The Central West region of New South Wales, encompassing cities like Bathurst, Orange, and Dubbo, experienced significant property market growth during the COVID-19 pandemic. Bathurst’s median house prices rose by 45%, and Orange saw a 53% increase, both surpassing Sydney’s 37% growth in the same period. Post-pandemic, these markets have stagnated, but recent data indicates a potential recovery. Understanding the overall NSW regional property forecast is essential to make informed investment decisions and strategise for long-term property growth.

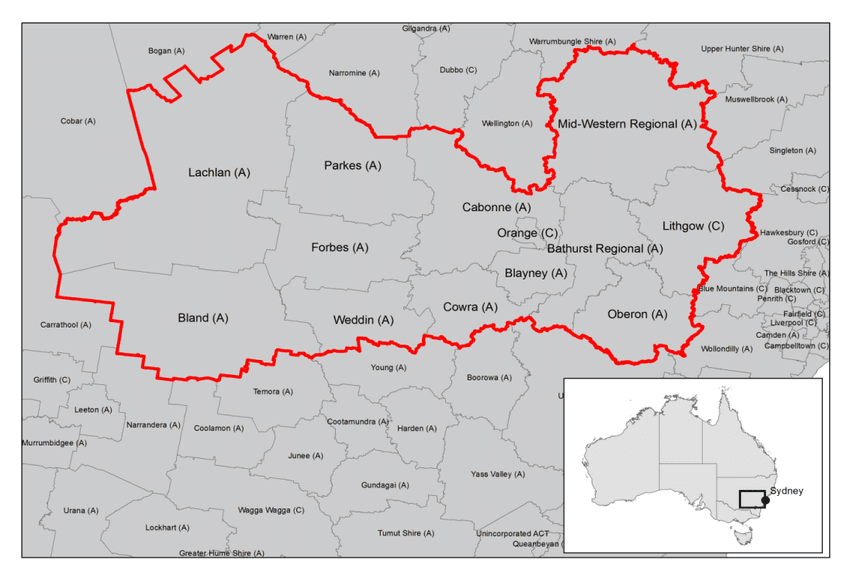

The Central West Region NSW

Stretching nearly 500 kilometres, the Central West region of New South Wales spans from the temperate Central Tablelands just west of the Blue Mountains to the semi-arid Central West plains.

The region is abundant in natural resources, with agriculture, mining, and tourism serving as key drivers of employment and economic growth. Health and education sectors also play an increasingly important role in the local economy.

The Central West comprises 11 local government areas, including Bathurst, Blayney, Cabonne, Cowra, Forbes, Lachlan, Lithgow, Oberon, Orange, Parkes, and Weddin. While located in the Orana region, Dubbo is often considered one of the Central West cities.

The Central West NSW property markets surged during the COVID property boom. Bathurst’s median price increased by 45% in just 2 years, while Orange’s soared by 53%. By comparison, Sydney’s median house prices grew by 37% during the same period.

Two years after the COVID boom, the region stagnated and seemed forgotten by many. How are they doing now? Let’s explore the three largest cities: Bathurst, Orange, and Dubbo.

By examining Bathurst real estate trends, the Orange NSW housing market, and Dubbo property investment prospects, we’ll compare them side by side and ultimately rank their respective growth potential.

Property Market Analysis

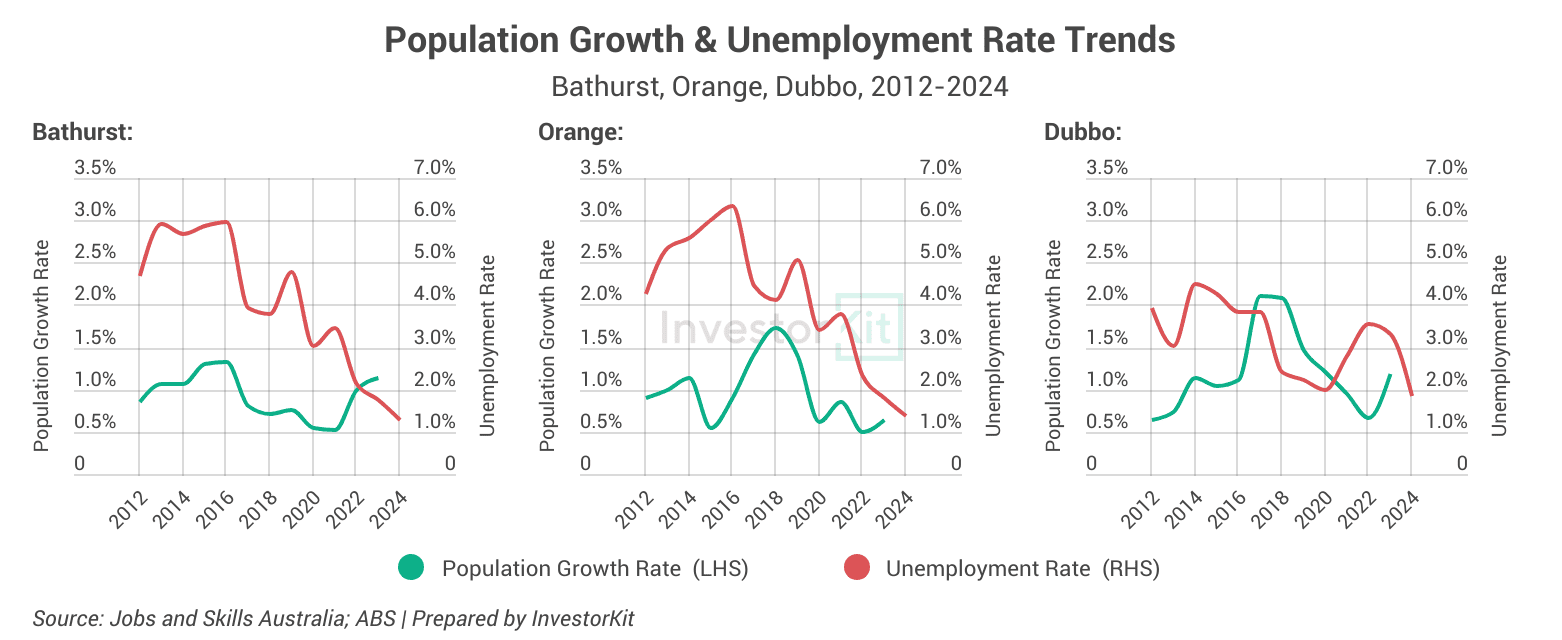

Population growth rates in the three cities are moderate, lower than Australia’s average level of 2.3% annually. However, population growth is almost never the strength of the three cities and is not a major property growth driver.

Over the past decade, Bathurst’s annual population growth has been lower than 1.5%; Orange only saw >1.5% population growth in 2018, while Dubbo had a population growth pike in 2017-18. None of them were experiencing high population growth in 2021&22 during the property boom.

Despite the moderate population growth, their local job markets are thriving. Bathurst and Orange’s unemployment rates have been trending downward since 2016/17. Dubbo’s unemployment rate has been relatively low over the decade. After a brief increase in 2021/22, it’s now fallen to under 2%.

The low and declining unemployment rates indicate active job markets in the three cities, underpinning solid demand for housing.

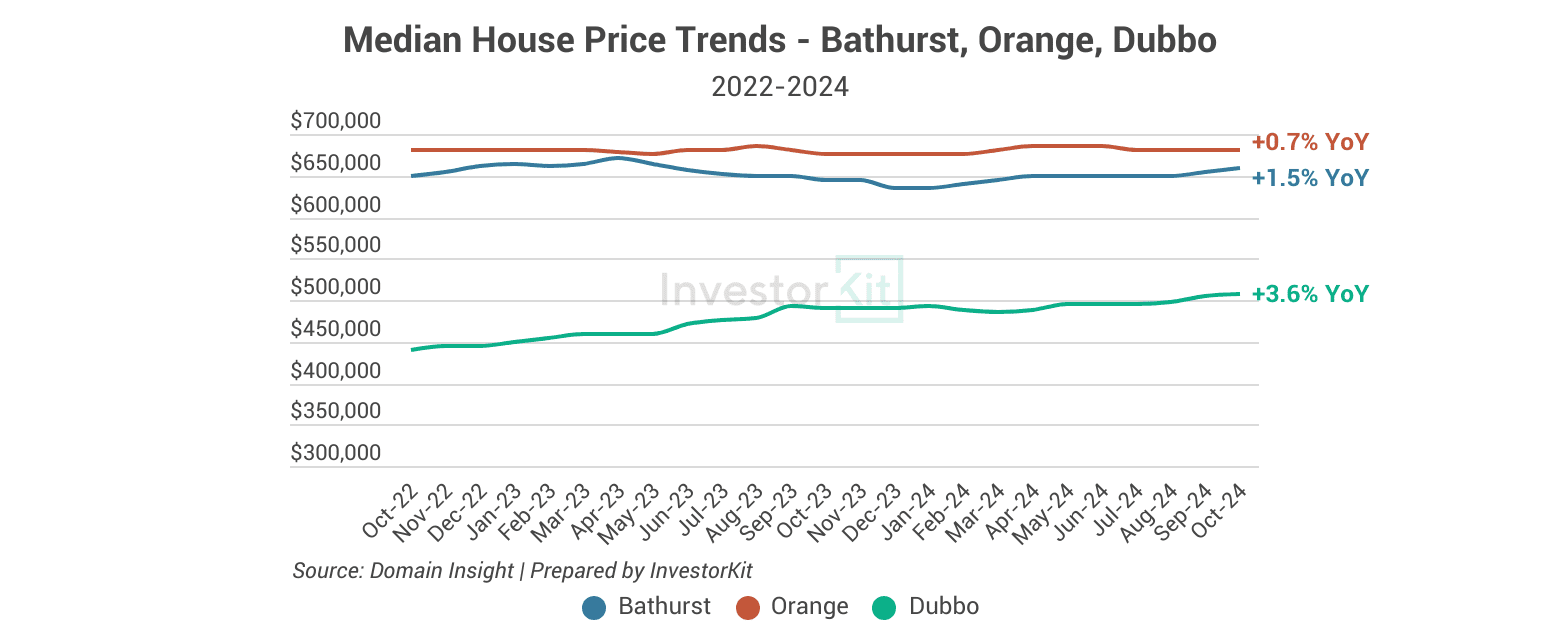

Sales market pressure is still somewhat weak but showing signs of recovery.

House prices in Bathurst and Orange were essentially in stagnation in the past 2 years. Dubbo, likely due to its affordability and milder growth over 2021/22 compared to the other two cities, achieved healthy growth in most of 2023 before significantly slowing down.

At the end of 2024, we are seeing signs of a slow recovery, with Dubbo leading in market pressure:

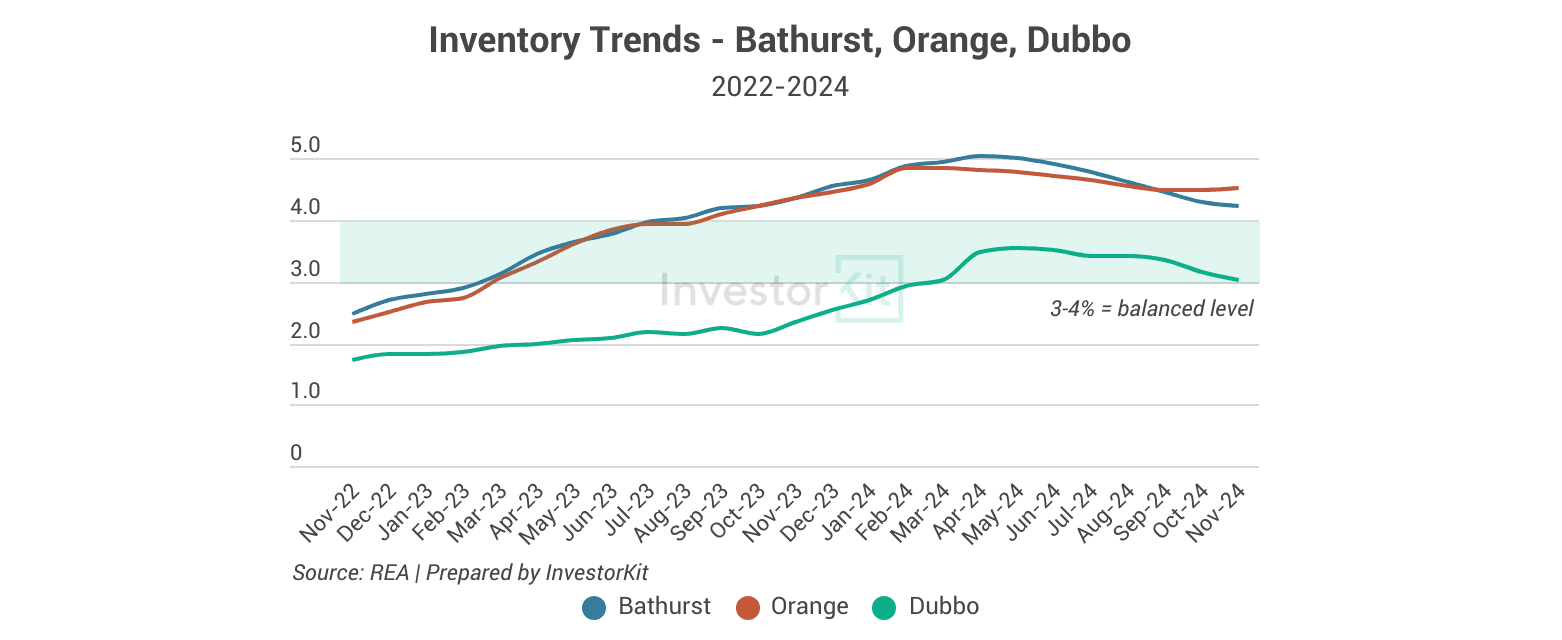

Inventory Trending Downward

Bathurst and Orange’s inventory levels move close to each other – understandable due to their proximity geographically and at price points. Their inventories have been declining since early to mid-2024 but are currently still higher than the balanced level. Between the two, Bathurst’s supply is tightening faster than Orange’s.

Dubbo, on the other hand, has always been enjoying tighter supply over the past 2 years. Inventory has now decreased to 3 months of stock, exerting more pressure on prices than the other two.

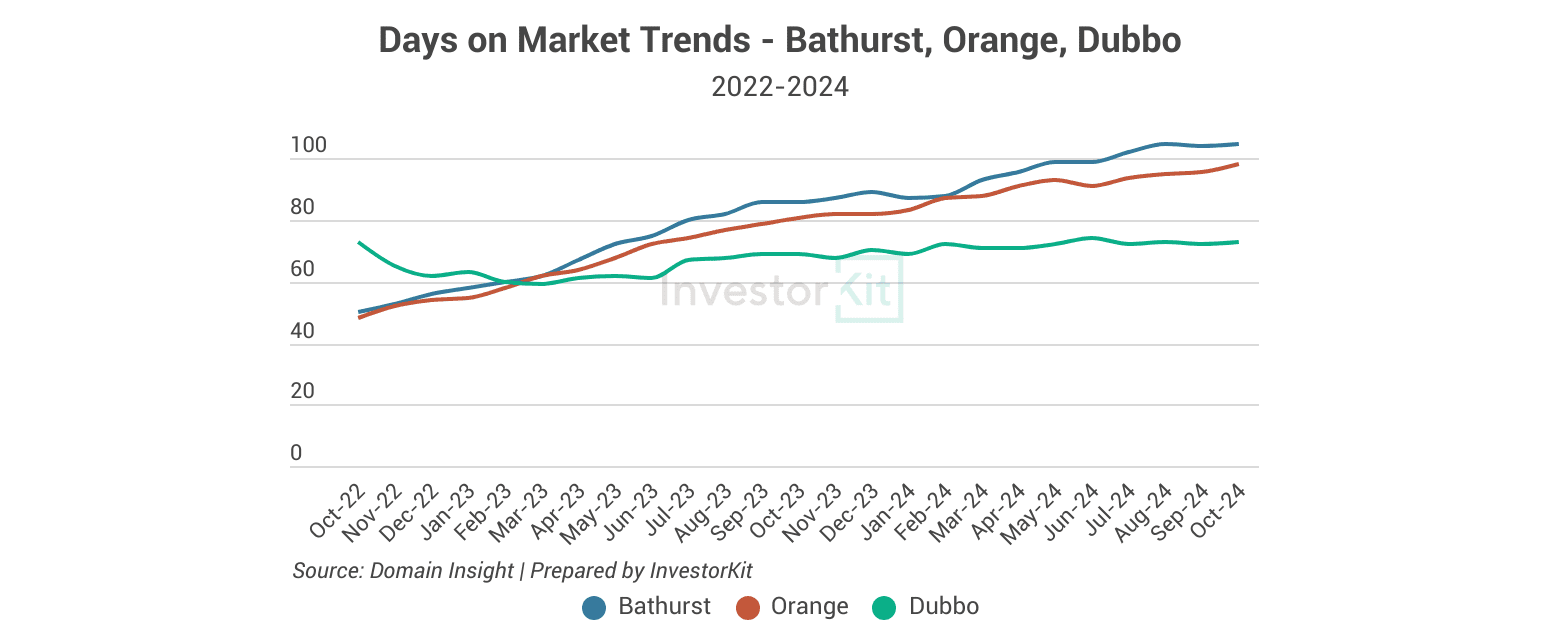

Days on Market Stabilising

While inventories have declined in all three cities, days on market (DoMs) show slightly different trends.

- Bathurst’s DoM seems to be stabilising as the inventory level approaches the balance range.

- Dubbo’s DoM has flatlined over the past half a year, and we could see some decline in the coming year if inventory continues to drop.

- In the meantime, Orange’s DoM is still trending upward. It might need more time before stabilising, given its inventory is going down slower.

Rental Markets are tightening.

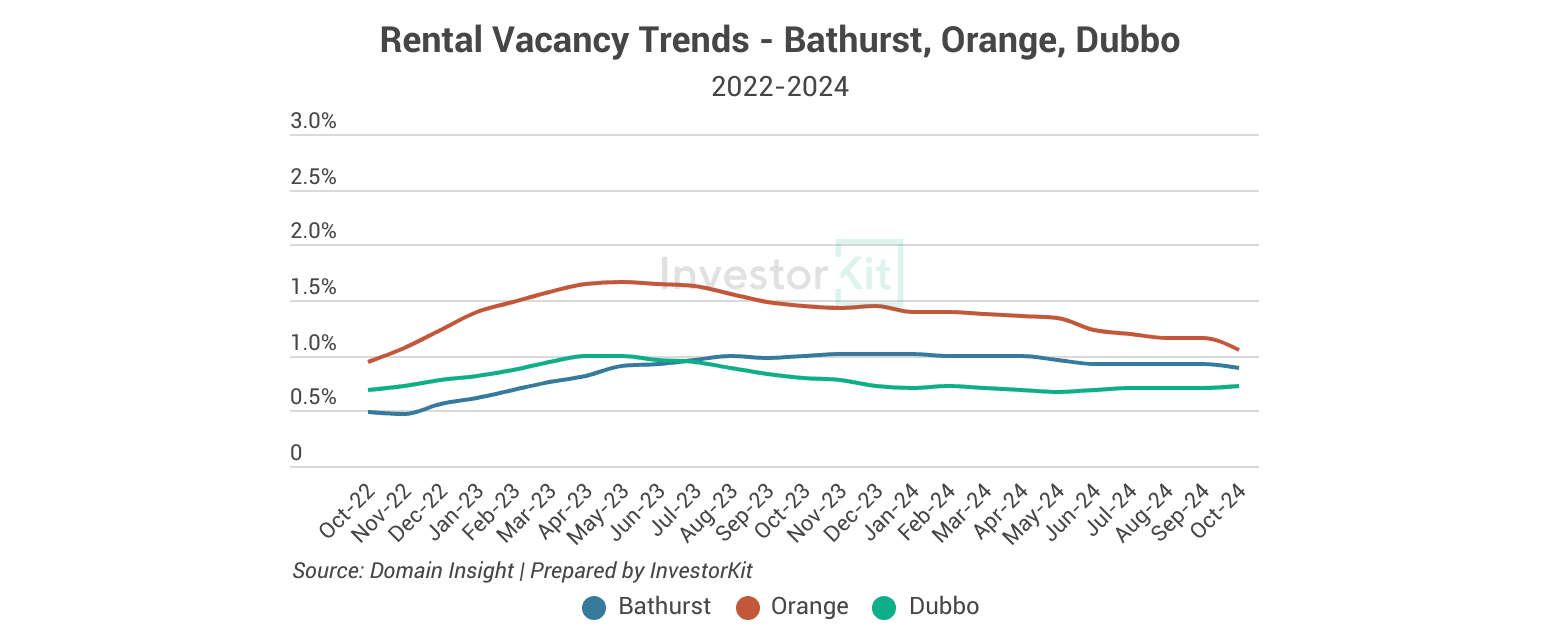

Vacancy Rates Declining

Vacancy rates in the three cities are all trending downward, with Orange seeing the most significant decline.

With the lowest vacancy rate, Dubbo saw the highest annual rental growth among the three cities (6.7%), followed by Orange (5.0%). Bathurst only achieved 2.1% rental growth in a year.

As vacancy rates decrease, more rental growth can be expected in the coming year.

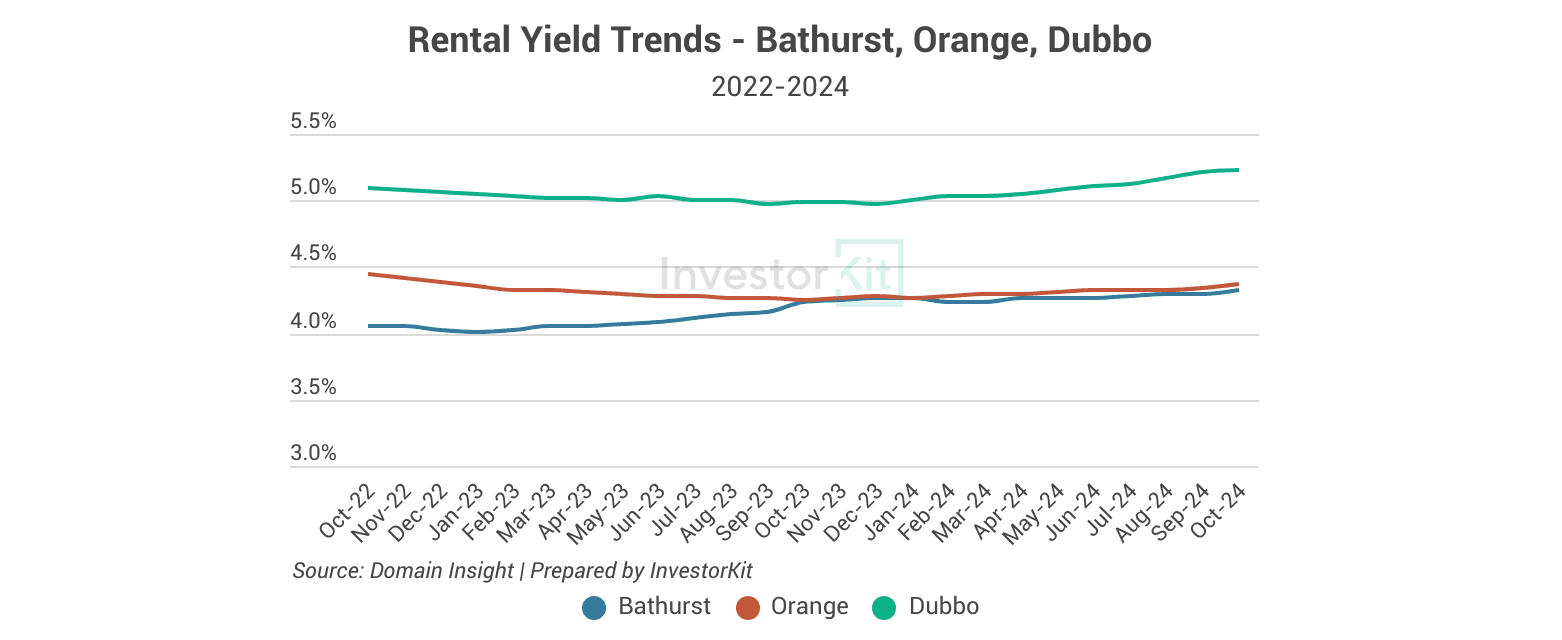

Rental Yields Trending Upward

Rental yields in the three cities are all increasing as rental growth exceeds sales price growth. Dubbo’s yield is the most healthy and improving the fastest. The increasing rental yields, over time, will attract more demand to the sales market.

What’s likely to happen next?

- Dubbo is leading the recovery among the three cities, as seen in the lower inventory level, stable days on market, low rental vacancy rate, and faster yield improvement. Its last 10-year annualised growth was just 5.9%, well in line with the long-term average (5-7% per year), giving us more confidence that it’s moving into a second-wind growth phase.

- Bathurst real estate trends indicate that the city is likely to be the second to see a recovery, based on the relatively steady decline in inventory, the stabilising days on market, and the considerable yield improvement over the past 2 years. Its last 10-year annualised growth was 7.1%, close to the long-term average, making it easier for the city to achieve better growth moving forward.

- The Orange NSW housing market will likely recover the latest among the three due to the slower decline in inventory and the still-increasing days on market. Its last 10-year annualised growth was 7.7%, higher than the long-term average, so, from a cycle perspective, it needs more time for correction before entering the next growth cycle.

InvestorKit is Australia’s #1 buyer’s agency with a team dedicated to helping Australian property investors understand the property markets across the country and make well-informed decisions on where to buy, using data-driven insights. Would you like to know more about our research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

People Also Ask

Is the Central West region a good place to invest in property?

The Central West region shows good promise for property investors. Dubbo, in particular, shows strong signs of growth potential, with Bathhurst not far behind.

What are the main factors driving property prices in Bathurst, Orange, and Dubbo?

Property prices in these Central West cities are mostly driven by healthy job markets, indicated by low and declining unemployment rates. Declining inventory levels and stabilising or decreasing DoMs contribute to upward price pressure. The region’s tight rental markets with low vacancy rates and increasing yields also attract investors and bolster overall demand. Dubbo’s relative affordability, compared to Bathurst and Orange, further fuels its growth.

What are the risks of investing in the Central West NSW property market?

The risks that come with investing in the Central West NSW property market include potential market stagnation, as seen post-pandemic. Varying recovery speeds, as observed in Orange’s slower rebound, can also impact investment timelines. Lastly, although not a primary driver, moderate population growth compared to larger cities could limit long-term growth potential.

How has the Central West NSW real estate market performed in recent years?

The Central West NSW property market experienced a significant boom during the COVID-19 pandemic, with cities like Bathurst and Orange surpassing Sydney’s growth. Following this surge, the market stagnated. However, recent data indicates a potential recovery, with Dubbo leading, followed by Bathurst. Orange is showing a slower recovery trajectory. Overall, Bathurst and Orange have seen growth that is close to or exceeding long-term averages, while Dubbo’s has been slightly below.

.svg)