Geelong: More Than Just A Gateway City

Just 1-hour drive from Melbourne, Geelong is not only the gateway city connecting Melbourne and western Victoria regions but also Australia’s largest regional city and one of the fastest growing cities across the country, with population and GRP growth outpacing the Victoria and national average. The city’s property market has benefited from a mix of lifestyle, relative affordability, and proximity to Melbourne and surged by 30%+ in value from 2020 to 2022. It went into a correction phase in 2023 and has stayed low-key. Where is Geelong going in 2024? Join us today exploring the city’s current property market conditions and outlook!

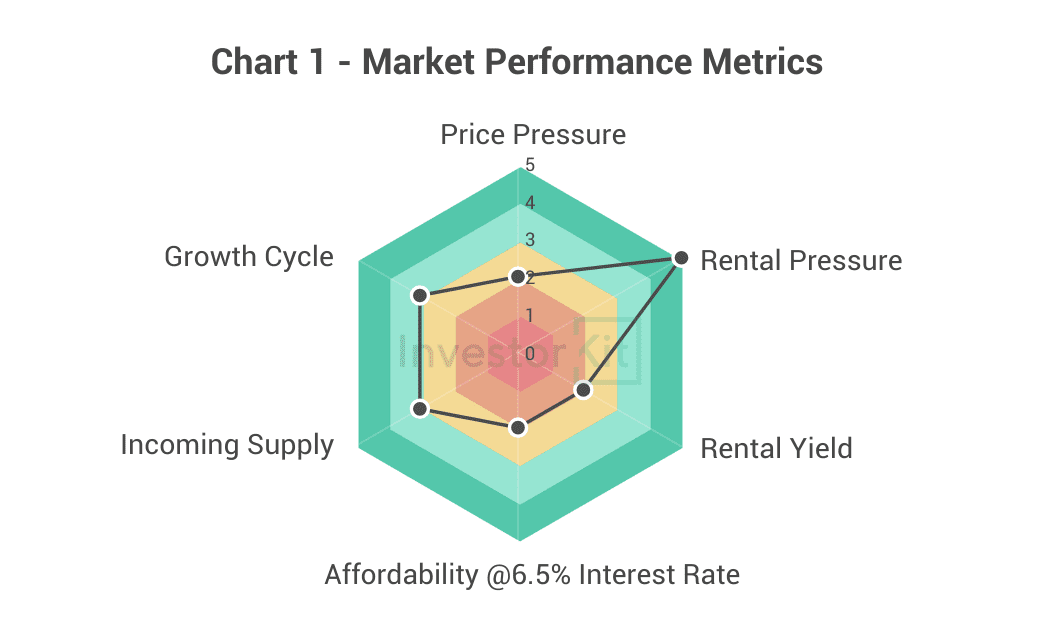

As of January 2024, Geelong’s House Market Pressure is still relatively Low.

Among the 6 metrics InvestorKit uses to measure market performance, Geelong’s rental pressure scores the highest (5=strong), followed by growth cycle (3=nuetral), while all other metrics are weak.

Demographic & Economic Trends

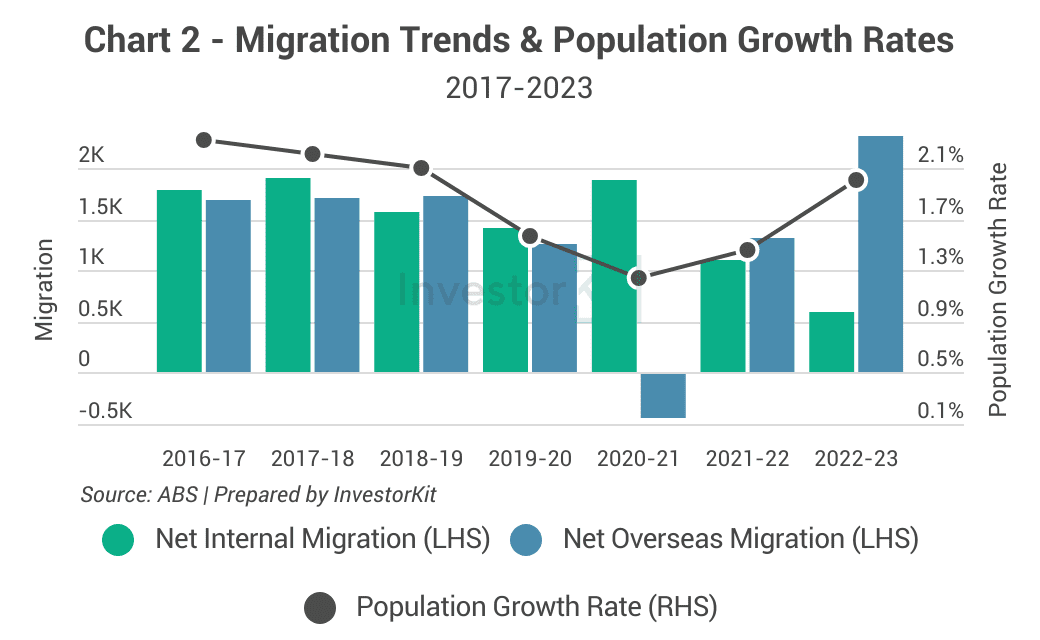

Geelong’s population growth rate is gradually recovering from the pandemic suppression: Net overseas migration is bouncing as the international border reopened in 2022, while net internal migration seems to have stabilised at the 2021/22 level, according to the latest (Dec 23) Regional Movers Index report by CBA and the Regional Australia Institute. Nonetheless, Geelong is the third largest net internal migration receiver among all regional cities, just behind Queensland’s Sunshine Coast and Gold Coast.

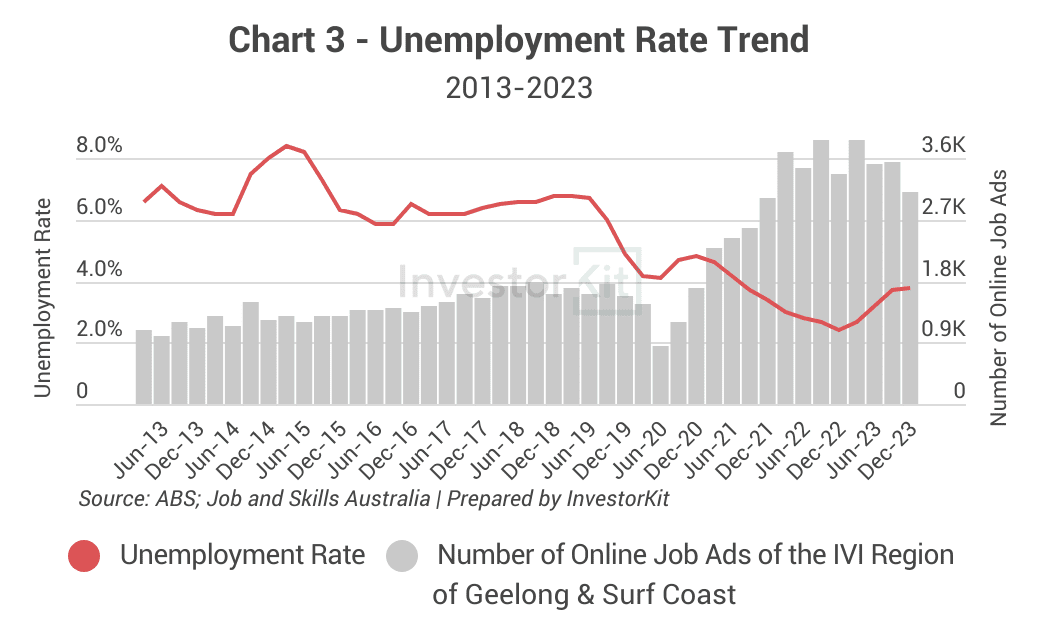

The unemployment rate has been rising over 2023 as the RBA cash rate hiked, up from 2.4% in Dec 22 to 3.8% in Dec 23. At the same time, the number of job vacancies has also declined from its peak in 2022.

However, it’s still clear that Geelong’s job market is at the most active point in over a decade: the unemployment rate is much lower than a decade ago (and also much lower than the commonly-held 5% full-employment benchmark), and the number of available jobs is 73% above the highest point pre-COVID.

Both job market indicators are showcasing a thriving local economy in Geelong.

Sales Market Trends

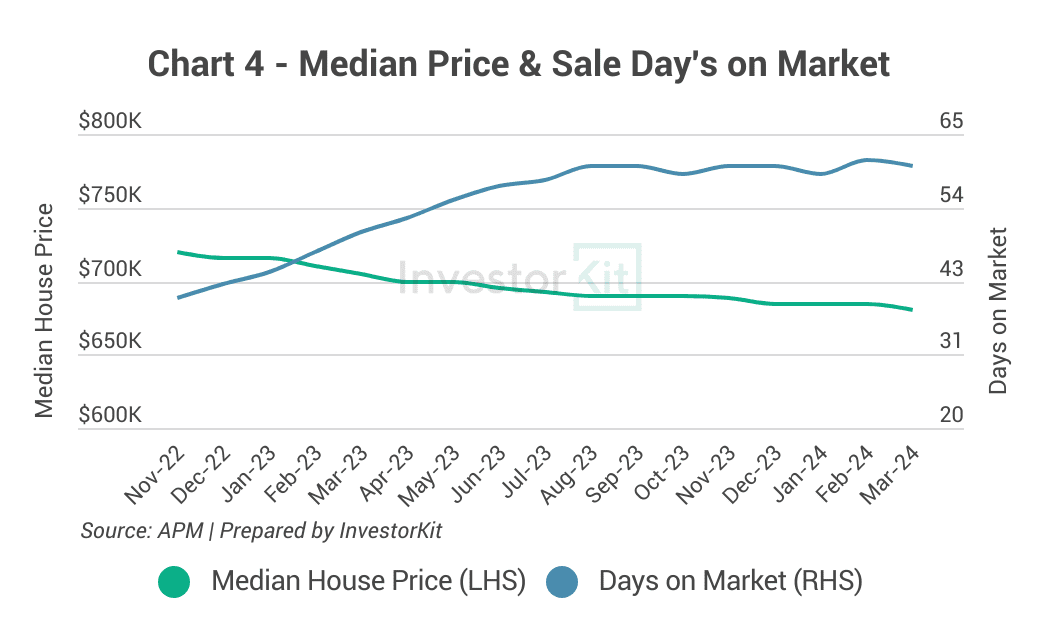

Geelong’s house price has been declining over 2023, down -3.5% in a year, currently at $680k.

Price declines are usually accompanied by increasing or high sale days on market. Unsurprisingly, Geelong houses’ sale days on market surged from 40 to 60 in the first half of 2023 and is now staying at the 60-day level.

Historically, Geelong’s house market trends followed Melbourne’s steps, with a 1-2 year lag. Now that Melbourne’s house market is gradually recovering and Geelong’s house prices show signs of bottoming out, we can probably expect a gradual recovery in 2024.

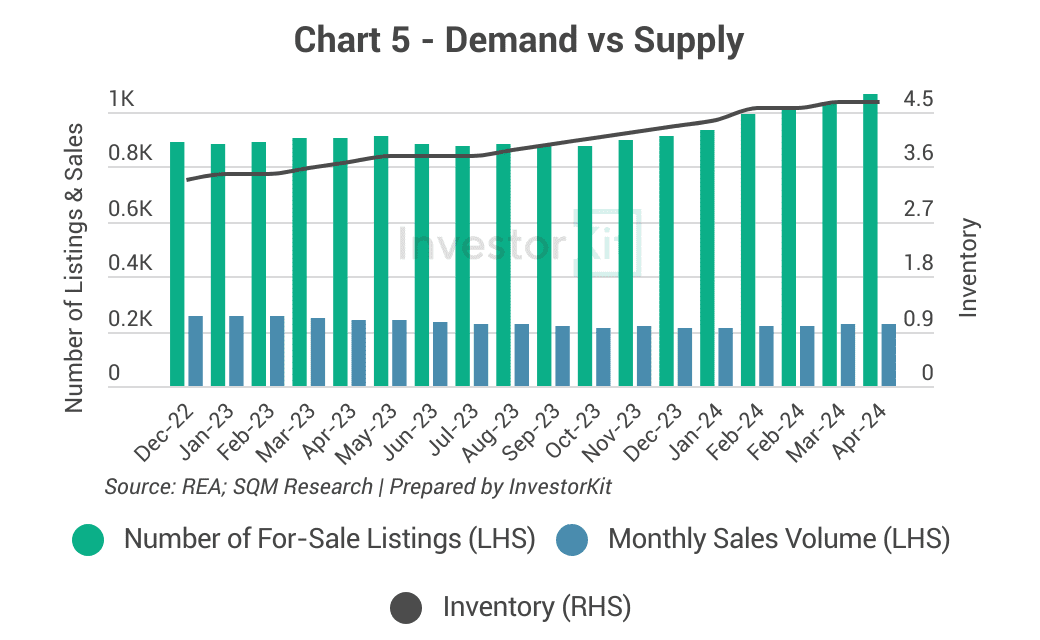

How soon we will see the recovery depends on the relationship between demand and supply. Currently, we see a slight tick in demand (monthly sales volume), but the supply level (number of for-sale listings) is still rising, leading to a relatively high 4.7 months of stock. A decline in inventories would signal an increase in market pressure and lead to price recovery. However, we can’t expect robust growth until the inventory level declines to 3.5 months or lower.

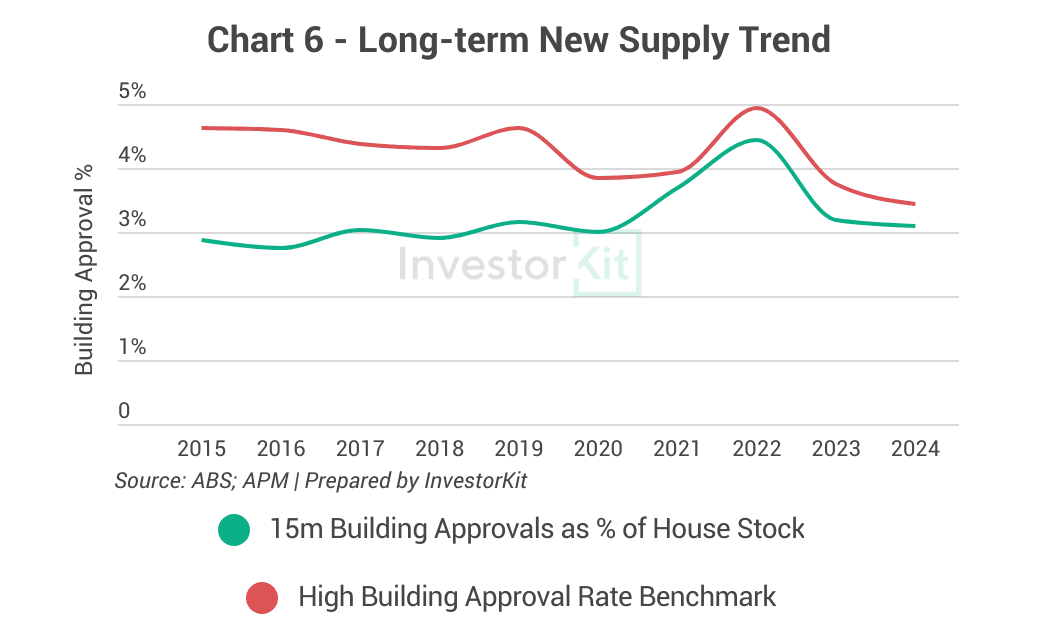

While the country’s average new-house-building activity is lower than pre-COVID, Geelong is more active. This is thanks to the city’s strong underlying housing demand driven by the active job market, constantly growing population, lifestyle & affordability attractiveness and a large number of infrastructure projects reshaping the city.

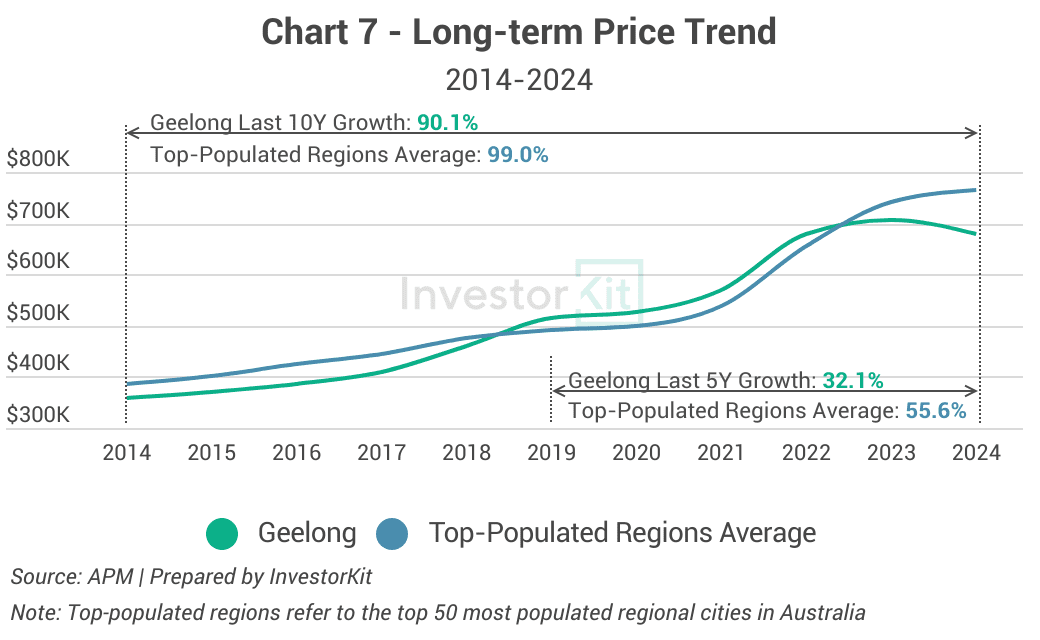

Geelong’s house prices increased by 90.1% in the past ten years, which aligns with other top-populated regional cities. However, in the past 5 years, Geelong’s performance was substantially behind the other big regional cities. This 5-year growth gap will likely boost Geelong to start a new wave of growth in the coming years should other recovery trends continue.

Rental Market Trends

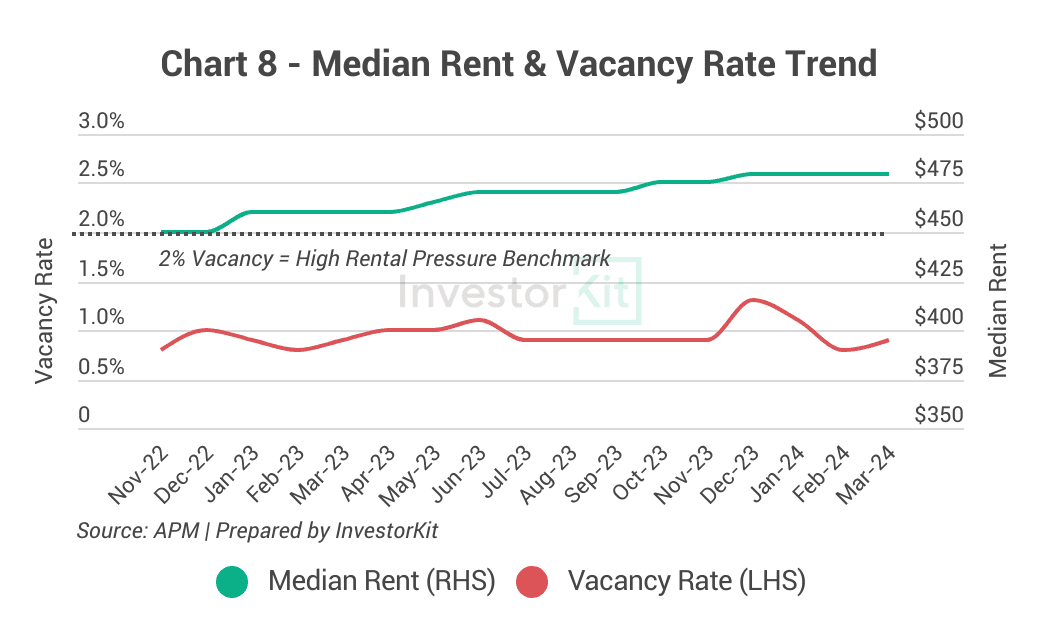

The rental market is under high pressure, with a vacancy rate of around 1.0%, leading to constant growth in rental prices over 2023. Further rental increases are expected due to the high pressure.

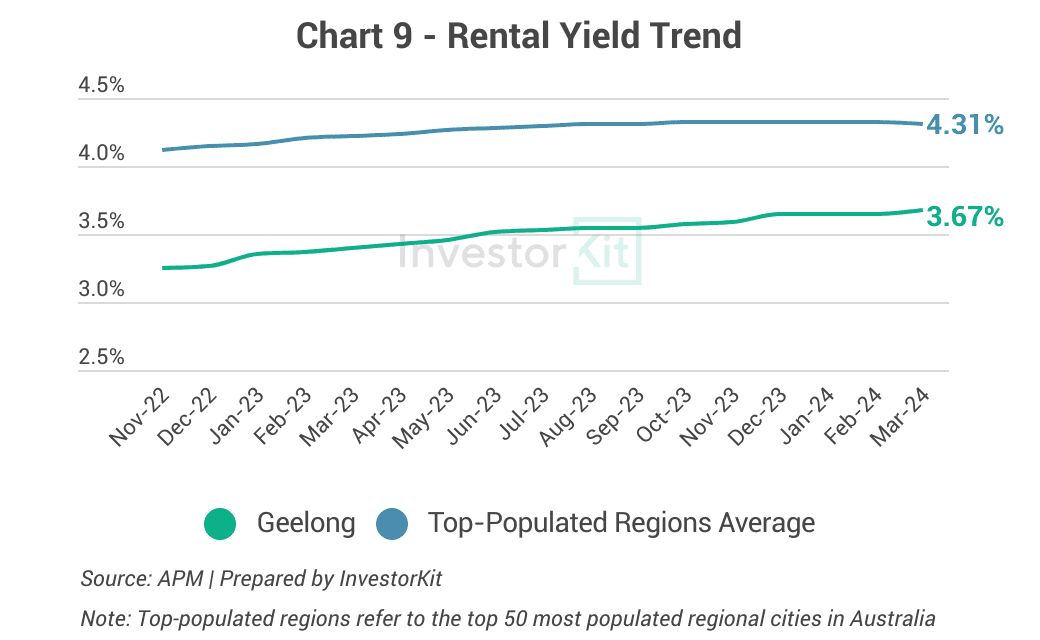

At only 3.67%, Geelong’s rental yield is much lower compared to the average of the top-populated regional cities, but increasing rental prices and declining sale prices over the past year or so have been helping improve the yield level. More improvement is expected as rents will likely outgrow sale prices again in 2024.

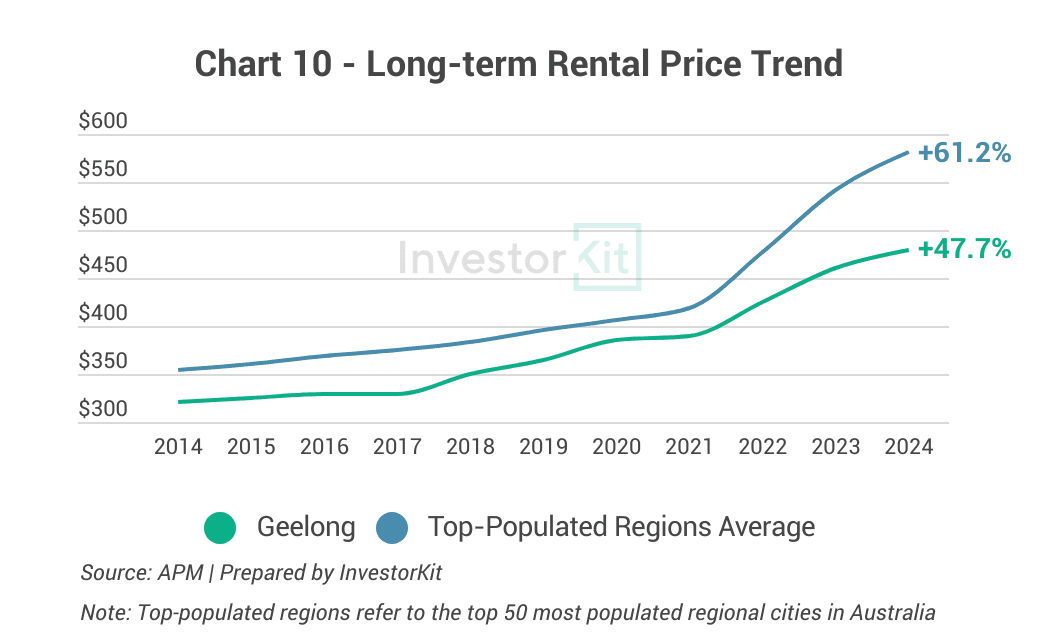

Over the past decade, Geelong’s rental prices have grown by 47.7%, lower than the average growth rate of the top-populated regional cities. We expect this to increase further considering the city’s increasing housing demand driven by the thriving economy, the balance between job opportunities and lifestyle, and relative affordability.

In the next 6-12 months…

Geelong’s housing market is currently under low pressure as it’s going through a correction phase following the COVID-19 growth peak. However, the underlying housing demand is strong, underpinned by its proximity to Melbourne, the active local economy, improving population growth rates, infrastructure improvements, lifestyle & affordability attractiveness, etc. We believe the housing prices in Geelong will start recovering in the coming 6-12 months at a moderate pace, and as market pressure cumulates, Geelong could very well move into a more robust growth phase and be among the top performers in the 3-5 years ahead considering the high housing demand and relatively low growth in the past 5 years.

Geelong is the first regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)