Oxford Economics’ recent Residential Property Prospects report predicts that in the coming 3 years, Sydney’s house prices will grow by 16%, while apartments will outperform and climb by 23%.

The report states that Sydney’s skyrocketed house prices will push property buyers to the more affordable apartment market, lifting apartment demand and therefore driving unit prices up.

This report has boosted the confidence of many investors that now is a good time to invest in Sydney apartments.

But is it?

No, It’s Not.

First thing first, Oxford’s forecast does make sense, the reasons being:

1. Affordability concerns may drive apartment demand high.

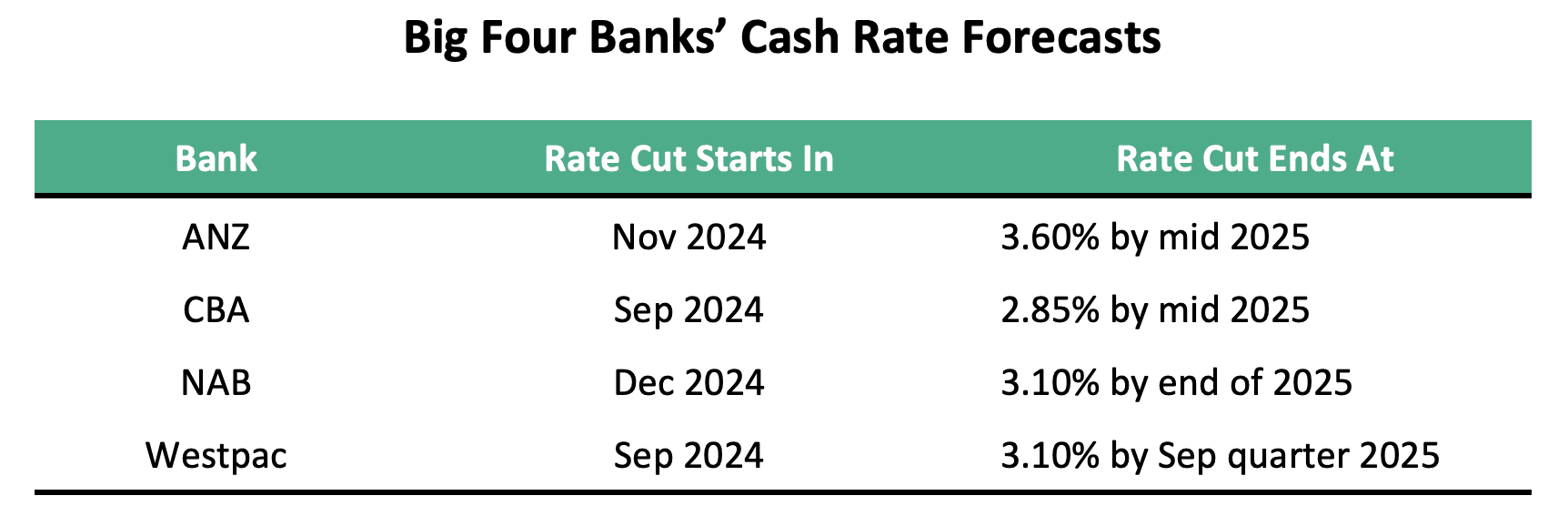

Affordability is a big concern for most property buyers. Interest rates are likely to stay high for most of 2024, and even though the RBA cash rate is estimated to start going down towards the end of the year, it won’t go back to the extremely low 0.1% level as it was during the pandemic (table below).

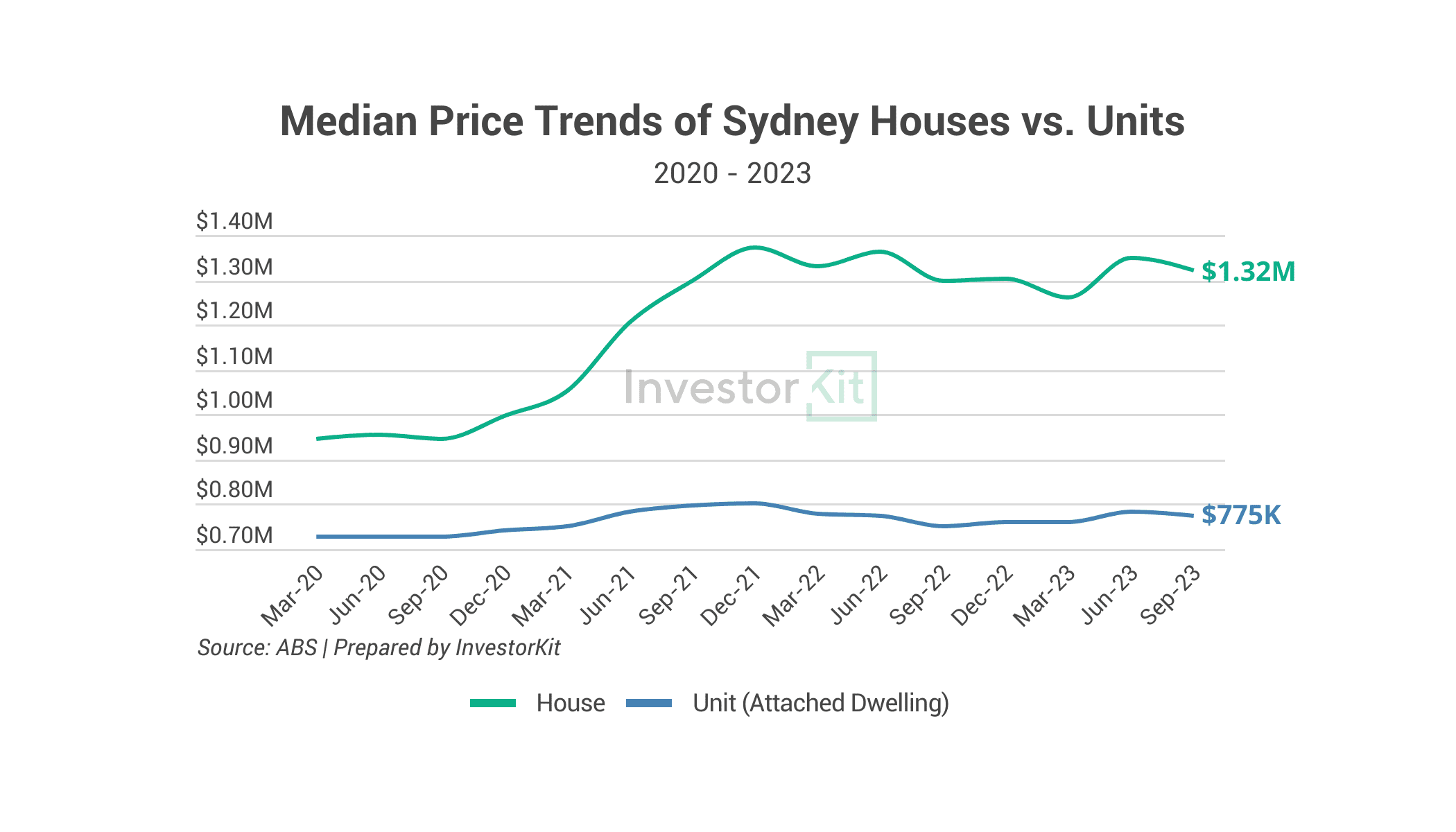

Being 41% cheaper than houses (chart below), the affordability advantage of units is now very considerable.

2. Apartment supply is limited due to construction delays.

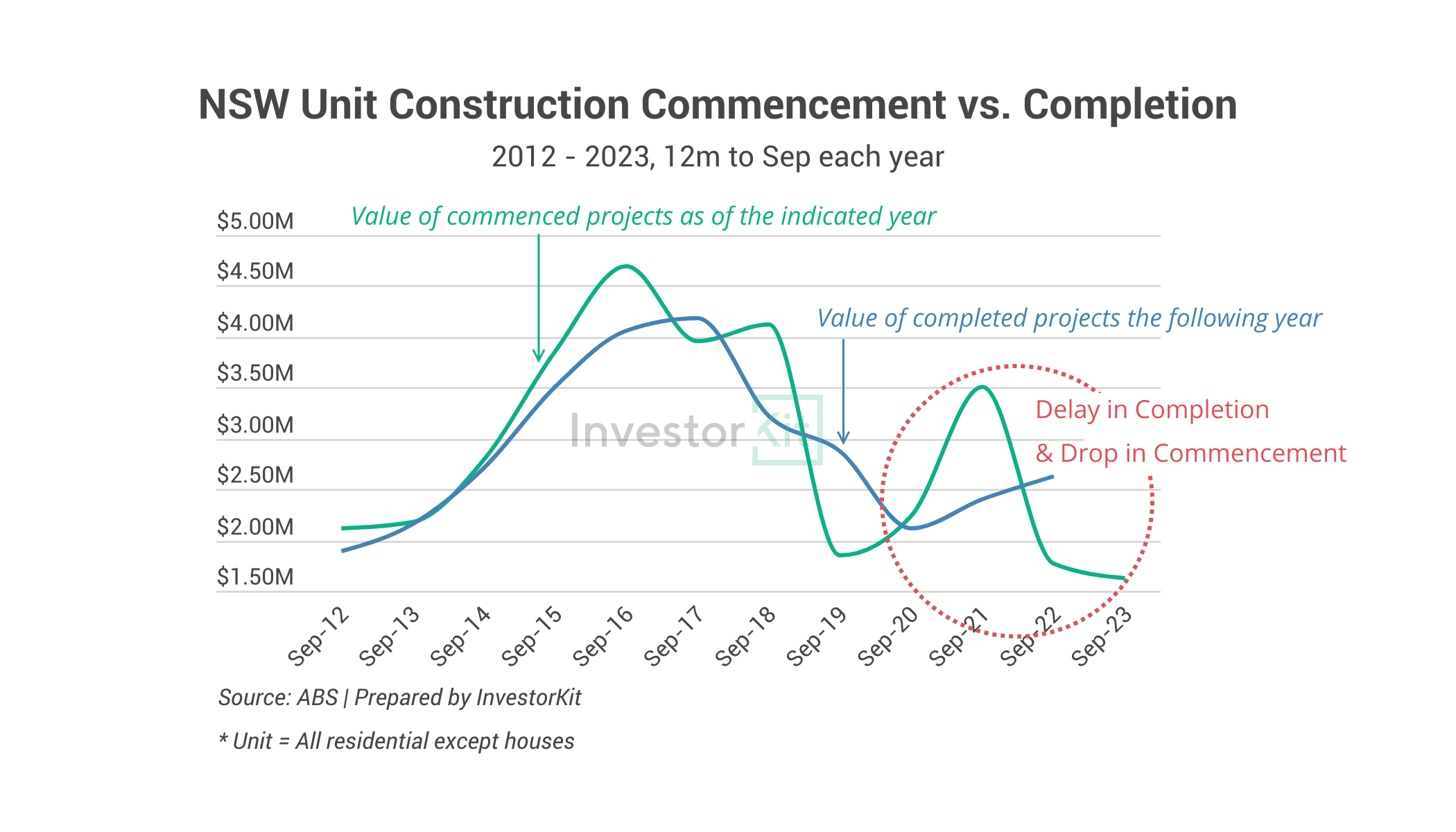

The surge in construction costs and labour shortage during the pandemic have led to massive delays in apartment delivery and a steep drop in construction commencement (chart below).

The decrease in new apartment completion has led apartment supply to slightly trend downward in recent years (chart below). The historic low construction commencement amount will likely result in a further decline in apartment supply in the coming years.

As demand increases while supply trends down, it’s not surprising that apartment prices are going to rise.

However, are apartments worth investing in now?

The answer is still NO, for the same old reason –

Lack of Scarcity

Houses are attached to lands, meaning if the land supply is limited, the house supply is limited, too. However, apartment supply is not limited by land size – you can build as many levels as you can so long as they align with local planning regulations (which can be adjusted if necessary).

Due to its high-in-supply nature, apartments are one of the solutions to the housing supply crisis and affordability problems in big cities: There’s supposed to be more and more apartment supply, so their prices stay relatively affordable.

Isn’t that the opposite of what you want for your investment asset?

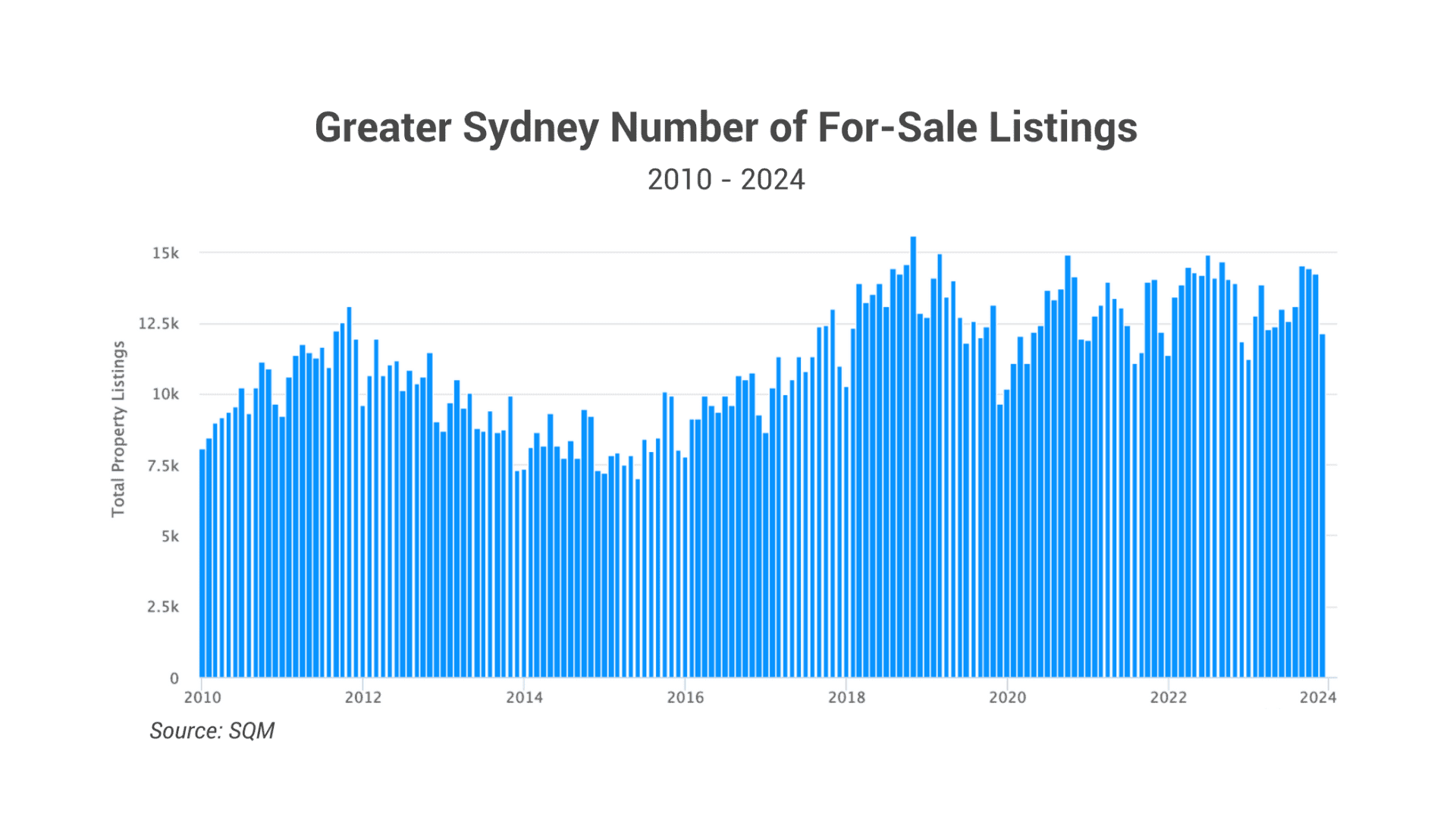

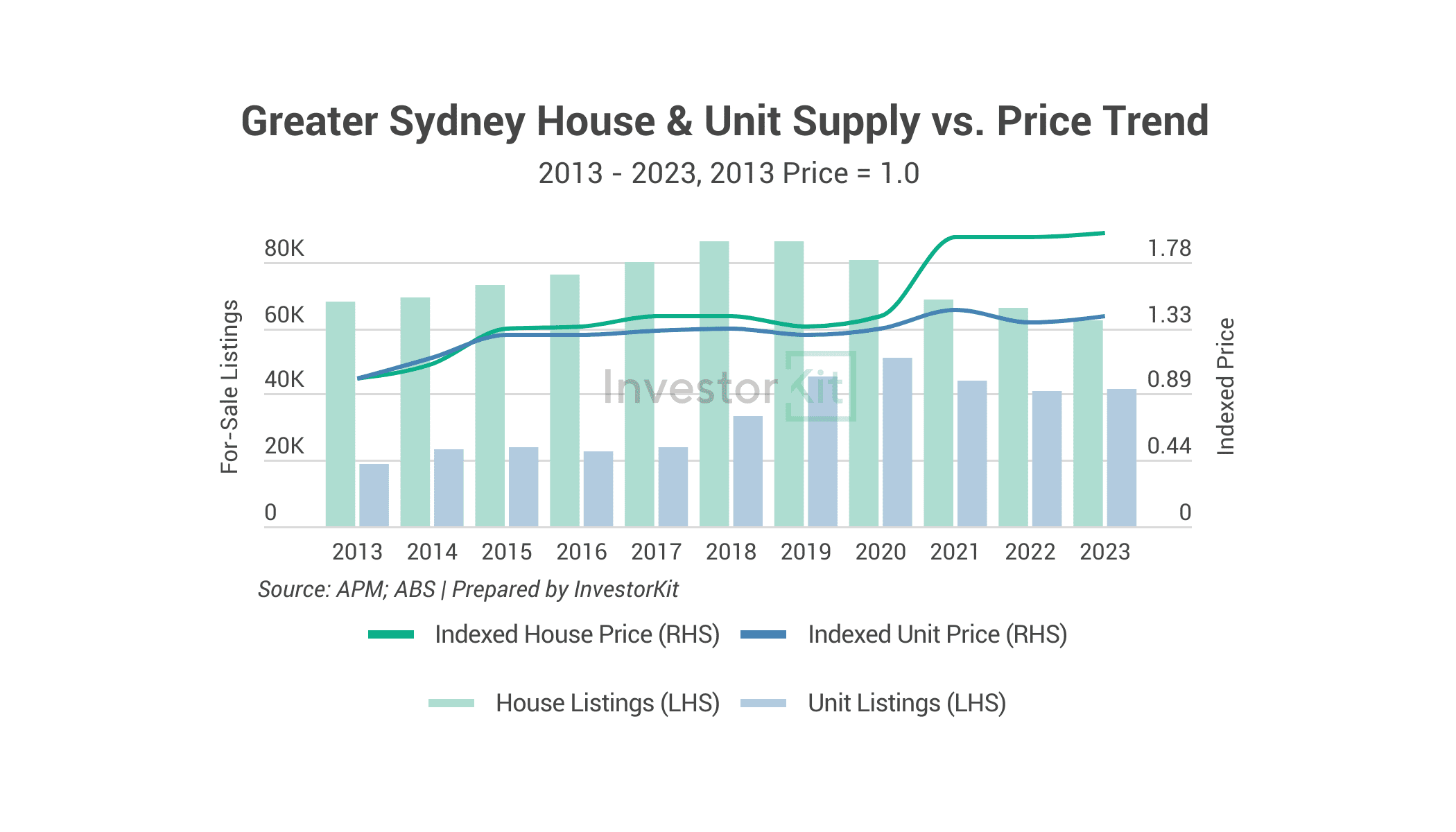

Oversupply led to the slow growth of apartments in the past 10 years. The chart below shows that since 2020, Sydney’s house supply (number of for-sale listings) has declined to the lowest level in a decade. In the meantime, house prices surged. In contrast, apartment supply, despite the decline in recent years, is twice the amount of a decade ago. The difference in supply level contributes significantly to the difference in price growth.

And oversupply will happen again and again because, as mentioned earlier, apartments are among the solutions to the housing supply crisis and affordability issues in big cities. As long as Australia’s population is heavily concentrated in the few big cities, which will be the case in the short and medium term, apartment buildings/complexes will keep coming to the market.

Short-term Investment for Quick Money?

Some investors may say I just want to hold the apartment for 3 years, grab that 23% growth, and sell.

Is that a good idea?

I’d still say NO.

First, 23% is an average prediction number; you’re not promised that growth rate by investing in any apartment.

Even if you are, property investment is a long-term game: holding for a long term and enjoying compound growth is the best option. Buying and selling in a short amount of time is costly:

- In buying – Stamp duty (4% of property value), conveyancing fee, building and pest inspection, LMI, loan application fee, etc.

- In selling – Marketing, staging & professional photo shooting, agency fee (approx. 2.2% of sales price), conveyancing fee, etc.

In total, it can cost you 10% or more of the property’s value in buying and selling, lowering your capital gain from 23% to only 13%, which averages 4.2% growth per annum.

Ask yourself, is it worth the time and effort to chase a 4.2% annual growth for three years?

You Have Better Options

Instead, why not put your money in a much longer-term investment and enjoy 5-6% p.a. compound growth over 20-30 years?

Yes, I’m talking about houses. Over the past 20 years (2003-2023), Australian houses have achieved 5.5% compound annual price growth.

How about budget and cashflow? Can houses be as affordable and achieve the same rental yields as apartments? If you look across the country, it may surprise you how many regions’ house prices are similar or cheaper than Sydney apartments with even higher rental yields.

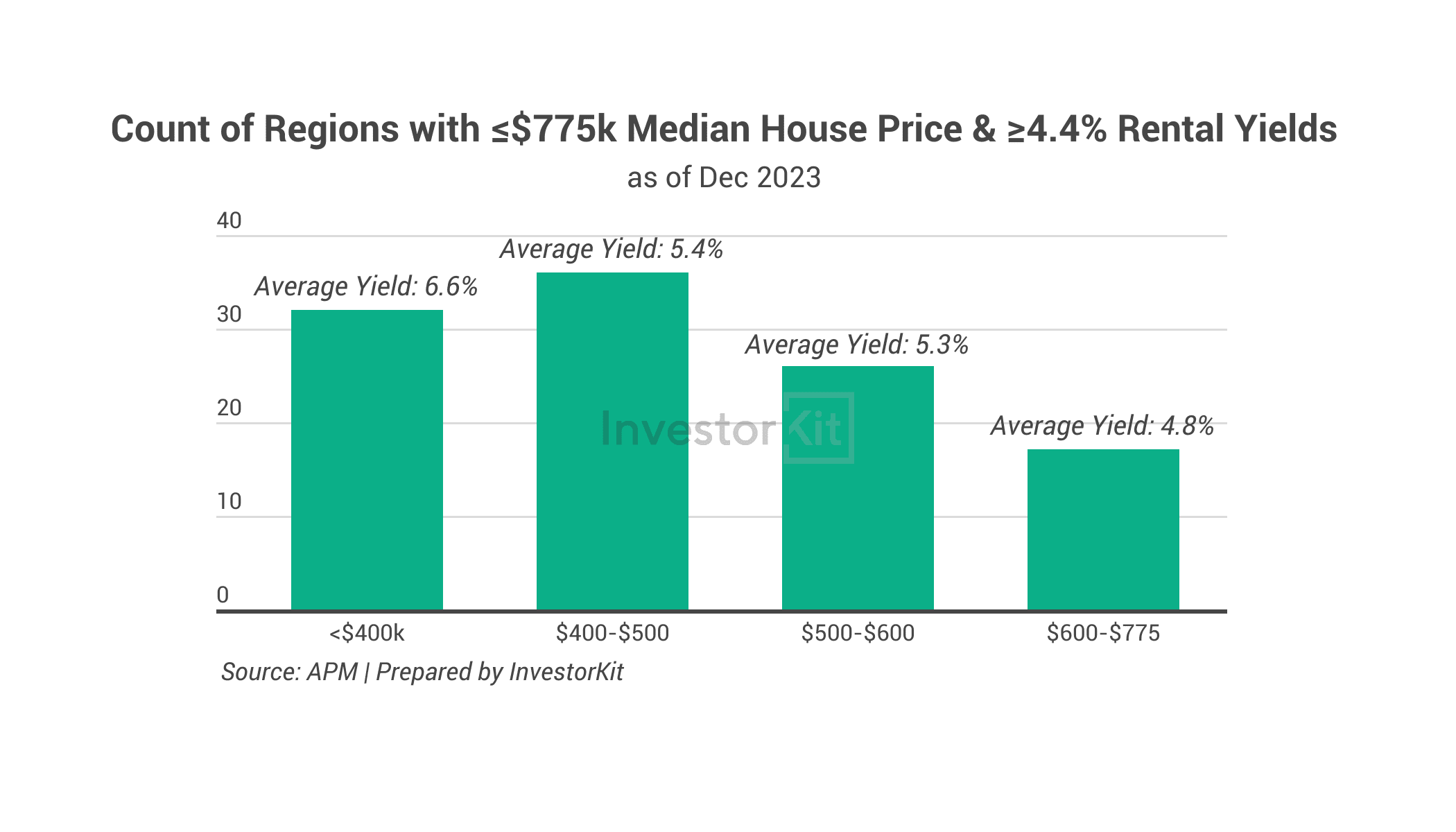

Sydney’s median apartment price is $775k as of the end of 2023, with an average yield of 4.4%.

Meanwhile, one-third of Australian SA3 regions (110 out of 330 with valid market data) enjoy median house prices lower than $775k and rental yields higher than 4.4% (chart below).

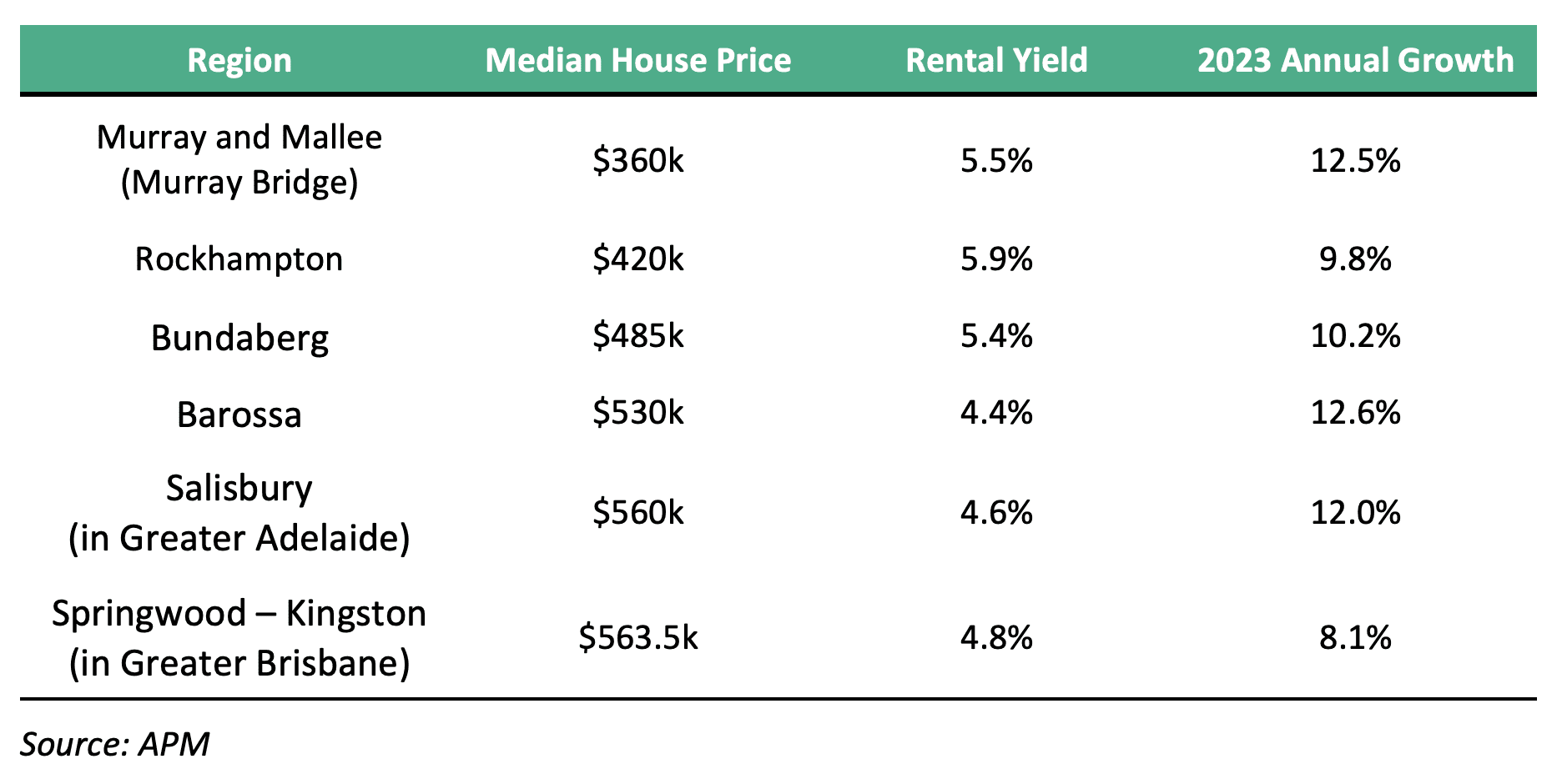

Some of these regions are:

Aren’t they all better options than Sydney apartments?

Don’t Lose Focus on Your Goal and the Bigger Picture

There are noises on your property investment journey, and the Oxford Economics unit market growth forecast is one. The prediction is reasonable, but note that it’s not investment advice. If your goal is to grow wealth through property investment as fast as possible, that prediction isn’t your reason to opt for apartment investment. Look at the bigger picture – apartments are unreliable in value growth due to their high-in-supply nature. They may grow fast in the short term because of favourable demand-supply relationships at some point in time, but over the long term, they underperform houses. Choosing the right asset is as crucial as, if not more than, choosing the right market.

InvestorKit is a buyer’s agency that utilises data and our rich industry experience to help property investors block out noises, focus on the bigger picture and achieve their investment goals faster. Want to start or continue your property investment journey with us? Talk to the team today by clicking here and requesting your 15-min FREE discovery call!

.svg)