Wollongong: The Largest City on NSW’s South Coast

Having explored Newcastle a few blogs ago, let’s move our attention to the south of Sydney and zoom into the other large coastal hub of NSW – Wollongong. Just 80km from Sydney and known for its industrial roots, stunning coastline and beaches and the university named after it, Wollongong has been one of the most popular regional destinations for overseas migrants in Australia. House prices in Wollongong have skyrocketed over the past decade. In Sep 2024, the median house price surpassed $1.2m, not much lower than Sydney ($1.4m).

With such high prices, can Wollongong’s property market continue growing in the coming year? Join us today to explore the city’s current property market conditions and outlook!

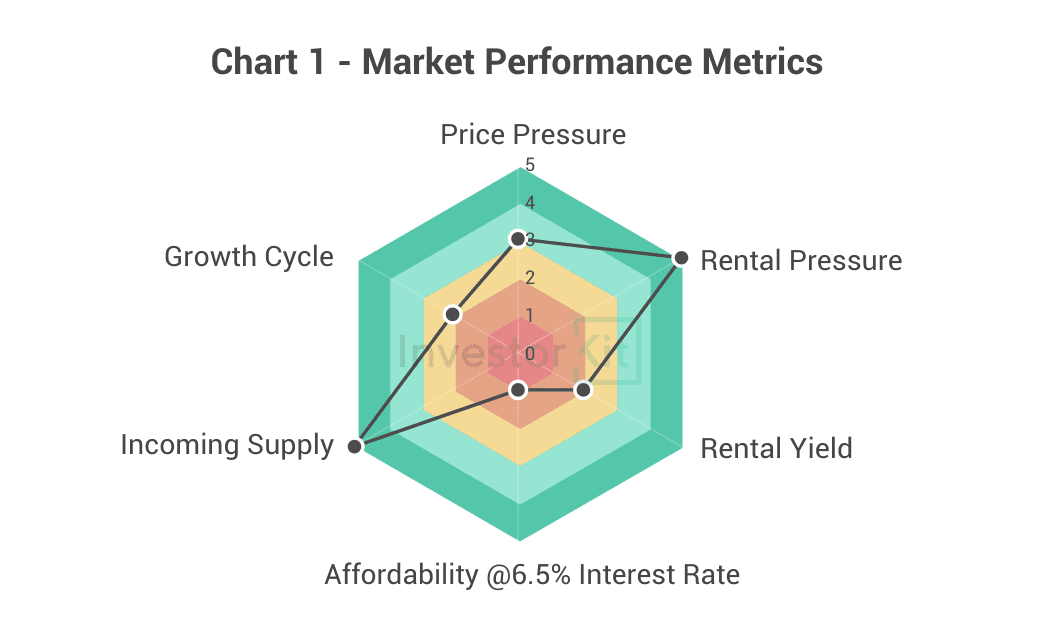

As of Sep 2024, Wollongong’s House Market Pressure is balanced.

Among the six metrics InvestorKit uses to measure market performance, Wollongong stands out in rental pressure and incoming supply. Price pressure is relatively high, while affordability, growth cycle, and rental yield scores are low.

Demographic & Economic Trends

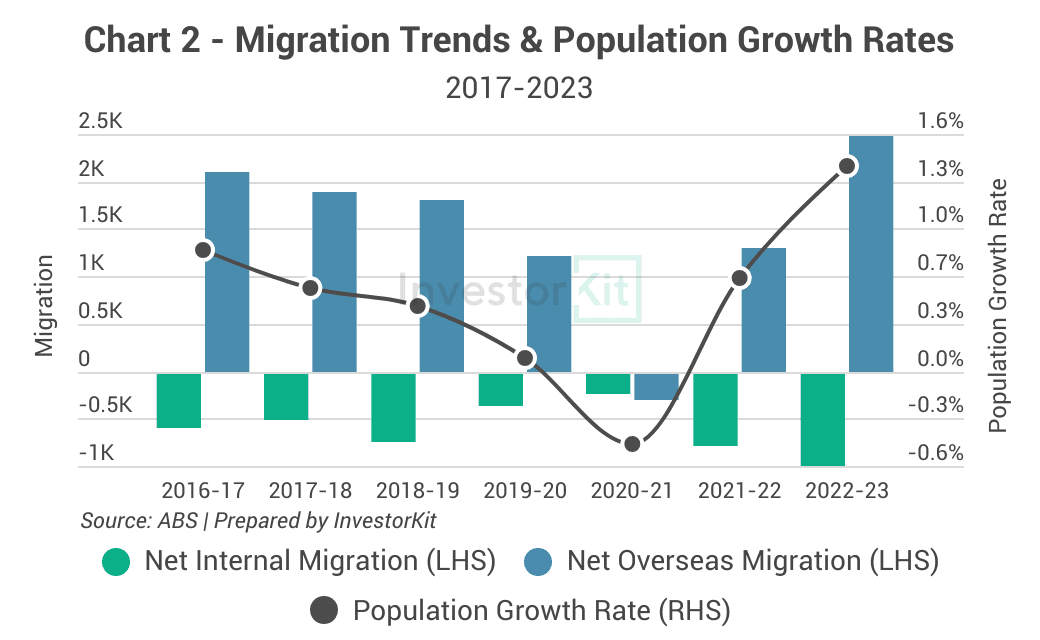

Wollongong’s population growth slowed down the few years before the pandemic, with decreasing net overseas migration and negative net internal migration. However, it has been recovering post-COVID thanks to the surging overseas migration. Internal migration continues to decline – poor housing affordability could be one of the major causes.

While population growth is improving, to what extent it can lift housing demand is yet to be determined – it could be less than that in cities where overseas and internal migration are both strong. The reasons are, one, the overseas migration post-COVID wasn’t the norm and won’t last long; and two, many overseas migrants are temporary residents, such as international students, whose housing demand rarely flows onto the sales market.

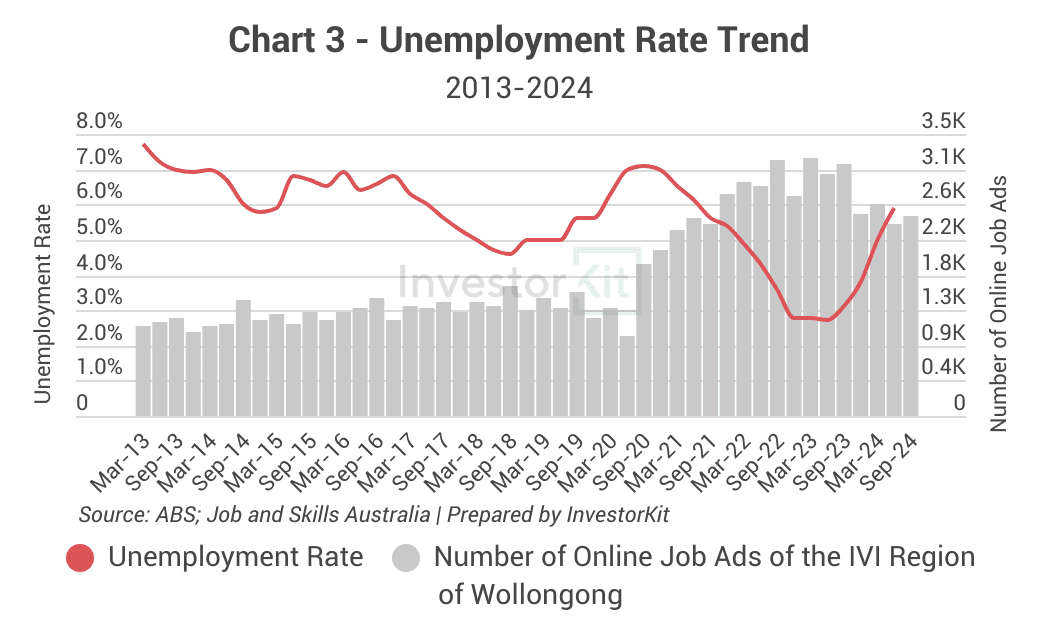

Wollongong’s unemployment rate has been increasing since mid-2023, reaching 5.9% in Q2 2024, back to its last-decade average level. In the meantime, the number of job vacancies remains elevated compared to the pre-COVID time, indicating an active job market. While we need to monitor where Wollongong’s economic strength is going from here, it’s currently performing well and is providing the property market with a healthy base.

Sales Market Trends

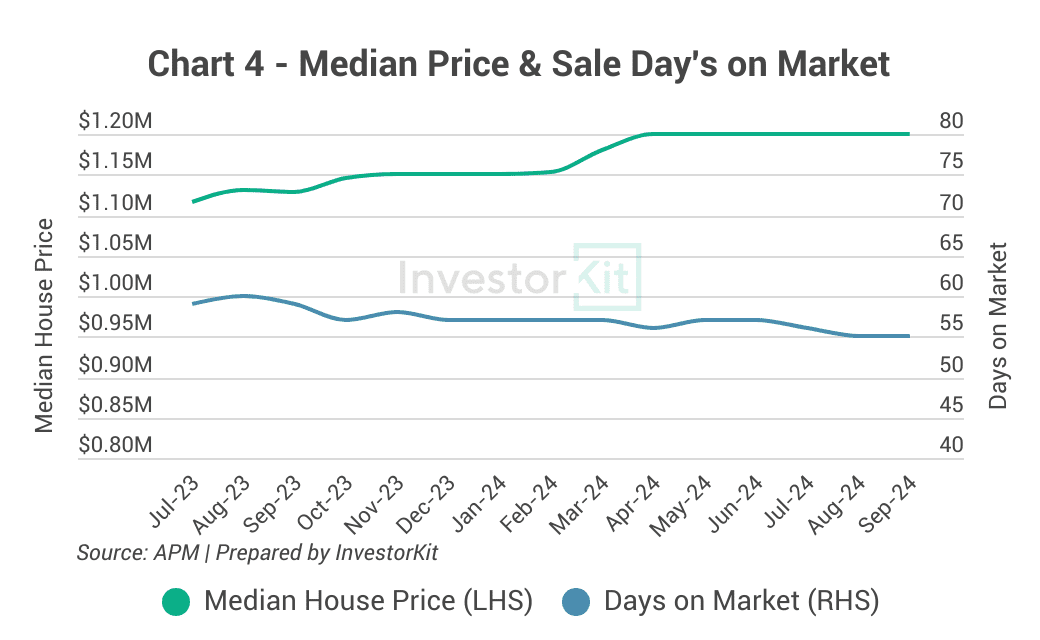

Wollongong’s house price has been flatlined since early 2024, having grown by 6.4% over the past year, in line with the long-term average. The moderate price growth is accompanied by a slight drop in sale days on market, which now seems to have stabilised at around 55 days, much elevated compared to 2 years ago (35 days).

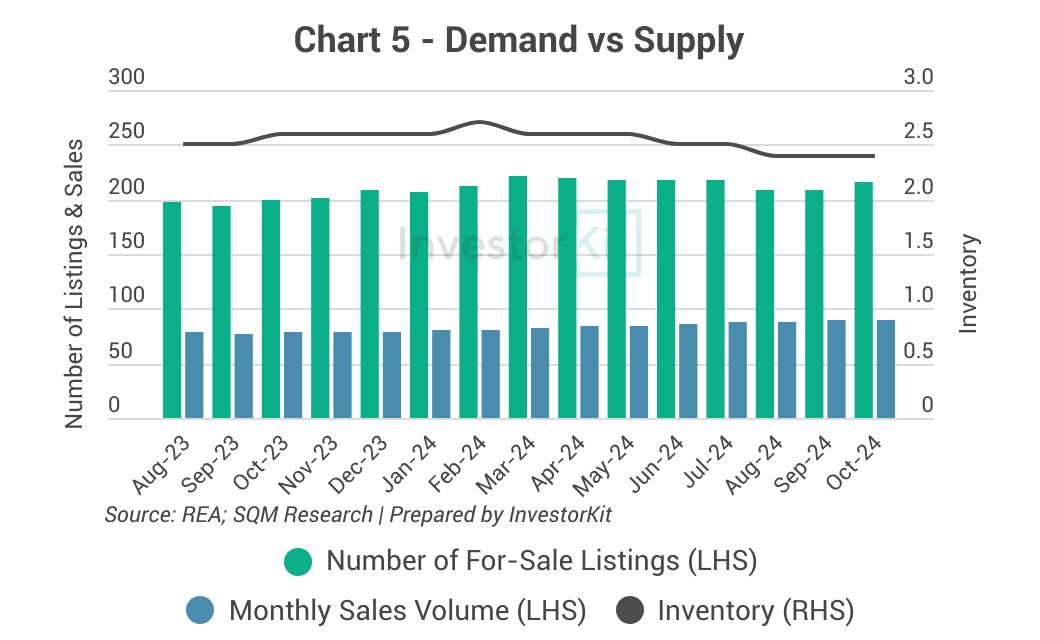

Looking at Wollongong’s house supply-demand relationship, it’s easy to tell why Wollongong’s house market, with an extremely high $1m+ median price, could still achieve healthy growth in the past year against the high interest rate headwinds. While the number of listings has gone up, the number of sales has also increased, making the ratio between the two, i.e. the inventory level, remain stable at a low level (well under 3 months of stock) for the entire year last year.

We expect this low and stable inventory level to continue driving Wollongong’s house market to grow, but as low inventory is almost the norm for Wollongong, we don’t expect a price surge unless there’s another significant drop in the inventory level.

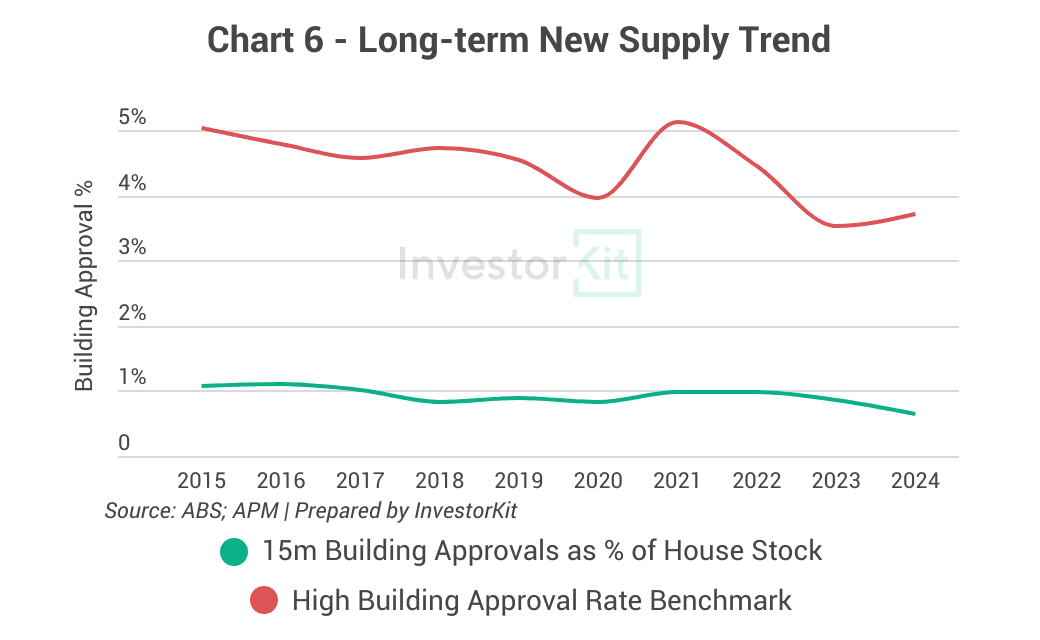

House construction activity in Wollongong has been low and stable in the past decade, showing little oversupply risk for the house market.

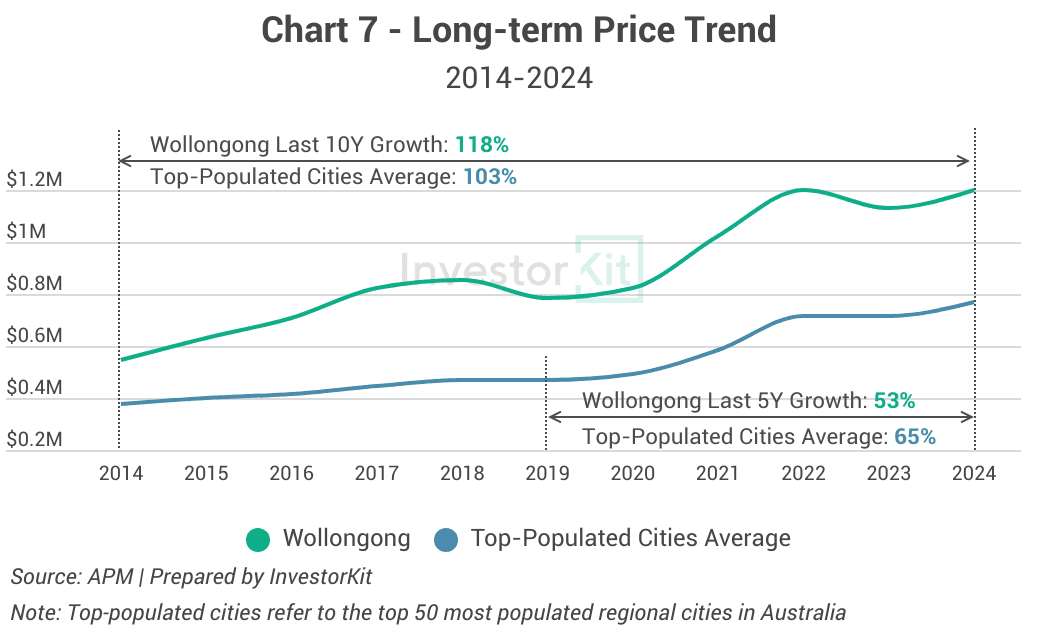

Wollongong’s house prices have achieved 53% growth in the past 5 years, lower than the average level of big regional cities. However, they have grown by 118% in the past 10 years, much higher than the average. This is all thanks to the boom before 2019. The extremely high past-10y growth, combined with poor affordability, will likely limit Wollongong’s price growth in the medium term.

Rental Market Trends

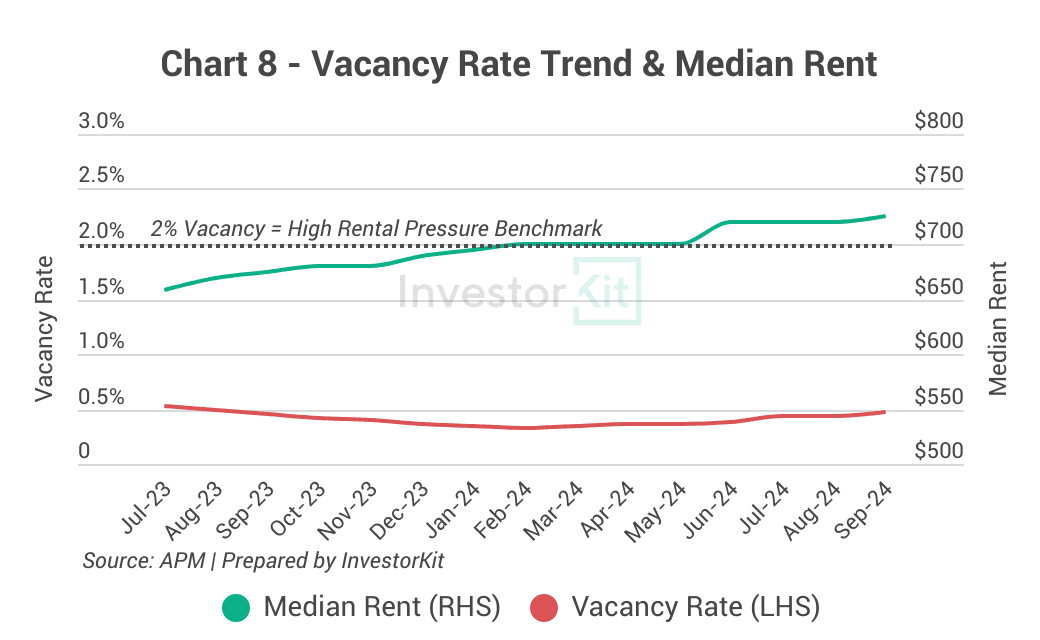

Wollongong’s rental market pressure is high, with under 1% vacancy rates and a 7.4% rental growth in a year.

Further rental increases are expected in the short term as the vacancy rate remains low and high house prices push first-home buyers away. However, rate cuts in the coming year may improve affordability and encourage more demand to move from the rental market to the sales market.

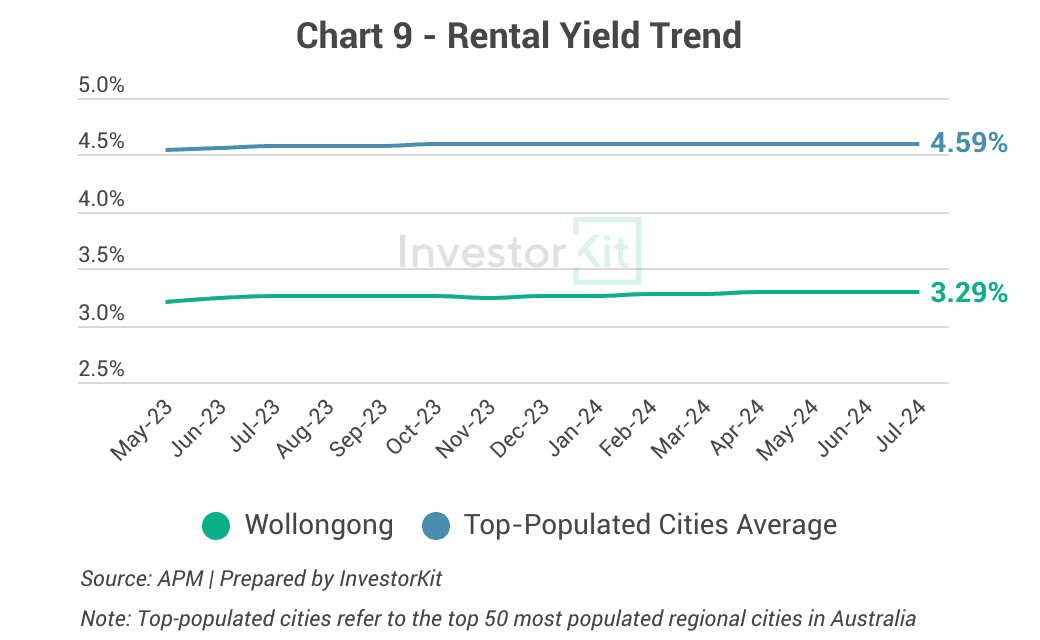

Averaged 3.3%, Wollongong’s rental yields are undoubtedly low. It’s not only much lower than the big regional cities’ average (4.6%), but also lower than most capital cities (but not Sydney, where the average house rental yield is 3.0%). The low rental yields and high prices make Wollongong difficult for investors to access.

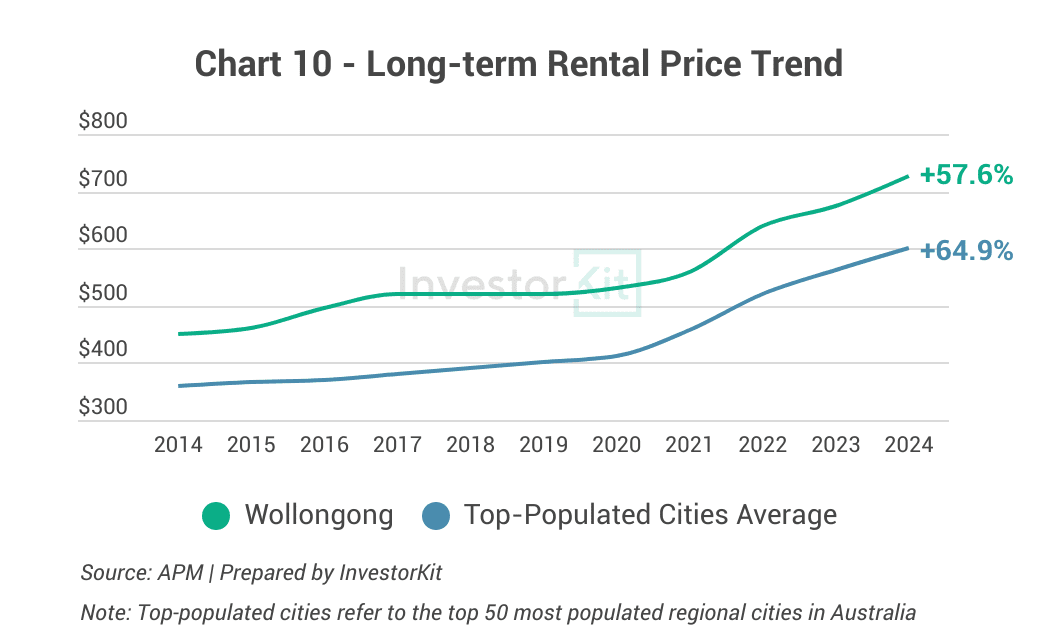

Over the past decade, Wollongong’s rental prices have grown by 58%, slightly lower than the average growth rate of the top-populated regional cities. The below-average rental growth and low rental yields make us believe that Wollongong’s rental market will outperform its sales market in the short to medium term.

In the next 6-12 months…

Wollongong’s property market is currently under balanced pressure. Price growth will be driven by the low supply level relative to demand but, in the meantime, limited by affordability. We expect Wollongong’s house prices to achieve healthy growth in the next 6-12 months, especially after the RBA cash rate begins to fall, which would somewhat relieve its affordability issue. However, in the medium term, there is likely to be another correction phase (a slowdown, if not a decline).

Wollongong is the 6th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)