move to improve affordability.

1. The impact on house prices would be minimal.

A model by the Grattan Institute shows that house prices would fall by around 2% if the labour government changed property tax breaks as mentioned in their election policies, including limiting negative gearing and halving the capital gain tax discount.

How can a 2% average decrease help solve housing affordability issue, considering even Adelaide, the relatively affordable capital city, has been 23% overvalued (prices need to decrease by 23% to meet the local residents’ affordability)?

However, negative gearing changes are not entirely powerless. According to modelling by NSW Treasury, tax changes could increase the home ownership rate in the long term by around 3%, from 67% to 70%. It can still help many renters become homeowners.

2. It will further boost rental prices, extending the rental crisis.

We have discussed the transitional effect of eliminating negative gearing concessions: as the number of investment properties decreases and rental supply tightens, rents would rise. A University of Melbourne study found that eliminating negative gearing would reduce the total housing supply by 1.8% and increase rents by 2.5%.

Australia is already experiencing a rental crisis with extremely low vacancy rates and rental surges nationwide. If carried out, the tax policy changes would only worsen the situation and make renters’ lives more difficult.

3. The major problem is the supply shortage.

Australia’s housing affordability problem is essentially caused by a severe shortage in supply: Over the past 10 years, the country’s population has grown by 16%, but the number of houses available to buy (for sale listings) has decreased by 34%. The supply shortage is contributed by a mix of many factors, including but not limited to:

- Extended hold period due to unreasonably high transaction costs (eg. the stamp duty bracket creep)

- Limited land supply and slow land-release processes

- Low development amount due to lack of planning certainty.

- High construction costs

- Shrinking household sizes

- Uneven distribution of population

- Lack of diversity in housing supply types (eg. public housing, build-to-rent.)

- etc.

To solve the supply shortage problem and improve affordability, the most effective ways are to address the causes: We need not only to build more housing supply but, more importantly, to have our population distributed more evenly, improve the efficiency of the planning system, have a fairer tax system to encourage stock mobility, enhance the diversity in housing/rental providers, etc.

(For more details, check our Australia’s Housing Supply Crunch Whitepaper where we analyse each causing factor in detail. By the way, a new issue is coming in November!)

Buffer is the key to weather tax changes.

In summary, while we believe that changing negative gearing concessions wouldn’t effectively improve affordability and wouldn’t be a good move for any political party, it wouldn’t be the end of the world for property investment if it happened. After all, it’s not your wealth-building fundamental but just a tool.

Just in case it happened, it’s important to maintain your cash buffer, like how you weather high interest rates. Also, similar to high interest rates, the impact of tax changes is short-lived. Rental growth will keep improving your cash flow as long as you’re in a market with a healthy local economy and without oversupply issues. You could be already enjoying a positive cash flow in just a couple of years.

Fast rental and value growth do not automatically happen: just think of Perth from 2013 to 2020. So be sure to do your market research before buying. Too busy to do your own research? Reach out to the professionals! InvestorKit is Australia’s #1 data-driven buyers agency that invests heavily in data and research. Would like to learn more? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)