After having purchased investment properties for hundreds of clients, one-third of whom now own more than 3properties, the InvestorKit team decide to share with you our secrets to investing success – The 5 Must-Follow Rules:

1. Don’t buy new.

2. Don’t purchase apartments; buy houses.

3. Be flexible and go borderless.

4. Aim for positive cash flow AND capital growth.

5. Target high-pressure market and reduce risk.

1. Don’t buy new.

New properties can be more harmful than good: A risk of oversupply, the lack of reliable data, and no renovation potential are some of the reasons that cause harm to property investors.

· New properties suffer from the risk of oversupply.

In one of our previous blogs, New Properties are More Harmful than Good to Your Investing Goals, we compare two Queensland suburbs’ growth from 2012 to 2021.

Newport was half-empty back in 2012 and has been filled up with new houses year by year, while its neighbouring suburb Redcliffe has been well-established the whole time.

During the test period, Newport’s median price fluctuated due to the constant release of new supply, while the Redcliffe market was steadier (see below charts). Looking at their capital growth, Newport has only achieved 14% growth (approx. 1.3% per year), while Redcliffe has experienced a stronger 62% growth (approx. 5% per year). In the first year of the COVID housing boom, Redcliffe performed better than Newport as well – 23% annual growth by Redcliffe, 9% by Newport.

The power of scarcity.

· New property markets lack reliable data, leading to higher uncertainty.

Before buying a property, you want to be sure of two things about it – the current value, so you don’t overpay for it, and the growth prospect, so you don’t lose money over time.

To determine the current value of a property, sales history and comparable properties are both important references. An established property is more likely to have a history of sales. Buying in an established area also makes it easier to find plenty of recent comparable sales nearby.

On the contrary, a new property has no previous sales record. If it’s surrounded by empty land, chances are much lower to find enough comparable properties to determine its fair value range. I’m sure you have come across situations where different valuers give way different valuation results on a recently completed property because they don’t have enough references.

Analysing market pressure Is a way we use to help uncover the growing prospect of an area. For an established area, data is consistent – The total number of houses and transaction volumes do not change dramatically over time, so we can put any year’s market data (eg. number of listings, sales volume, days on market, vacancy rates, etc.) together to examine trends with greater statistical reliability.

However, if an area has a large number of new houses coming up to the market from time to time, its market data would be rather unstable – This year it may have 200 sales because of the completion of a new development, the next year only 50 as there’s no new completion, and the third year 120… Having reliable market trends is important to uncover the real market pressure of a given area, buying new and area of high supply doesn’t allow for this.

2. Don’t purchase apartments, buy houses.

Many property investment newbies would go for an apartment when their smaller budget can’t afford a house in the areas they like – that is the biggest mistake we see first-time investors make.

When buying an apartment, you are putting yourself in front of a huge risk we just discussed – Oversupply.

The Brisbane apartment market is a good example.

In the first few years of the 2010s, Brisbane’s strong population growth and increasing housing needs led to a steady rise in apartment price, which triggered a hike in the number of apartment building approvals from 2012 to 2016. With this surge of new supply, the apartment prices were severely suppressed in the following years, and only achieved an average 2% annual growth for the decade.

In the meantime, the rental market didn’t perform impressively either. With so many new apartments listed for lease every year, the median rent increased by only 6.6% in 9 years. That is just 0.7% per annum.

You may be asking: If I can’t afford a house in the area I like, and I should not buy an apartment either, do I just give up on property investing?

Of course not. Why not look beyond the border – There are plenty of houses even cheaper than metropolitan apartments in booming regional areas or the capital cities in other states!

As of April 2022,

– there were 25 SA3’s in New South Wales where median house prices are still under $650k, all of which are regional cities. Many of them are well-known lifestyle locations or regional centres, such as Bathurst, Taree – Gloucester, Wagga Wagga, Albury.

– Launceston, Tasmania’s second largest city, has a median house price of $540k, having grown 35% in a year.

– Warrnambool, a VIC town on the Great Ocean Road, has a median house price of $586k, having grown 33% in a year.

…

Going borderless, you will achieve much more than limiting yourself in your local apartment market.

3. Be flexible and go borderless.

Investors often create a list of must-haves assuming they would assure the growth of a property. Some of the common ones are

· Suburbs surrounding the CBD

· School catchment zones

· Towns by water

· Capital cities

· Avoid tropical areas

…

All these preferences are limiting your options and holding your investing success back.

· Capital City vs. Regional Town

One of our previous blogs, Why a Capital vs. Regional City Mindset Will Hold your Investing Success Back, finds that regional property markets are getting more active than capital cities, and they don’t necessarily grow slower than capital cities.

– Regional property markets are more active

While hosting less than 1/3 of the country’s population, regional Australia generates 37% of all property transactions nationally, and this number has been growing since around 2014 (so it’s not just a COVID trend).

– Capital cities don’t necessarily grow faster than regional cities.

Many investors believe that capital cities grow better than regional cities, but data won’t agree. The property price trends of Sydney and regional NSW over the last 15 years (the below chart) tell us that regional markets can even beat the largest city.

How about some specific examples? Let me show you some SA3s’ annual growth figures up to April 2022:

The capital city SA3s in the above list are some of the fanciest suburbs of the country, yet they don’t always grow the fastest. In the past year, their property growth rates were far behind many regional cities.

· Are amenities that crucial?

If you still believe that amenities – train stations, shopping centres, schools, etc. – bring faster growth, you should check our previous blog and get an idea why stations, schools, shops, beaches and distance to CBD should not be your no.1 focus when Investing. Long story short, what’s there has always been there. A new amenity’s influence may help its surrounding area grow faster for awhile, but the growth rate would come back to “normal” once the difference is fully reflected in the price level.

Taking Melbourne school catchment zones as an example.

Nossal High School is ranked No. 3 inVictoria. As it is a selective school, we draw a 2km radius around it and get theSA3s Narre Warren and Berwick as its catchment zone.

We use the SA3s Endeavour Hills and Doveton Gleneagles as comparison as they are the catchment zones of two average schools, Secondary College and Dandemon High School, both ranked 200+ in the state.

The below chart shows the 9-year price growth trends of the two groups. Guess what? They are parallel to each other, with the average school catchment growing slightly (0.44% annually) faster.

How about the distance to CBD? We pick two SA3s northwest of Sydney CBD:

Ryde &Hunters Hill – 10km to Sydney CBD

Baulkham Hills -30km to Sydney CBD

Their 9-year growth trends show that Baulkham Hills, though farther from the CBD, has grown better than Ryde &Hunters Hill (the below chart).

Check the blog for more data tests on train stations, schools, and distance to CBDs in other cities.

In addition to the fact that the amenities’ influence on property growth does not last forever, one important thing to note is that people’s needs and preferences vary – Not everyone likes living close to a busy train station; not all households have a kid who must attend a top school; not everyone enjoys the beach … Every location has a market. If we buy investment properties based on our own tastes only, we would be missing out on so many possibilities.

4. Aim for positive cashflow AND capital growth.

Greater Sydney’s gross rental yield (annual rent to price ratio) has declined to 2.4%, Greater Melbourne 2.7%, as of April2022. Although these two cities’ house prices have surged in the past 2 years, it seems impossible to achieve positive cash flow here unless you’re a cash-buyer.

Does that mean that positive cash flow and capital growth are enemies that we can never achieve both at the same time?

No. Check out the below chart – Out of the 261regions that have achieved double-digit growth in the past year, 80 still enjoy a yield higher than 4%, 24 even higher than 5%.

Some of these healthy-yield regions are:

These regions may not have achieved the fastest annual growth, or the highest rental yield, but they are positioned at a sweet spot where you can enjoy good capital growth, while not having to take extra cash out of your pocket to keep the property.

It’s important to note that the rental yields in many regions declined steeply in the past year because the price grew so fast that the rental price could not catch up in the short term. Currently Australia is going through a rental crisis with a national average vacancy rate of just 0.7%. We expect rents in many cities across the country to catch up fast in the coming 1-2 years to get a more balanced yield level (check our recent whitepaper 20 Regions Where Rents Will Continue Surging).

Some people believe that the lower yield, the stronger growth. However, data tell us that it’s not always the case. The below charts show the 20-Y property growth rate and yield trends of four greater capital cities – Sydney, Melbourne, Brisbane, and Adelaide.

– From 2012 to 2021, it does appear thatlower-yield cities tend to perform better:

Average Yield: Melbourne (3.31%)< Sydney (3.43%) < Brisbane (4.18%) < Adelaide (4.28%)

10-Y Growth: Adelaide (40.5%) <Brisbane (49.4%) < Melbourne (78.1%) < Sydney (97.9%)

– However, if we look at the previousdecade, it’s not the case:

Average Yield: Melbourne (4.19%)< Sydney (4.21%) < Adelaide (4.54%) < Brisbane (4.77%)

10-Y Growth: Sydney (66.4%) <Melbourne (98.3%) < Adelaide (130.1%) < Brisbane (132.4%)

Why? Because property growth is driven by demand and supply in the sales market, but yield is not a direct indicator of it. As mentioned previously, the low yield level in many regions is the result of price surges, instead of the cause. If you enter a market because of its low yield, you could have just missed its fast-growing phase.

5. Target high-pressure market and reduce risk.

We always talk about avoiding the risk of oversupply and being as flexible with locations as possible. Then how do we make sure that a location is of low risk and is set to grow?

We examine the local economic performance and market demand and supply to decide its market pressure, and we buy in areas with higher pressure.

· Local Economy

A thriving local economy would bring people, job and business opportunities, and money into a market, and therefore drive up the local housing demand. So the economic performance is a crucial indicator of the local property market.

Then how do we understand the local economic activities? Some major indicators include:

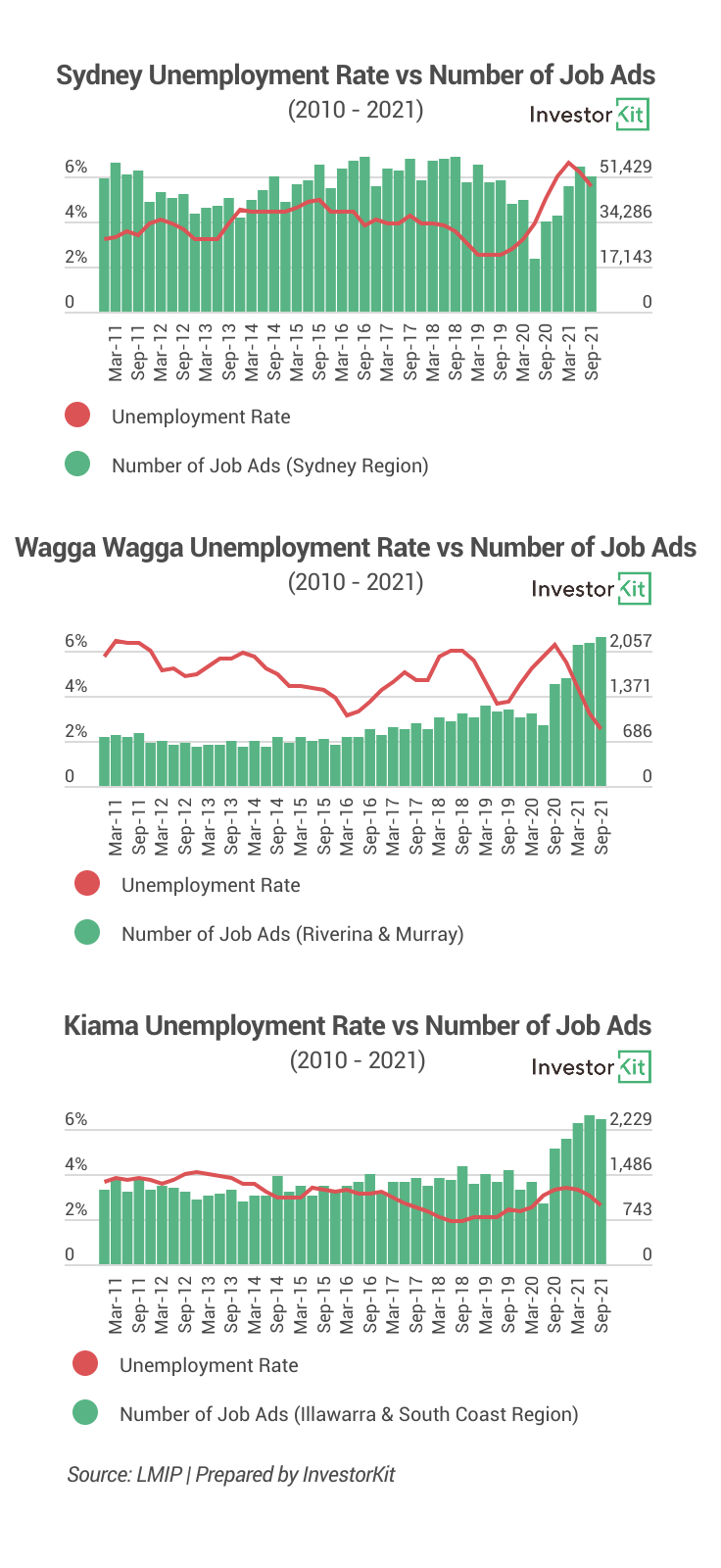

– Unemployment rates & Number of job ads

When unemployment rates are low or lowering, the local job markets are active. The job market activity can be reflected by the total number of job ads, and the growing number of job ads is an early sign of a strengthening local economy. Increasingly active job markets. The below charts show Sydney and 2 regional NSW cities’ unemployment rates and number of job ads trends. Once knowing that the regional cities’ job markets have been thriving in recent years, it would be easier to understand why regional NSW’s property markets are now performing even better than the capital city.

-Internal migration trends

An Australia Centre for Population report suggests that employment opportunities and affordability are two of the main reasons why people migrate between cities, and the growth of population would stimulate consumption and boost the local economy in return. Taking Victoria as an example (the below chart), when a region (either Greater Melbourne or the rest of VIC) is gaining more people, their unemployment rate would follow and decrease, indicating more robust economy.

-Infrastructure investments

Infrastructure investments provide additional stimulus for the local economy. A 2020 Global Infrastructure Hub study finds that the economic multiplier for public investment (including infrastructure) is 1.5 times greater than the initial investment in two to five years (below chart).

All three levels of government have been using infrastructure investments to boost economies. For example, the NSW StateGovernment established the Restart NSW Fund since 2011 to enable the funding and delivery of high-priority infrastructure projects. 30% of this fund is committed to regional areas outside of the metropolitan areas of Sydney,Newcastle, and Wollongong over its life. Up until the release of the 2021-22 State Budget, $10.2 billion from Restart NSW has been committed and reserved for programs and projects in regional NSW. These infrastructure projects have inevitably contributed to the revitalisation of regional NSW economy in recent years.

Other helpful economic indicators include industry composition (resilience of an economy), airport passenger movements(liveability and attractiveness), and housing finance commitment trends (confidence in making large purchases), etc. Check this blog for more details.

· Market Demand & Supply

Price grows when demand exceeds supply. Look out for the below 3 signs to identify such a market:

– Low inventory

Inventory is a ratio calculated by dividing the current number of total listings by monthly sale volume. It’s a direct indicator of the relationship between sales market demand and supply. The higher inventory, the higher risk of oversupply, and the lower market pressure.

The below charts show the inventory and median house price trends of two VIC regions from Dec 2020 to Dec 2021. With a lower inventory level, Bendigo grew 14% more than Wyndham.

We are not saying that Bendigo grew better solely because of the low level of inventory, but the high market pressure does make it easier for price to grow strongly, as existing house supply will be the greatest way to see upcoming capital growth potential. We are simply saying that the low inventory level creates an environment of scarcity for prices to continue rising.

– Low building approval rate

The number of new house Building Approvals is the future supply to the sales market, and without increasing demand, large number of new houses could mean oversupply, which would lead to weak price growth.

The below charts show the building approval rate(number of building approvals to number of existing houses ratio) and the median house price trends of 2 NSW regions over the 5 years to the end of 2021.

In five years, Hornsby houses have grown 10%+ more in value than Blacktown – North houses. Although Blacktown-North is cheaper, making it more attractive to many, large blocks of new houses flooding into the market reduced its market pressure. On the contrary, Hornsby’s house market is much tighter with a much lower level of incoming new-built supply, allowing for greater price growth when the demand returns.

– Low vacancy rate

Vacancy rate is a great way to analyse rental market demand and supply. A low vacancy rate (<2%) means it is a landlord’s market where it’s easier to rent your property out and rents will be growing fast.

The below charts show the vacancy rates and rent trends of 2 QLD regions from Dec 2020 to Dec 2021.

For PortDouglas where the initial vacancy rate was high, the weekly rent didn’t grow until the vacancy rate declined to around 1% in the 6month. On the other hand, with a constantly low vacancy rate, Buderim’s weekly rent has been rising steadily over the year, achieving a higher annual growth than PortDouglas.

Summary

This has been a bit too long for a blog. If you have made it here, you must have noticed that all we are talking about is demand and supply. For investors, it’s not low purchase price, capital city location, or a certain yield level that makes a good investment, but a healthy relationship between demand and supply.

To correctly understand the demand and supply in markets across the country, data is essential. InvestorKit buyers’ agency commit ourselves to the highest level of quality in the space of data interpretation and trend analysis. We spend hundreds of thousands of dollars on data acquisition and market analysis every year just to make sure that every purchase we make for you is backed by solid data.

If you also believe in the power of demand and supply but have no time or effort for data analysis, let us help! Just book in your 45-min FREE no-obligation consultation today and leave the rest to us!

.svg)