Adelaide: Smaller Yet Powerful

With a population of 1.4 million, Adelaide is the smallest of Australia’s five major capital cities. However, its property market has been one of the best performers against the interest hike headwind post-COVID. According to CoreLogic’s November 2023 Chart Pack, Adelaide is the second-best performer among all capital cities, with 4.2% quarterly dwelling value growth, just 0.4% lower than Perth, the top performer. Today, let’s dive into data and decode Adelaide’s success together!

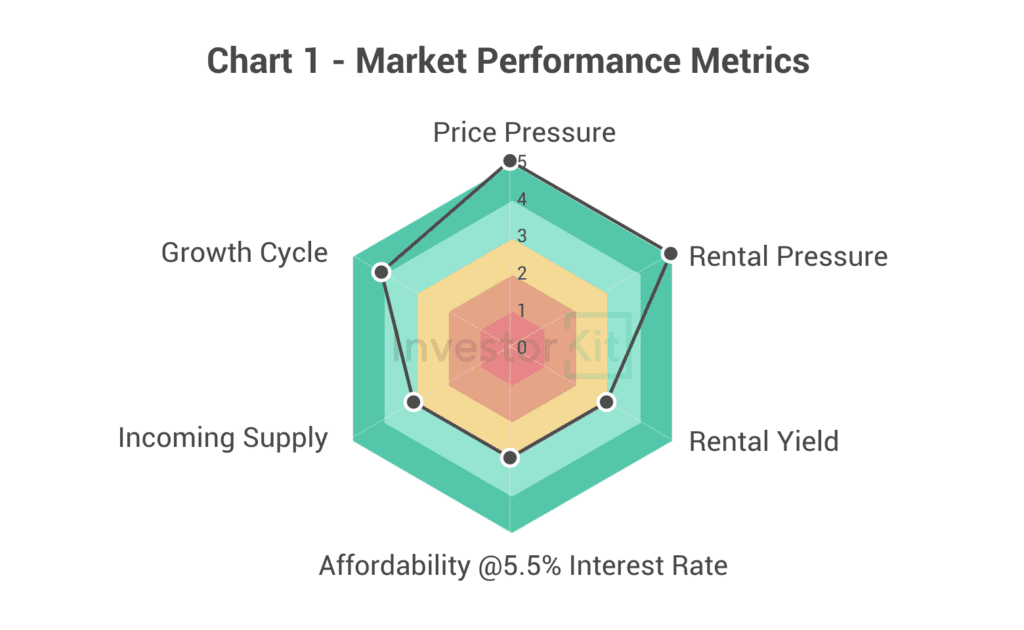

As of November 2023, Adelaide is still showing signs of a hot market with high pressure.

Among the 6 metrics InvestorKit uses to measure market performance, Adelaide’s Price and Rental Pressure stand out. Growth Cycle doesn’t score the highest as the city is well into its peak phase. The city’s rental yield and affordability have declined from “high” to a “balanced” level due to the robust price growth over the past 2 years. As to incoming supply, Adelaide stays balanced, where the amount of new builds is unlikely to cause oversupply.

Details are discussed below.

Adelaide Demographic & Economic Trends

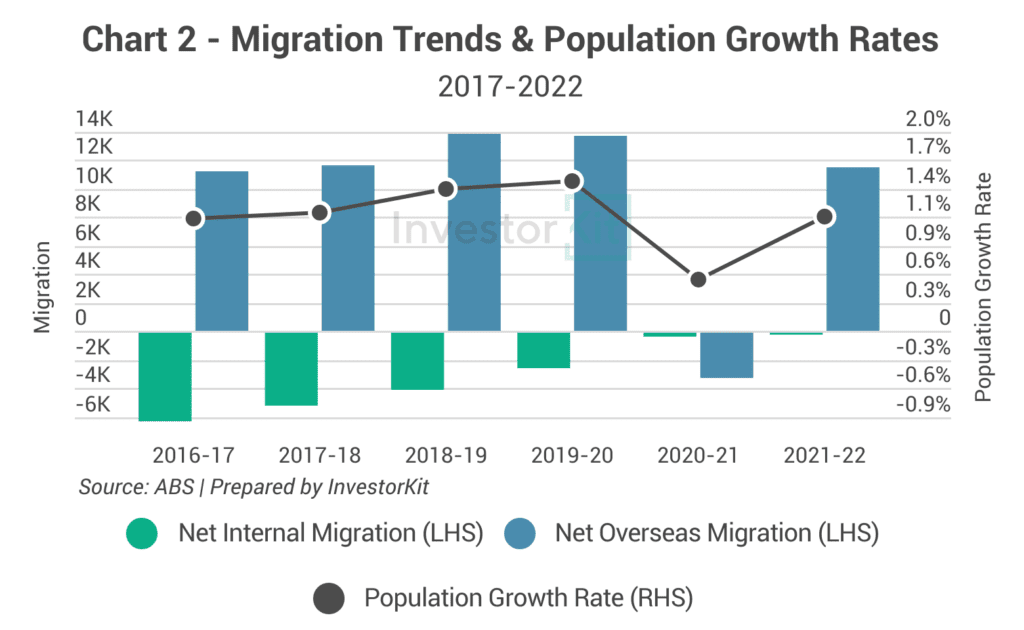

Adelaide’s internal migration and overseas migration trends were both improving in the few years leading up to COVID. Now that the impact of international border closure has gone, overseas migration is recovering robustly, leading to a substantial increase in Adelaide’s population growth, which indicates increasing housing demand in the years to come.

While we do not have Greater Adelaide’s net internal migration data for FY 22-23, South Australia’s population growth rate in Q1 2023 was 1.61%, higher than 0.94% a year ago. As Adelaide hosts 77% of SA’s population, it’s safe to infer that Greater Adelaide’s population is also growing faster than last year.

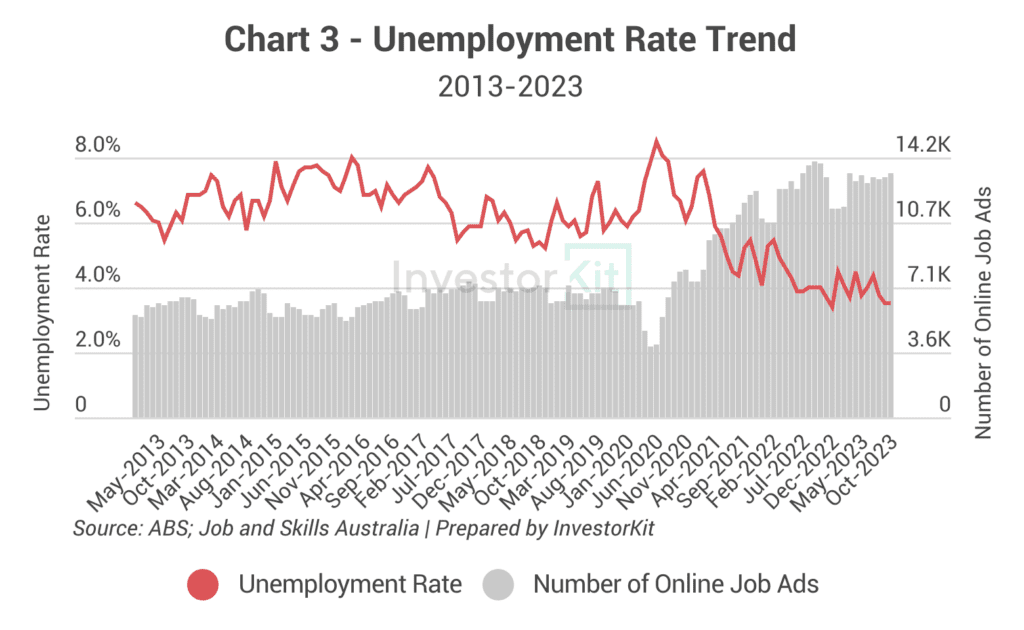

The robust economic recovery and active job market are two of the reasons behind Adelaide’s improving internal and overseas migration trends.

Adelaide’s unemployment rate has been hovering around 4% since mid-2022, the lowest level in over a decade. The number of available jobs (indicated by the number of online job ads) has also been staying at a decade-high level. They both suggest Adelaide’s job market is more active than ever, and the local economy thrives.

Adelaide Property Market Sales Market Trends

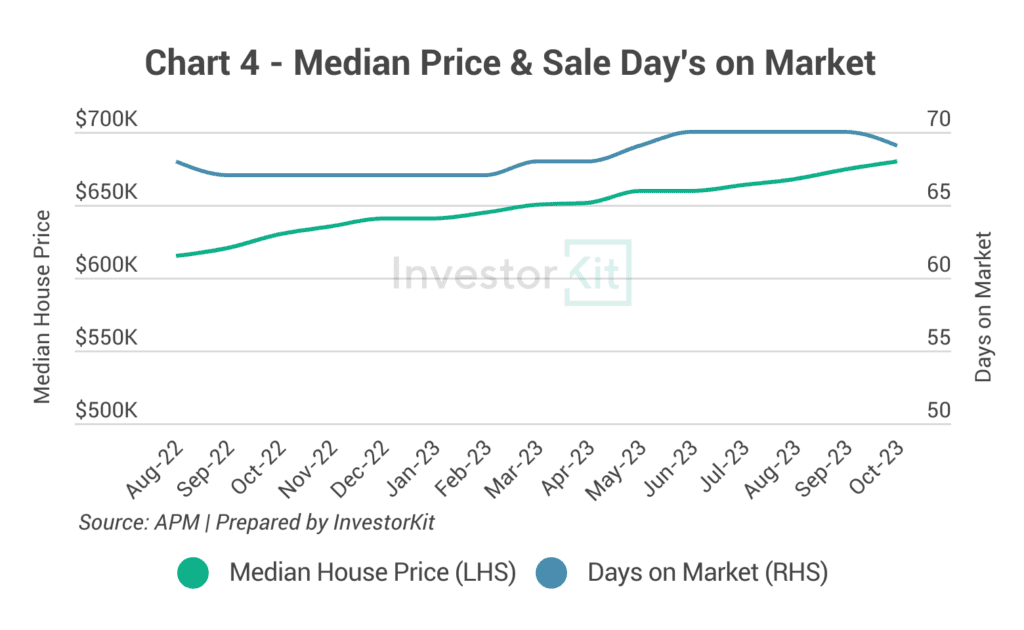

Although Greater Adelaide’s house prices experienced some minor MoM decline briefly in 2022, the city’s 12m rolling price trend has been steady (Chart 4), showing strong resilience against the interest rate hike headwinds.

The Sale Days on Market, a leading indicator of market pressure, is declining again, showing increasing pressure in recent months. The increasing pressure has been reflected in Addelaide’s quarterly solid value growth: +4.2% growth in the 3 months leading up to the end of Oct, making Adelaide the second-best performer in the quarter (just a bit lower than Perth’s 4.6%).

With a median price of $680k, Adelaide’s houses are becoming less affordable for the locals (overvalued by 12% assuming interest rate = 5.5%, and by 21% if interest rate = 6.5%), but, just like Brisbane, it is much more affordable compared to Sydney and Melbourne, making it much attractive to investors from the eastern states.

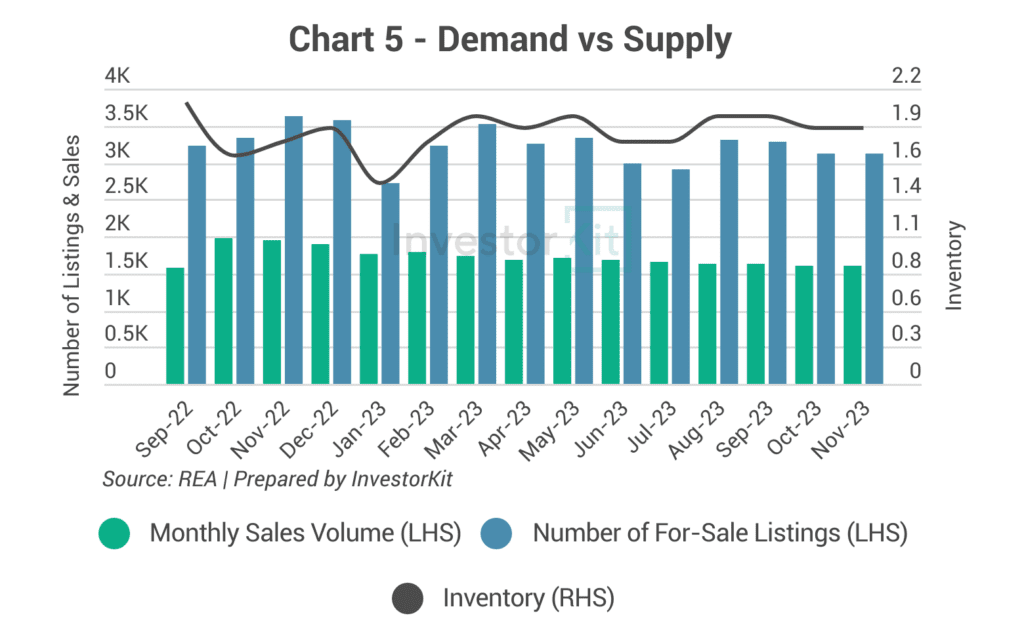

Adelaide’s high market pressure is reflected by its demand-supply relationship, too. The monthly sales volume (demand) has been declining, but the number of listings (supply) has also been decreasing. As a result, Adelaide’s house inventory has stayed around 1.9 (months’ worth of stock) since Mar 2023, well below the 3-3.5 balanced mark.

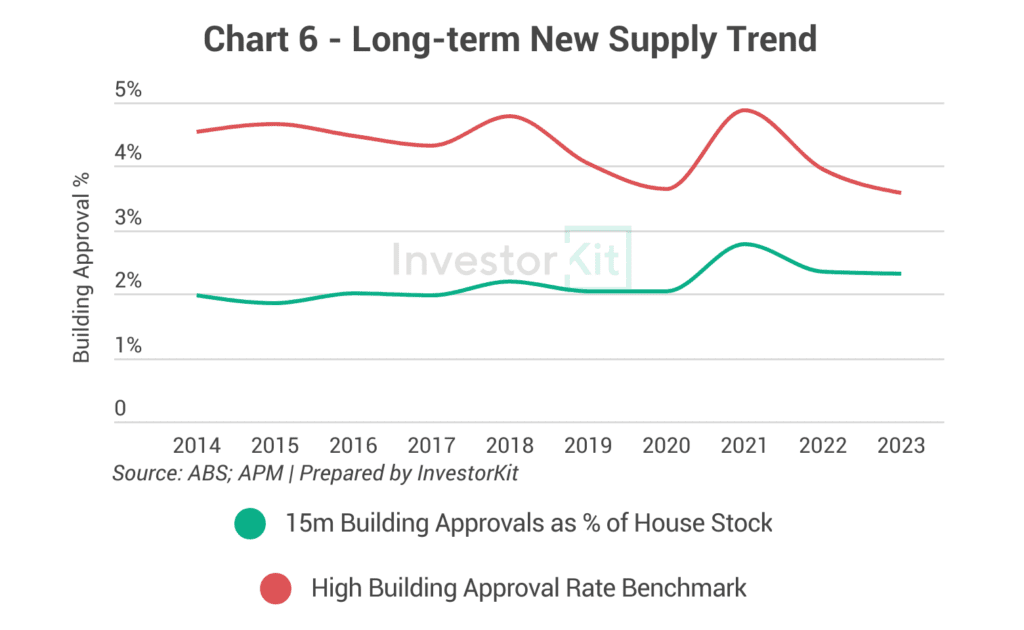

Adelaide’s new house construction activities have remained moderate in the past decade, only stimulated by the HomeBuilder Grant in 2021. Currently, the proportion (%) that new house building approvals represent in the total house stock in Adelaide is one of the highest across all capital cities, at around 2.3%. However, it is still balanced and not even close to the number that would cause oversupply.

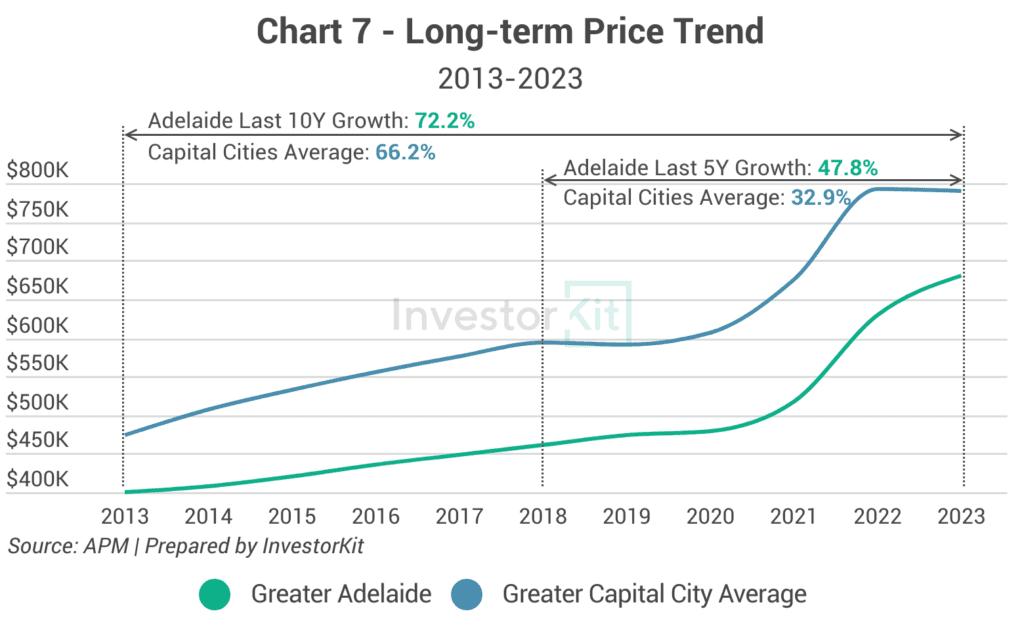

Adelaide’s house price growth in the past decade was slightly higher than the capital city average. In the short term, we expect Adelaide’s performance to exceed the average level even more, considering the high market pressure it’s experiencing right now.

Adelaide Rental Market Trends

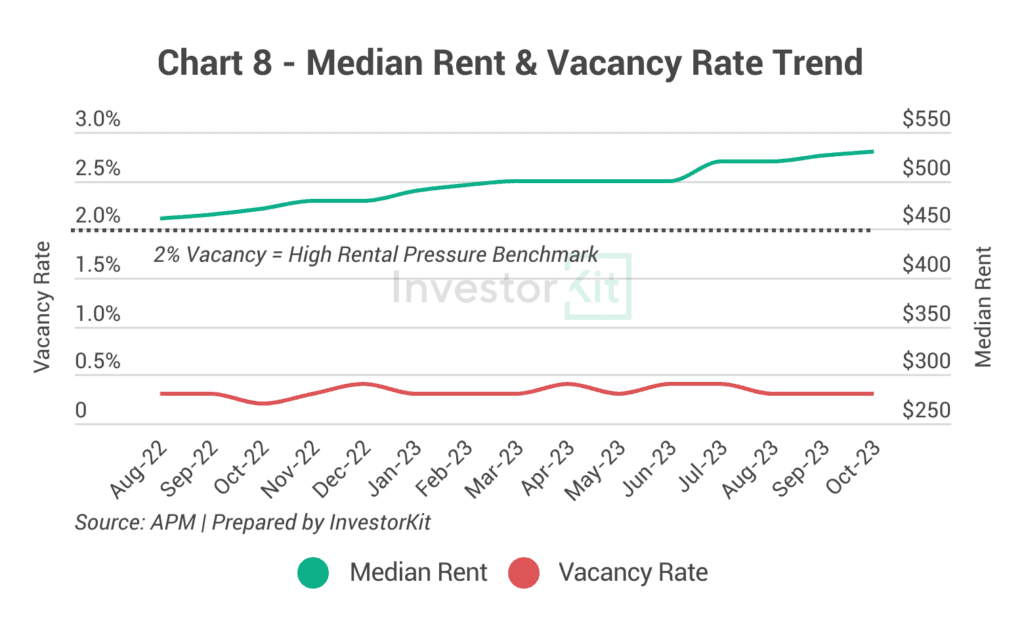

With a crisis-level vacancy rate of 0.3%, Greater Adelaide’s rental market is under high pressure. This high pressure has led to a 13.0% annual increase in house rental prices. Further increases are expected as the rental pressure remains high.

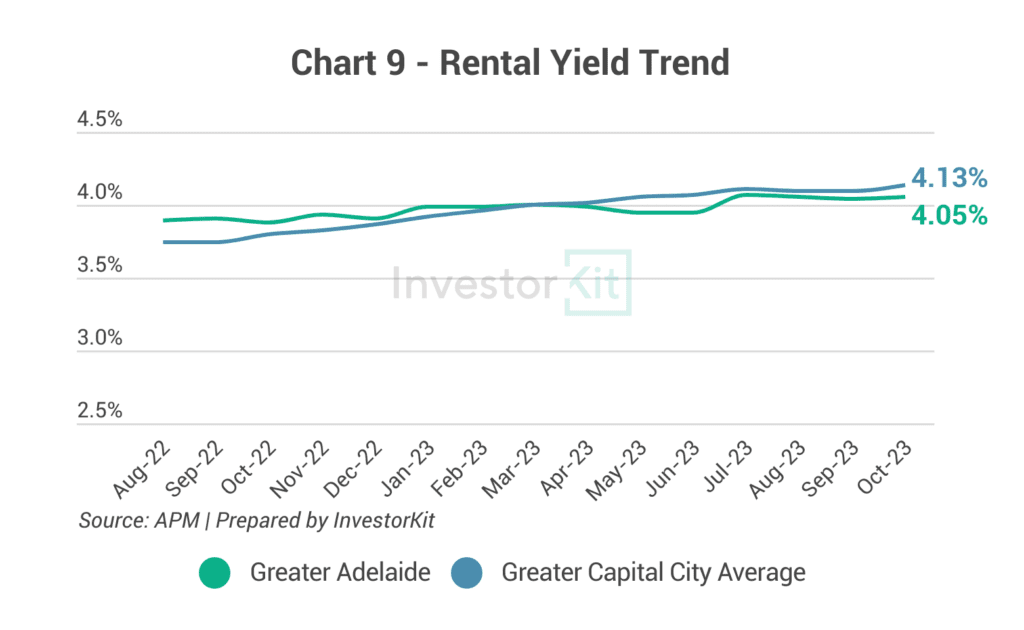

Although Adelaide’s rental prices have achieved impressive growth over the past year, rental yield is not rising as fast as the other capital cities due to the market’s strong sales price growth. Currently, at 4.05%, the rental yield is not high enough to generate a healthy cashflow in this high interest rate environment. However, once you have entered the market, the yield on purchase will improve fast as rents keep growing.

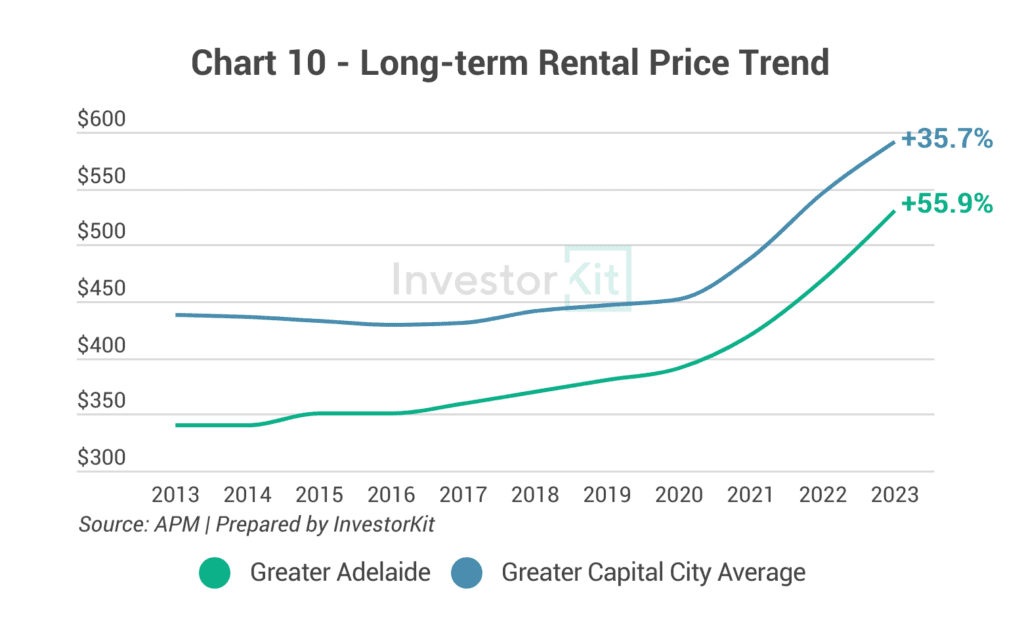

Over the past decade, Greater Adelaide’s rental price has grown by 55.9%, higher than the capital cities’ average growth rate. However, the extremely low vacancy rate indicates that rents will likely keep the robust growing momentum in the short term before slowing down.

In the next 6-12 months…

As Greater Adelaide’s house market is still showing signs of high pressure with low inventory & declining days on market in the sales market, and low vacancy rates in the rental market, prices are expected to keep the healthy growing momentum in the coming 6-12 months in both sales and rental markets. The further strong growth is also backed by:

- High consumer confidence: Adelaide has the highest auction clearance rate in all capital cities;

- Strong population growth and migration recovery;

- Low stock level: Adelaide’s number of for-sale listings is nearly 40% lower than the last 10-year average.

Adelaide is the fourth city we examine in this Market Pressure Review Series. Stay tuned for the next hotspot, Perth, to come! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)