“You should buy below the median price.”

You may have received such advice.

Better not listen to them.

Many think that you shouldn’t buy a house that’s more expensive than the local median price, as the cheaper ones tend to have better growth potential.

But is their theory right? To find out, let’s do a little research about the Median Price.

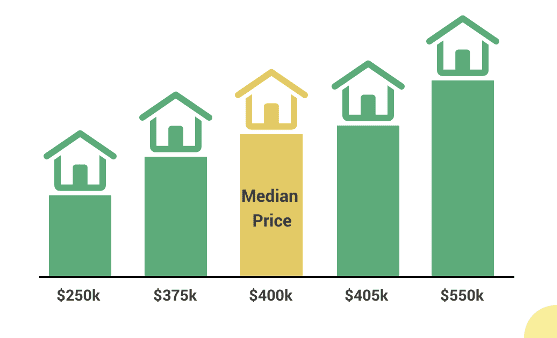

The Median Price is the middle value of a list of sale prices in order from lowest to highest.

It is one of the most important indicators in assessing the market trend and is usually more reliable than the average price. The average tends to be affected by a few exceptionally high or exceptionally low sale prices, while median price does not.

Many investors believe that if you buy below median, there is potential to add value by renovation, adding rooms, adding outdoor living areas so that you can make more profit upon resale.

It sounds reasonable, but is it always the case?

Well, we need to clarify two things:

(1) Median price is not always the best indicator of the local market trend; and

(2) even in the suburbs where median price is reliable, capital growth is not always higher for a house cheaper than the median.

First, let’s see where we can rely on the median price and where not.

Where does median price work well?

a. Suburbs where a fair amount of transaction activities happen regularly. An example is the suburb of Buderim in the Sunshine Coast. As a market there has always been a healthy amount of activity, with 70-90 for sale listings and 50-70 sales per month. The price segmentation is stable, so the median price reflects the market trend very well.

b. Suburbs with mostly homogenous properties even though they are relatively small. An example is the suburb of Goodwood in GreaterHobart, where most of the houses were built in the 1950s and are of very similar size and condition.

Where is median price not as accurate?

a. Suburbs where properties are tightly held and few transactions happen. This typically happens to rural areas, such as Ross Creek in the Gympie Region of Queensland. The median price of such areas usually equals the sale price of the only sold property, which is not statistically meaningful.

b. Suburbs with two or more distinct markets, such as seaside suburbs with waterfront luxury houses and inland affordable houses. One example is Point Frederick in Central Coast, NSW. The median price in August2021 is $1m, but the waterfront mansions on the peninsula are mostly worth multi-million dollars, while houses in the north tend to be smaller and mostly below $1 million. In this type of suburb, it would make more sense to examine each. sub-market separately instead of looking at the combined suburb median.

Now that we have understood that median price is more reliable in some suburbs than others, should we buy based on the median price where it is reliable?

Let’s look at some real-life examples…

We have got 4 properties as listed below.

Round 1: 6 Karibu Street vs. 25 Illawong Street

In 2019, 6 Karibu Street was sold for $650k, which is lower than the Buderim medium of $652.5k that year. 2 years later, it was resold in 2021 for $860k, having achieved 38% growth.

A few kilometres to the north, 25 Illawong Street was sold for $1.6m in 2019, much higher than that year’s suburb median. 2 years later, it was resold in 2021 for $2.25m, having grown for 41% in value.

There were no major renovations for either of the properties during the 3 years.

In this round, the above-median-price property has performed better than the lower priced one.

Round 2: 5 Bretz Street vs. 2 Bunyarra Court

In 2018, 5 Bretz Street was sold for $615k, which is lower than the Buderim median price $661.3k that year. 3 years later, it was resold in2021 for $815k, having grown 33% in value.

A couple of kilometres to the east in the woods, 2 Bunyarra Court was sold for $800k in 2018, higher than the Buderim median. 3 years later, it was resold for $990k in 2021, having achieved 24% growth.

There were no major renovations for either of the properties during the 3 years.

In this round, the below-median-price property has performed better than the more expensive one.

By looking at the above cases, you must have noticed that the growth potential of a property does not solely depend on whether it’s above or below the suburb median price. The house’s location, land size, house size, condition, neighbourhood and many other factors work together in producing the varying results.

So, it’s not wise to forecast growth simply by comparing the prices.

However, at the end of the day, you still need a price reference to decide whether a region suits your budget or not. If not median price, what should you look at?

We recommend you check price segmentation.

Price segmentation tells you how house prices are distributed across different sale price brackets (segments) in an area. Below is the price segmentation for the SA3 of Buderim in July 2021. Whilst no perfect rule, we often suggest that the two price segments with the highest sale volumes should be your target market. For example, you would want to buy in the price range of $600k to $1m.

The reason for buying in those price segments is this.

On one hand, you want to have as many comparable properties as possible to support your decision, whether to buy or sell. Buying in the highest-sale-volume price segments would provide you with the most comparable sales so that you buy with the most confidence.

On the other hand, the number of sales reflects the attractiveness of properties to purchasers to an extent. By buying in the groups with the largest number of sales, you are most likely getting a property more appealing to the mass market, which means that you can expect competing buyers when you are selling.

Of course, we are not saying that properties in the smaller or higher price segments are bad. It’s just that the lack of comparable sales may increase hesitation and suppress desires. These, in return, could lead to volatile prices.

In a nutshell, capital growth is influenced by a combination of various factors. Data and examples have proven that a simple comparison between a property’s price and the local median is not enough to infer the property’s growth. So, forget about median price, you need a more comprehensive market analysis around the area and your target property before making your purchase decision.

By comprehensive analysis, I mean a systematic process examining all market indicators (eg. price, days on market, inventory, yield, vacancy rate…) from the macro level (State & SA3) to the micro level (neighbourhood& property). With this research and analysis system, InvestorKit has helped hundreds property investors nail outperforming properties and grow their wealth fast.

Would like to discuss more about our market analysis methodology? Or need some inspiration on how to locate your next investment? Why not book a FREE no-obligation 45-minutes consultation to see if our services are a fit.

.svg)