“I’m well in my 40s now, is it too late to start investing at 40 in properties?”

We’ve met many first-time investors in their 40s—or even later—who regret not entering the market earlier to enjoy more years of compound growth. Looking ahead, they worry they don’t have enough time before retirement to build wealth through property investing.

…But have they really missed the chance to invest in real estate?

The simple answer from Australia’s #1 property buyer’s agency is NO.

If you’re in your 40s or 50s and are wondering about “is it too late to start investing at 40”, this blog is for you. Here, we’ll discuss your advantages, how to start investing at 40, what to be aware of as a “starting-late” investor and why it’s NEVER too late to start.

Advantages of Investing in 40’s

1. You’re in a strong and more stable financial position.

Most investors who start investing at 40 have more secure financial positions with high savings, well-established careers, and likely fewer debt burdens. This can provide them with a stronger foundation for making property investments.

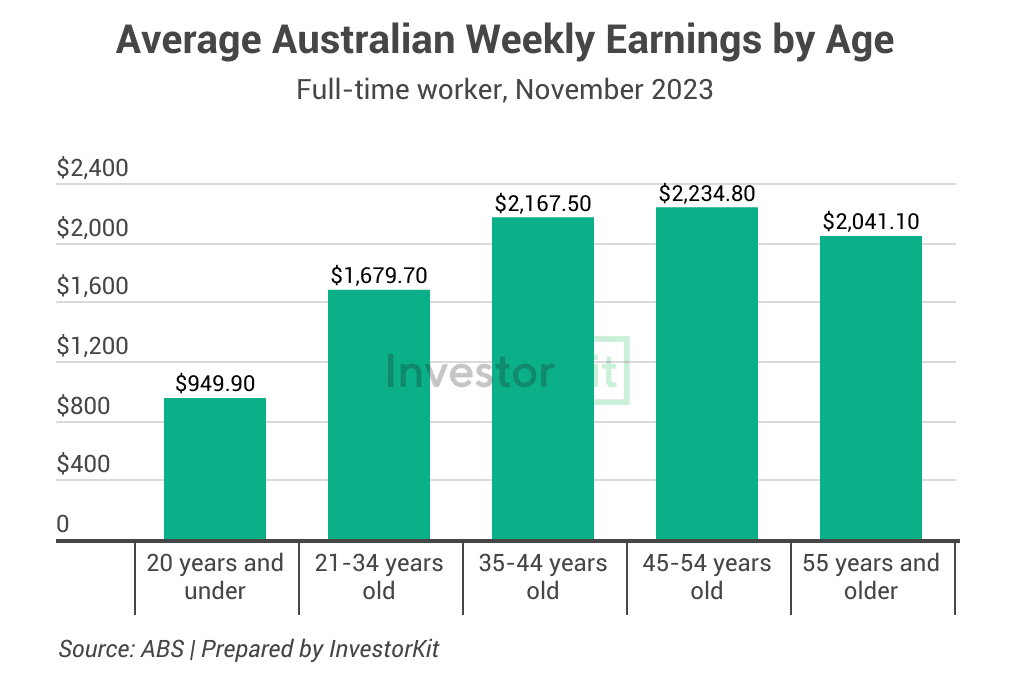

We’re not just speculating. According to ABS, the 45-54 age group is the highest earning group, with an average weekly income of $2,235 for a full-time worker ($116,210 annually). Following that is the 35-44 age group, with a weekly income of $2,168 ($112,710 annually), and 55+ years, who earn $2,041 per week ($106,137 annually) on average (chart below).

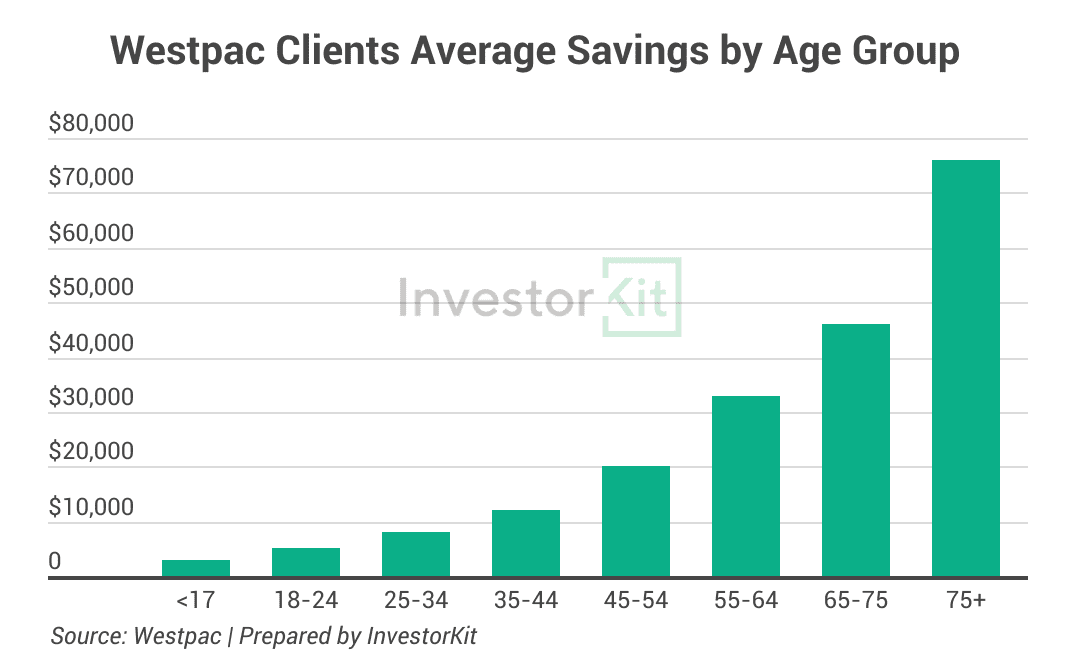

Savings increase as we age, too. The trend is perfectly shown in the chart below, which shows the average savings amount of Westpac customers by age group. Note that there is a clear climb between 35-44 and 45-54, which is more evidence that you are likely to be able to save faster than the younger investors.

Most of our clients who start investing at 40 also report that they have paid off their primary residence, making them almost debt-free to enter the investment market.

2. You have more financial experience and better financial literacy

Multiple research papers have shown that financial experience and financial literacy, which are crucial for wealth-building and financial decision-making (Lusardi & Mitchell, 2014), are positively correlated with age.

- Research by Li et al in 2013 and 2015 (titled “Complementary cognitive capabilities, economic decision making, and aging” and “Sound credit scores and financial decisions despite cognitive aging”) revealed that older adults tend to have more financial experience in general and may also be more financially literate than younger ones.

- Research by Lusardi and Mitchell in 2014 (“The economic importance of financial literacy: Theory and evidence“) showed that middle-aged adults outperform both younger and older adults regarding financial literacy.

- Research by Jenna et al. in 2021 (“Benefits of Experience and Knowledge for Older Adults’ Monetary Sequence Preferences”) found that age has a positive correlation with financial experience and financial literacy, which simply means that the older you are, the more financial experience and financial knowledge you have. The result also showed that greater the financial experience, the higher the level of financial knowledge.

- Some other research (Strough, de Bruin, et al., 2015; Strough, Parker, et al., 2015) about aging and decision-making has said that personal experiences older adults have accumulated over time may be beneficial to their decision-making. As a result, older adults tend to make better financial decisions than younger adults (Jenna et al., 2021).

By now, you might have some clarity about “when should you start investing”.We are not saying that younger investors necessarily know less about investment or make worse decisions, but showing middle-aged investment newbies that you may have started investing later than many, but with a richer experience and better decision-making abilities, you could be much more efficient in reaching your wealth-building goal now than ten/twenty years ago.

3. You are more focused on achieving your goal.

Students are usually the most focused and study the most effectively before a deadline.

It is the same here. When you know your wealth-building deadline (i.e., your retirement age target) is approaching, you feel more pressure to diligently save and invest and likely progress faster.

In comparison, when someone starts investing in their 20s or early 30s unless they are extremely self-disciplined, they would be distracted much more easily by everyday enjoyment: a pair of Jimmy Choo, a new iPhone, big-name camping gear, and so on. Many of these seemingly small expenses could significantly slow down their investment journey because of the thought, “It is still early”.

Another reason you could be more focused when you are older relates to the previous point we discussed: more prosperous financial literacy. Research by Anisa in 2020 on the influence of financial literacy on the impulsive buying behavior indicates that the higher the consumer’s financial literacy, the lower the impulse buying behaviour, and vice versa. As a result, starting later when you have more financial experience and higher literacy helps you focus on what’s important and achieve your goal faster.

What to Be Aware of When Investing at 40

You may have lower trial-and-error affordability.

As much as we want every investment decision to be perfect, mistakes can happen. While you have 30 years ahead of you, it’s much easier to get out of a non-performance investment, redeploy the capital and enjoy many more years of healthy growth. However, when there are only 10 or 15 years ahead, the opportunity cost of any wrong investment decision would seem much higher.

You may need to sacrifice lifestyle expenses.

Although you may have more savings and earn more income, you may still need to work on cutting back quite significantly on spending. This is not only because you need to save for the deposits but also in preparation for potential negative cash flow.

While the best scenario is to have your investment property sustain itself (rental income to cover outgoings including loan repayment), it’s almost impossible, considering the current high interest rate environment, to buy 3-4 properties in a short period, across different locations, and have them all generate positive cashflow. Here is an example. Say you’ll purchase your first two properties in North Queensland and Perth, where prices are affordable and rental yields are high enough for you to enjoy positive or balanced cashflow; However, for your 3rd, you would like to diverse in market cycles and buy in NSW – rental yields in this state are not as healthy as in QLD or WA, so you may need to contribute to the monthly cashflow from your own pocket for a few years before its rental price grows to a high enough level.

That’s the sacrifice you want to be prepared for when you take out a decent amount of debt in a short amount of time.

Case Study

If Cam could do it, you can do it, too!

Now, I want to share with you a story about our client Cameron (check his full story here). In short, he purchased his first investment property in late 2020, and by late 2022, he had already acquired three properties across Adelaide and regional Queensland. By Jan 2024, the three properties’ total value had increased by 42% (from $1.55m to $2.2m).

Three properties in just two years, and 42% value growth in less than 4 years! How did Cam do it?

Yes, his great saving habit helped him kick into the market. The rest?

Market selection and the financing strategy.

- Market selection: Backed by InvestorKit’s research, Cam decided to invest in Adelaide, a rising market, in 2020, which proved to be one of the best-performing markets in the following years. Then, in 2021, he purchased in Toowoomba, a high-pressure market that achieved 16% annual growth in the next 3 years. In mid-2022, he entered Townsville, an early-adopter market at that time, in order to enjoy its entire growth cycle – As expected, Townsville’s house price growth has been accelerating year by year since then.

- Financing strategy: Cam didn’t solely rely on his savings to scale up his portfolio. He took out of the equity gained from the capital growth of his Adelaide property to purchase the Toowoomba one, and the ongoing growth from the first and second houses generated the equity to be used for his third one.

If Cam could achieve a scaled portfolio in just a couple of years, you can, too! You already have the advantage of a good financial position, rich financial experience, high discipline (and probably even more savings than Cam). You need to enter the right markets that would allow you to gain fast capital growth and speed up the scaling process.

Don’t know how to start investing at 40, how to buy an investment property or how to pick the right market? Consider using a buyer’s agent! InvestorKit is a data-driven buyers’ agency that dedicated ourselves to understanding Australia’s property markets through data. We pair our clients with the best markets that suit their portfolio-building requirements to achieve investment goals faster. Sounds good? Talk to our team today by clicking here and requesting your 15-minute FREE no-obligation discovery call!

Acknowledgement:

Thanks to our Research Analyst, Grace Nguyen, for data collection, literature review, and drafting.

.svg)