The RBA has finally lowered its cash rate target.

On 18th Feb, the RBA announced the first rate cut in over four years. While it remains a question of when the next cut will be, which will depend on how inflation trends from here, more cuts are expected in the coming 1-2 years.

For the property market, rate cuts are generally good news. They would increase loan serviceability, improve investors’ cash flow, lift the overall buyers’ confidence, etc., and therefore boost property market growth.

However, not all markets will benefit from the rate cuts to the same extent. In this article, I’m showing you 3 cities that will likely become the largest beneficiaries.

Sydney

Sydney represents the cities where property prices are significantly sensitive to interest rates and consumer sentiment.

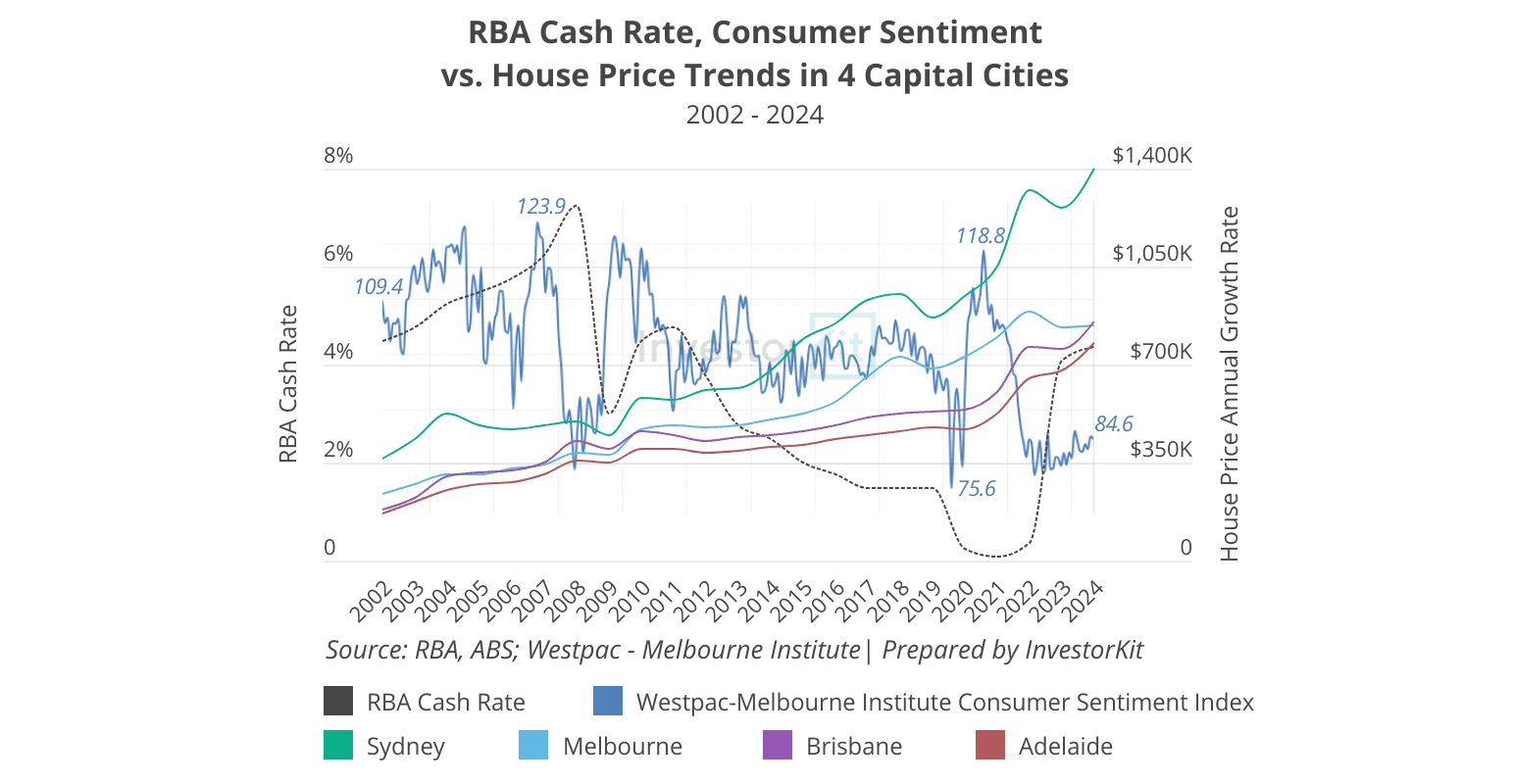

The chart below shows how house prices of four capital cities have been moving alongside the RBA cash rates and Australia’s consumer sentiment over the past 20 years.

Sydney’s price trendline responds to the cash rate and consumer confidence changes the quickest and, in many cases, to the most significant extent. Melbourne’s house prices are not as sensitive as Sydney’s but are still more closely connected with the cash rate and consumer sentiment trends than the other two.

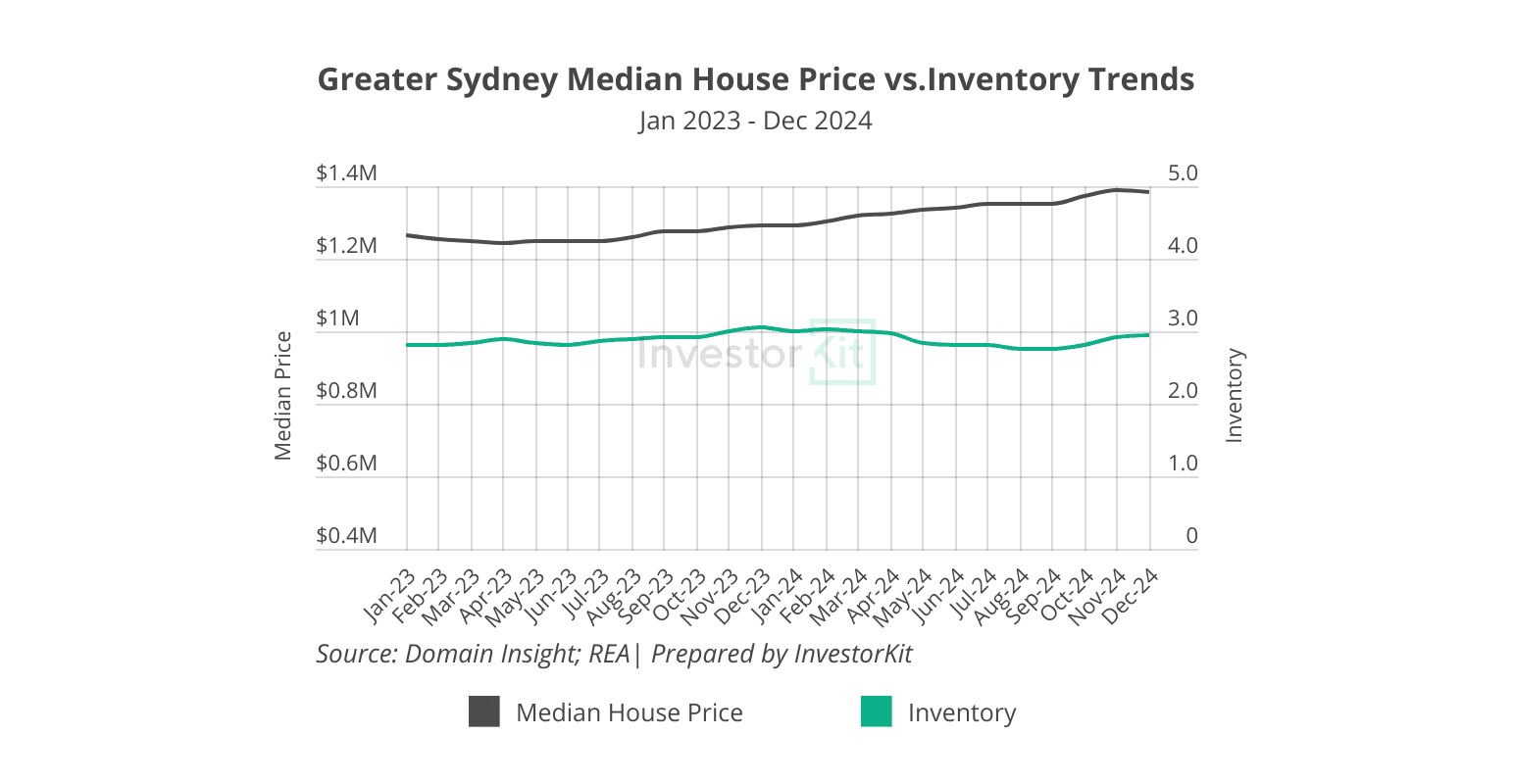

Greater Sydney’s house supply has always been relatively tight – Over the past two years, inventory has always been around 3 months (under 3 months is deemed a tight supply). However, the poor affordability and low buyers’ confidence caused by high interest rates have been suppressing price growth. The median price only increased by 9.5% in the past two years, while the smaller capital cities have been achieving double-digit growth annually.

As the interest rates decline, Sydney’s house market will be benefitted in two ways:

- One, relative affordability will be improved as loan serviceability increases, and,

- More importantly, demand will be boosted as consumer sentiment improves, which has been proven historically.

Newcastle

Newcastle is representative of the cities where house prices may not be highly sensitive to interest rates, but market pressure is rising, and the rate cuts will likely give the recovery a solid boost.

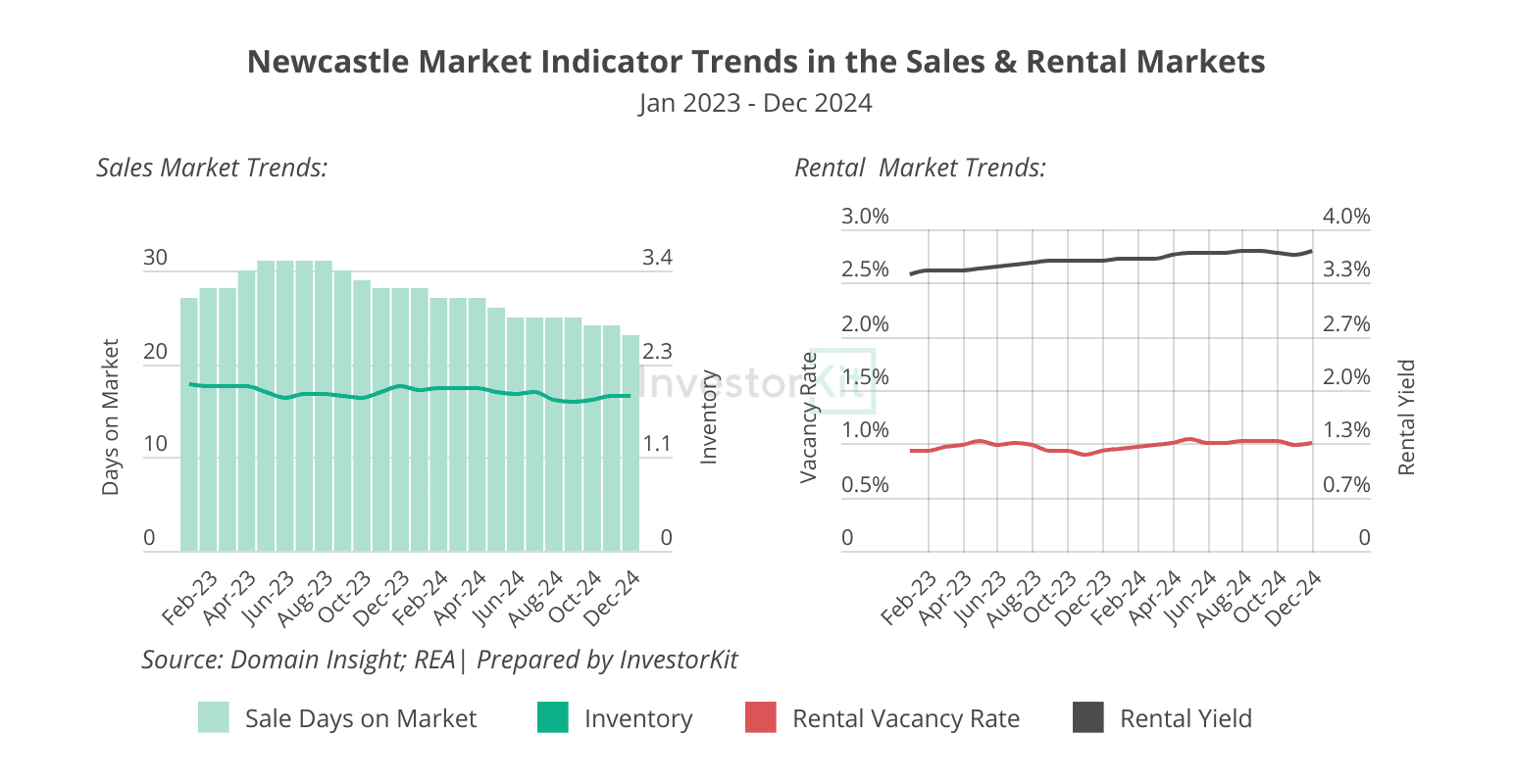

Newcastle’s house market inventory level has been low at around 2 months over the past 2 years. In the meantime, sale days on market has been trending downward since the second half of 2024. In the rental market, vacancy rates have been around 1% for years with no signs of relief. Rents have been increasing faster than sale prices, leading to a consistent increase in rental yields. All these are signs of high and rising housing demand relative to supply (see charts below).

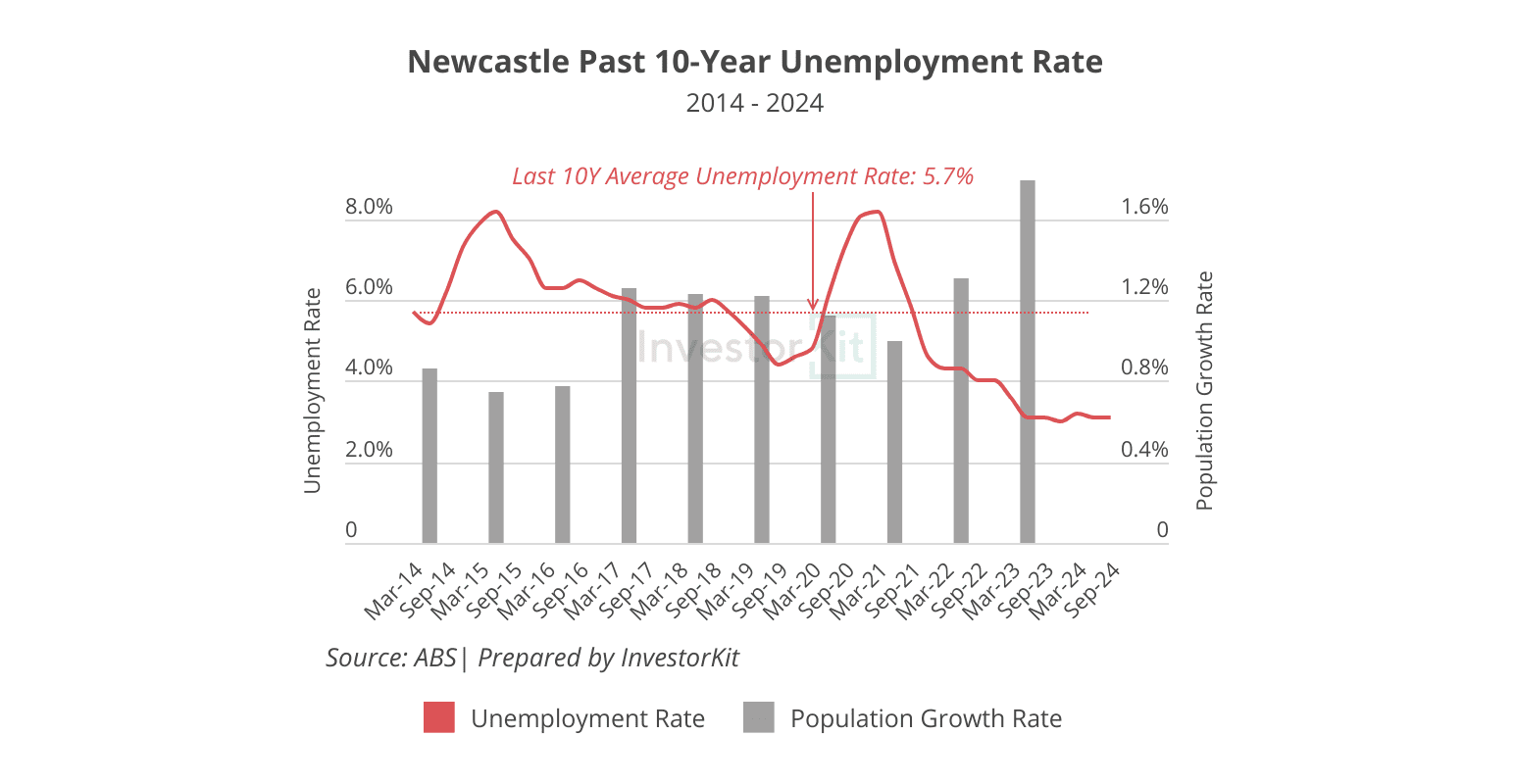

On top of that, Newcastle’s underlying housing demand is also improving as population growth accelerates and unemployment rates trend downward (see chart below).

While the increasing market pressure will lead to growth, the rate cuts will boost Newcastle’s property market by increasing affordability and boosting consumer confidence.

Bendigo

Bendigo represents the cities where house prices are borderline unaffordable with moderate rental yields.

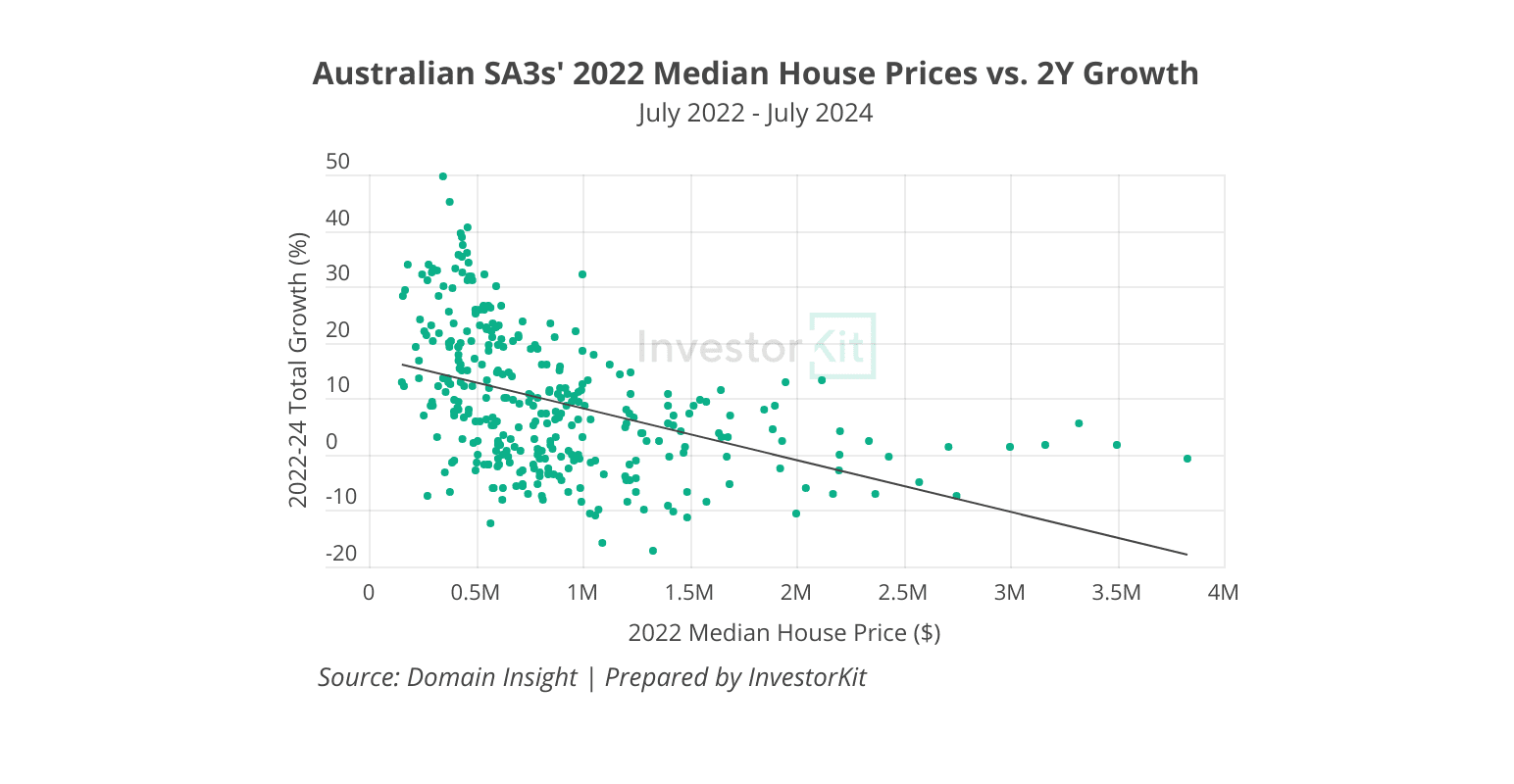

In the high interest rate environment over the past two years, property market demand has shifted significantly towards the affordable end, evident by the overall better performance of affordable markets than that of the pricier ones (see chart below).

In 2025, while rate cuts have started, the drop will most likely be slow, so the high interest rate environment will linger, and affordability will continue favouring growth.

Some markets are “borderline unaffordable”, where house prices are slightly above the local residents’ affordability (≤30% of after-tax income used for home loan repayment). With only a few rate cuts, these borderline unaffordable markets can quickly become affordable, significantly encouraging demand from both owner-occupiers and investors.

Moreover, these borderline unaffordable markets typically have moderate rental yields between 4% and 5%, which are not the most ideal for a healthy cash flow in the high interest rate environment. As monthly repayment decreases, 4-5% rental yields would become more attractive to investors.

Bendigo is such a borderline unaffordable city. Its median house price is just 1% above the affordability threshold when the home loan interest rate is 6.5%, and a slight 0.25% rate drop would make it 5% below that threshold.

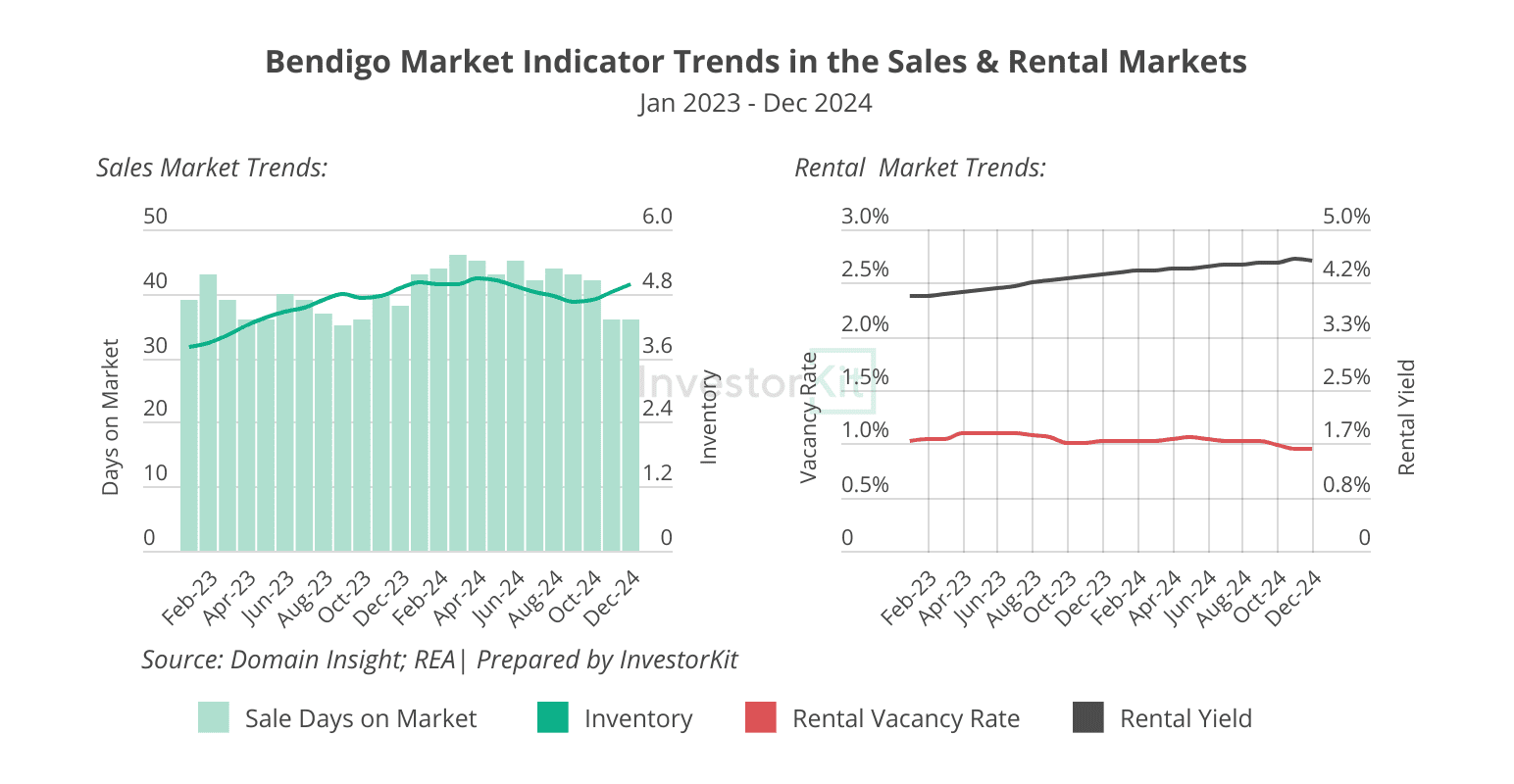

The current market pressure is still reasonably low but has started to show signs of recovery: While inventory is above the balanced range (3-4 months) and still increasing, other indicators, such as the days on market and vendor discount, have started to tighten (see charts below). In the rental market, vacancy rates remain low and are trending slightly downward, indicating consistently high housing demand. Rental yield has been improving in the past 2 years, now sitting at the sweet spot of 4.5%, which could easily turn attractive when interest rates are lower.

To summarise, we have reviewed 3 cities that will likely benefit from the rate cuts in 2025 the most:

- Sydney: The city where the property market is the most sensitive to the RBA cash rate and consumer sentiment among all cities,

- Newcastle: A city where market pressure has already been recovering, and the recovery will be boosted by the rate cuts by both affordability and market confidence improvement.

- Bendigo: A “borderline unaffordable” city with moderate rental yields that can quickly become affordable with healthy rental return rates after just a slight rate drop.

These are just 3 of the 10 cities the InvestorKit team identified last year that would benefit most from the rate cuts. To see the complete list of the 10 cities, check out the whitepaper: 10 Cities That Will Benefit from Rate Cuts the Most.

InvestorKit is a data-driven buyer’s agency dedicated to analysing not just the property market trends but also every influencer of the property market, such as the cash rate, to achieve a holistic view of how markets move. Our holistic approach has helped countless clients to seize opportunities and achieve their financial goals faster. Would like to have an assistant like InvestorKit for your next purchase? Book your 15-min FREE no-obligation discovery call today!

.svg)