What is Rentvesting?

Rentvesting, a blend of “renting” and “investing”, means you rent a place to reside while investing in properties elsewhere.

This strategy has become increasingly popular among property investors amid interest rate hikes and house price surges in many parts of the country.

By following this method, investors can cut down on their living costs, living the lifestyle they desire while initiating their wealth-building journey. That sounds like a great idea, but is it a good idea for everyone?

In today’s blog, get ready to uncover the bare truth of rentvesting to see if it’s your right strategy.

Benefits of Rentvesting

Benefit 1: Rentvesting can help you cut down costs while building your wealth

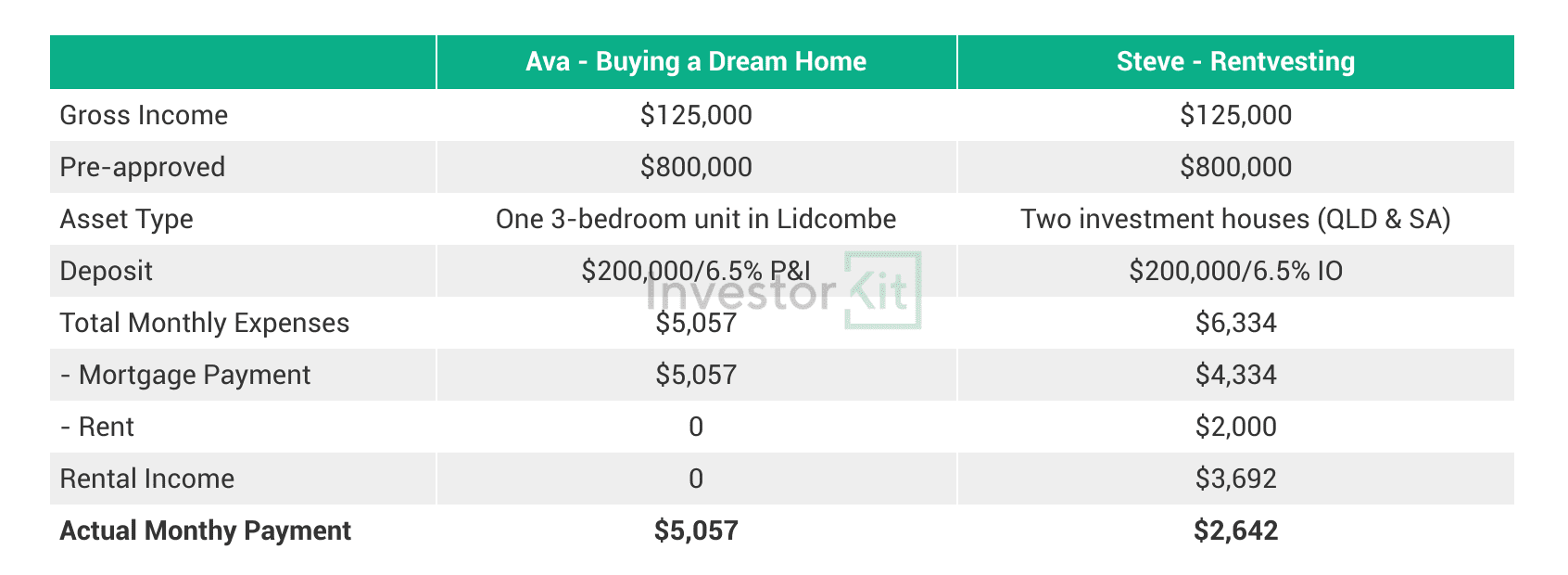

Imagine Ava and Steve, two young professionals living in Sydney. They both earn $125,000 a year (before tax), have no debt, and are pre-approved for an $800,000 loan (80% LVR, 6.5% interest rate, 30 years).

- Ava decides to buy a 3-bedroom apartment in the Sydney suburb of Lidcombe for $1 million to live in.

- Meanwhile, Steve purchases two investment properties (2 houses) for $500,000 each (one in regional Queensland, the other in regional South Australia) while renting an apartment with his partner near the Sydney CBD. His share of rent is $500/w.

- Ava makes principal and interest (P&I) payments, while Steve opts for interest-only (IO) repayments.

So, how can rentvesting help cut down costs? Let’s take a look at the table below:

At first glance, Ava seems to be in a better position with lower monthly expenses. But here’s the twist: Steve’s two investments generate around $3,692 a month in rental income (with a 4.8% net yield each). After factoring in this income, Steve’s actual out-of-pocket expenses drop to just $2,642—almost half of what Ava is paying.

How about the long-term growth prospects? Let’s see who’s likely to be in a better financial position in terms of capital growth in 20 years.

According to Domain Insight data, Sydney’s unit market has grown by an average of 116% over the past two decades (2004-2024), while regional QLD’s house market increased by 180% and SA’s by 186%. Based on these figures, Ava’s 3-bedroom unit would reach $2.16 million in 20 years. Meanwhile, Steve would see his portfolio grow to approximately $2.83 million over the same period. There’s a $670,000 difference in capital gain between Ava and Steve.

By rentvesting, not only does Steve benefit from living near the CBD—an area he couldn’t afford to buy in—but his week-to-week expenses are also more manageable. Plus, with better asset choices, Steve is on track for stronger long-term wealth growth.

Benefit 2: Rentvesting gives you better flexibility while preventing the risks of becoming an “accidental investor”

For those who want or need to relocate frequently for work or lifestyle changes, renting is a good option. Instead of locking yourself into a huge mortgage for a “Dream Home”, renting offers the freedom to live wherever you wish, experiencing different neighbourhoods, cities, or even countries without the burden of financial commitment.

For example, a young couple who prefers to live in a vibrant urban centre may find renting an apartment a good idea. Later, if their work situation changes or they want to start a family, moving to the outer suburbs for a larger house is easy.

However, suppose a couple buys a home and later discovers they don’t want to stay there forever. In that case, they may have to become ” accidental investors”: Not willing to sell (due to poor value growth, high transaction costs, stressful campaign, or even emotional attachment, etc), they decide to turn this home into a rental and buy or rent another place to live.

This solution wouldn’t be bad if they’d bought the right asset at the beginning. By “right asset”, I mean a property with a healthy rental yield and solid long-term growth potential that can easily fit into their wealth-building plan.

But what if they bought the wrong type of asset?

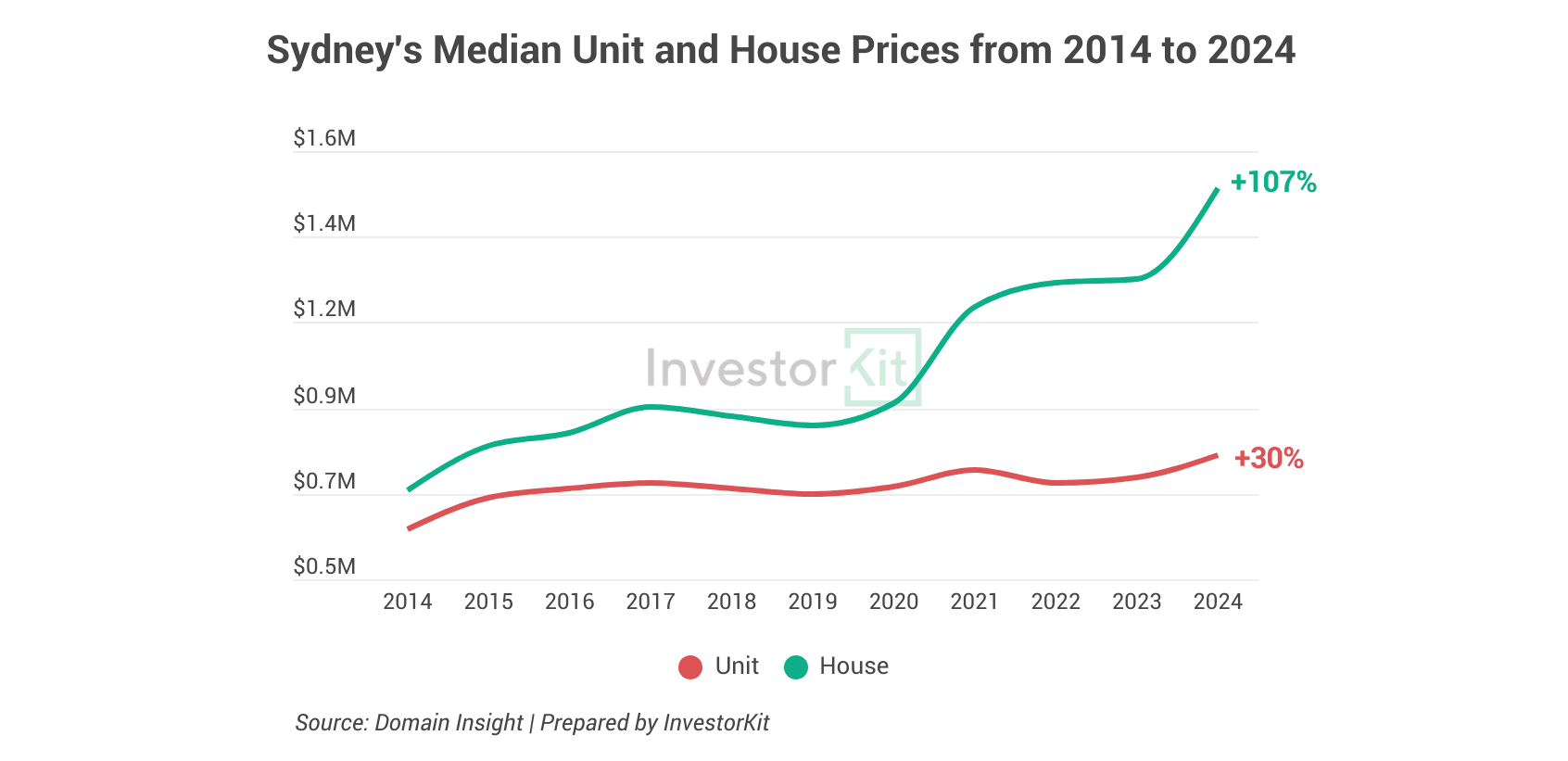

As house prices skyrocket in many major cities, purchasing a unit seems more of a viable solution for many. However, what they don’t realise is that the units’ long-term growth can be far less promising. Take Sydney as an example (see chart below). Over the past decade, the value growth of apartments has been about 3.6 times lower than that of houses!

A unit might be a great home option for many people due to its affordability and low maintenance. Nevertheless, turning it into an investment without careful planning could impact your borrowing capacity, set unrealistic expectations for wealth growth, and limit your ability to make future purchases.

Is Rentvesting a Good Idea?

While rentvesting offers benefits, it may not be the best strategy…

If you’re living in a low-price-high-yield location

Imagine you’re planning to move to a high-yield and extremely affordable location like Broken Hill. Let’s compare the costs of renting versus buying.

In Broken Hill, the median house price is $202,000, the median weekly rent is $330, and the rental yield is 8.5%.

- Renting: Your monthly rent would be around $1,400.

- Buying: Your monthly mortgage payment (on interest-only terms, with an 80% LVR, 6.5% interest rate, and 30-year loan) would be approximately $867.

That’s a difference of $533 per month, meaning you’d pay significantly more to rent than to own.

If you don’t like the idea of rental increases or frequent moving

To many, renting means sacrificing their stable and secure life and taking the risks of moving out anytime. Renters commonly face rent hikes at lease renewal times, and sometimes, the landlords do not want to renew the lease for various reasons, eg. they may sell the property, or they want their children to move in, etc. It’s perfectly understandable if you emphasise peace of mind over fast wealth-building progress.

If you are not willing to give up First-Home Buyer benefits

In many states, if you buy an investment property before buying your first primary place of residence (PPOR), you’ll lose the opportunity to claim the First-Home Buyer Grant (FHBG) when you eventually buy your actual first home, so if you want to take advantage of the FHBG, be careful about going revesting from the beginning.

Three scenarios where you may want to stop rentvesting

We discussed in the above section that if you live in a low-price-high-yield area, rentvesting won’t be beneficial. However, even if you’re in an area where rentvesting is financially beneficial, it doesn’t mean that you should never stop doing it. Here are three scenarios where you may want to buy a home instead of rentvesting.

- Are you going to live in this property for at least 10 years? — If the answer is “yes”, buying a home can make sense. While it might not always be the best financial solution, owning a home offers peace of mind and better clarity on your budget and investment plans. Consequently, you can focus on your future investments without the concerns of rising rents or instability.

- Is it part of your wealth-building plan? — If the home you are considering buying is big enough, it can become part of your wealth-building strategy. When you retire and downsize, the equity you’ve built in this property could be high enough to pay off a big chunk of your debt.

- Is it your forever home? If it’s a “yes”, and you see your family living there for generations, go for it! It might slow your investment journey a bit, but all the family memories you will create there will make it all worthwhile.

All in all, it’s about your preferences. Rentvesting can be a strategic option for those seeking to kick-start their wealth-building adventure while reducing costs, staying flexible and chasing lifestyles. However, buying a home will give you peace of mind if you’re more into the idea of living under a secure roof and are not comfortable taking the risks while rentvesting.

This blog is inspired by two InvestorKit Podcast episodes:

Rentvesting in 2024: Key Factors to Consider

Doing The Numbers On Rentvesting – With Arjun Paliwal

Check them out for more discussion on rentvesting!

While rentvesting can be a good wealth-building strategy, it’s not a solution. You can’t ensure fast wealth growth without a clear investment plan or the right location choice. No idea where to start? The InvestorKit team is here to help! Our dedicated strategists will help you build the most efficient portfolio plan, and our devoted research team constantly review market data across the country in search of locations that best suit your plan. If that sounds good, chat with us by clicking here and requesting your 15-minute FREE no-obligation discovery call!

.svg)