Bunbury Property Market

Bunbury: A lively city where nature meets heritage and art

2 hours’ drive south of Perth lies Bunbury. The port city is Western Australia’s second-largest urban area and is famous for wild but friendly bottlenose dolphins, public art, and rich aboriginal and colonial history. The strengthening local economy, laid-back coastal lifestyle and relative affordability here have attracted many home buyers and investors to Bunbury in recent years. House prices have been accelerating since 2020, achieving 23% in the last 12 months.

Can Bunbury’s house prices continue surging in the coming year? Join us today to explore the city’s current property market conditions and outlook!

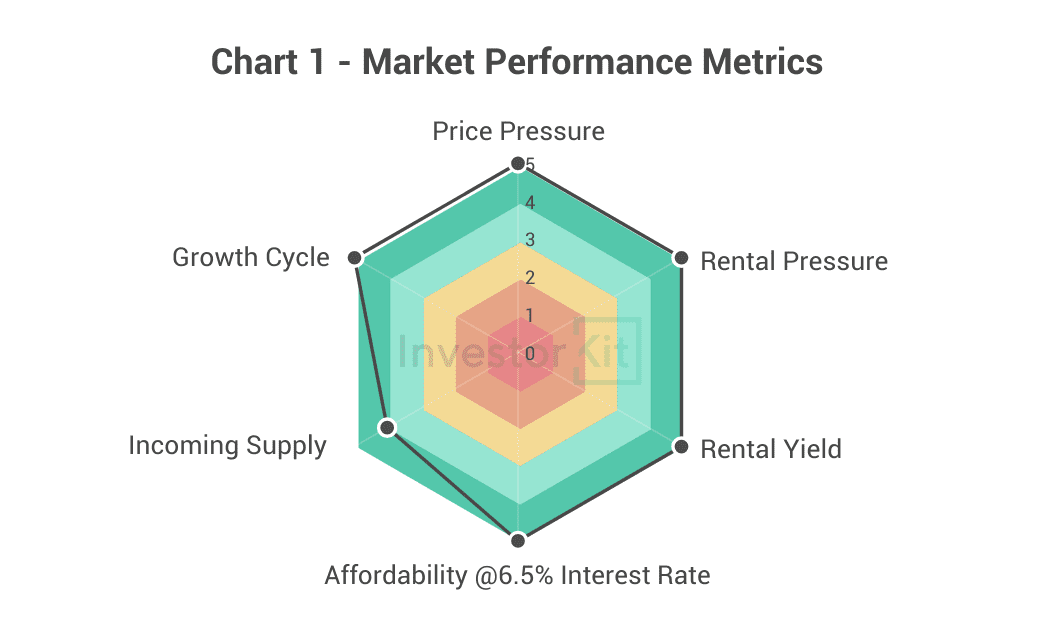

Bunbury Property Market Overall Performance

As of Nov 2024, Bunbury’s House Market Pressure is still high.

Among the six metrics InvestorKit uses to measure market performance, Bunbury scores 5/5 in all but Incoming Supply, which is a 4, but still a high score.

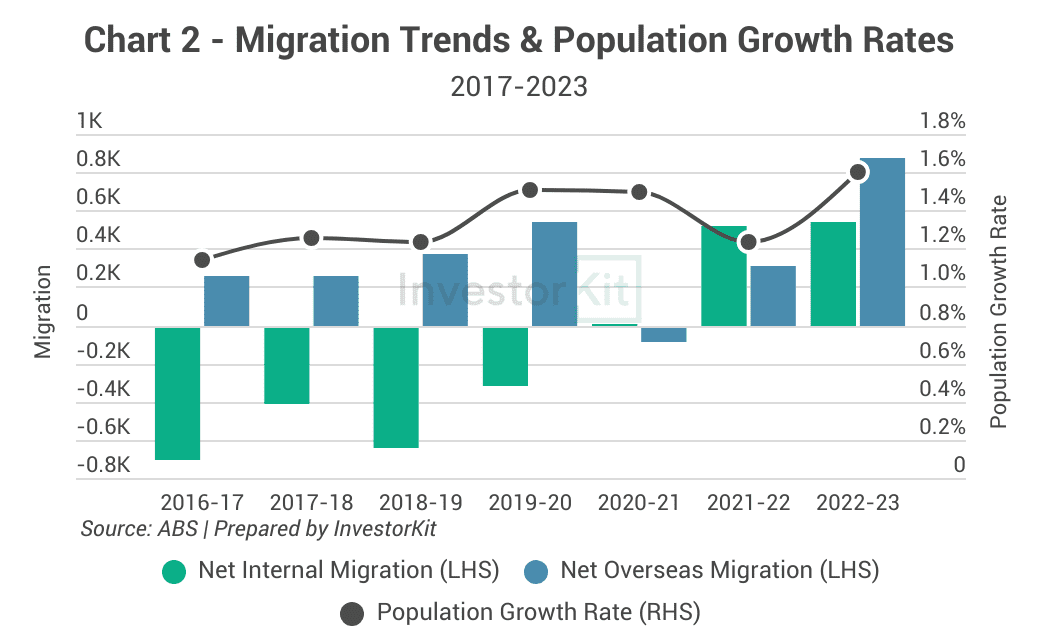

Bunbury’s Demographic & Economic Trends

Bunbury’s population growth slowed in the early 2010s and stabilised around 1.2-1.5% from 2016 to 2022. Since both internal and overseas migration are growing, the population growth rate has shown a solid upward trend since 2023.

The faster population growth, especially the increasing net internal migration, will likely continue boosting Bunbury’s housing demand in the coming years.

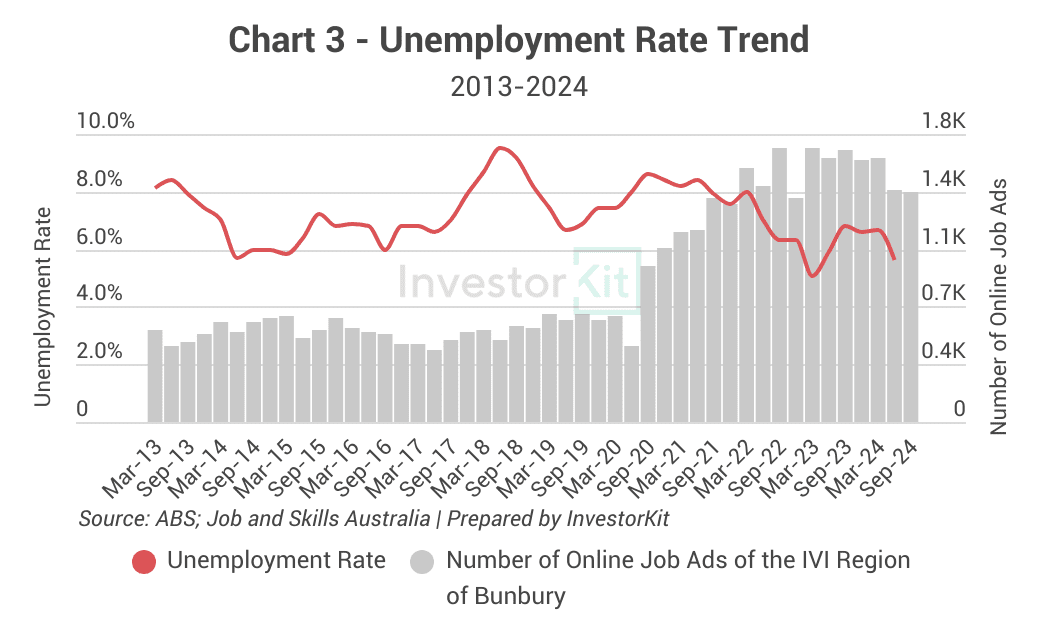

Bunbury’s unemployment rate has been trending downward since 2018, reaching 5.6% in Q2 2024. While this unemployment rate is not typically considered low, it is much lower than Bunbury’s last-decade- average, indicating a recovering economy.

In the meantime, the number of job opportunities is more than twice as high as the pre-COVID average.

Both indicators indicate that Bunbury’s local economy is strengthening and will provide the property market with a solid economic foundation.

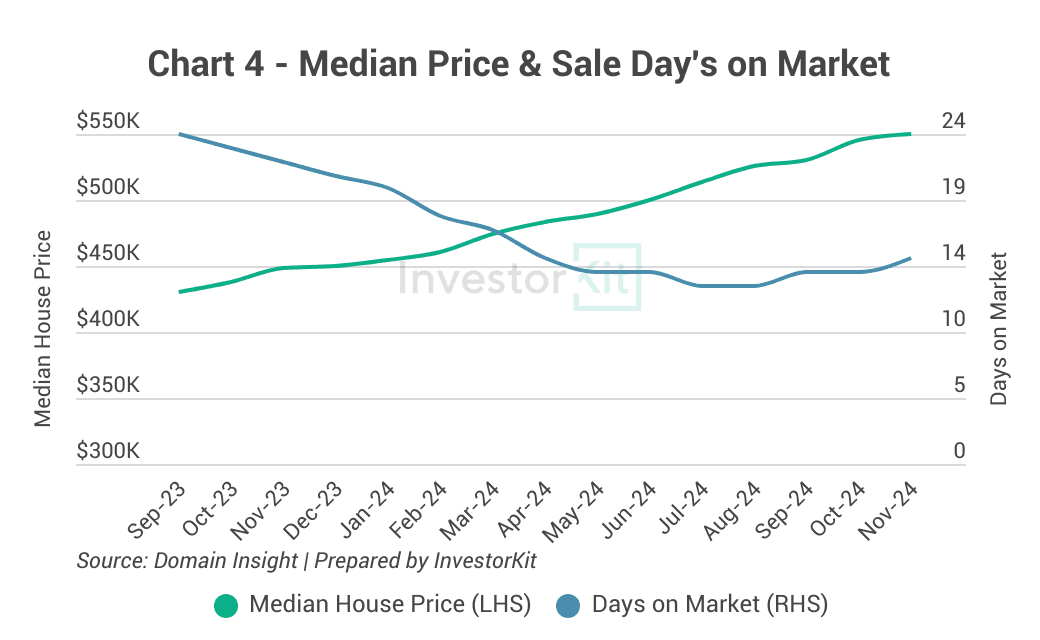

Bunbury’s Sales Market Trends

Bunbury’s house price growth has accelerated since 2023, achieving a 23% annual growth in the past year. The robust growth was accompanied by a steep 54% drop in days on market (DoM), down from 28 days in May 2023 to just 13 days in July 2024. The decline has stopped since then, but the market continues to be extremely hot as we are not seeing any significant increase in DoM.

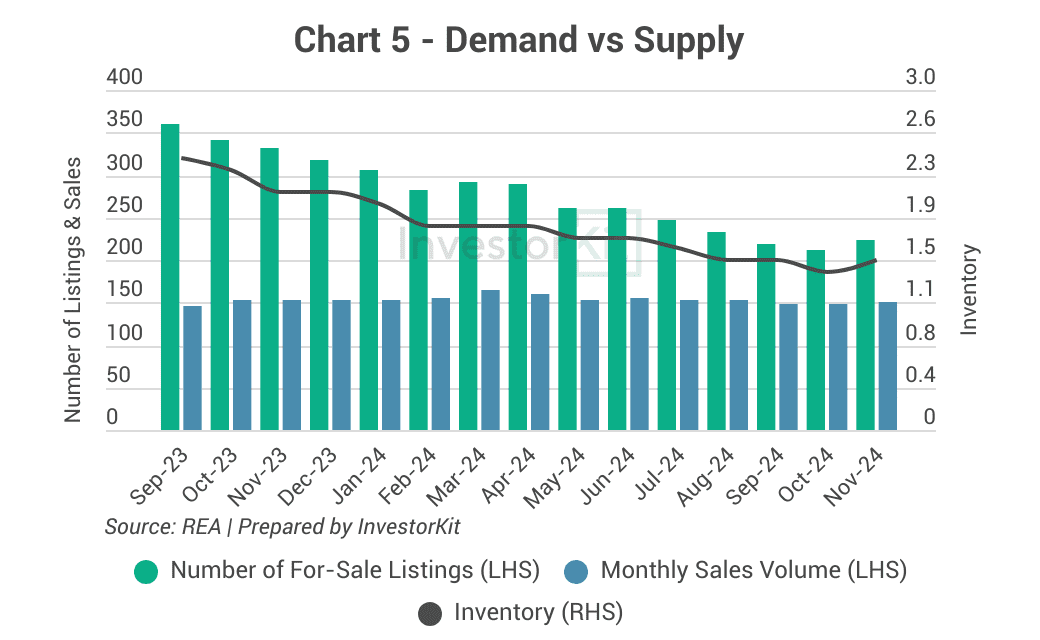

While sales volume has remained steady over the past year, supply (for-sale listings) has dropped significantly, leading to a steep decline in house inventory level in Bunbury, down from 2.4 last year to the current 1.5, displaying extremely high pressure.

We expect this high market pressure to continue driving Bunbury’s house market to thrive in the coming year.

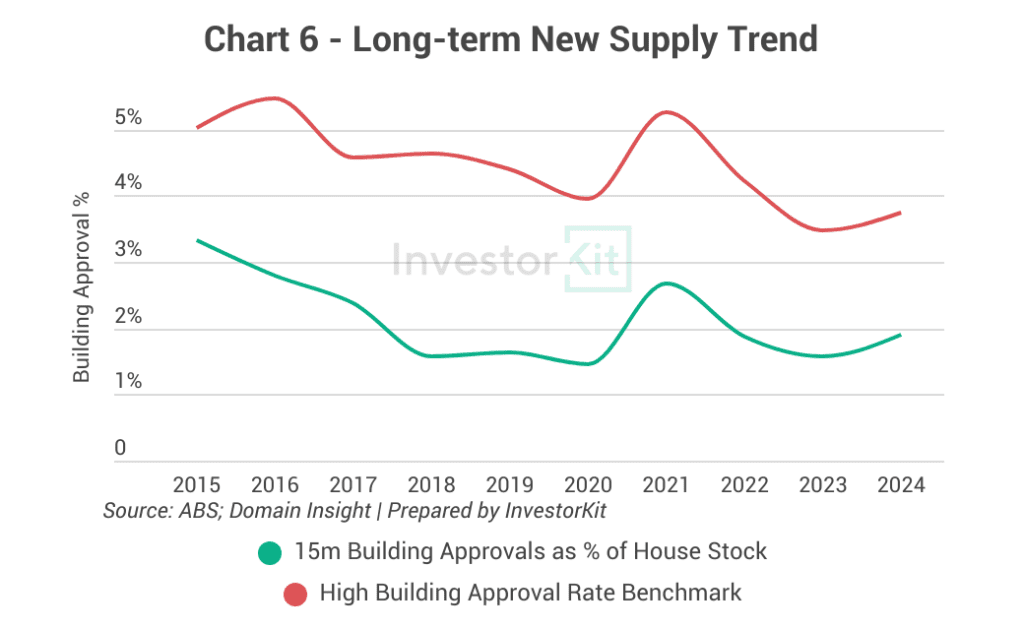

House construction activity in Bunbury has been lower than in the previous decade. While the 1.9% building approval rate is higher than many regional cities in the east-coast states, it’s still lower than the balanced level (2-3%), and we do not see oversupply risks in Bunbury.

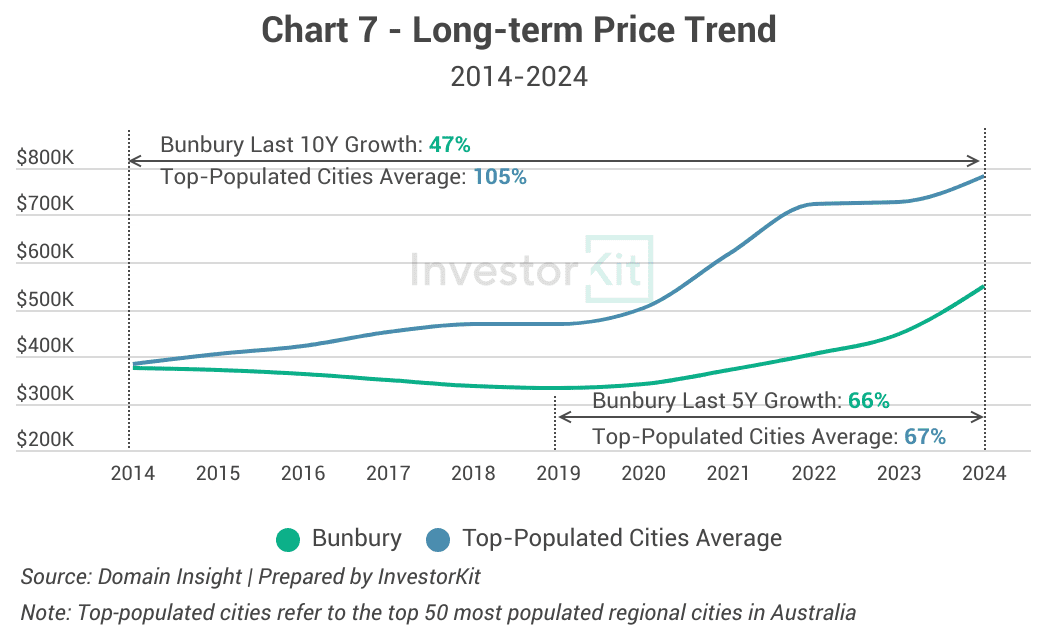

Bunbury house prices have achieved 66% growth in the past 5 years, which alighs with the average level of big regional cities. However, the last 10 years of growth have been only 47%, much lower than the average of large regional cities and its long-term average. The below-average 10-year growth allows Bunbury room for further strong growth in the medium term.

Bunbury’s Real Estate Rental Market Trends

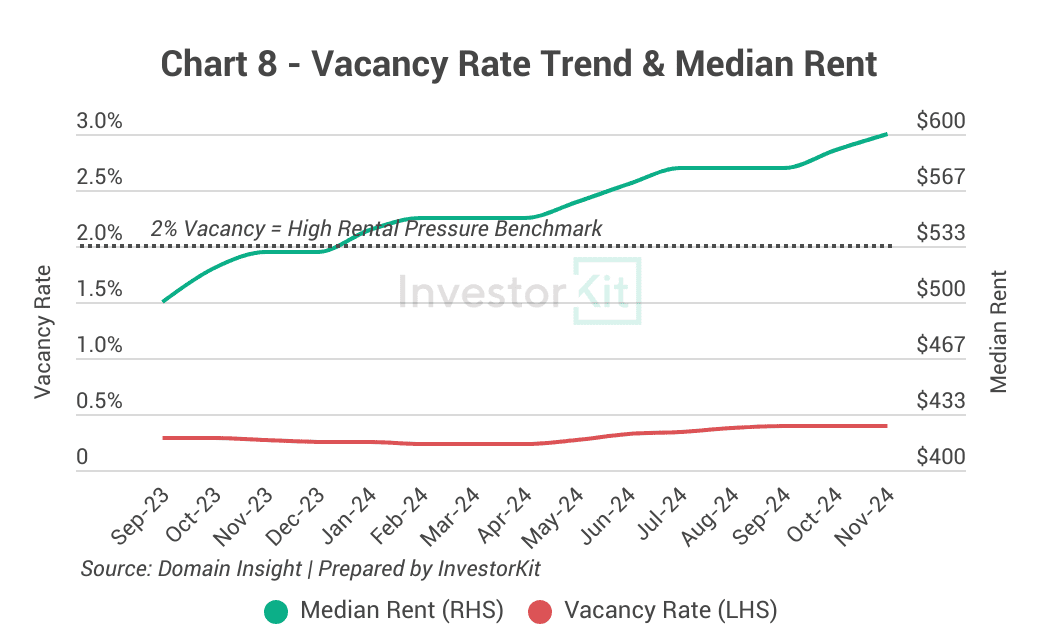

Bunbury’s rental market pressure is high, with under 0.5% vacancy rates and a 13% rental growth in a year.

Further rental increases are expected as the vacancy rate remains low. However, as rents approach the affordability ceiling and rate cuts to increase buyers’ confidence, demand is likely to shift to the sales market and slow down the rental growth in the coming year.

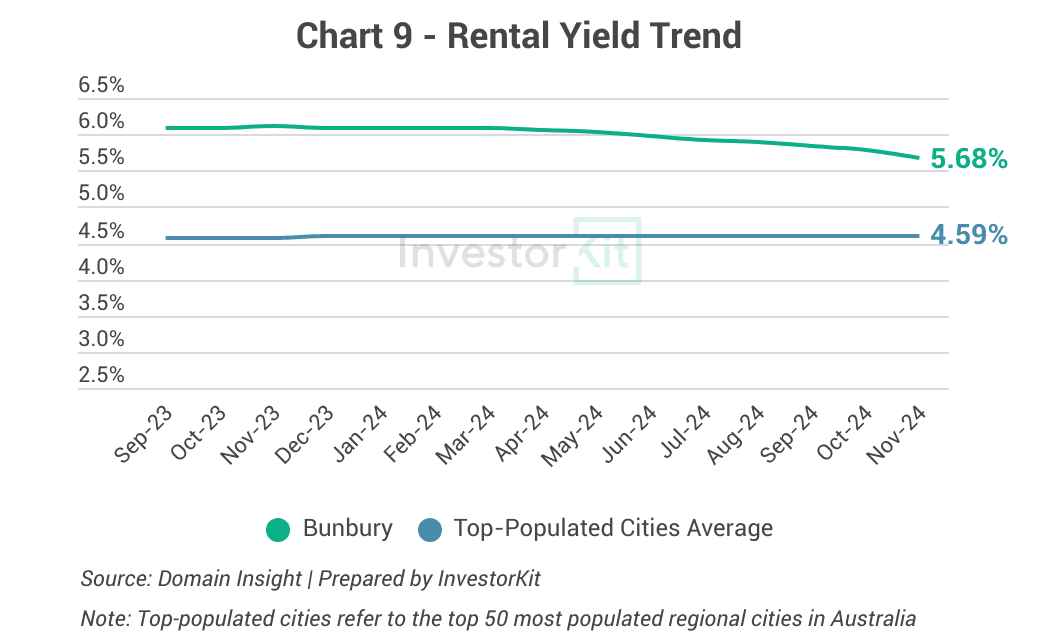

Averaged 5.7%, Bunbury’s rental yields are very healthy and better than big regional cities’ average. It’s one of the main reasons Bunbury is so attractive to investors. However, as price growth keeps exceeding rental growth, the yield level has notably declined this year, and we expect this downward trend to continue.

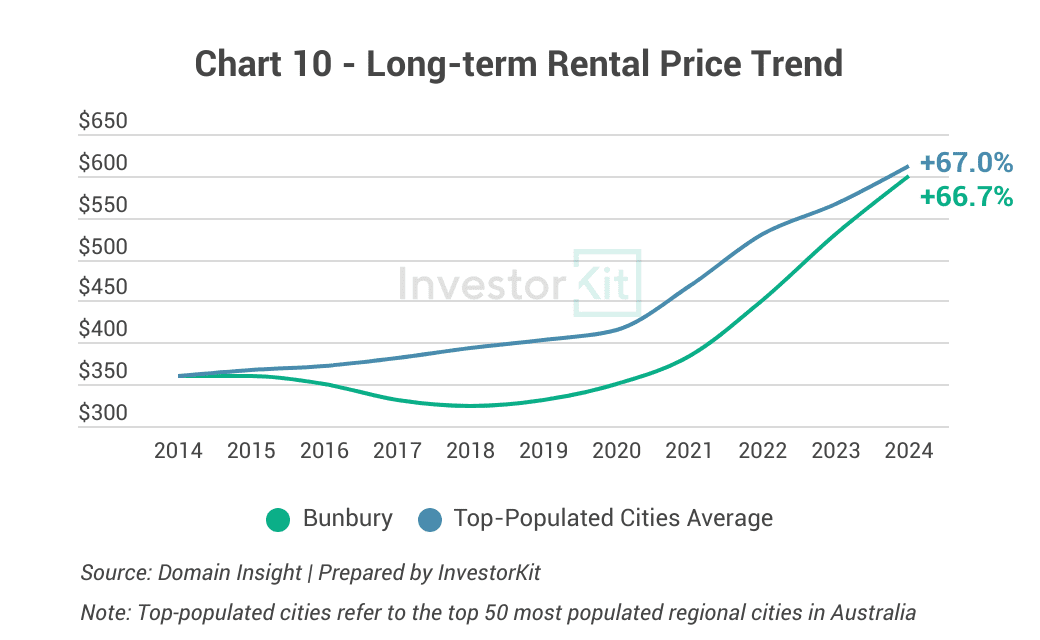

Bunbury’s rental prices declined and stayed stagnant over the first half of the last decade and played an extremely strong catch-up in the past 4 years, having achieved similar 10-year total growth with the large regional cities average. Given the stronger-than-average growth momentum in this city, it’s highly likely that Bunbury’s trendline will exceed the average trendline in the coming year.

In the next 6-12 months…

Bunbury’s property market is currently under high pressure. Price growth will be driven by the low supply level relative to demand as well as relative affordability. We expect Bunbury house prices to achieve double-digit growth in the next year. Its lower-than-average 10-year growth also shows that the market has room for further strong growth in the medium term.

Bunbury is the 8th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)