Newcastle: The Largest City on NSW’s North Coast

When we think of major regional cities in New South Wales, Newcastle is always among the top two. The city is not just a large regional hub with a decent number of job opportunities, an international airport, and the world’s largest coal-exporting port; it’s also surrounded by lifestyle destinations such as the famous Hunter Valley and Port Stephens, offering an ideal mix of city life, coastal life and country life.

As liveable as Newcastle is, the city’s house market has only grown by 1% in the past year. What happened to Newcastle? Where is it going in the coming year? Join us today to explore the city’s current property market conditions and outlook!

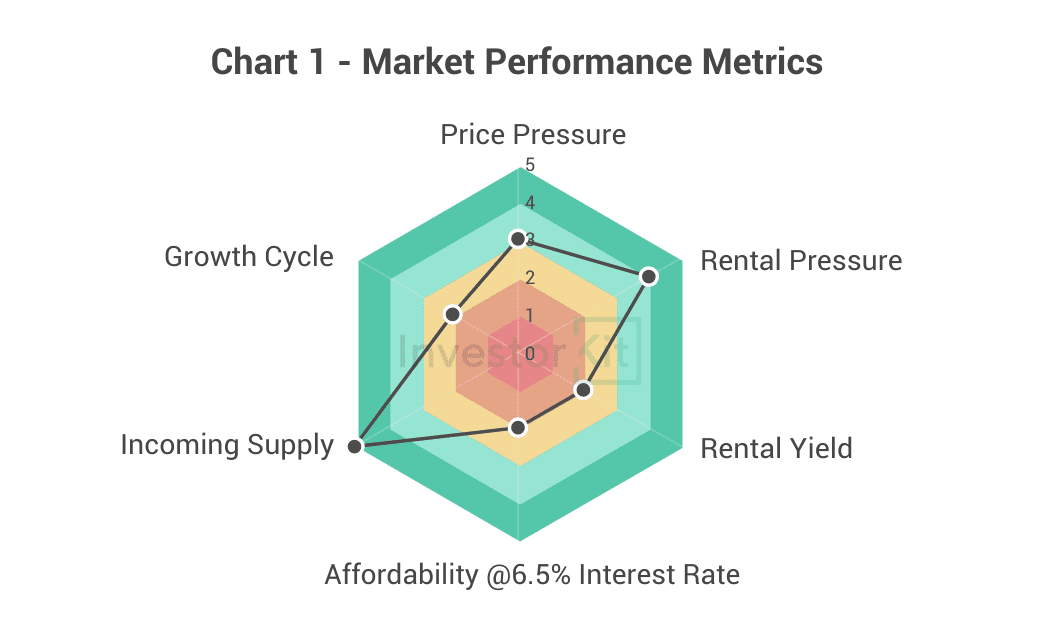

As of June 2024, Newcastle’s House Market Pressure is balanced with an upward trend.

Among the six metrics InvestorKit uses to measure market performance, Newcastle stands out in incoming supply. Rental pressure scores relatively high (4/5), price pressure is balanced (3/5), but rental yield, affordability and growth cycle are relatively weak (2/5).

Newcastle Demographic & Economic Trends

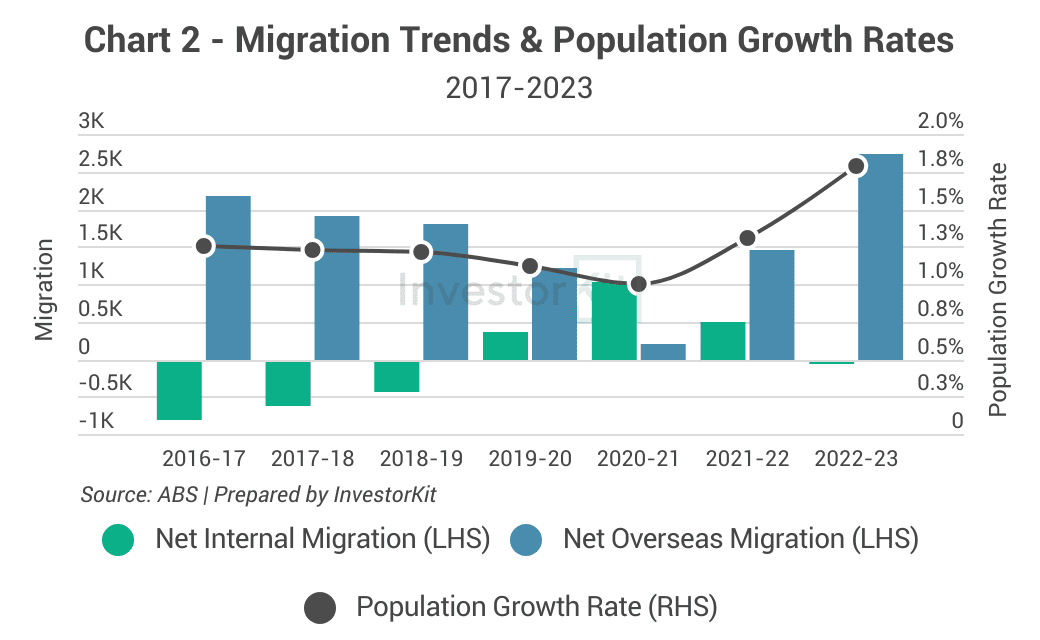

Newcastle’s population growth has significantly improved since 2021, recording 1.6% annual growth in FY 2022-23. While lower than the national average, it’s Newcastle’s highest annual growth rate in more than 20 years.

The population growth rate increase is a result of both the improved internal migration (compared to 5 years ago) and the surge in overseas migration since 2022.

The accelerating population growth and migration surge will likely push Newcastle’s housing demand up in the coming years.

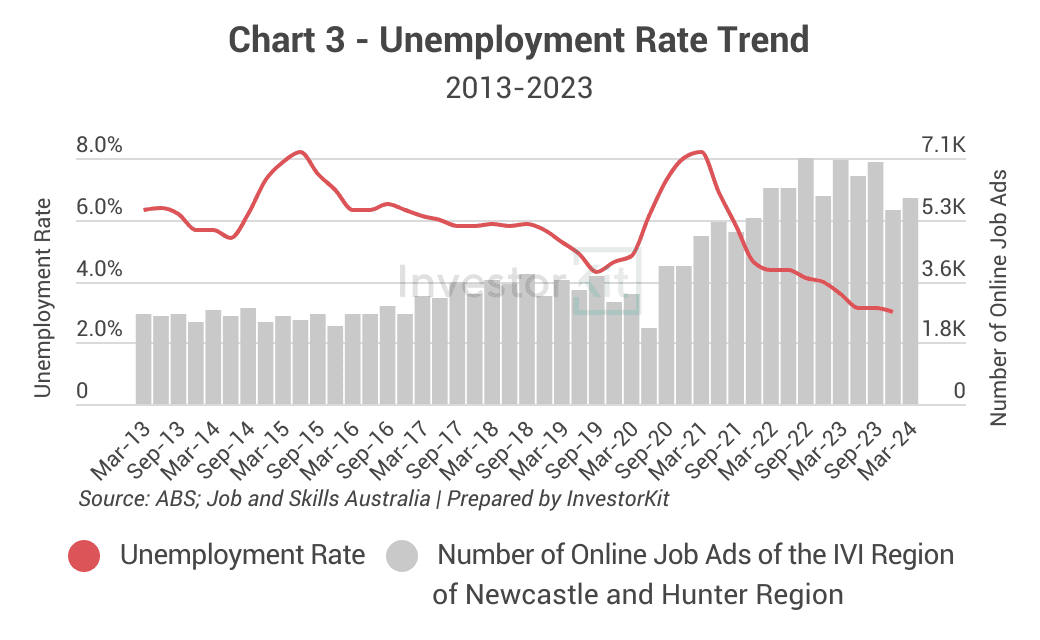

While the cash rate hikes have increased the unemployment rates in many cities, Newcastle is an exception. The unemployment rate in this city has been continuously declining since 2021. Now at 3%, it is the lowest level in over a decade.

At the same time, the number of job vacancies is more than twice as high as ten years ago, despite the slight decline in the past year.

Both indicators show that Newcastle’s job market is more active than ever, and the local economy is thriving, offering a solid foundation for the housing market.

Newcastle House Price Sales Market Trend

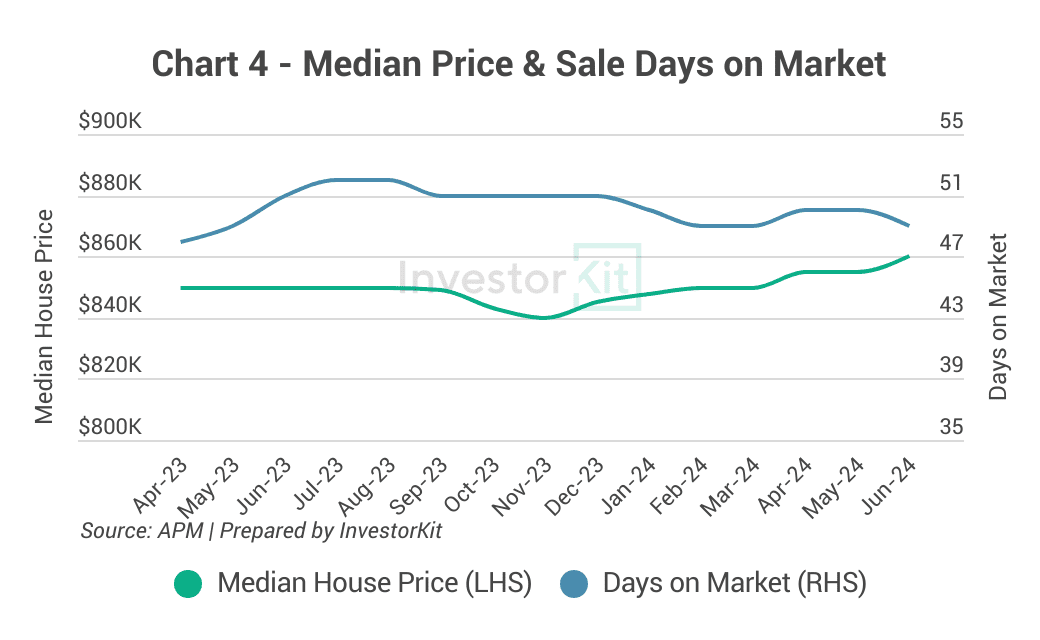

Newcastle’s house market has been slowly recovering since the end of 2023. In mid-2024, the median house price finally returned to its 2022 peak of $860k.

At the same time, the sale days on market has been trending downward gradually since mid-2023, indicating increasing demand, which could be a sign of faster price recovery ahead.

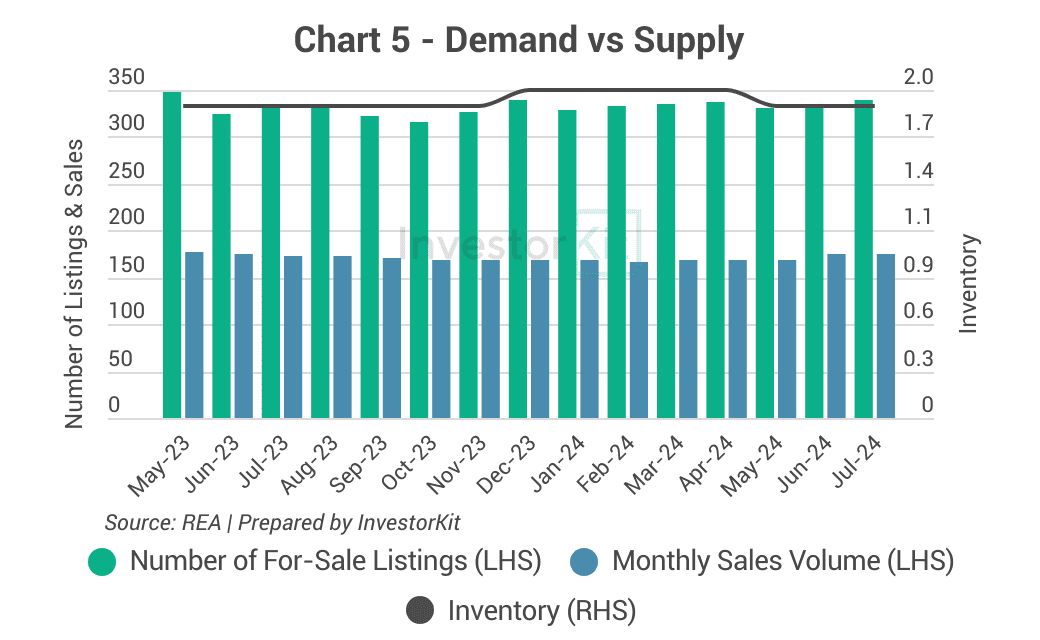

From a demand and supply perspective, Newcastle’s house market seems tight. Although the monthly sales volume is now lower than the 2022 peak, the number of for-sale listings has also dropped. As a result, the inventory level in Newcastle has stayed at around 2 months of stock since 2023, a fairly low level even compared to many regional cities where prices are surging (eg. Bundaberg, where house prices increased by 13% last year, has 3.2 months of stock).

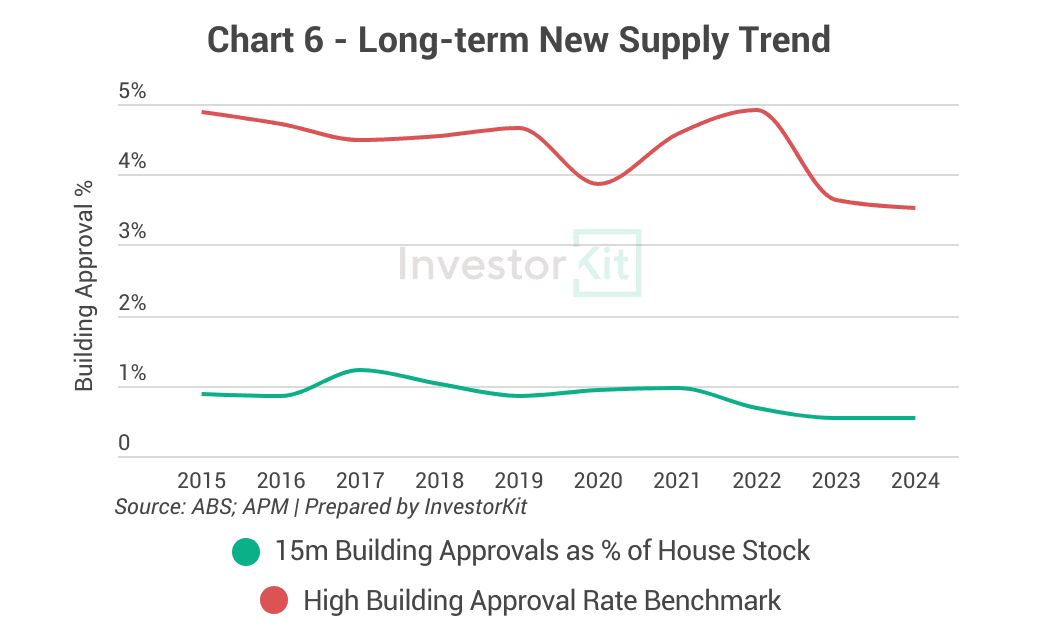

It’s not just the established supply that’s tight in Newcastle. The incoming supply level is also quite low. Newcastle’s new house construction has been inactive for a while. The current number of new-house building approvals only takes 0.53% of all house stock, much lower than the 2-3% balanced level. There wasn’t even a home-builder-grant spike in 2022 as in many other cities (as shown in the red curve above).

Usually, such low supply levels are accompanied by fast price growth. However, that didn’t happen to Newcastle. Why? The following chart may tell the answer.

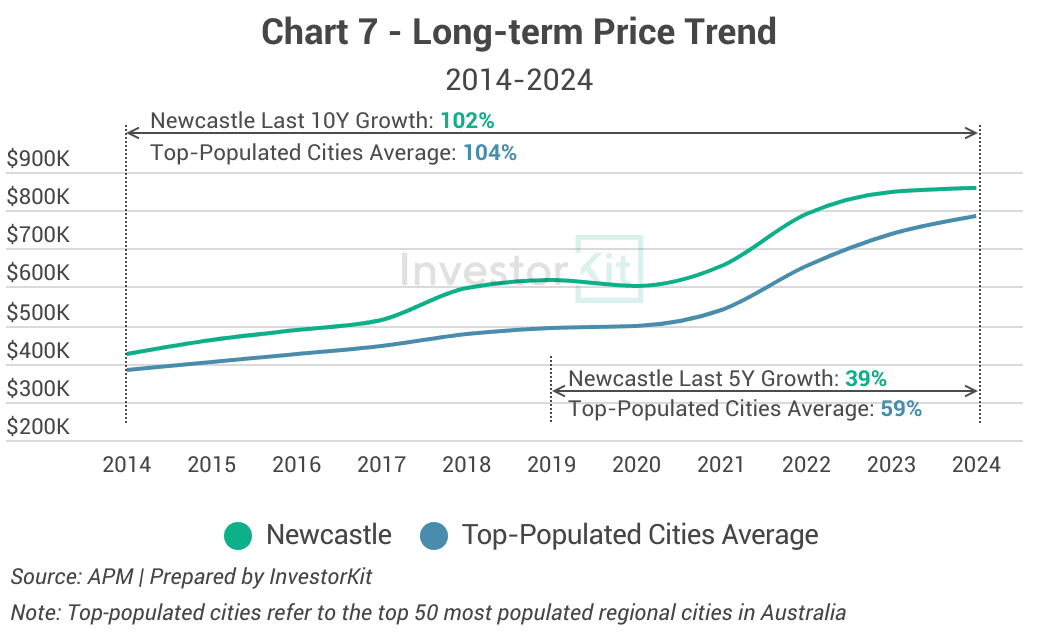

Newcastle is in the middle of a trough between two growth cycles. In the past 10 years, Newcastle’s house prices have grown by 100%, in line with the average growth of the top-populated regional cities; however, much higher than Australia’s long-term average (5-6% annualised growth). In the last growth cycle (2020-2023), house prices increased by 42% in 3 years, averaging 12%+ growth each year. The city is now on a well-deserved break to regather strength for the next growth cycle.

Considering the low inventory level and declining sale days on the market, we expect the next growth cycle to start in the coming year. The relatively low last five-year growth will likely give it a further boost.

Newcastle Rental Market Trends

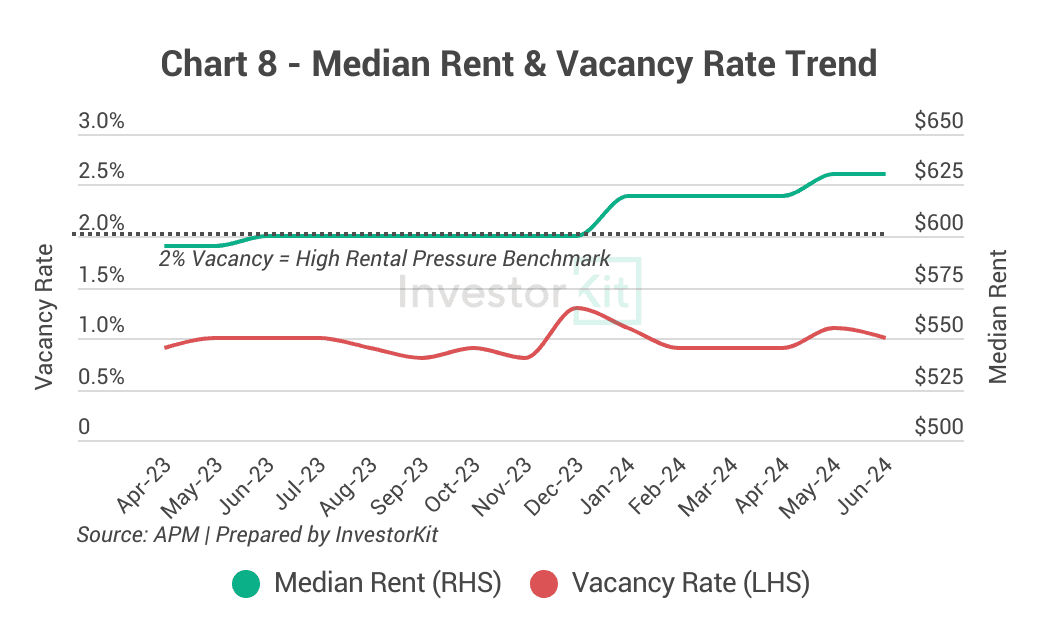

Newcastle’s rental vacancy rate has been hovering around 1% over the past year, much lower than the high-pressure benchmark of 2%. However, the low vacancy rate didn’t lead to high rental growth in the past year (only 5% growth). This is most likely because rental prices have hit the affordability ceiling after two years of surge (up 30% from 2021 to 2023).

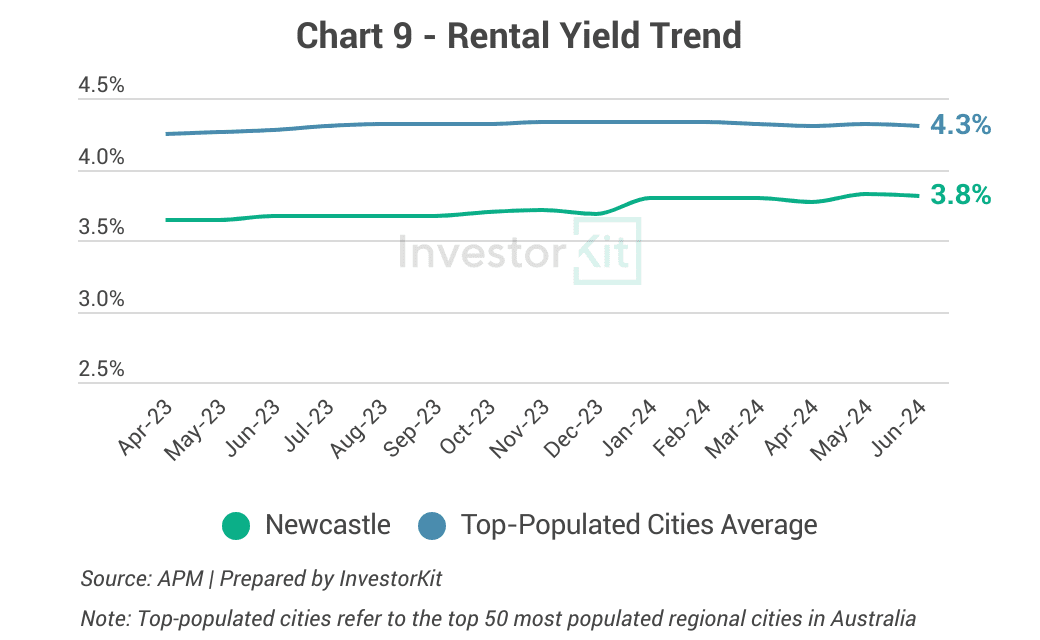

At 3.8%, Newcastle’s rental yield is much lower compared to the average of the top-populated regional cities, but the increasing rental prices and stagnant sale prices over the past year have been lifting the yield level. Whether the yield level will further increase will depend on how soon the sale prices start to grow.

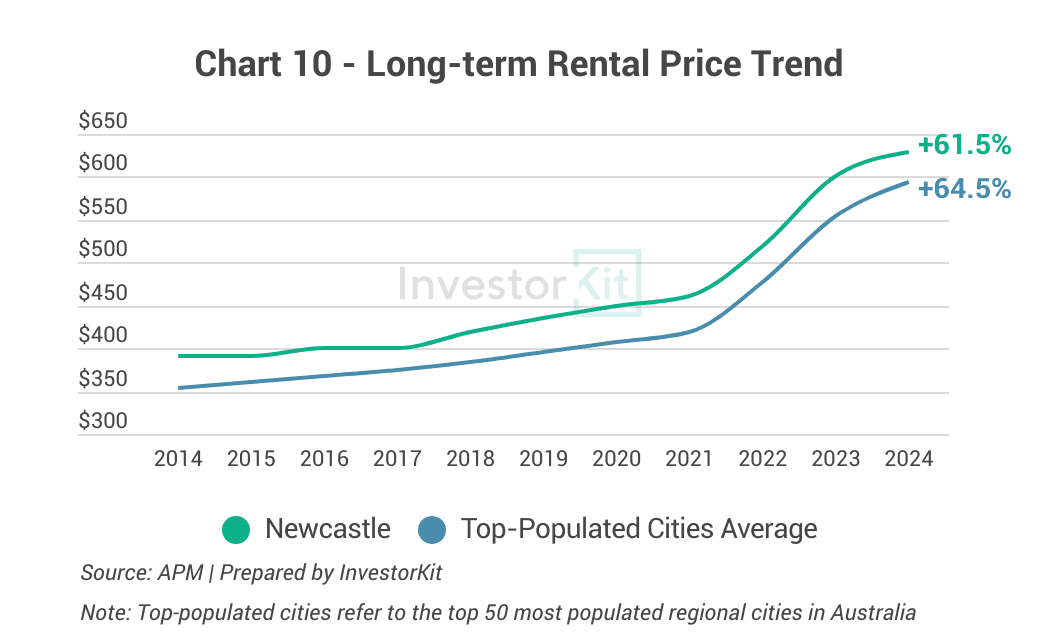

Over the past decade, Newcastle’s rental prices have grown by 61.5%, in line with the average growth rate of the top-populated regional cities. Again, both are higher than Australia’s long-term average. As a result of the above-average long-term growth, we expect Newcastle’s rental prices to grow moderately in the coming year.

In the next 6-12 months…

Newcastle’s property market pressure is currently balanced but continues to accumulate. Price growth is stagnant because of its market cycle position and low affordability. In the next 6-12 months, we expect house prices to move out of the stagnancy and start growing due to the tight supply level (as seen in the low inventory) and increasing demand (as seen in the declining sale days on market). However, the growth should be moderate in the short term as the current limitations can’t be removed anytime soon. In the medium term (2-3 years), however, growth is expected to speed up as affordability improves (due to wage growth and potential rate cuts) and housing demand further increases (as the population grows and high rents squeeze renters to the sales market and attract investors at the same time).

Newcastle is the third regional city we examine in this Market Pressure Review Blog Series. More cities’ market pressure reviews like this are available in our News & Insights, and stay tuned for more cities to follow!

InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)