Brisbane: Welcome to the Sunshine State!

As the capital of the Sunshine State, Brisbane has been championing the internal migration game against all the other capital cities since 2017. Besides residents, Brisbane’s property market is also attracting so many investors. Today, let’s dive into data and discover Brisbane’s secret weapons together!

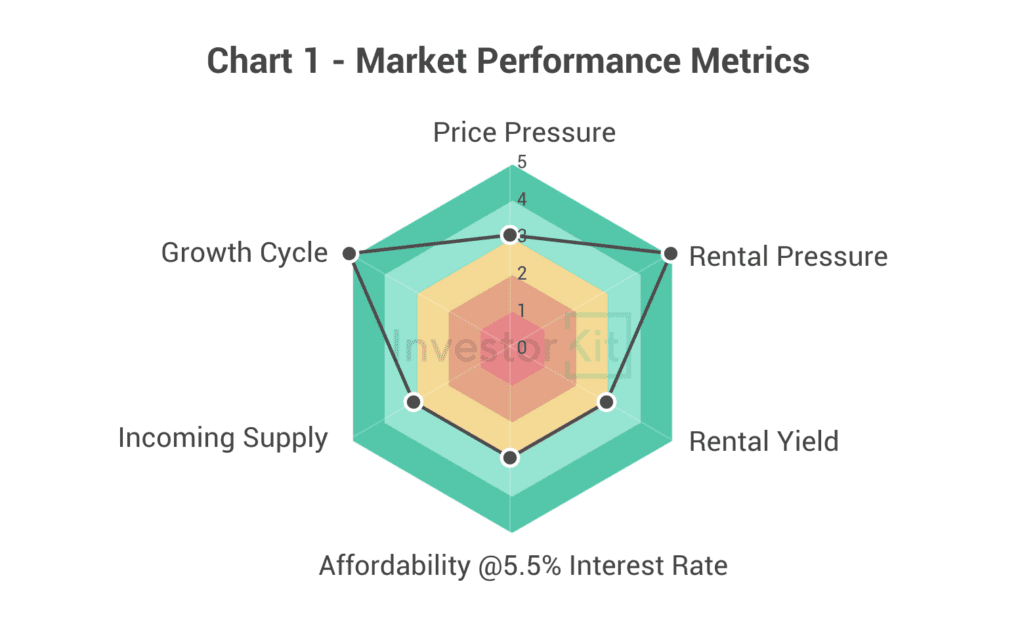

As of September 2023, Greater Brisbane’s House Market Pressure quickly moves from Balanced towards High.

Among the 6 metrics InvestorKit uses to measure market performance, Brisbane’s Rental Pressure and Growth Cycle stand out, while all the other metrics are balanced – Brisbane has no weak spots.

Demographic & Economic Trends

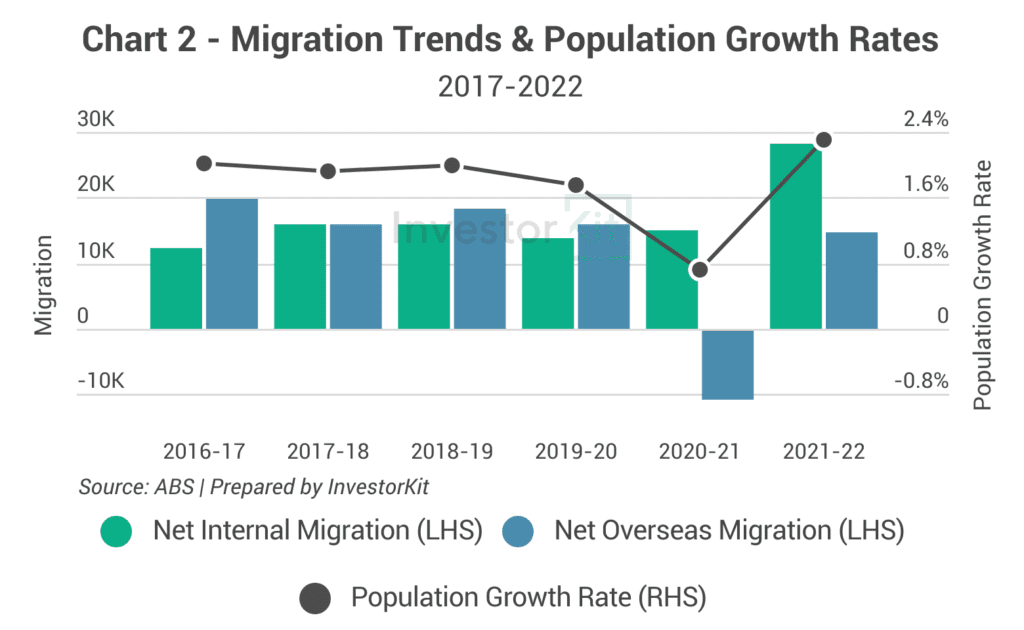

Brisbane’s population growth has been among the strongest among all capital cities over the past decade, while last year (FY2021/22), it recorded the highest population growth of 2.3%, much higher than Perth’s 1.5%, which comes in second place.

The fast population growth is attributable to the fast recovery of overseas migration and a surge in the net internal migration number.

It’s noteworthy that Brisbane was one of the only two capital cities gaining internal migrants, the other being Perth, and Brisbane’s net internal migration number (28k) was more than three times of Perth’s (9k).

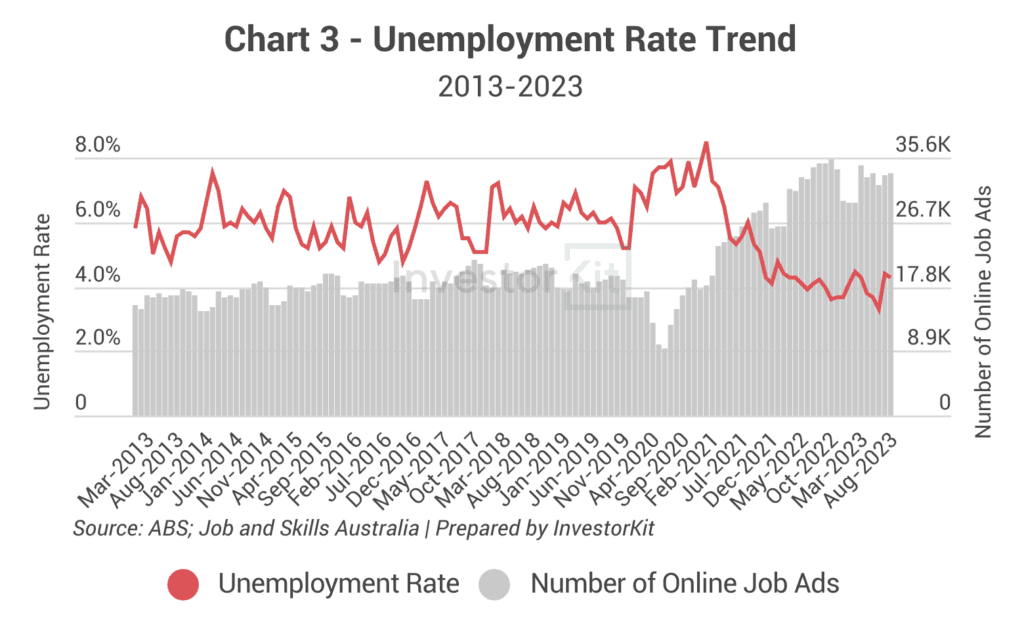

The robust economic recovery and active job market are among the top reasons Brisbane attracts so many internal migrants.

Brisbane’s unemployment rate is hovering around 4% in the past 2 years, the lowest level in over a decade. The number of available jobs (indicated by the number of online job ads) is also at a decade-high level. They both indicate a more active than ever job market and a thriving local economy.

As the RBA cash rate hikes, the total number of job vacancies in Greater Brisbane has been declining slowly over the past year. We expect the unemployment rate to follow this trend to rise gradually in the coming 1-2 years.

Sales Market Trends

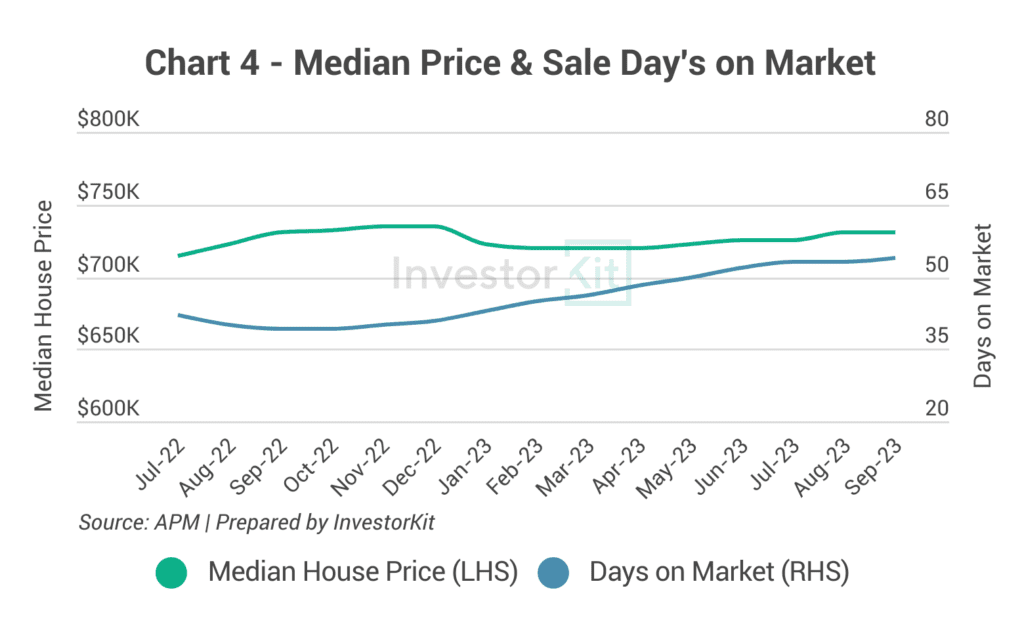

Greater Brisbane’s median house price has been recovering from a brief decline in early 2023, achieving +9.1% growth since bottoming out and +4.0% QoQ, being the second-best performer in the 3rd quarter of 2023 (Adelaide being the best performer with +4.3% QoQ growth).

Although Brisbane’s median house price of $730k is considered slightly above the affordable threshold (overvalued by 14% assuming interest rate = 5.5%) compared to the local household income level, it is significantly more affordable than the capital cities in the south: 43% lower than Sydney, 14% lower than Melbourne, and 24% lower than Canberra. The relative affordability is one of the reasons why Brisbane is so attractive to investors from down south.

For-sale days on market has flattened in recent months, indicating that Brisbane market is regaining pressure.

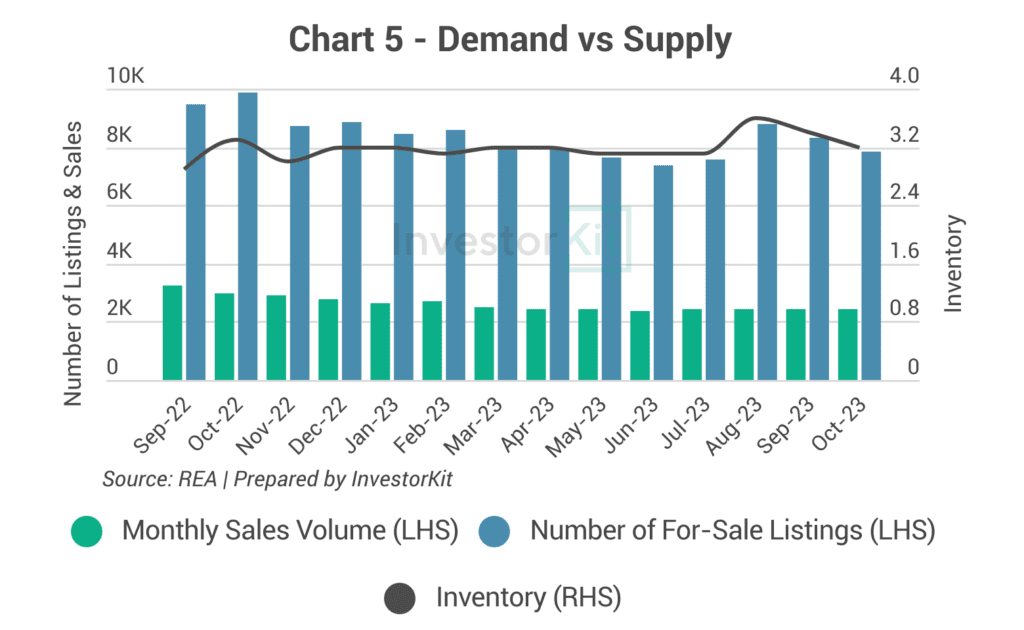

Whilst the number of sales in Greater Brisbane decreased over the past year, the number of for-sale listings has also been trending downward since late 2022, leading inventory level to hover around a healthy level of just above 3%. Inventory has shown a declining trend in recent months as sales volumes stabilize, indicating increased market pressure. In the coming months, listing levels vs sales volumes will be critical to watch to understand how the market goes from here.

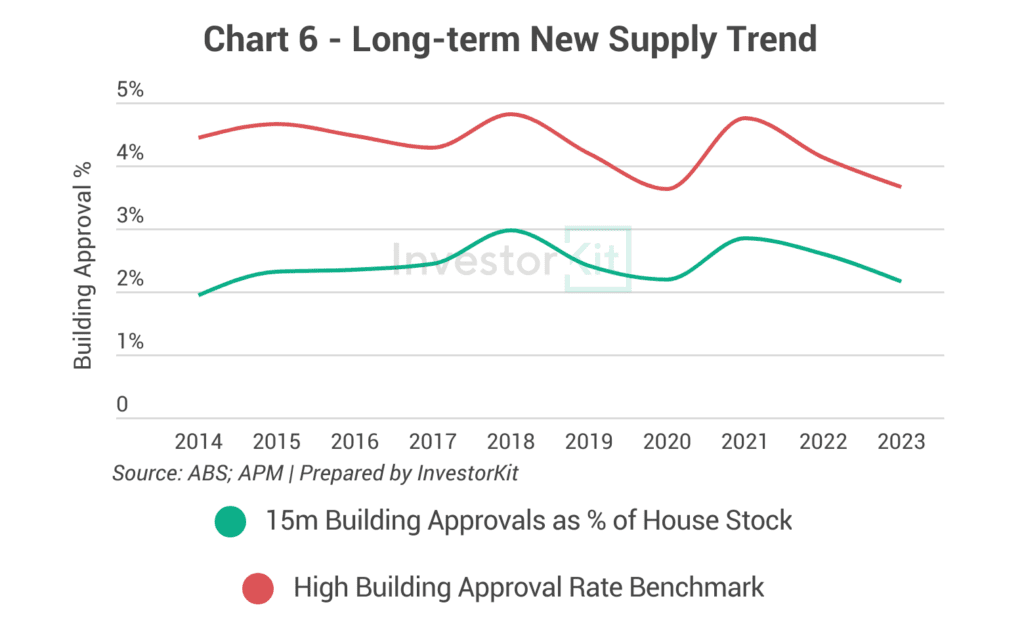

In the past decade, Brisbane’s new house construction activities remained moderate compared to its robust population (housing demand) growth. The declining trend in the past two years is in line with most regions across the country as construction costs soar, but is causing a severe supply crunch to the local housing supply as the city receives more new residents than ever.

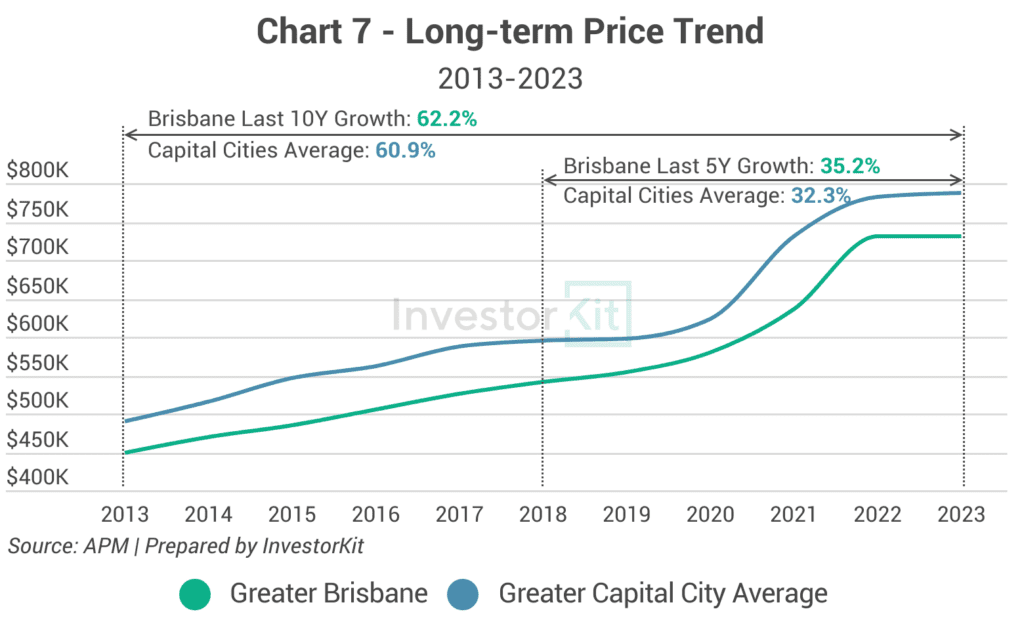

Brisbane’s house price growth in the past decade was just slightly higher than the capital-city average. Moving forward, we expect Brisbane’s performance to exceed the average level even more, considering the soaring demand and limited supply.

Rental Market Trends

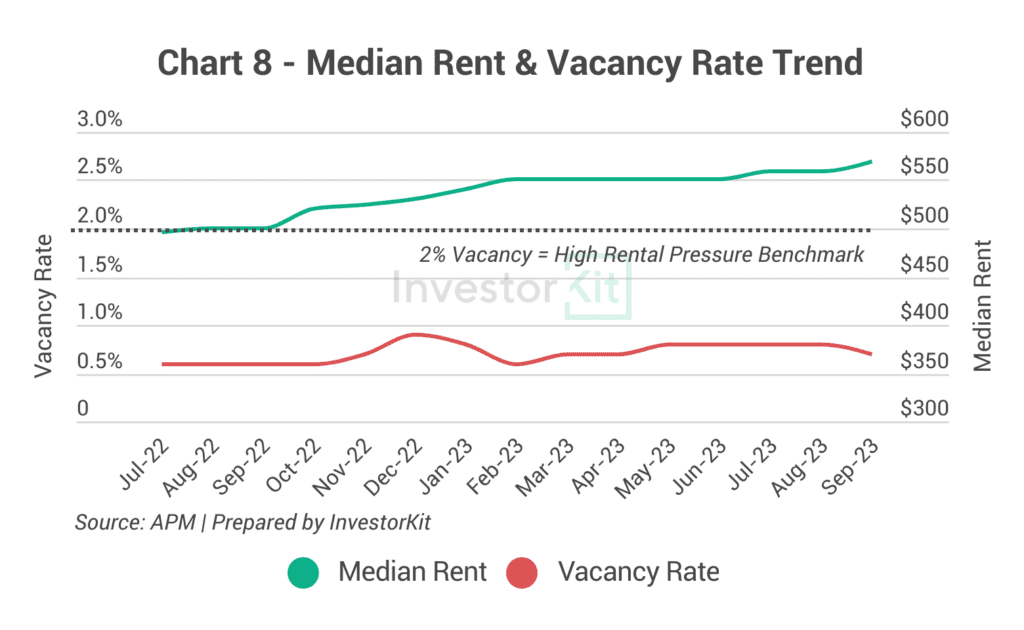

The rental market is under high pressure, with vacancy rates well below 1.0%. This high pressure has led to a 14.0% annual increase in house rental prices. Further increases are expected as market pressure remains high.

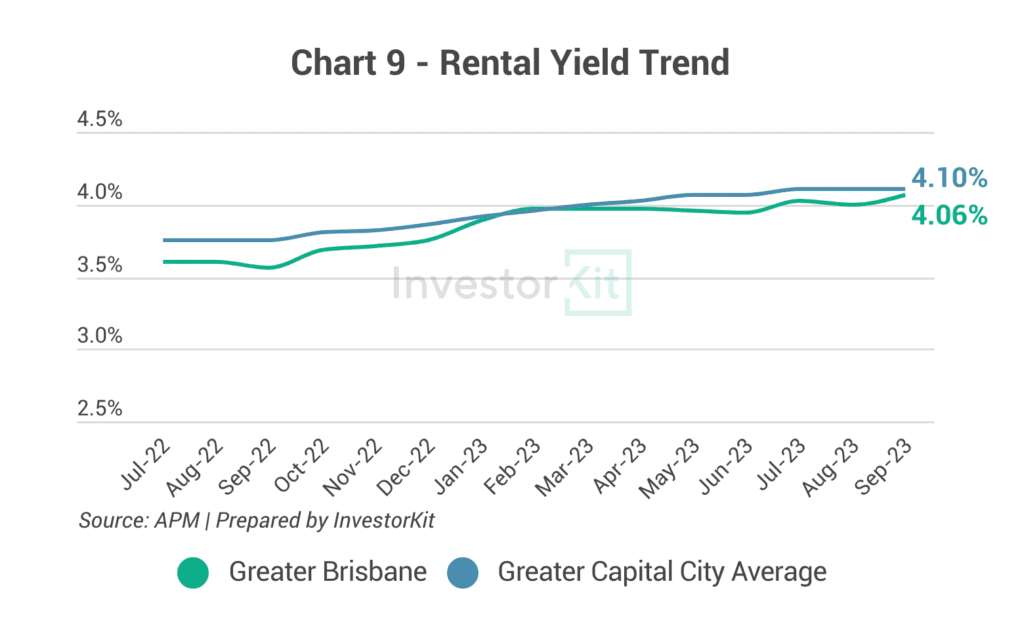

The fast rental price growth has lifted Greater Brisbane’s rental yields from 3.5%+ last year to 4.0%+, healthier than the two biggest cities. However, it can only be considered as moderate due to the high mortgage interest rates. We expect rental yields in Brisbane to increase further as the solid rental price growth continues. When the interest rates come down, which is expected to happen next year, a 4.0%+ rental yield would become much more viable and attractive to investors.

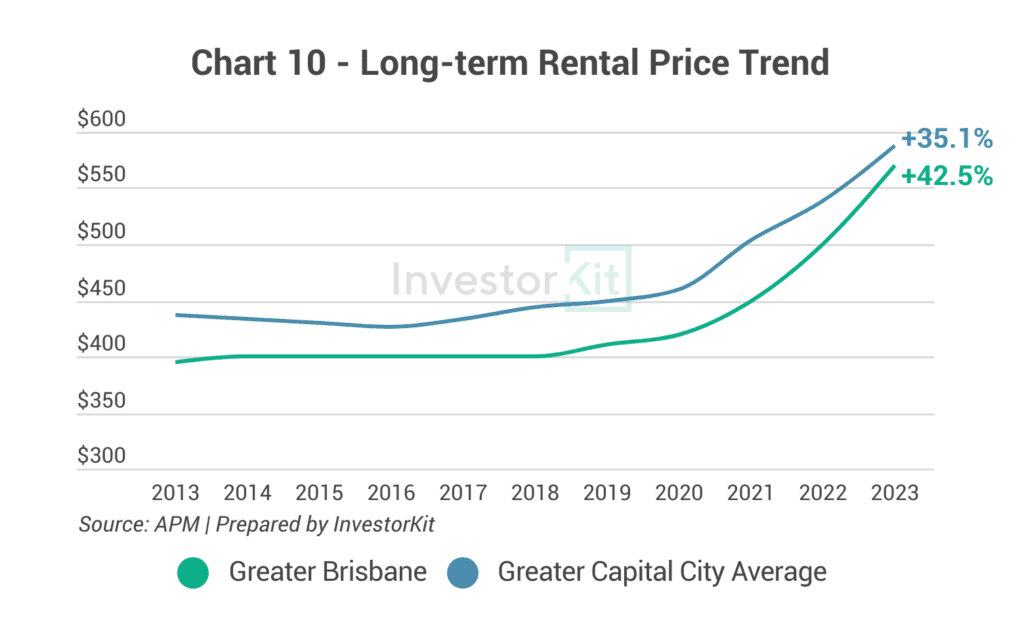

Over the past decade, Greater Brisbane’s rental price has grown by 35.1%, lower than the capital-city average growth rate. Seeing the city’s robust housing demand growth and recent rental surge, we are confident Brisbane will quickly catch up with and probably surpass the national average.

In the next 6-12 months…

Greater Brisbane’s housing market is quickly picking up market pressure and growth momentum, benefiting from its strong population growth, internal migration trend, active economy, and relatively affordable prices compared to Sydney and Melbourne. Clearance rate has been trending up since the beginning of 2023, indicating rising consumer confidence in the market. We believe the housing prices in Greater Brisbane will keep growing in the 6-12 months at an accelerating pace. With the 2032 Olympic Games coming, Brisbane and South East Queensland is seeing a huge wave of infrastructure improvements that would boost the local economy and population growth further, underpinning healthy housing market growth in the coming decade.

Brisbane is the third city we examine in this Market Pressure Review Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)