A few weeks ago, we explored why Australia’s bold 1.2 million home target was unlikely to be achieved on time.

However, not every city is falling behind equally — some are building faster, while others are significantly lagging.

So, in this blog, we’re zooming in at the LGA (Local Government Area) level to uncover the 10 cities where new home building approvals are falling behind the most.

How did we identify these cities?

Step 1: How many homes should have been approved so far?

The goal is to build 1.2 million homes between June 2024 and June 2029. Since it typically takes about a year to complete a new home, we’ll need 1.2 million residential building approvals between June 2023 and June 2028.

As of January 2025, we’re 20 months into that 60-month window. That means we should have seen about 400,000 building approvals nationwide by now.

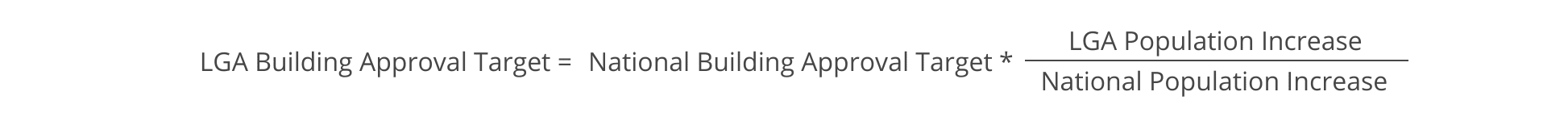

Step 2: How many of those approvals should each city contribute?

To fairly assess whether each LGA is keeping pace, we need to break down the national target of 400,000 across local areas. There are two potential approaches:

- By population size: Intuitively, larger cities are supposed to have more building approvals, but it wouldn’t make sense to build too many new homes if there are not enough additional residents (population growth) to claim them.

- By population growth: The more additional population, the greater the need for housing. However, not all new residents create additional housing demand; for example, the newborns (natural increase).

Both have pros and cons, but for this blog, we’re going with the population growth-based method. That means we allocate each LGA a portion of the national target based on their share of Australia’s population growth in FY23–24.

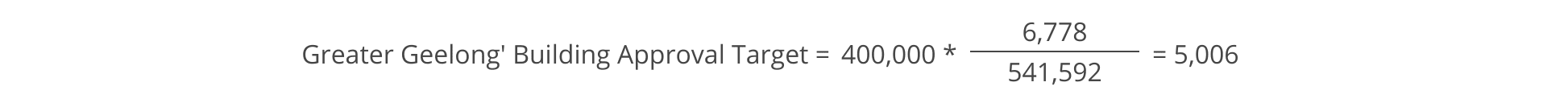

Let’s look at Greater Geelong as an example. In the last financial year, Geelong’s population increased by 6,778, while Australia’s population grew by 541,592, so:

Step 3: Comparing target vs actual building approvals

Now that we have a target building approval number for each city, we can compare what’s already been approved with that target.

From June 2023 to January 2025, Geelong approved 4,989 new homes, just 0.3% below its target. In other words, it’s on track.

But that’s not the case everywhere.

Across 533 LGAs, 146 have fallen short of their targets. Below, we reveal the 10 cities falling the furthest behind.

The 10 Cities Falling Behind on New Housing Supply the Most

Key Observations

Greater Perth (Cambridge, Victoria Park, Fremantle): Greater Perth dominates this list, with many LGAs struggling to match rapid population growth amid high construction costs.

Greater Sydney (North Sydney & Georges River): Despite very different population growth rates (Georges River receives significantly more overseas migrants than North Sydney, and sees much higher population growth), both are falling well behind in supply.

Greater Melbourne (Frankston): While West Melbourne is booming with new house construction, in the east, more established LGAs like Frankston aren’t keeping pace.

Queensland (Gladstone, Brisbane, Rockhampton): Despite strong population gains, new housing isn’t keeping up. That is one of the many drivers of Queensland’s hot property markets.

Greater Darwin (Palmerston): Even with modest population growth, Greater Darwin’s LGAs are well behind, contributing to a 52% shortfall across the NT capital region.

Final Thoughts

As this list shows, even moderate population growth can strain housing supply if building approvals don’t keep up. In faster-growing cities, the gap is even more pronounced, fueling higher competition, rising prices, and affordability concerns.

But as we always say at InvestorKit: incoming supply is just one part of the property puzzle. To truly understand how markets will evolve, you need a holistic view, including demand, economic strength, affordability, infrastructure, employment, and more.

Don’t have time to pull all the data and do the full analysis yourself? That’s what we’re here for.

Book your FREE no-obligation 15-minute discovery call with the InvestorKit team today, and let’s take the first step toward smarter property decisions.

.svg)