Townsville: The ‘Capital of the North’

Regarded as the heart of northern Queensland, Townsville is famous for its stunning beaches, natural landscapes, warm climate, and rich cultural diversity. With its thriving and diversifying economy, vibrant community, and affordable housing, Townsville has been attractive to many families and individuals as a holiday destination or as their new home.

Over the last three years, Townsville’s house prices have increased significantly. What forces are driving the rapid growth of Townsville’s housing market? Will this growing speed continue in the coming year? See our predictions for 2025 here. Join us today to explore the city’s current property market conditions and outlook!

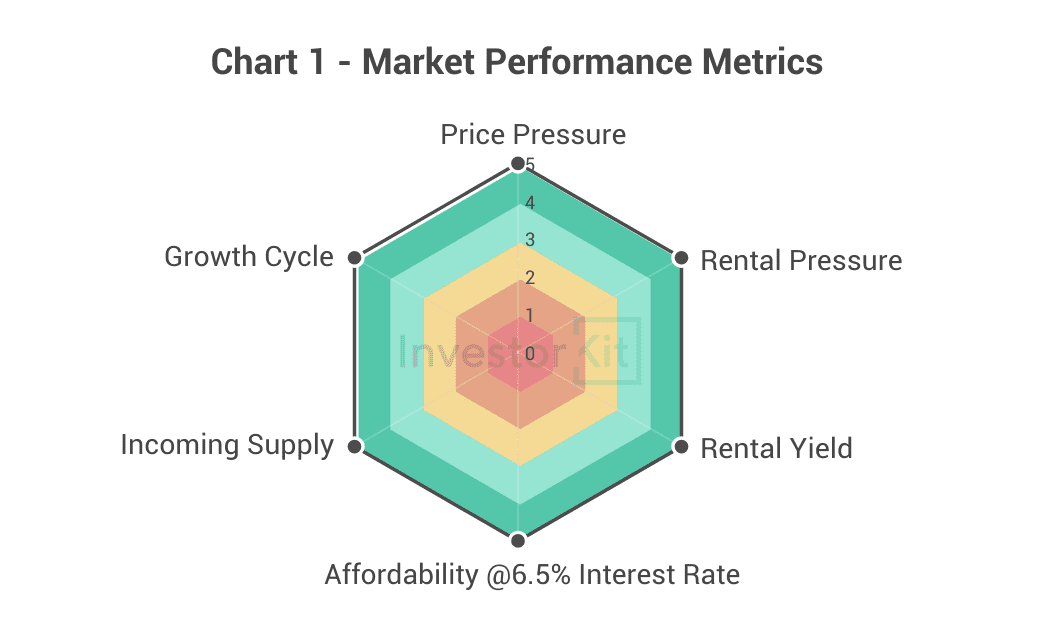

As of October 2024, Townsville’s House Market Pressure is high.

Among the six metrics InvestorKit uses to measure market performance, Townsville scores the highest (=5) in all of them: price pressure, rental pressure, rental yield, affordability, incoming supply, and growth cycle.

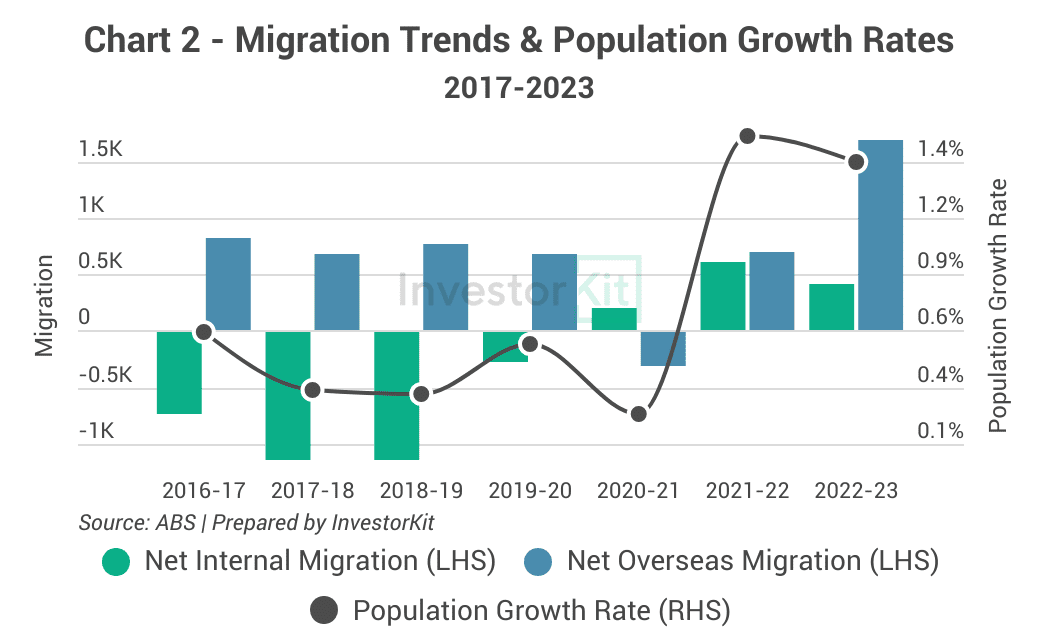

Demographic Trend for Townsville

Before 2021, Townsville’s population growth was weak. The primary reason behind this was the economic downturn after the mining boom.

After a tough time, Townsville started seeing higher population growth in 2022, primarily due to the “exodus to lifestyle and affordability” trends during the pandemic and the recovering economy that significantly increased internal and overseas migration. Townsville’s population growth rate was 1.4% in FY 2022-23. While this is slightly lower than the previous 12 months, it still stands as one of the highest annual growth rates over the past decade.

The accelerating population growth and migration surge will likely push Townsville’s housing demand up in the coming years.

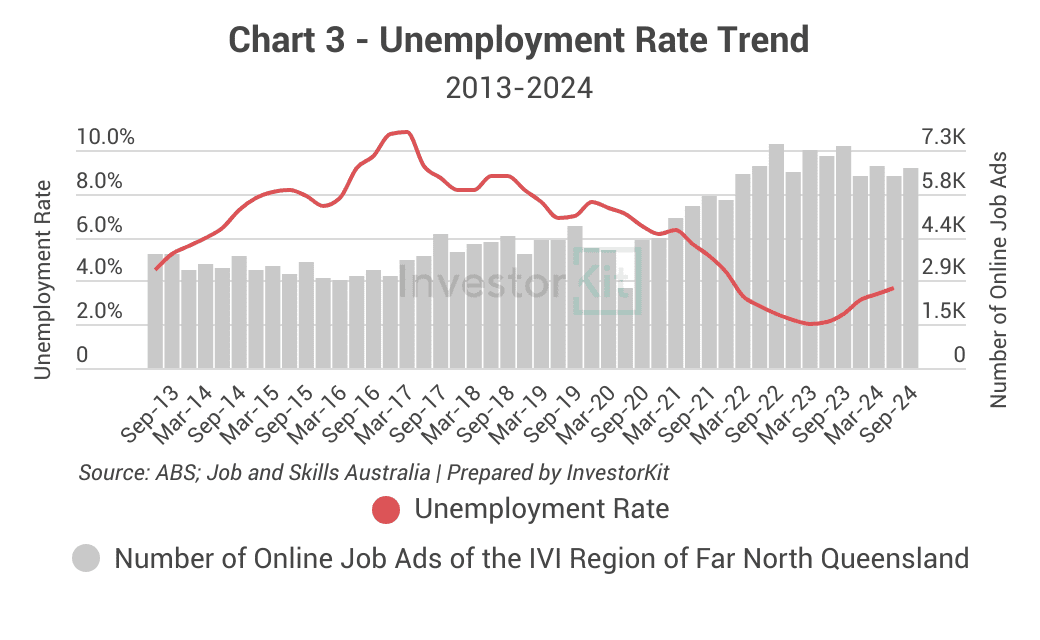

Townsville’s Unemployment Rate Trend

Since mid-2023, Townsville’s unemployment rate has been increasing due to the high RBA cash rate. Nevertheless, it is still extremely low compared to the last decade.

On the other hand, despite a slight drop, the number of job vacancies is still much higher (by approximately 50%) than the pre-pandemic average.

Both indicators show that Townsville’s job market is more active than ever, and the local economy is thriving.

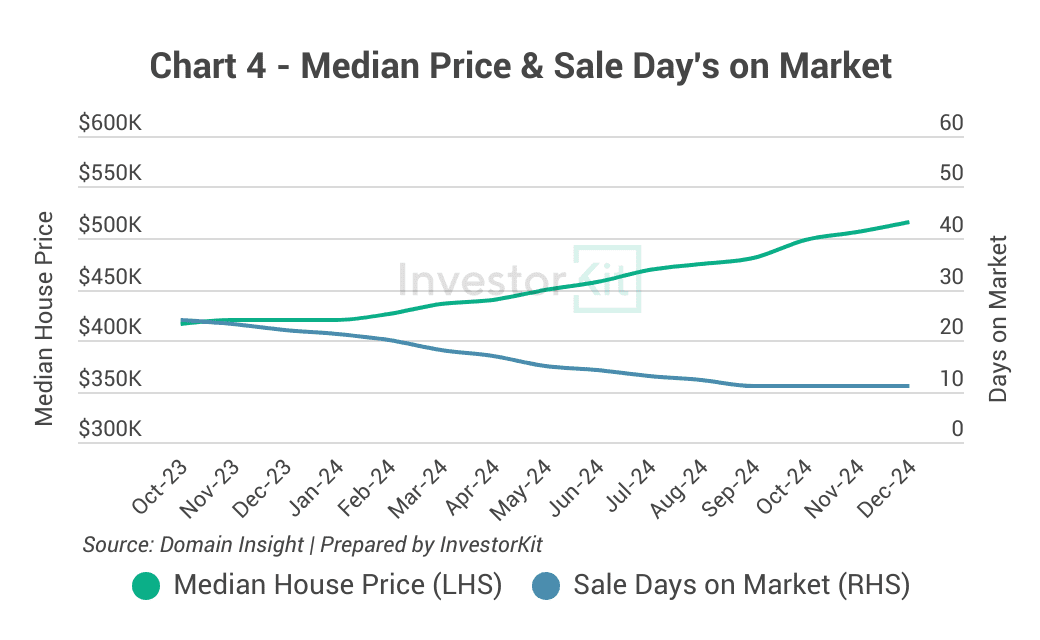

Townsville’s Sales Market Trends

Townsville’s house market has experienced a strong price rise over the past year. The current median house price is $516,000, 23% higher than a year ago.

At the same time, the sale days on market trended downward rapidly over 2024, now stabilised at a low 11 days, indicating high demand and potential for healthy price growth ahead.

Why are houses taking a short time to be sold?

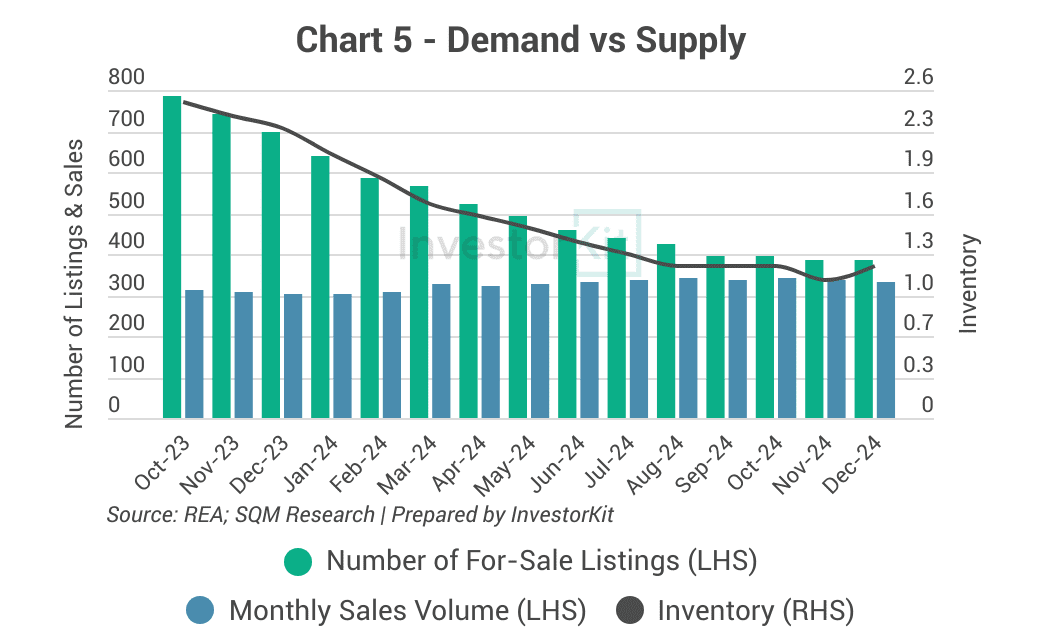

Over 2024, the number of for-sale house listings in Townsville has fallen remarkably while the sale volume has slightly lifted. This contributed to a sharp drop in inventory, which is currently at an extremely low level of 1.15 months of stock.

The low inventory level implies that market pressure in Townsville stays high, resulting in the short time to sell we saw.

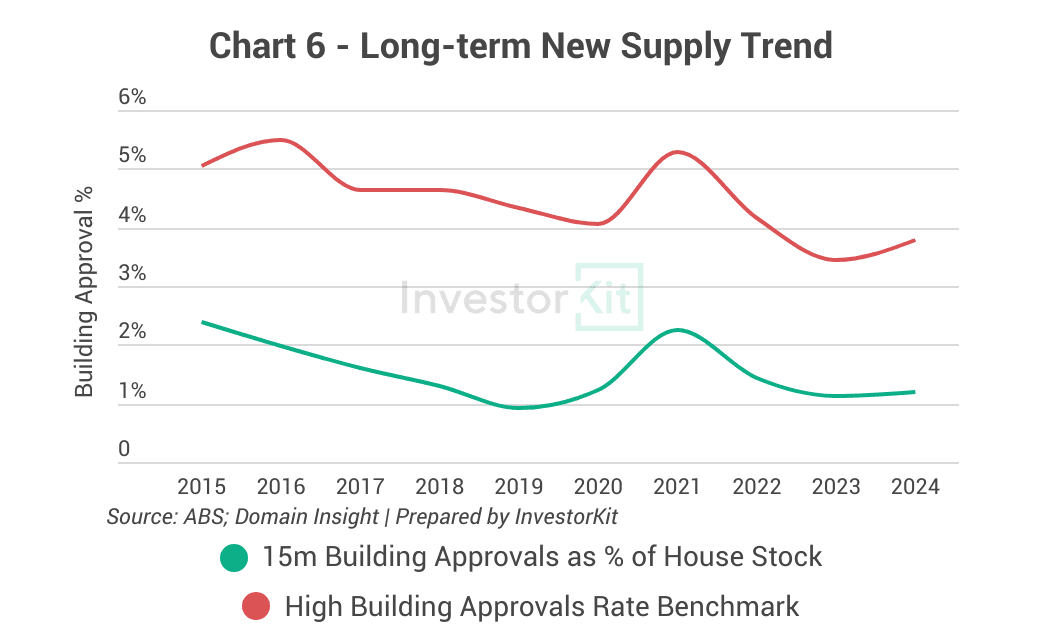

With Townsville’s population growth accelerating, will there be a massive incoming housing supply to cater for the growing demands?

Townsville hasn’t seen much house construction activity over the last decade, indicating a low risk of oversupply in the housing market. This is a good sign for investors in the sense of capital growth.

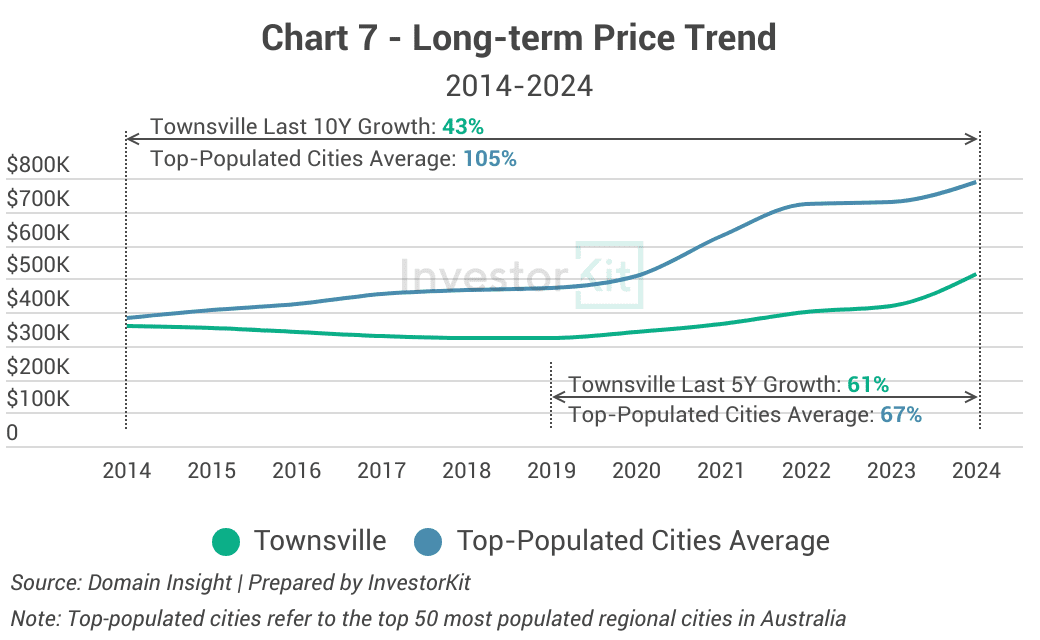

Townsville’s house price growth only started speeding up in 2021, rising modestly by 43% over the last ten years, nearly four times lower than the average of the top-populated regional cities. This slow 10-year growth implies that Townsville is at a relatively early growth cycle stage; thus, there is more room for upside potential.

Townsville’s Rental Market Trends

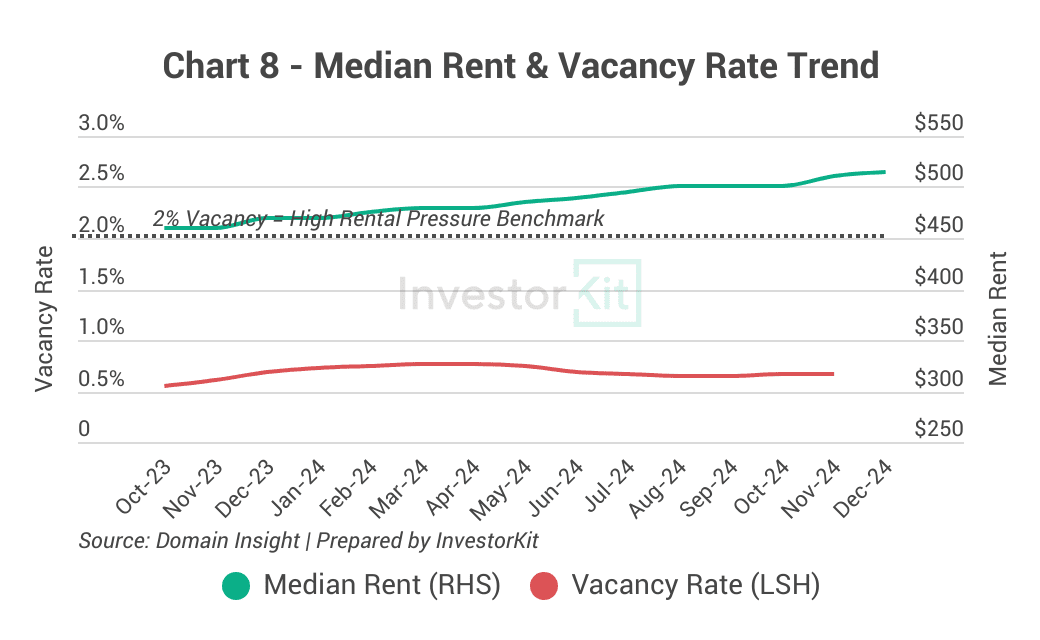

Townsville’s rental market is under high pressure. The vacancy rate is at a low level of around 0.7%, while rent has grown steadily at a healthy level of 9.6% over the last 12 months. Both are good signs of further healthy rental growth.

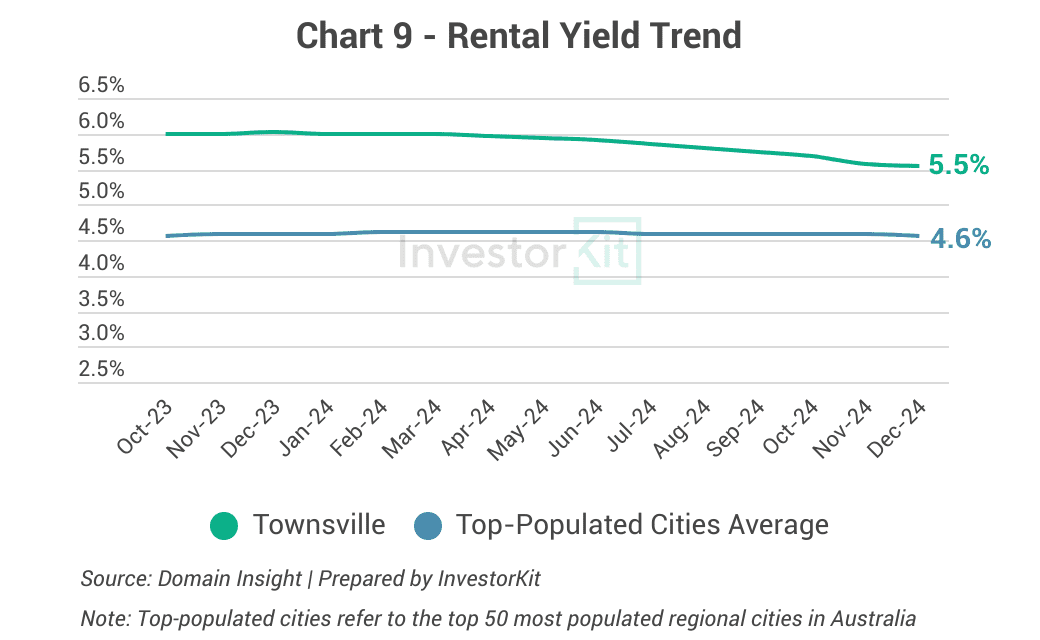

Townsville enjoys a high rental yield of 5.5%, higher than the average of the top-populated cities. Since sales prices have grown considerably faster than rental prices, yields have been decreasing since early 2024. We expect this declining trend to continue as sales prices keep outperforming.

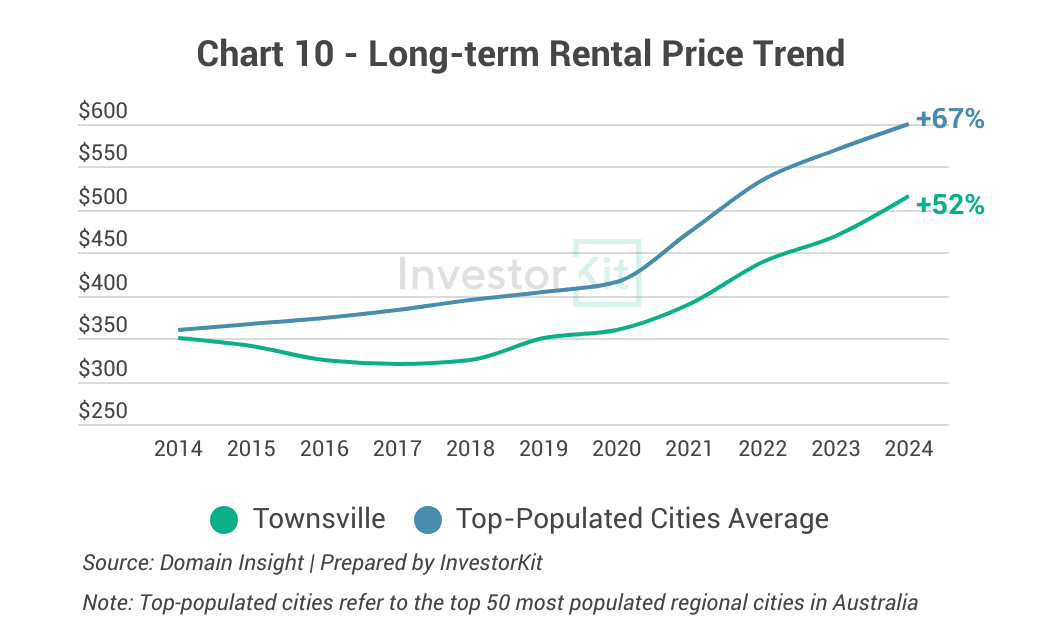

Over the past decade, Townsville’s rental prices have grown by 52%, lower than the average growth rate of the top-populated regional cities. We expect this to increase further, considering the region’s increasing housing demand driven by the thriving economy, large number of job opportunities, and high rental market pressure.

In the next 6-12 months…

Townsville’s house market is currently under high pressure. House prices have trended upward significantly with low inventory and days on market, while the rental vacancy rate remains extremely low. In the coming 6-12 months, we expect Townsville’s house prices to continue the current robust growth, supported by the high market pressure and the affordability advantage.

Townsville is the 7th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s real estate and buyers agency? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)