“Perth’s house market is expected to rise by 4% in 2025.”

Reading this, you might think someone’s living in a parallel universe, considering how tight Perth’s market is right now.

But this isn’t just anyone’s opinion – it’s KPMG’s forecast from their latest Residential Property Market Outlook report. Released last week, the report analyses economic and property market trends and provides growth forecasts for each capital city over the next two years.

So, let’s take a closer look.

The Forecasts: Are They Accurate?

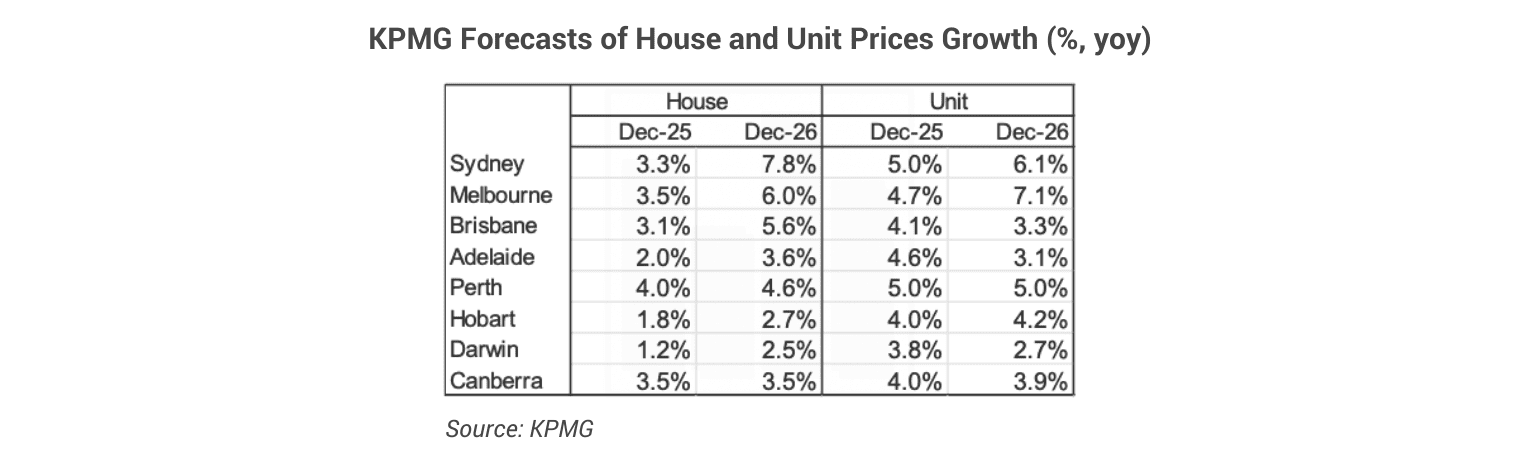

Here’s a snapshot of KPMG’s house and unit price growth predictions across Australia’s capital cities in 2025 and 2026.

To many, the forecasts for Perth, Adelaide and Brisbane seem surprisingly low, considering the high market pressure we are seeing in the data.

So I got curious: how accurate have their past forecasts been?

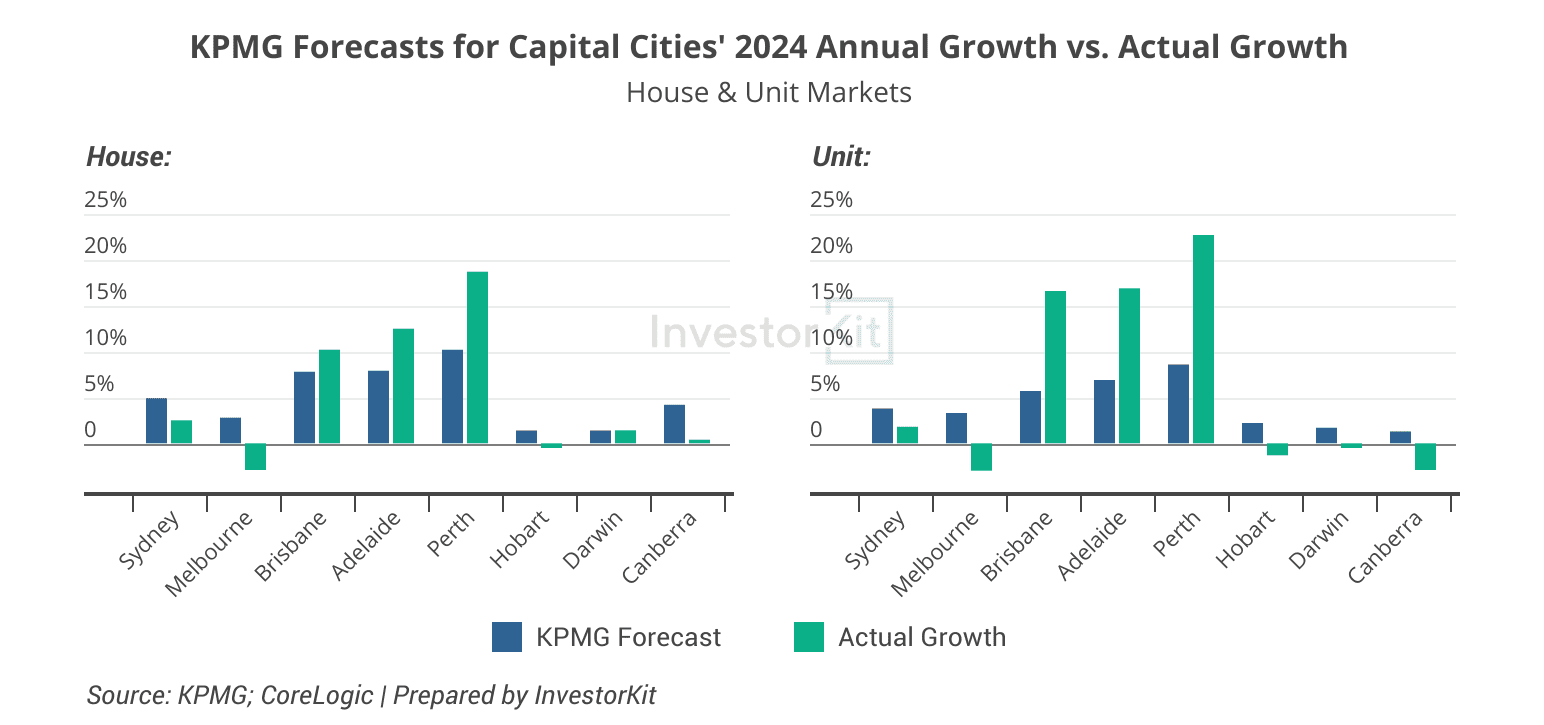

The charts below compare KPMG’s previous forecast (made 6 months ago) for 2024 with what actually happened.

While they correctly identified the growth leaders – Perth, Brisbane and Adelaide – the forecast numbers were way off.

And that’s when it hit me: big names don’t always mean precise forecasts.

KPMG excels at macro trends and financial market analysis, but forecasting precision depends on factors like data availability, variables considered, and industry expertise.

The Trends: Where the Real Value Is.

Despite the not-very-accurate numbers, many of KPMG’s observations on key influencer trends in their previous report were spot-on. Here are a few examples:

- Building approvals fell well below underlying demand, worsening housing affordability;

- Uncertainty about borrowing capacities should be reduced as the RBA tightening cycle tops out;

- High rental costs may make owning a home more appealing;

- Rental costs are expected to remain high.

These trends have been consistent with what data has shown us in 2024.

Key Trends from KPMG’s Latest Report

Here are some key trends that would be more useful for decision-making than the forecasting figures.

Market Influencers

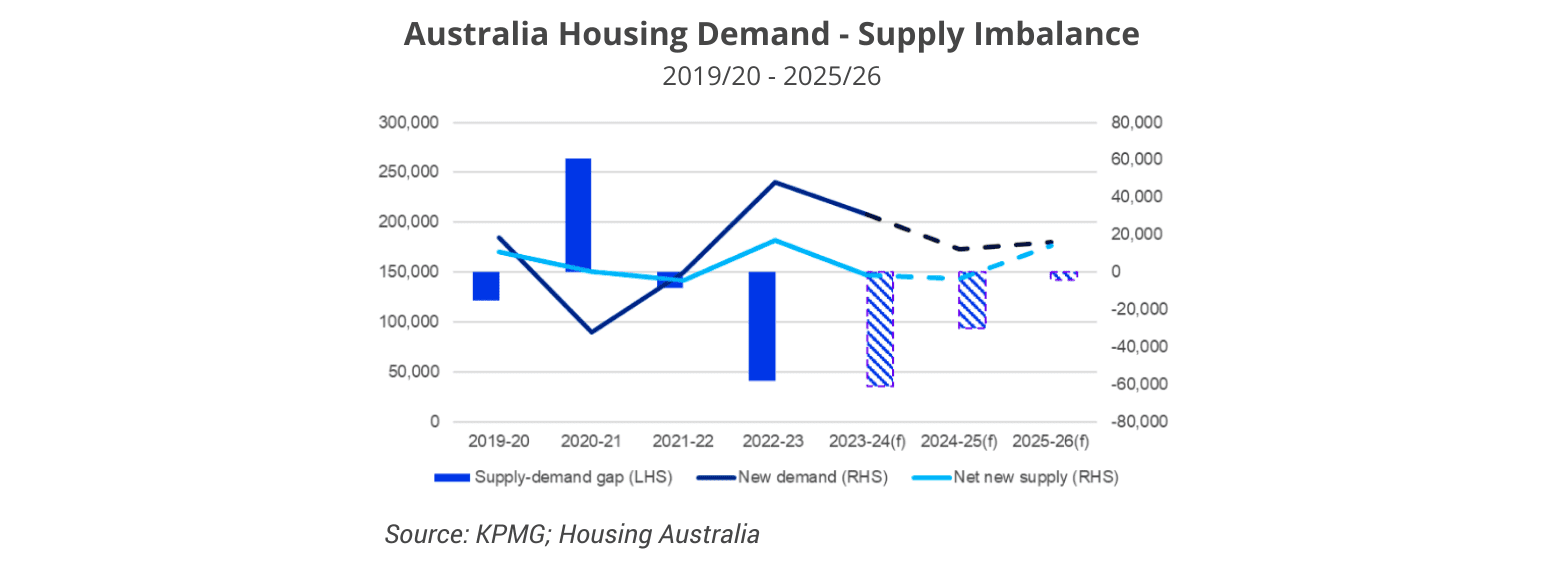

- Building approvals are increasing, but the imbalance between housing demand and supply will persist in the coming 2 years (chart below).

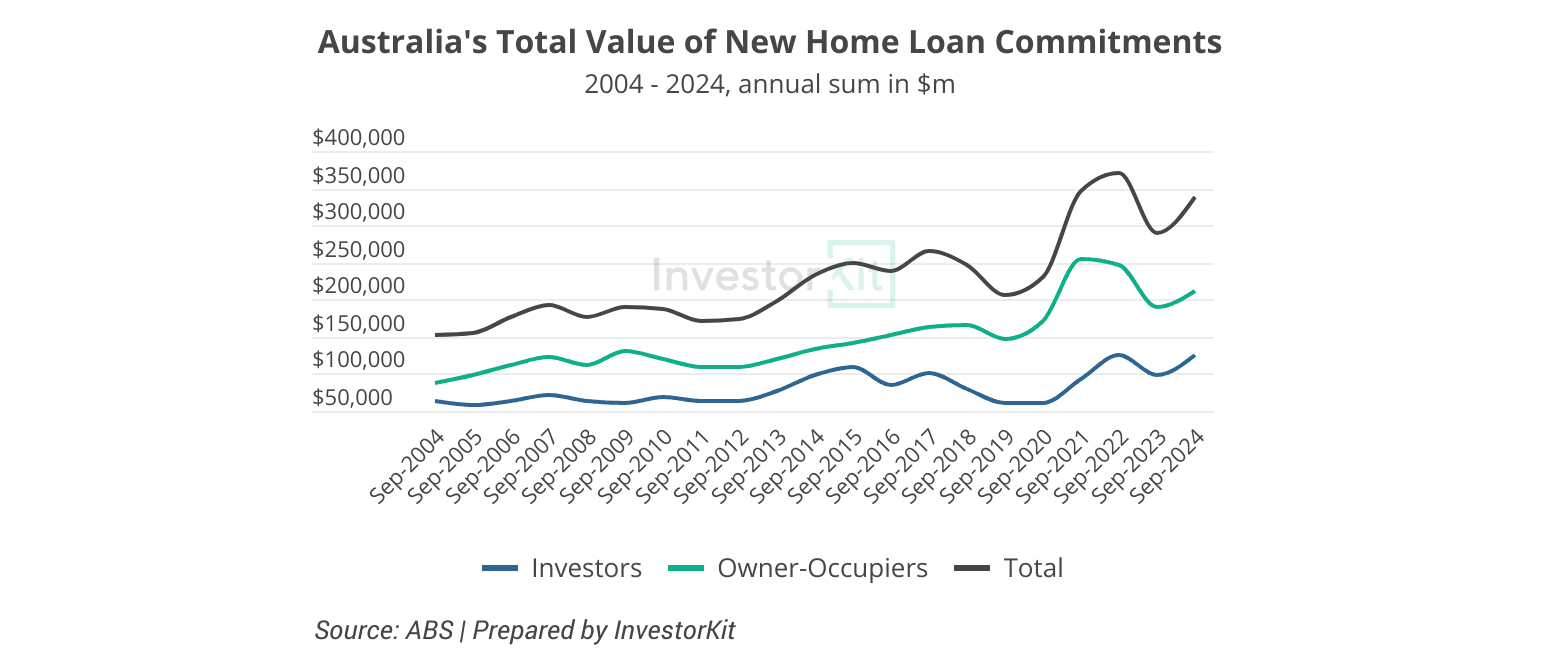

- In the financial market, loan arrears are picking up but are still at a low level, while buyer confidence is strengthening, reflected in the growing value of new home loan commitments (chart below).

- The rental surge is expected to ease, and the high rents will likely make buying more appealing than renting in many markets.

Capital Cities Market Growth

- Perth is expected to continue leading the market, driven by a strong resource sector and government spending.

- Brisbane will experience affordability constraints, leading to modest growth, but investor sentiment will likely remain strong (especially with the Olympics on the horizon).

- Adelaide is expected to see more moderate price growth over the next two years due to a pick-up in housing completion, affordable challenges, etc.

- Sydney’s property market is anticipated to demonstrate resilience, backed by strong overseas migration and a housing supply shortage.

- Melbourne is projected to recover in 2025, with growing housing demand and relative affordability offsetting challenges such as the land tax on investment properties.

- Darwin’s strong government spending is expected to help the city escape the current stagnation, although that may take time.

- Canberra and Hobart are forecasted to continue growing modestly.

Speaking of trends, InvestorKit has published our own 7 Trends that Shape Australia’s Property Market in 2025, covering trends across affordability, rental crisis, supply-demand imbalances, demand shifts, and more. Click here to get your free copy!

If this KPMG report has taught me anything, it’s this: There will always be forecasts out there that could be very different from one another. You can either chase numbers and get confused, or focus on key trends and let real data reveal what’s happening.

At InvestorKit, we choose the latter.

We don’t blindly follow forecasts — instead, we gather as much raw data as possible and use our proven market pressure analysis system to make informed investment decisions.

Would like to learn more about how we research the markets? Book your 15-min FREE no-obligation discovery call today!

.svg)