Australia is one of the least affordable housing markets in the world.

In the recently released Demographia International Housing Affordability Report (2024 edition), Sydney, Melbourne, and Adelaide are among the top 10 most unaffordable cities in the 94 cities examined, ranked #2, #7, and #9.

Housing supply shortage is always one of the top causes of the country’s housing affordability issue. In today’s blog, let’s zoom into Australia’s housing supply crunch and discuss the top three factors that have led to it. Shall we?

1. Extended hold periods have reduced market mobility, bringing established supply down.

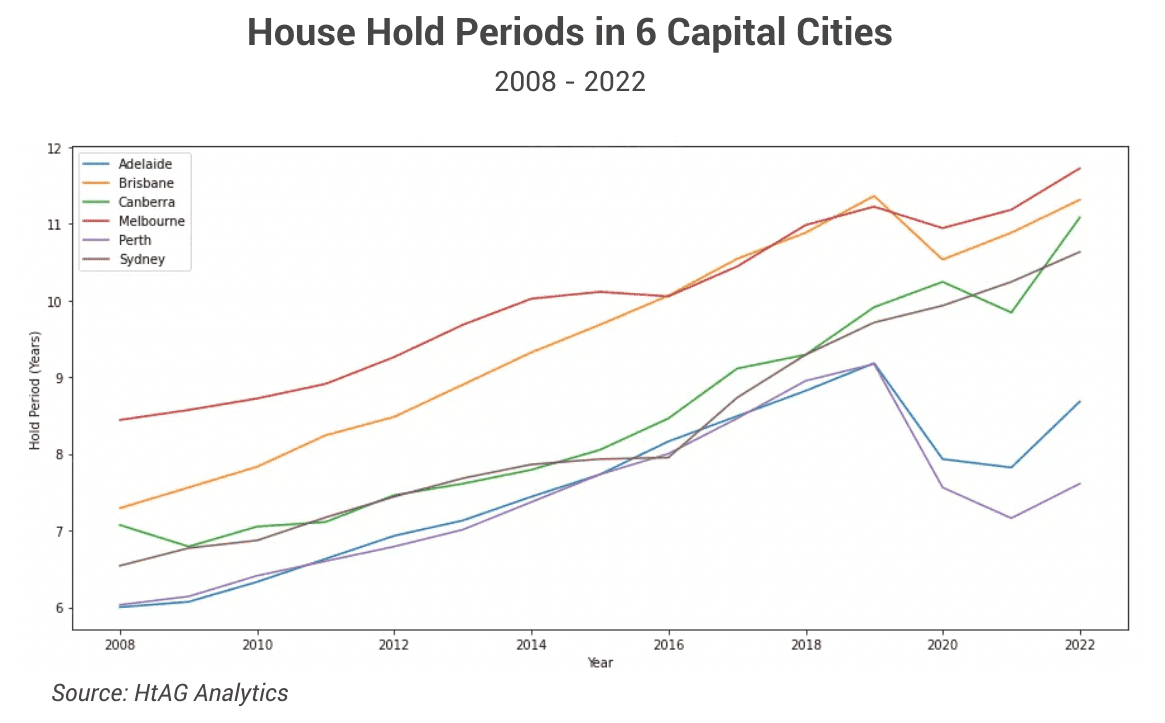

The chart below demonstrates that Australians are holding onto their properties for longer.

The increasing hold period is attributed to many factors. For individuals, longer hold periods could be because of house growth rates, personal financial plans, desires changes (e.g., elderlies choose to age in the current home instead of downsizing), belief in long-term investment, etc. However, on a national level, a clear common cause is the surging transaction costs, especially stamp duty.

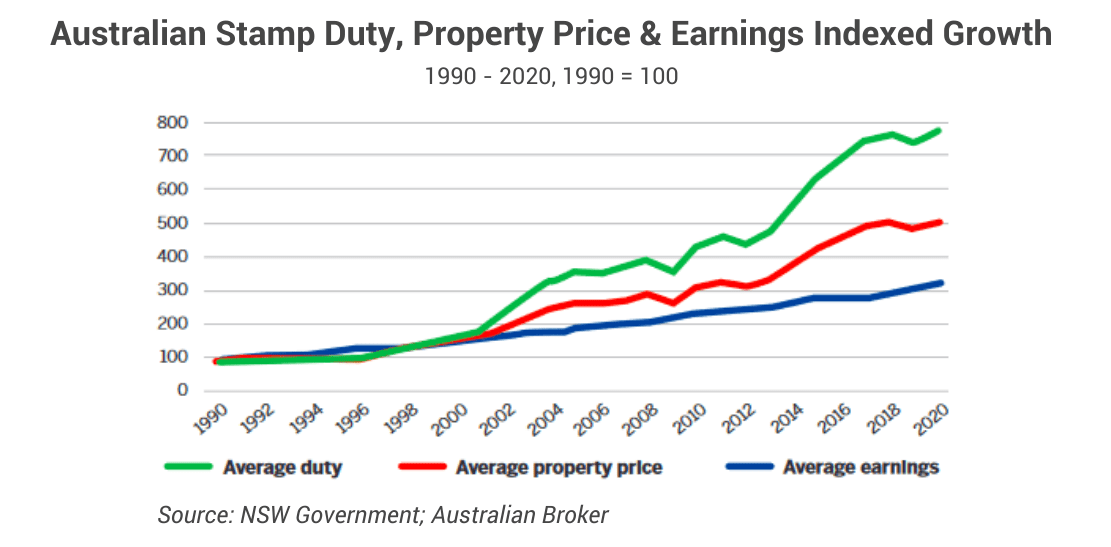

The chart below shows that in 2020, Australia’s household income was about three times that of 30 years ago, while property prices were five times, and stamp duty was almost eight times the amount 30 years ago.

The vast difference in stamp duty and property price and income growth is primarily caused by the effect of stamp duty bracket creep, which has not moved in line with the natural change in house prices.

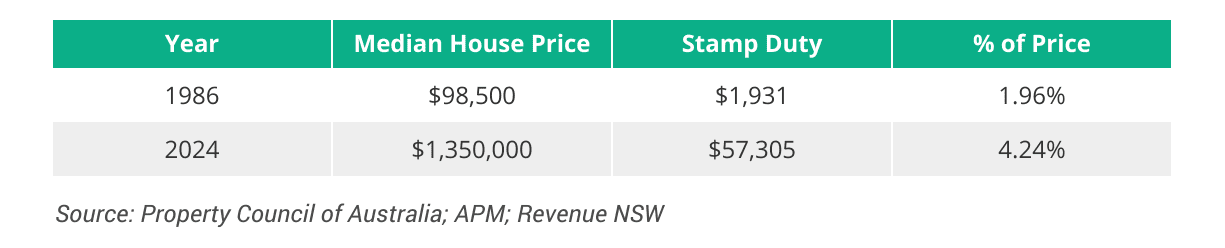

The table below shows a Sydney example. In 1986, property buyers paid approximately 2% of the property value to buy a median-price house, while now they have to pay more than 4%. The increased cost of changing houses encourages people to stay in their current homes for longer, i.e., longer hold periods.

NSW started indexing stamp duty thresholds to the inflation rates in 2019 and introduced a stamp duty reform in 2023, increasing the exemption threshold. While these changes are not making too much of an impact, they’re a good start.

2. Planning uncertainty and high construction costs slow the pace of new supply.

- Planning uncertainty

The State of the Nation’s Housing 2022-23 report by the National Housing Finance and Investment Corporation (NHFIC) advises that the increased time for development approval (DA) remains a challenging issue for housing supply. This is due to complex legislative systems and constant pushback from communities, among many other reasons.

Similarly, a 2023 survey of developers, private lenders, and high-net-worth investors conducted by Wingate shows that 1/3 of the respondents consider getting DA a key development impediment, and around half of them don’t intend to acquire any land this year because of the lack of certainty in the planning system.

To speed up the rezoning and development approval process and housing supply, the NSW Government initiated its Rezoning Pathways Program. Under this program, developers can skip councils and apply directly with the state government regarding their rezoning and development proposal. Five projects have been approved so far, and the State has revealed it will fast-track the development of a total of 5,803 homes.

NSW’s experiment is a good start. Australia needs more.

- High construction costs

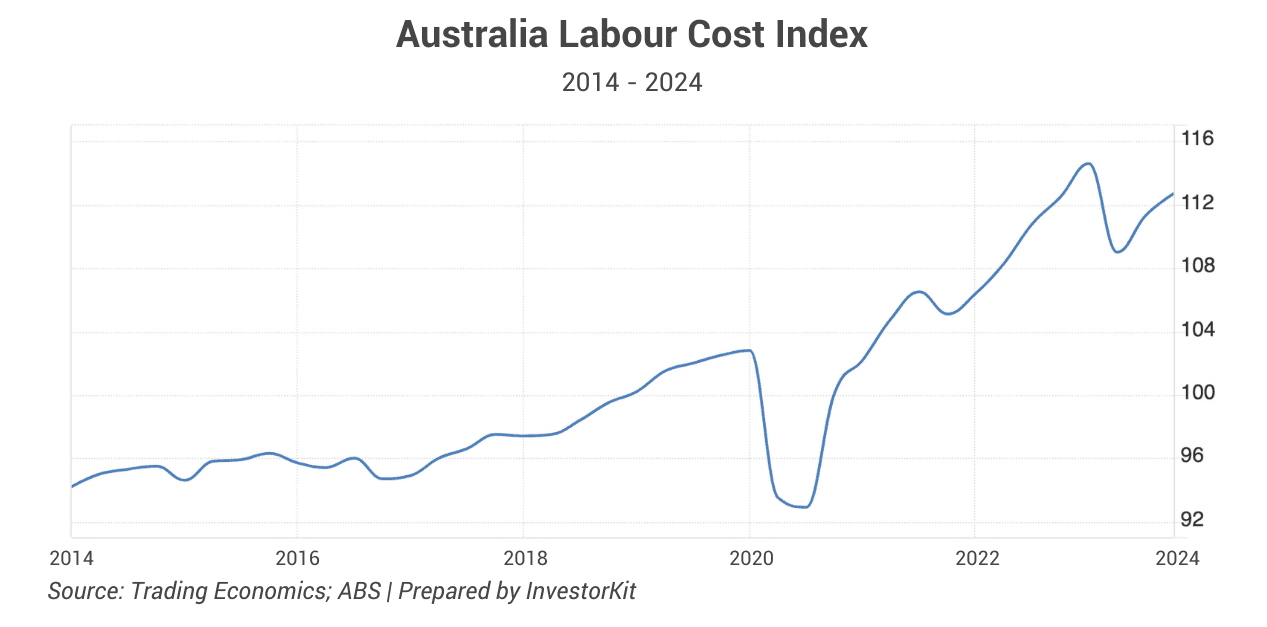

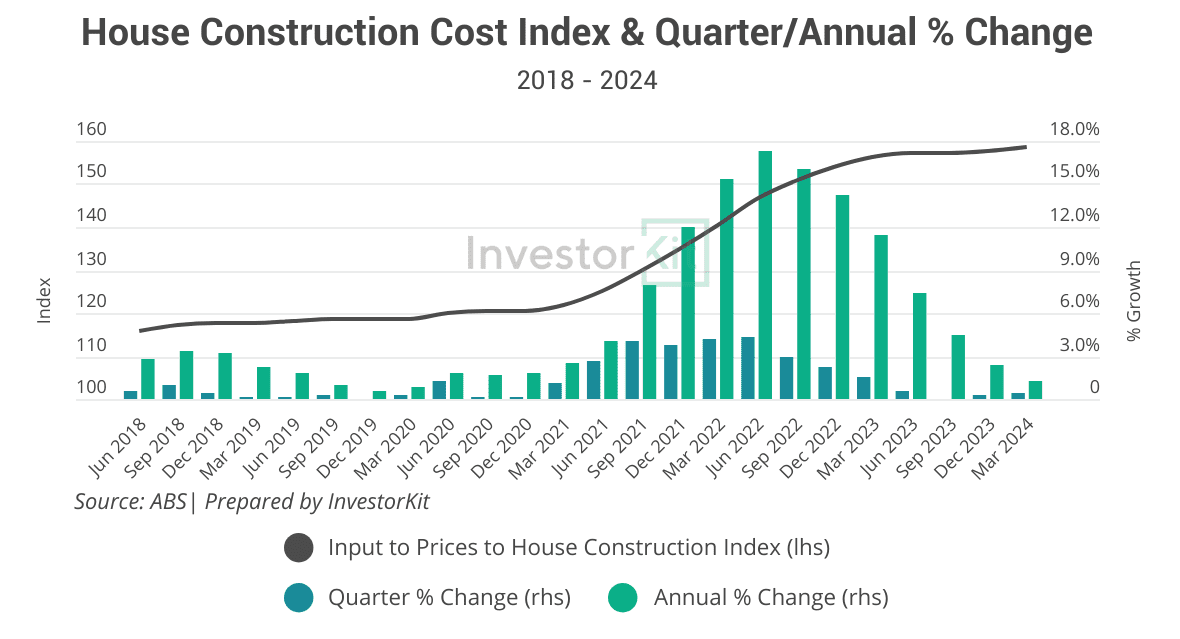

In building a new home, 40-45% of the total cost is the cost of materials, and 35-40% is labour. During the pandemic, building material costs, especially steel and timber, surged due to supply chain disturbance, and labour costs surged (chart below) due to shortages following the border closures of Australia and many labour source countries.

The two factors working together have caused the fastest construction cost growth ever recorded (chart below). Although the growth rate has been declining since mid-2022, construction costs are still 33.4% higher than four years ago (the pre-COVID level).

Labour shortages and cost lifts, similar to building material cost surges, have also been relieved as the world came back to normal from border closures. However, it’s not 100% resolved. In the Wingate survey mentioned earlier, over a third of the respondents advised that the availability and cost of labour and trades were still a major issue preventing more homes from being built.

3. Record-high immigration and population growth combined with declining household sizes push demand high.

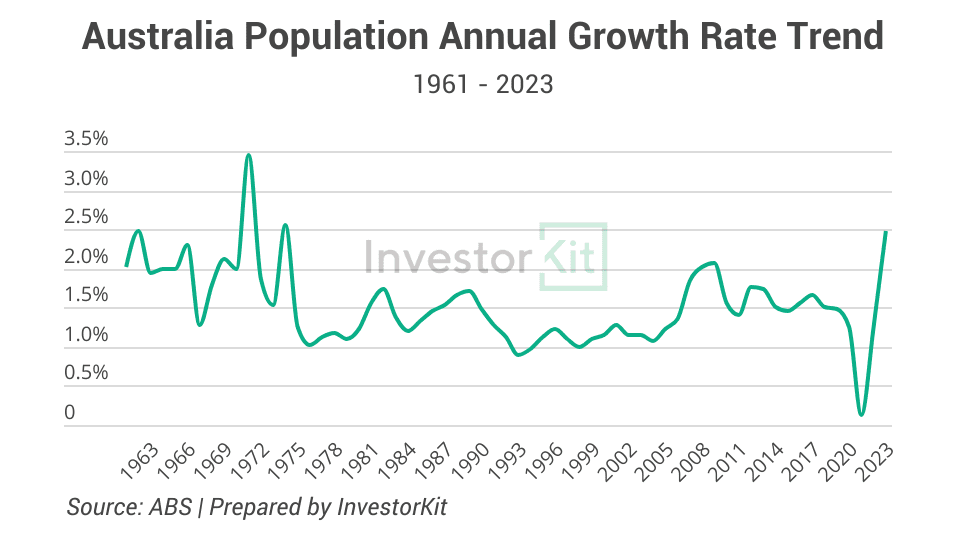

Australia’s population has grown by 2.47% over the 12 months to Dec 2023, the highest level since the 1970s (chart below).

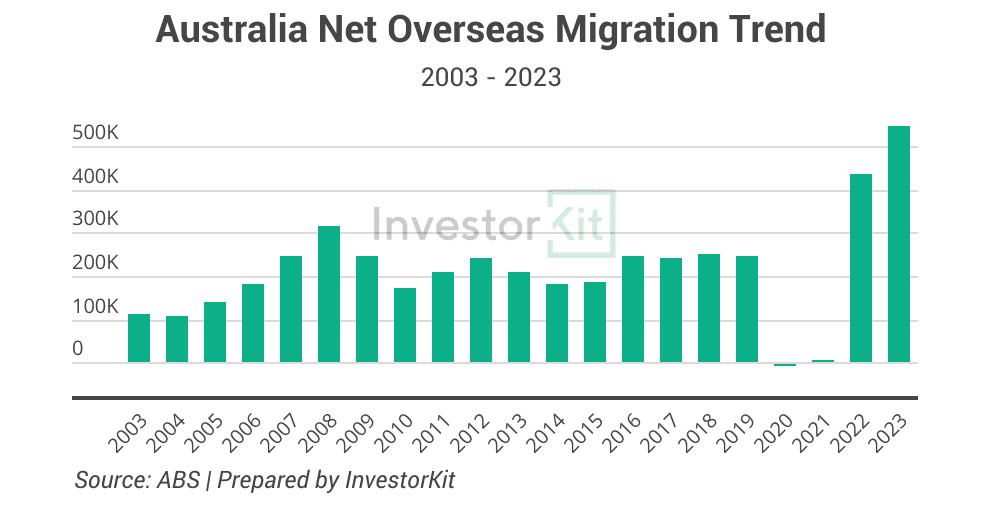

This strong population growth is primarily (83%) contributed by the fast recovery of overseas migration, which added 547,267 people to the population in the calendar year of 2023, another historic high (chart below).

Whilst the growing population and immigration are adding more housing demand to the country’s property market, the average household size continues shrinking, generating more housing demand from the inside. The chart below shows that Australia’s household sizes have been trending downward since 2015, and now remains at a historic low level of under 2.5 people per household.

As housing and rental prices keep surging, we expect Australia’s household sizes to gradually increase in the coming years. However, they’re unlikely to recover to the 2015 level or exceed it anytime soon.

To summarise, this blog introduced three significant reasons for Australia’s housing supply shortage issue:

- Reduced market mobility due to high transaction costs

- Slow pace of new supply due to planning uncertainty and high construction costs

- Heightened housing demand due to surging overseas migration and shrinking household sizes

These are just the top 3 reasons among many we have analysed in our Whitepaper Australia’s Housing Supply Crunch & 20 Undersupplied Regions FY 23/24. Check it out for more insights!

InvestorKit is a data-driven buyers’ agency that has dedicated itself to understanding Australia’s property markets through data analysis from the macroeconomy to local markets. Our deep understanding of the market has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)