A rising yield is usually a good sign of growth.

An example is Wyong.

Wyong’s Story

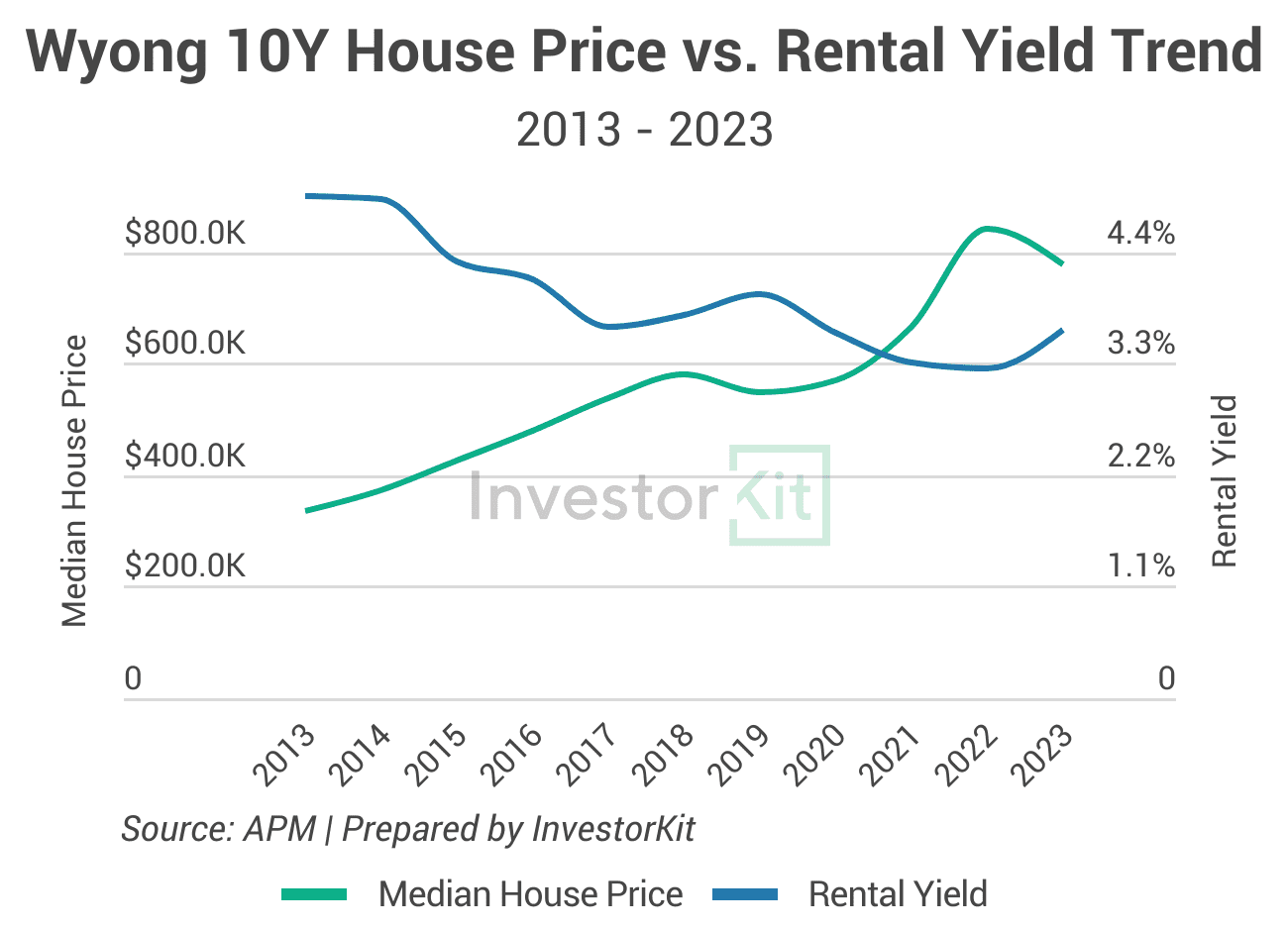

The chart below shows that Wyong’s house rental yields increased from 3.7% to 4.0% from 2017 to 2019, and following that, house prices started growing robustly from 2020.

Admittedly, there’s no clear cause-and-effect relationship between rental yields and price growth. In other words, price growth is not necessarily caused by the increase in rental yields. However, in many submarkets, increasing or lifted rental yields play an important role in attracting investors, who represent circa 1/3 of all property buyers, leading to an increase in demand, which could eventually cause market pressure and property prices to rise.

One reason why the effect was more noticeable in Wyong was a combination of a healthy rental yield level, affordable prices, and a convenient location:

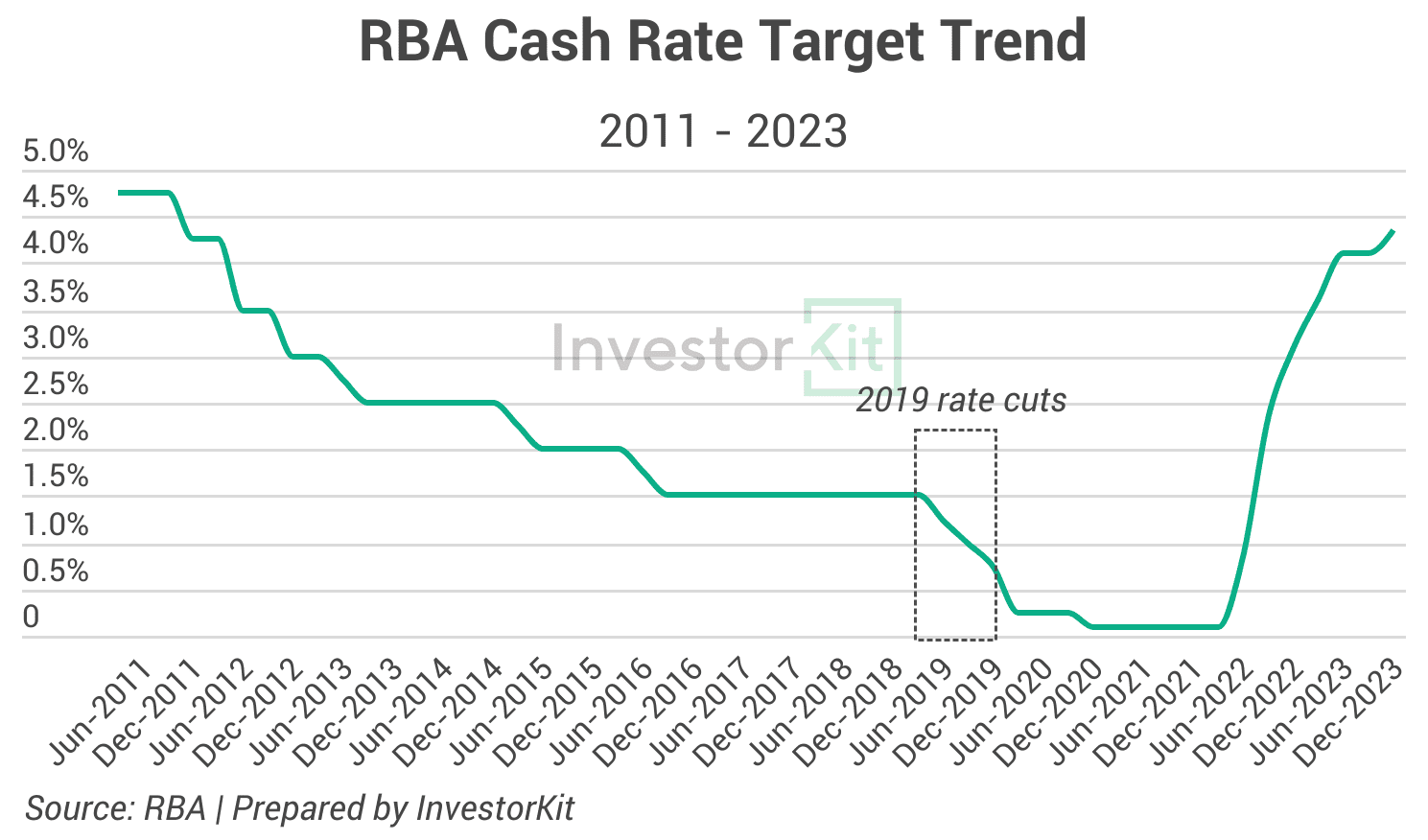

- Wyong’s rental yield increased to around 4% in 2019, which was considered healthy for cashflow as interest rates were fast decreasing.

- Wyong is at the north edge of the Greater Sydney Region. The proximity to metropolitan Sydney and the affordable house prices (median price = $550k as of 2019) made it an appealing alternative to Sydney both as an investing market and as a residing place for many Sydneysiders.

The Nationwide Rental Yield Recovery

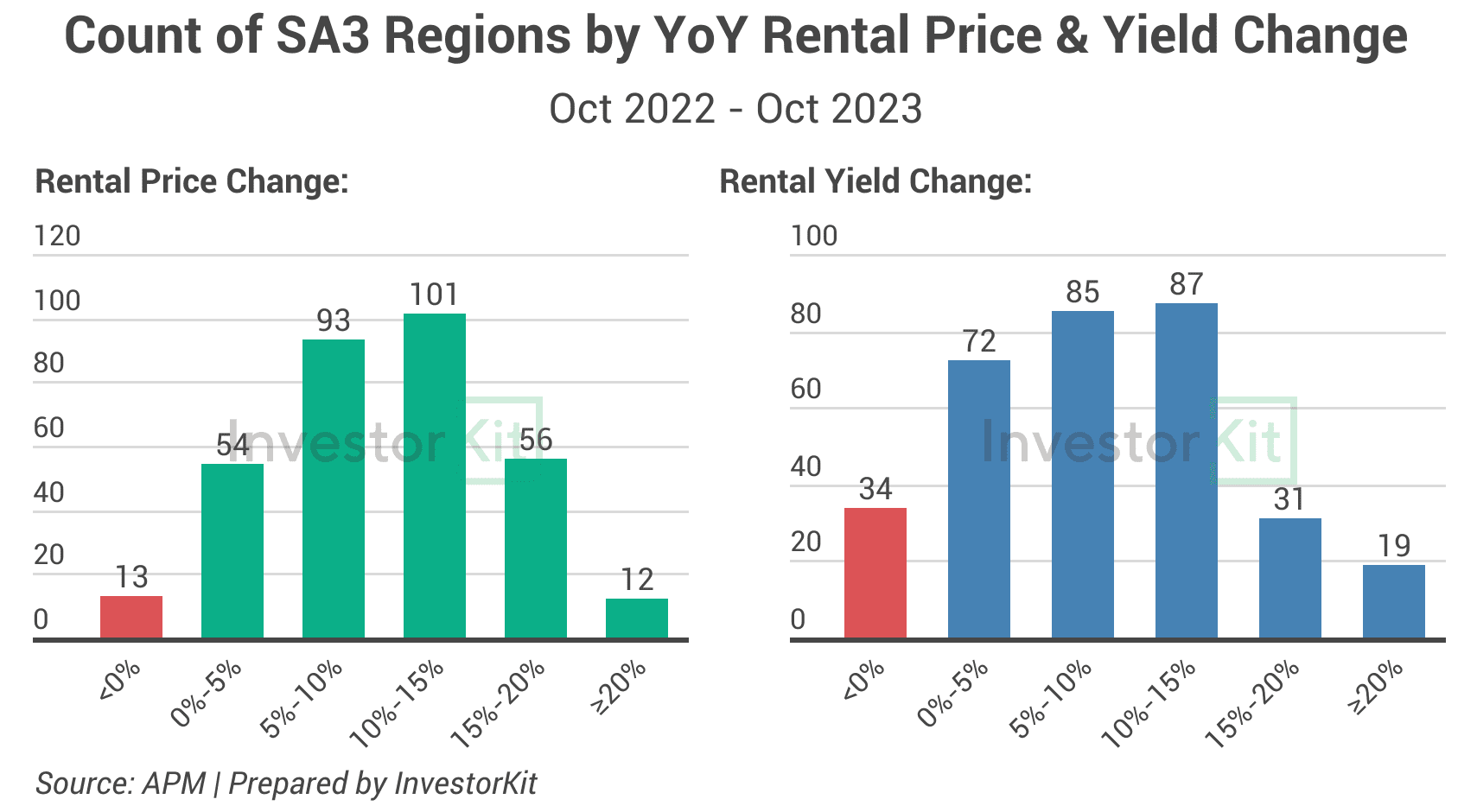

In the past 2 years, we’ve been seeing rental prices increasing faster than property value in most regions across the country. As a result, rental yields are recovering nationwide (chart below).

- In the 12 months to the end of Oct 23, 169 SA3 regions (out of 329 SA3s with valid market data) have recorded >10% rental growth (above chart, left).

- 294 SA3 regions have recorded increased rental yields (above chart, right).

Potential Impact of the Yield Recovery on Growth

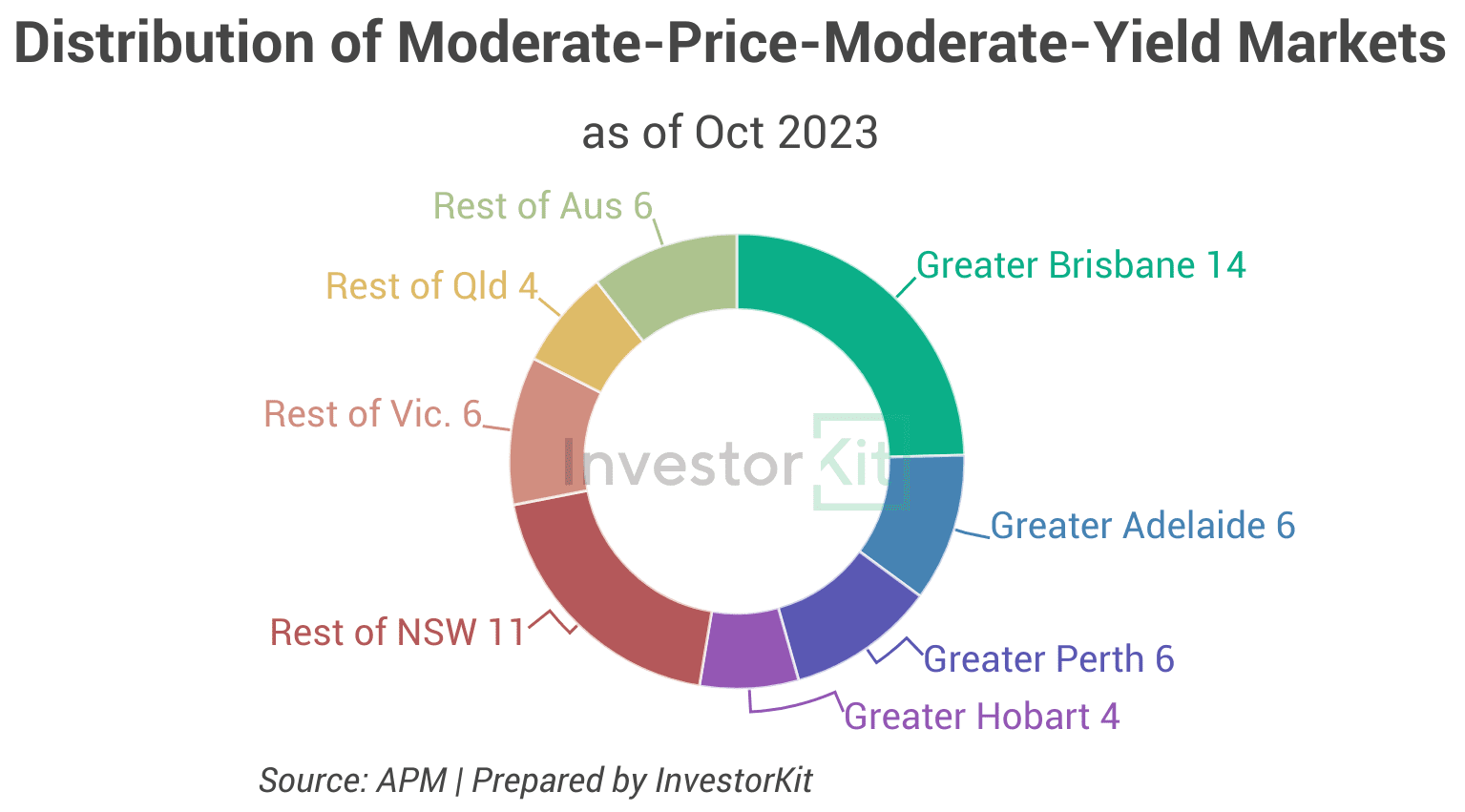

The increasing rental prices and yields are likely to attract investors back to the market, lifting housing demand. This effect will be more noticeable in the markets with moderate prices ($500k-$750k) and moderate yields (4-5%).

Why do we believe so? Because these markets are in a very similar situation to Wyong in 2019.

As of Oct 2023, 98 SA3s have a median house price between $500k and $750k; 57 of them have a rental yield of 4%-5%.

Approximately 80% of these markets are in smaller capital cities (eg. Adelaide, Brisbane) or big regional hubs (eg. Sunshine Coast, Bendigo, Maitland), enjoying high rental market pressure.

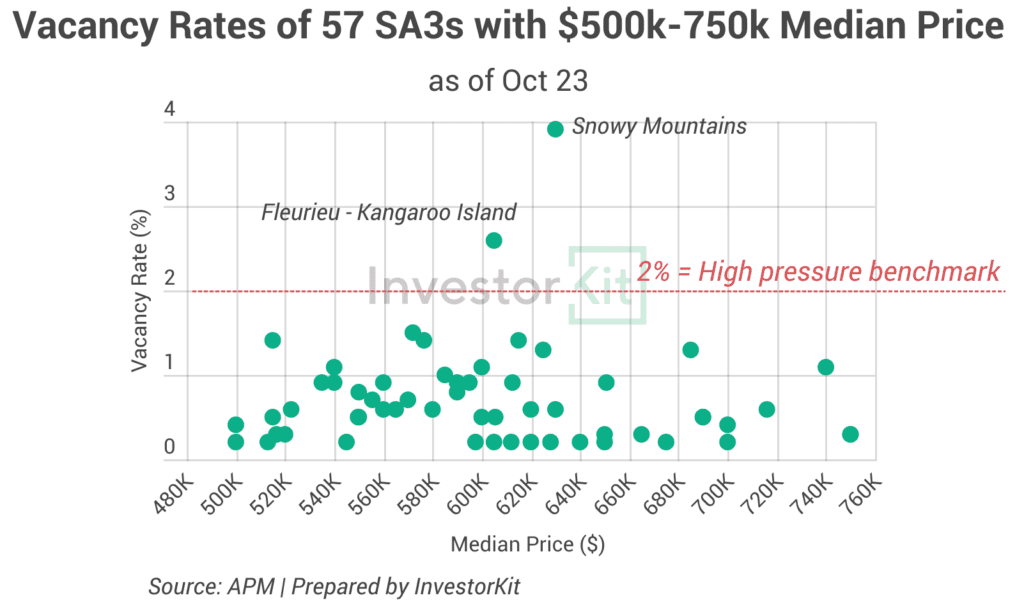

All the 57 moderate-price-moderate-yield regions enjoy high-pressure (<2%) vacancy rates except Snowy Mountains and Fleurieu – Kangaroo Island (chart below). 46 of them even see <1% vacancy rates, a crisis level.

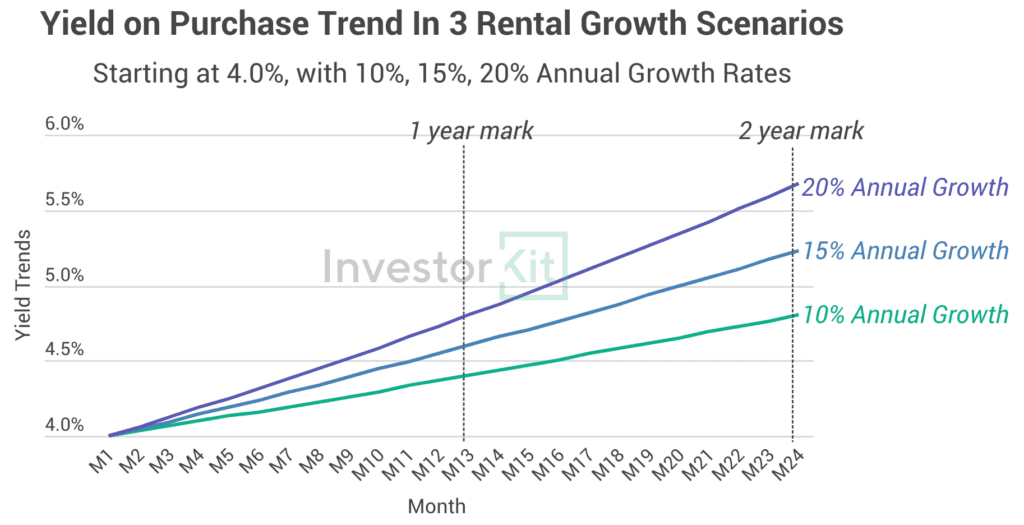

The middle ground price level means they are not exceptionally hard to enter even with lifted interest rates, and the high rental market pressure (low vacancy rates) makes it easy for rents to increase by 10% to 15% or even 20% within the first 1-3 years of holding, quickly lifting the owners’ Yield on Purchase to a healthy level of 4.5-5.5% or higher. The chart below shows how Yield on Purchase grows over 2 years after purchase in 3 growth rate scenarios.

In a nutshell, the nationwide increase in rental yields is likely to attract investors back to the market and, therefore, increase market demand, which would lead to price growth. However, this effect is not fixed or universal – It can be more noticeable in some markets (eg. the moderate-price-moderate-yield markets) than others. It’s crucial to note that the property market is complex and influenced by a multitude of factors. Housing supply, demographic trends, economic activity, government policies, and many other influencers can all contribute to rental yields, house price growth and the interplay between them.

InvestorKit buyers’ agency focuses on decoding the complex property market by collecting and interpreting data. Our data-driven approach has helped hundreds of property investors find the balance between equity growth and cashflow and build a scaled portfolio that meets their own investment goals fast, no matter what the macro environment is like.

Would like to buy your next investment property with InvestorKit by your side? Talk to us today by clicking here and requesting your 45-min FREE no-obligation consultation!

.svg)