Sydney, the most unaffordable city of the country housing wise, is experiencing the biggest property boom in decades.

As a buyers’ agency based in this city, InvestorKit team meets a huge number of Sydneysiders who are lured by the wild climb of Sydney’s housing price and want to start their own property investment journey. Many of these property investment newbies are young and don’t have much budget, so the first thing they tend to think is to go for an apartment.

This may be the biggest mistake that first-time investors are making: They only feel comfortable buying in their own city (or even their own neighbourhood) and buying something looking nice. And because of their limited budget, they end up with an off-the-plan apartment.

What they have overlooked is that if they invest borderless with the help of a professional/buyers’ agent, they can get a house that generates similar rental return but grows much better in value.

We call ourselves professional not because we are always saying you’re making a mistake, but we use data and real-life cases to prove our theory. Now let’s go for a data ride.

Why is it better to go for a borderless house than a Sydney apartment?

Now that we know that buying apartments is not a good idea for investors, what should we do when our budget doesn’t allow us to buy the unaffordable Sydney houses?

You don’t have to limit yourself to Sydney. There are so many locations across the country where houses are still affordable and generate good rental return.

Just look at these numbers:

As of Nov 2021,

– there were 27 SA3’s in New South Wales where the median house prices are still under $650k, all of which are regional cities;

– the median house price of Nundah, an SA3less than 10km from Brisbane CBD, was $760k, having grown 21% in a year;

– the median house price of Onkaparinga, anSA3 30km south of Adelaide CBD was $459k, having grown 18% in a year;

…

So many options if you look beyond the city or state border.

Now how about some real-life examples?Below are 3 properties that were sold 10 years ago and then sold again lately.

Imagine your budget was $650k back in 2012. By buying property #1, you got a shiny new apartment. In 10 years, it brought you $331k capital growth and $650 rental income per week;

However, if you didn’t mind buying in regional cities and got property #2 in Wollongong with just $20k above your budget, your capital gain would be $790k and the rental income now would be $950 per week;

If you didn’t feel comfortable increasing your budget but was flexible to go interstate, you could find property #3, just 8km south of Brisbane CBD, and $50k lower in price than the apartment. 10 years later, it would have brought you $645k capital growth and circa $750 weekly rental income.

By going borderless, you get so many more options. The only thing you need to do is to get rid of the mindset of “buying in my city”.

What if we stay in that mindset? The biggest risk would be oversupply.

Oversupply happens in both sales and rental market.

New apartments don’t come alone, they either come with a whole building of other new apartments, or even worse, are in a newly developed area where thousands of new apartments are in the pipeline.

You know that healthy growth occurs when demand exceeds supply. With thousands of new properties continuously being supplied, how do you think the capital growth will be like?

Brisbane inner city is a good example.

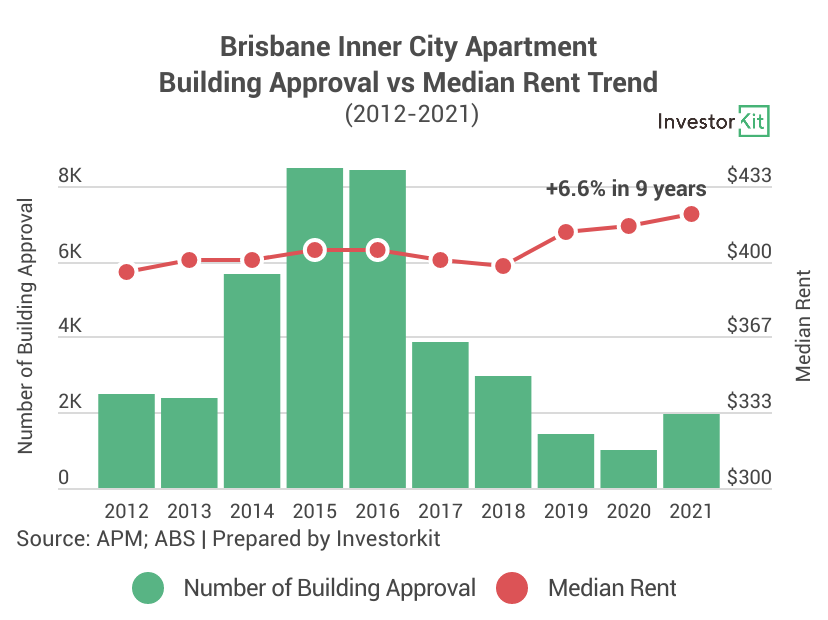

In the last 10 years, the population of Brisbane inner city (including the SA3 of Brisbane Inner, Brisbane Inner – East, Brisbane Inner – North, Brisbane Inner – West) was growing strongly, leading to a steady apartment price growth, which triggered a hike in the number of apartment building approvals from 2012 to 2016. With this surge of new supplies, the apartment median price just grew averagely 2% per annum in the decade, with a slight decline in 2016-18. Although the steady population growth has increased housing demands to some extent, the huge number of new buildings inevitably led to oversupply and substantially slowed down the price growth.

In the meantime, the rental market didn’t perform impressively either. With so many new apartments listed for lease every year, the median rent only has grown by 6.6% in 9 years. That is just 0.7% per annum.

So if you are planning to invest in an off-the-plan apartment just because you can’t afford a house in your comfortable zone, whether it’s your suburb, your city or your state, think of Brisbane’s inner-city apartment market. Don’t think that you have no other options, because you do – Just look beyond the border.

To feel comfortable to go borderless, you need to carefully do your research, getting familiar with the local economy, market trends, and the lifestyle. For most property investment newbies who are investing more time in career development, a property investment professional, such as InvestorKit, is highly recommended. We take over all the boring jobs – data digging, property search, due diligence, etc. – and just present you the best of the best that suits your goal and budget. It saves you time and effort, and what’s more, it gives you peace of mind.

Are you considering investing in a Sydney apartment just thinking you can’t afford a house? Think twice and better talk to a professional before putting your savings in. InvestorKit offers a 45min no-obligation consultation on property investment for FREE. Why not take this opportunity to get a second opinion? To organise it, simply hit the booking button or give us a call on 1300 119 796!

.svg)