September 23, 2024

The Traps of Chasing Positive Cash Flow in a High-Interest-Rate Environment – Part I

As property investors, we LOVE positive cash flow. Without having to take cash out of our own pocket to hold a property, we can save faster and achieve a scaled…

As property investors, we LOVE positive cash flow.

Without having to take cash out of our own pocket to hold a property, we can save faster and achieve a scaled portfolio sooner. Many investors even hold positive cash flow as a strict purchase criterion.

It was easy a few years ago when interest rates were historically low. In fact, “positive cash flow” became hot in that period. However, in the current high-interest-rate environment, it’s become much more difficult to achieve – so much so that being obsessed with positive cash flow could even harm your investment journey.

How could it be possible? Let me explain it with four potential traps over this two-part blog series. Today, let’s discuss the first two traps.

Chasing the Wrong Type of Assets

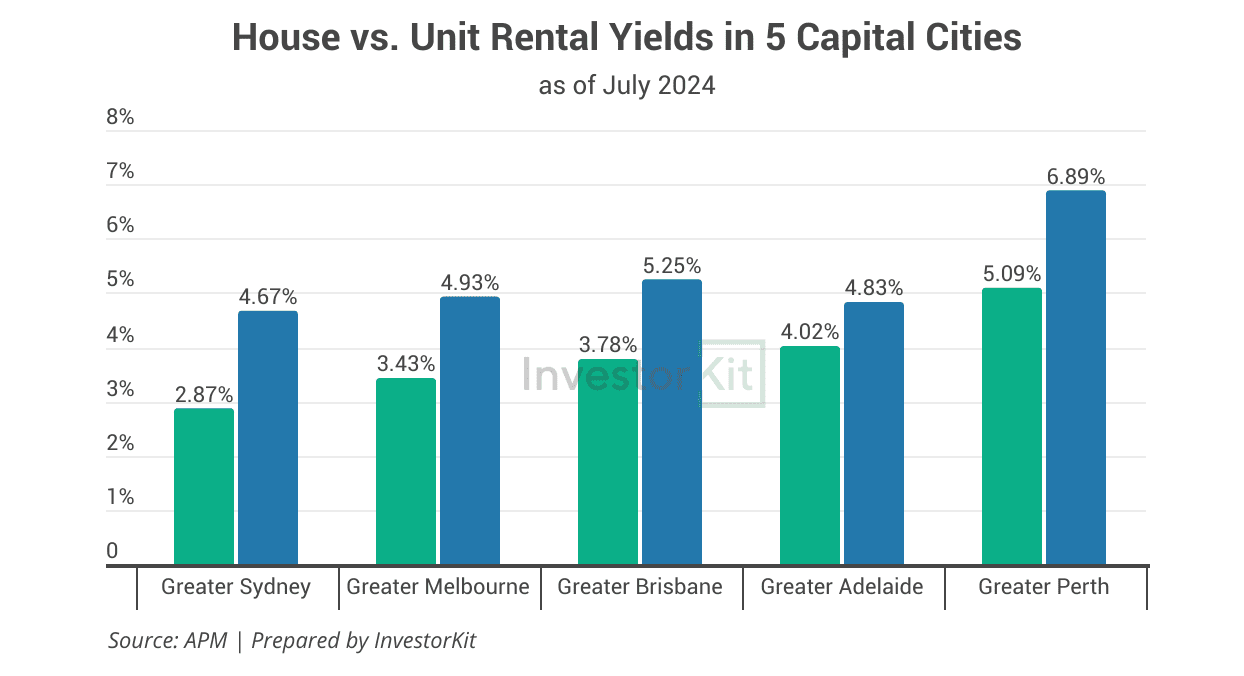

Units offer much higher rental yields than houses, especially in the largest cities. The chart below shows how house and unit yields differ in the five major capital cities.

From a cash flow perspective, units seem a better option than houses to invest in. To continue enjoying positive cash flow, some investors could be enticed to the unit market. However, that decision would be more harmful than bearing negative cash flow by buying a house.

While units are great in addressing the country’s housing supply shortage issue, they are not the best investment asset due to their weaker value growth prospect and high hidden holding costs (eg. special levies).

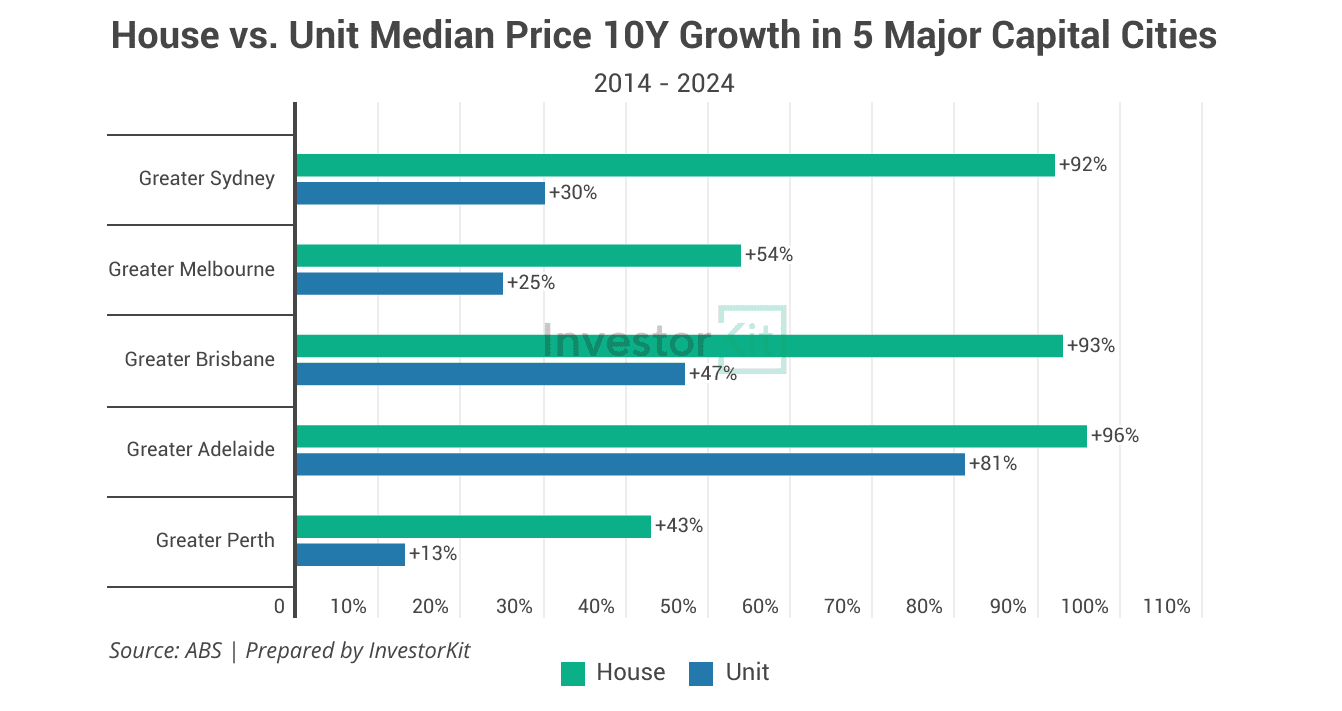

The chart below shows how median house and unit prices have grown in the five major capital cities in the past ten years.

None of the unit markets has performed as well as the house markets. Even the best performer, Adelaide, sees a 15% difference between the two sub-markets.

The primary reason for units’ poorer performance is the uncontrollable supply – While one extra slot of land brings one extra house to the market, it can add 10+ apartments as long as the local planning regulation allows. House supply is always limited by land supply, but apartment supply is adjustable by changing planning regulations – Need more housing supply? Let’s increase density and allow taller apartment buildings.

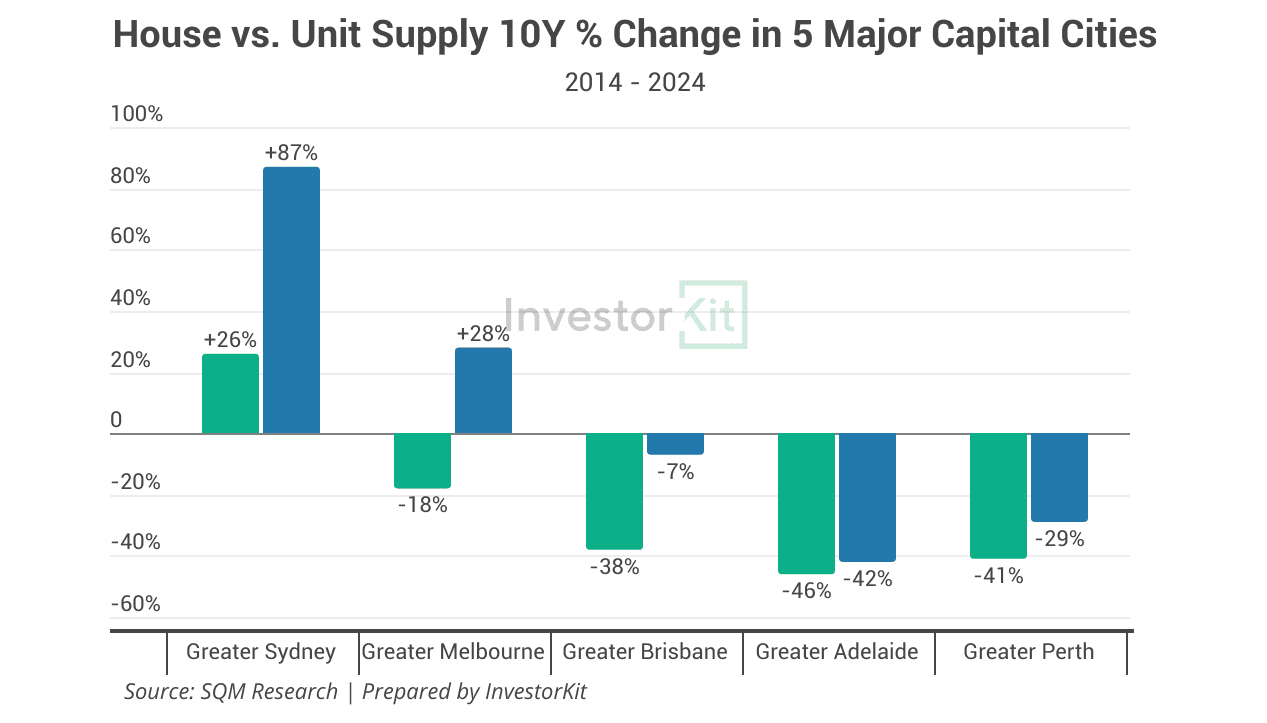

The past decade has demonstrated the negative correlation between housing supply and value growth. The chart below shows how house and unit supply has changed from 2014 to 2024 in the major capital cities.

Notice that Adelaide’s unit supply decreased the most among all five cities and is the closest to the city’s house supply decrease. That explains, at least partially explains, why the Adelaide unit prices have grown the most.

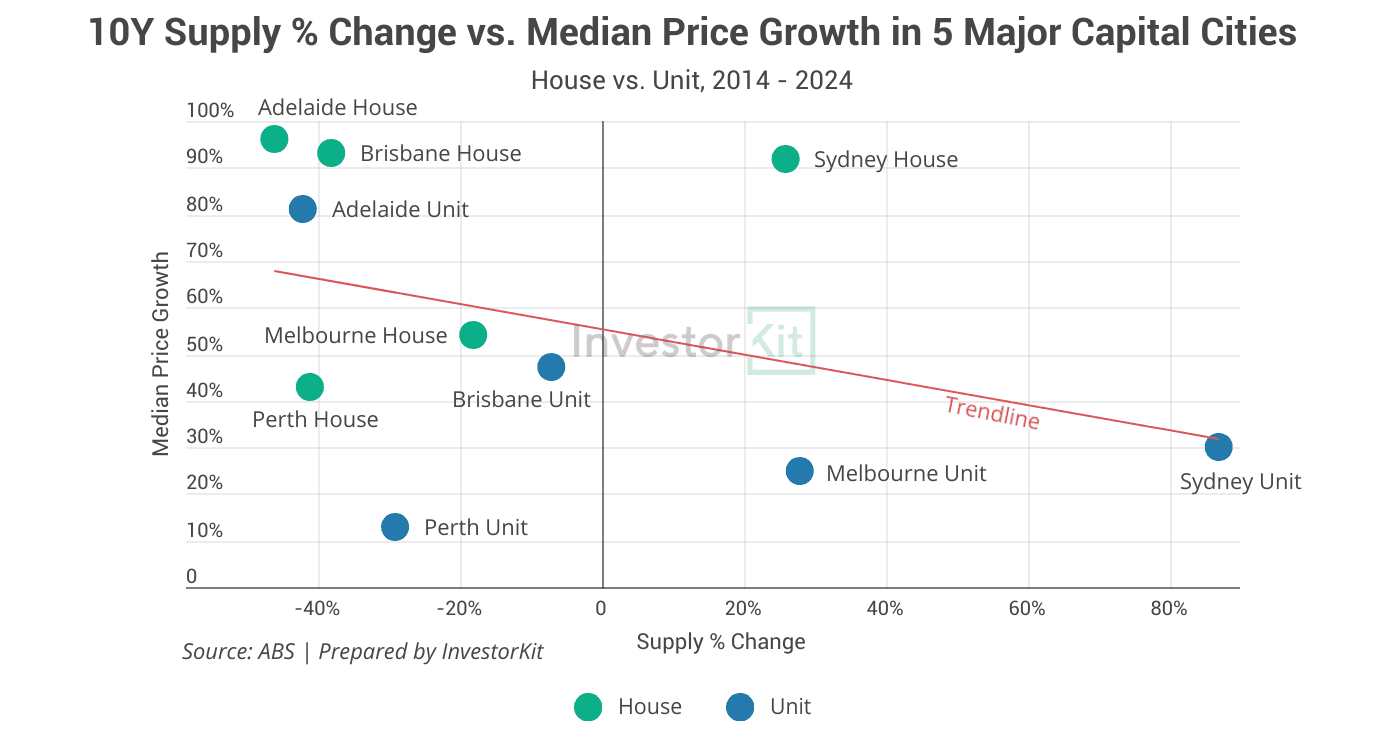

To make it easier to read, let’s put all five cities’ supply change % and median price growth % together (chart below).

The negative correlation is clear – The more supply has increased, the lower the median price growth.

Admittedly, the correlation isn’t perfect. That’s because supply level is not the only determinant of growth. People movement, economic strength, market cycles, and many other factors also influence property market growth significantly.

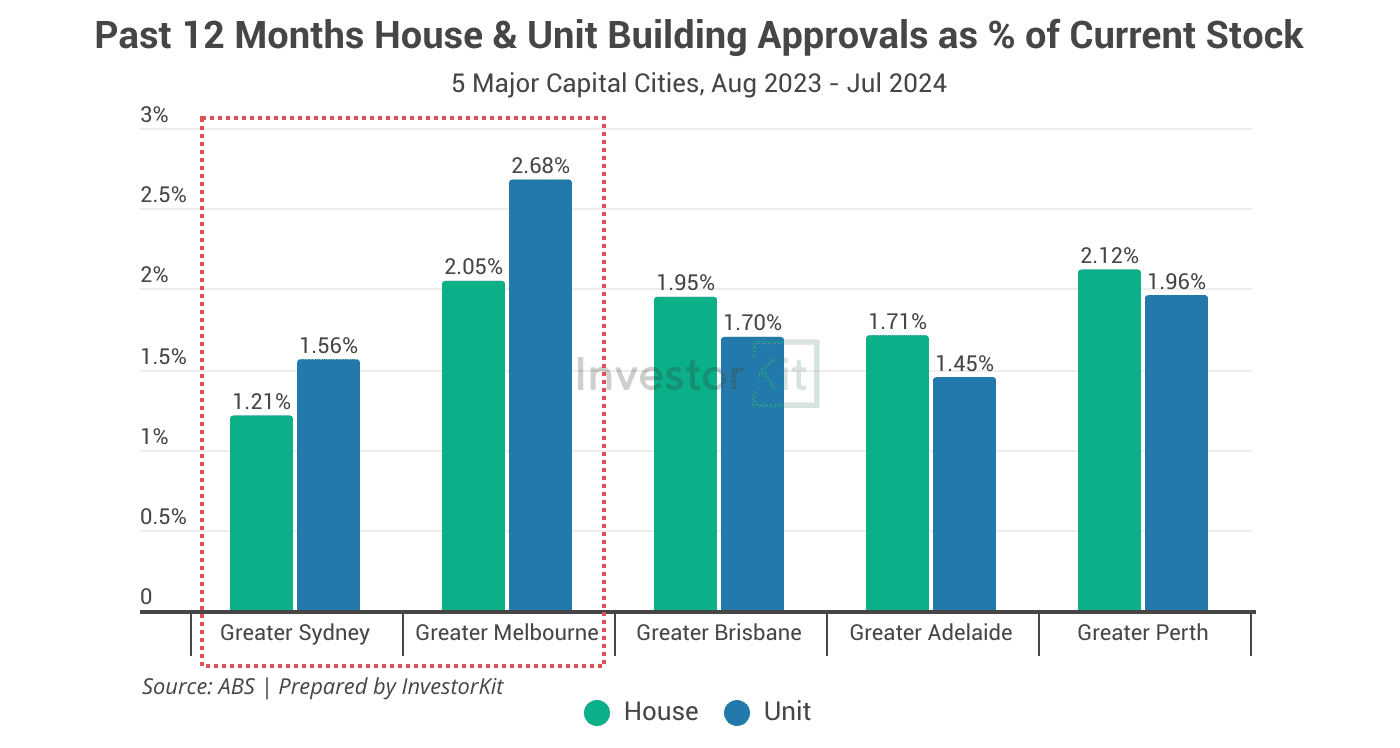

Moving forward, as long as we need to increase the housing supply quickly, the apartment supply is expected to grow faster than the house supply does. That is especially the case in high-population-density cities, such as Sydney and Melbourne: In the past 12 months, Sydney and Melbourne’s new apartment building approval amount relative to their current stock was much higher than new house building approvals (chart below).

Besides lower value growth, apartments also suffer from high hidden holding costs.

Australian apartment buildings are not reputed for high quality. A research by Australian Apartment Advocacy earlier this year showed that up to 60% of new apartments in Australia suffer from problems such as cracked foundations, water leaks, balcony defects and flammable cladding. These construction flaws could cause extremely high special levies to be fixed.

In some cases, according to that research, owners cannot afford the special levies and are forced to sell (very likely at a significant discount). Even if you can afford the special levies, your cash flow could be heavily compromised – will it still be positive?

So, do you really want to risk putting your money in an asset with low value growth confidence and high holding costs?

Limiting Your Market Options

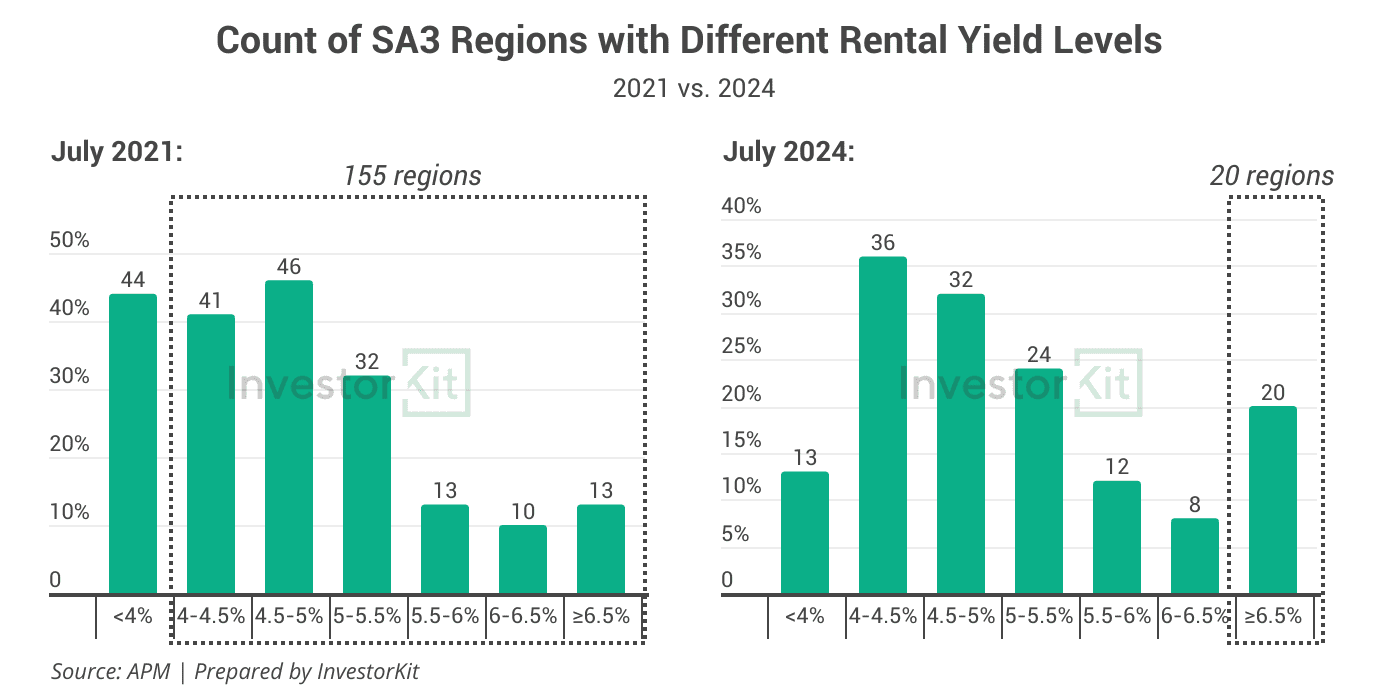

When the cash rate was only 0.1%, a 4%+ yield could generate positive cash flow for you, but now you need a 6.5%+ yield to make the cash flow positive or at least balanced.

Assuming you have a budget of $700k, let’s see how many markets would meet your criteria in 2021 and 2024, respectively.

In 2021, 199 regions had a median house price under $700k, and 155 of them offered 4%+ rental yields. It would be easy for you to choose from 155 markets for one property that met not only your positive cash flow requirement but also other criteria (eg. location diversity, short-term growth, long-term growth, etc.).

In 2024, only 145 regions still enjoy under $700k median prices, and you only have 20 regions, where rental yields are 6.5%+, to choose from if you’re after positive cash flow. What’s more, not every one of these 20 regions would meet all your requirements:

- Some heavily rely on one single industry (eg. mining);

- Some do not have an active local job market;

- Some are still seeing price declines;

- Some are in the area where you already have properties, and you want diversity, etc.

In the end, your options may be limited to just a handful.

The lack of options would lead to high competition, as we are seeing now in Perth, Adelaide, and many Queensland cities. High competition means that you may have to compromise on price, time, or quality:

- You could be overpaying to win a house that really meets your requirements;

- You might keep missing out on good properties and waste a lot of time before finally getting one;

- You might not have the time and patience to do a thorough due diligence and end up with a risky house.

- You might not find anything that meets all your requirements and decide to lower some criteria, ending up with something that doesn’t 100% fit your portfolio needs.

- …

None of these would benefit you in the long term.

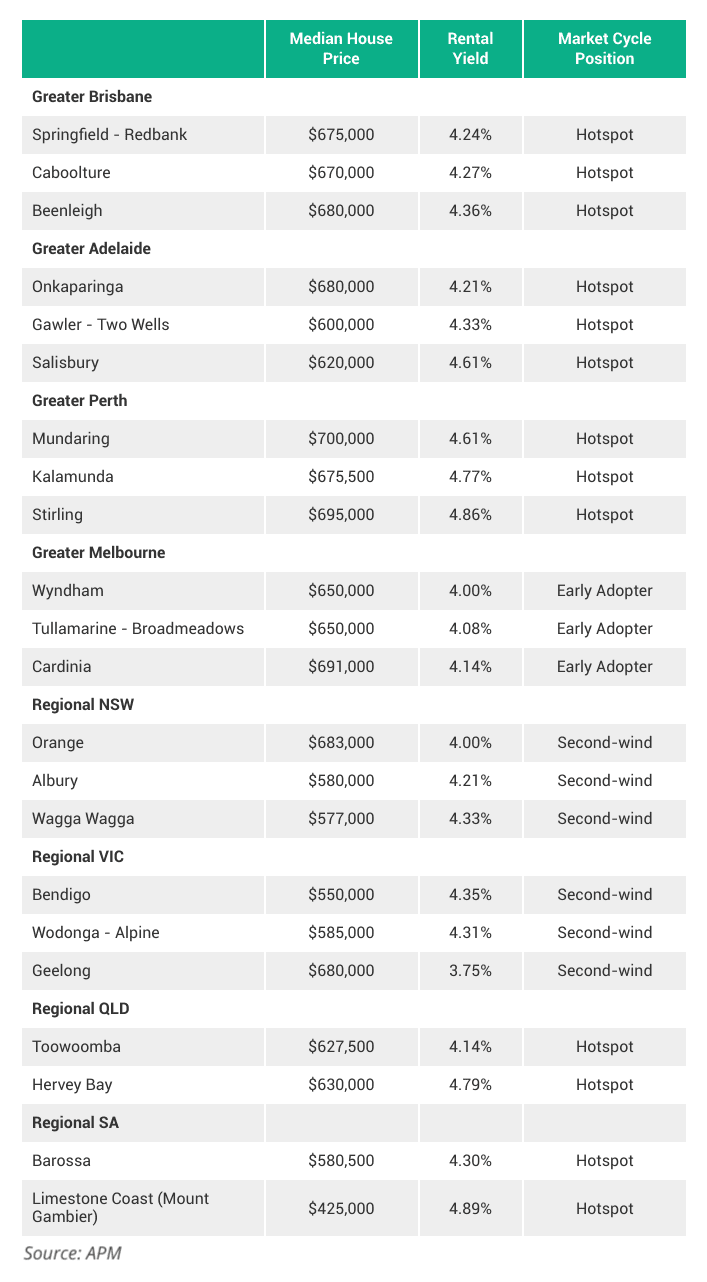

However, if you are willing to bear some negative cash flow for a few years and lower your rental yield target to 4%+, you’ll immediately unlock 112 more options!

The table below shows some examples of these 112 extra options: That’s a good mix of different states, capital/regional options, seaside/inland options, and market cycle positions (early adopters, hotspots, second-winds).

Having these extra options, you’d be able to significantly increase your chance of securing a high-quality property that meets your portfolio needs within a much shorter period of time. Furthermore, your cash flow won’t remain negative. As rents grow and interest rates decrease, your cash flow will become positive in a few years.

This article discusses the first two traps in chasing positive cash flow in a high-interest-rate environment. We’ll unveil the next two traps in Part 2. Stay tuned!

Positive cash flow by itself is great, but in a high-interest-rate environment, it may not be the best strategy for everyone to prioritise it. The InvestorKit buyer’s agency team doesn’t simply help you buy properties labelled with buzzwords such as “high rental yield”, “positive cash flow” or “hotspot”, but more importantly, we help you clarify your portfolio goals & plan and then buy the property/ies according to your portfolio needs, which will benefit you in the long run. Would like to have such a helper by your side on your investment journey? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!