Ballarat Property Market: Victoria’s Historic Regional Charm

Ballarat, located in Victoria’s Central Highlands, 110 kilometres northwest of Melbourne, is a thriving regional city known for its rich history. It features iconic attractions like Sovereign Hill, the Eureka Stockade site, stunning Victorian-era architecture, and natural landmarks such as Lake Wendouree and the Botanical Gardens. With a diverse economy, cultural festivals, modern amenities, and affordable housing, Ballarat appeals to families and individuals as both a holiday destination and a place to call home.

Ballarat’s house market boomed between 2018 and 2022, with house prices growing at a double-digit rate each year. However, after that peak growth period, the market entered a downturn, and house prices have fallen for years. Is a return to growth likely in the coming year? Join us today to explore the city’s current property market conditions and outlook!

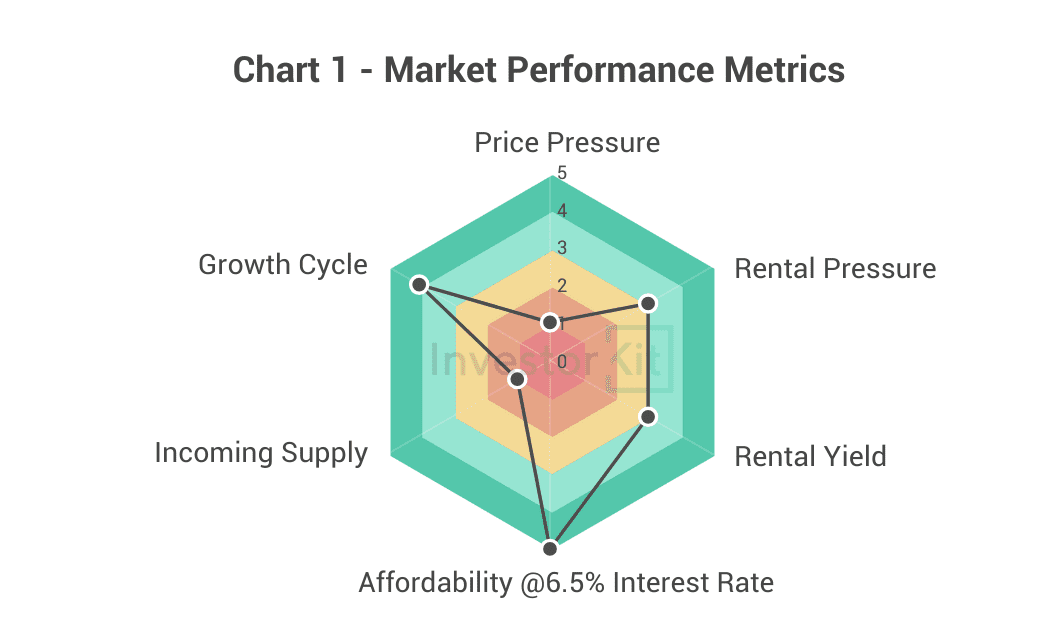

As of January 2025, Ballarat’s House Market Pressure is relatively low.

Among the six metrics InvestorKit uses to measure market performance, Ballarat scores the highest (=5) in affordability, 4 in growth cycle, 3 in rental yield and rental pressure, and 1 in price pressure and incoming supply.

Ballarat’s Demographic & Economic Trends

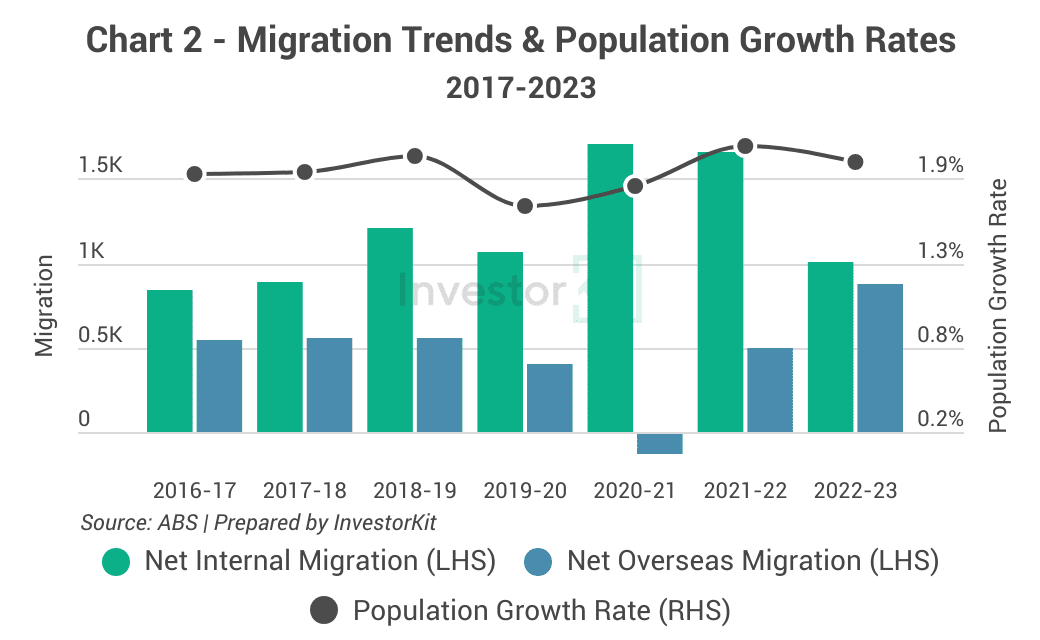

Ballarat’s population growth has been steady between 2017 and 2023. Even during the COVID pandemic, the region was not heavily impacted and quickly rebounded. From 2020 to 2021, Ballarat saw a significant influx of internal migrants due to the “regional relocation” trend, while overseas migration dropped sharply due to international border closures.

Since late 2021, as restrictions eased, the number of overseas migrants to Ballarat has increased. Conversely, net internal migration has decreased as Melbourne went back to normal and work-from-home arrangements diminished.

In 2022-23, Ballarat’s population growth rate was 1.98%, slightly lower than the previous 12 months. This growth was almost equally driven by internal and overseas migration.

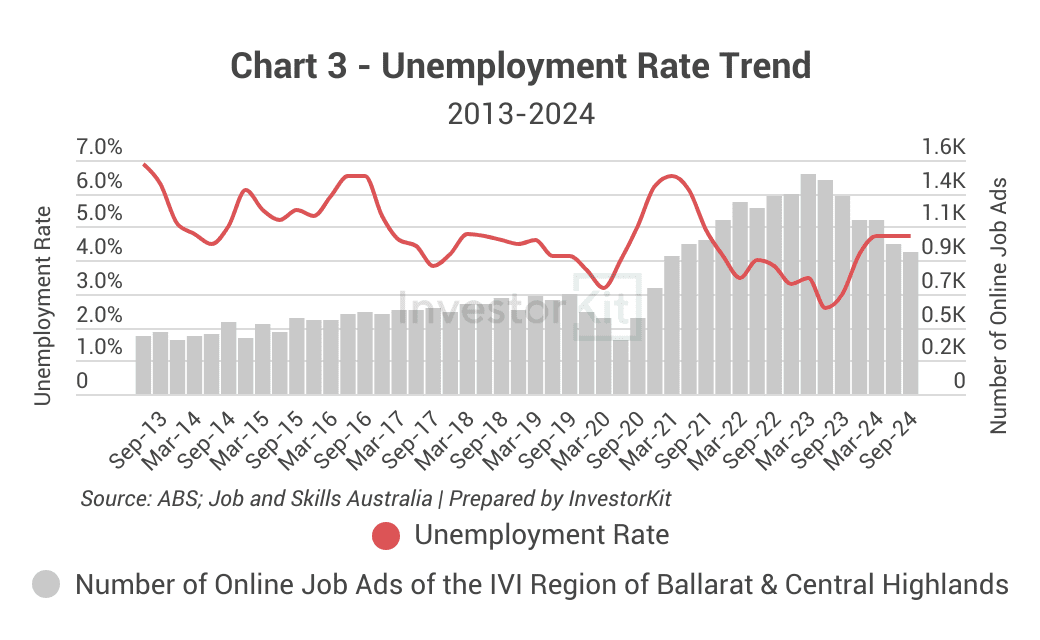

Since mid-2023, Ballarat’s unemployment rate has gone up due to the high RBA cash rate. However, it is still much lower than the past decade’s average and has started stabilising. Meanwhile, despite a fall, job vacancies are still much higher (by approximately 50%) than the pre-pandemic average.

These indicators highlight that Ballarat’s job market is highly active, reflecting a strong and thriving local economy.

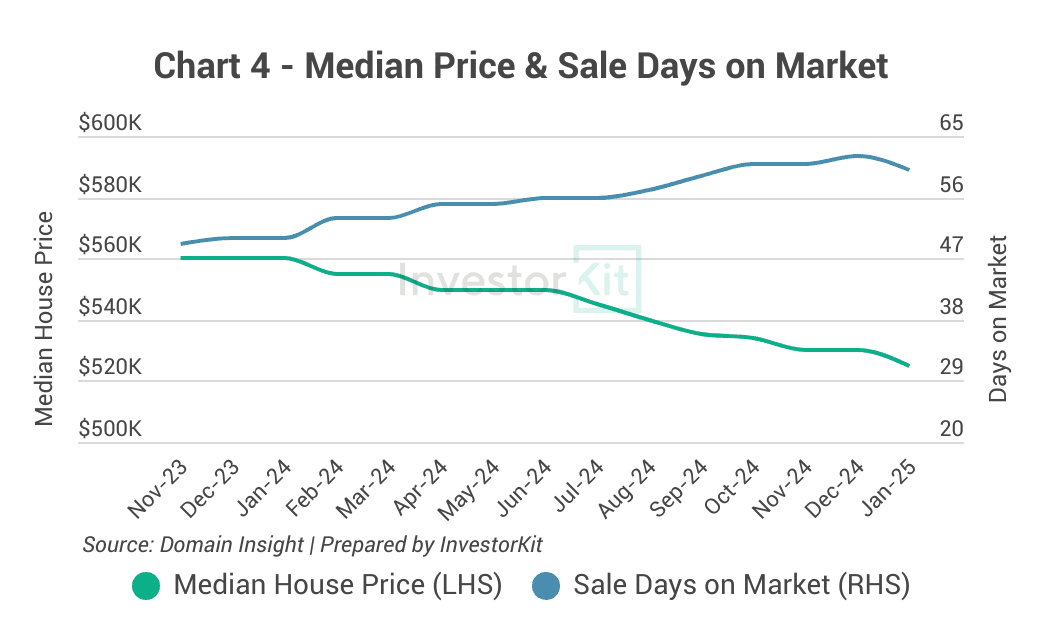

Ballarat Median House Price – Sales Market Trends

Ballarat’s house market hasn’t performed well over the past 15 months. The current median house price is $525k, down by about 6.3% compared to a year ago. At the same time, the number of sale days on the market has gone up rapidly, up by 20% in a year. This trend indicates declining demand and easing market pressure.

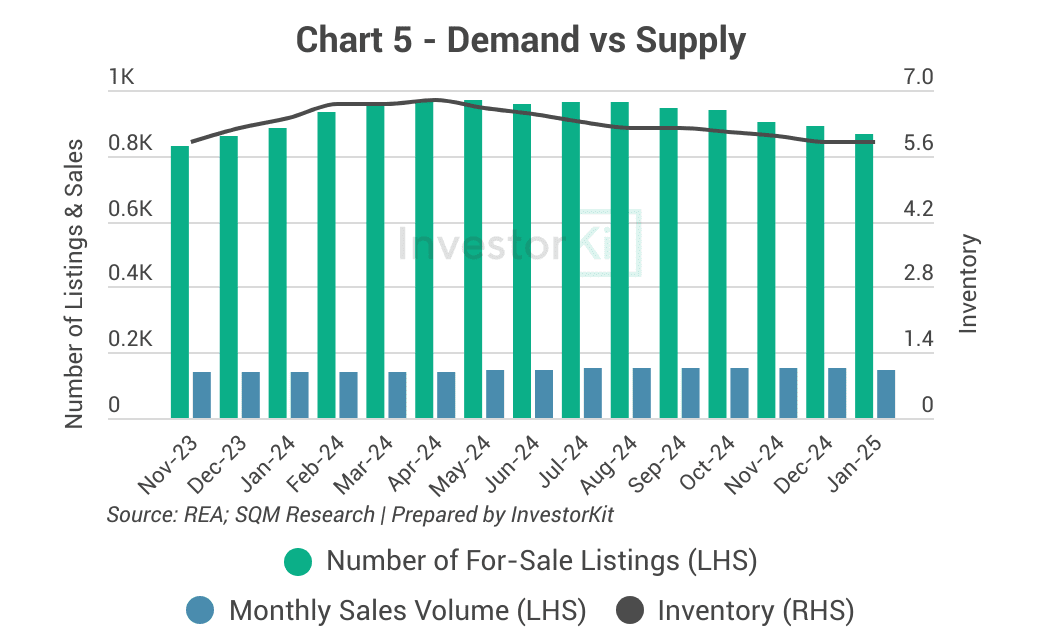

Over the past 12 months, the number of houses sold in Ballarat was stable while the number of houses listed for sale declined, contributing to a drop in inventory. Nevertheless, inventory is still at a high level, nearly six months of stock. The high inventory level implies that market pressure in Ballarat is low.

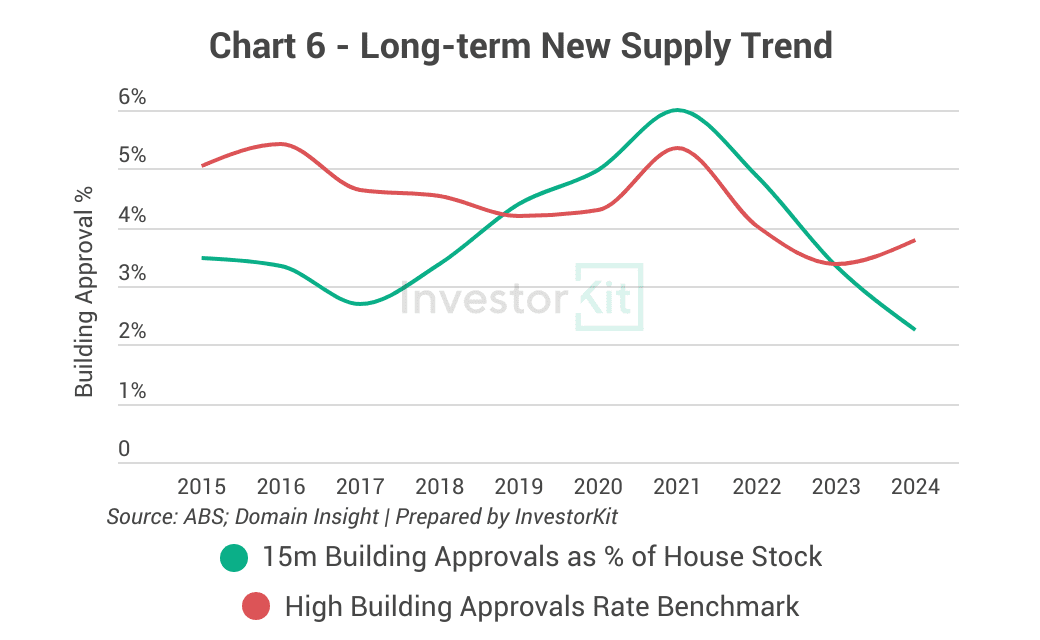

Between 2017 and 2021, Ballarat experienced a surge in house construction activity. This dramatic lift was boosted by the “regional relocation” trend and the Home Builder Grant during COVID.

However, after that period, construction slowed down and is now sitting below the high building approval rate benchmark, which is a positive sign for price growth.

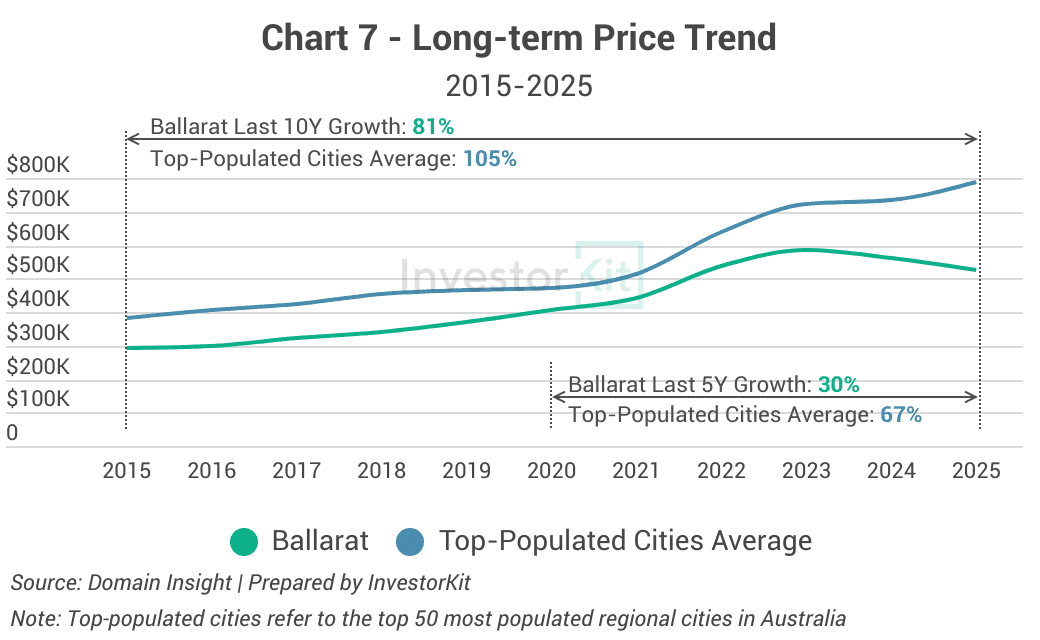

Ballarat’s house price growth started speeding up in 2018. It went up by 81% over the last ten years, in line with its long-term average and lower than the average of the top-populated regional cities. The moderate 10-year growth gives Ballarat room for growth when its market pressure recovers.

Ballarat’s Real Estate Market – Rental Market Trends

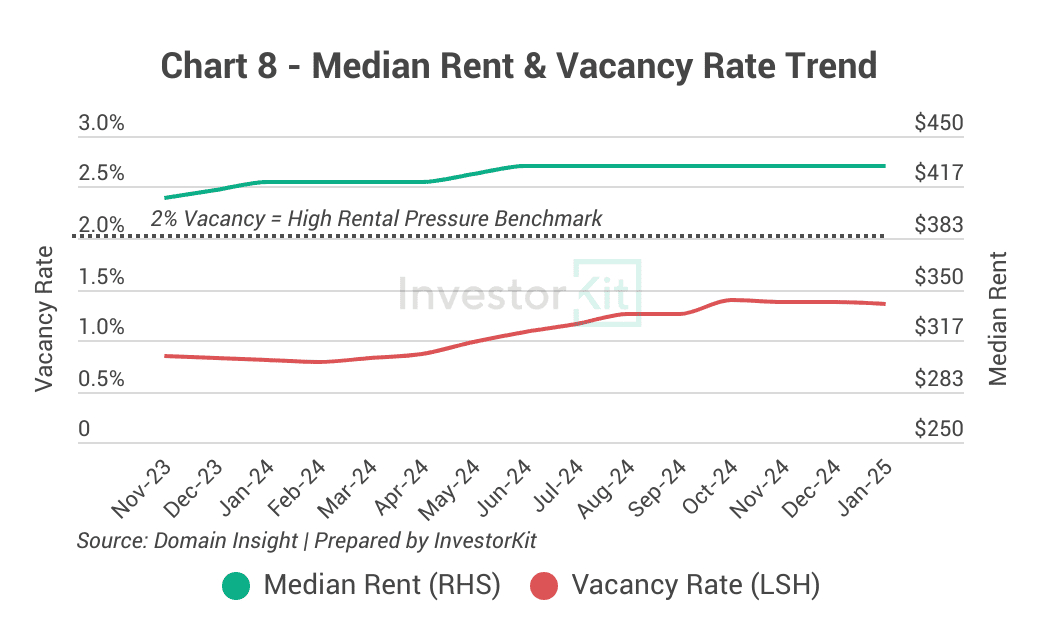

Ballarat’s rental market is under moderate pressure. The vacancy rate has increased compared to a year ago, and has been stabilised at around 1.4% since October 2024. Rent has been stagnant for months and only grew by around 2.4% over the last 12 months.

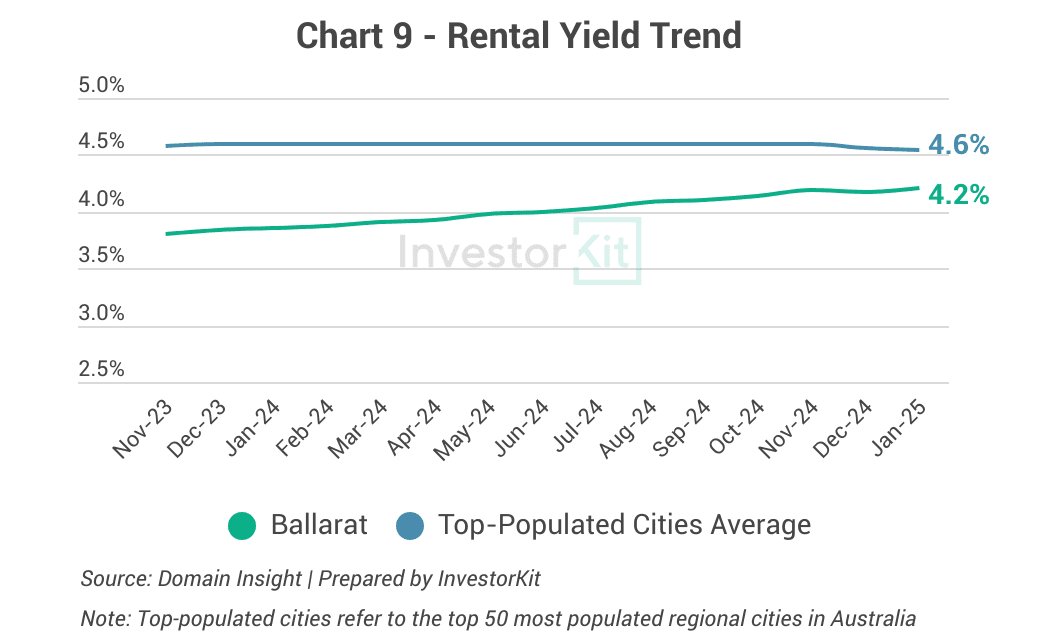

Ballarat enjoys a moderate rental yield of 4.2%. While this figure is lower than the average of the top-populated cities, it has been improving over the last 15 months, up by 9.1% compared to last year.

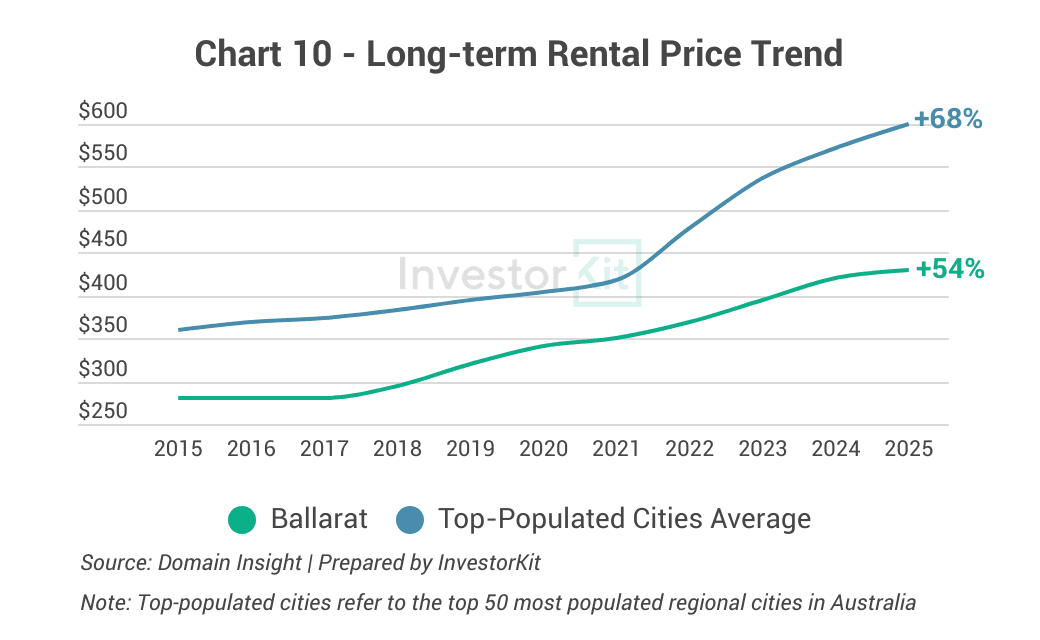

Over the past decade, Ballarat’s rental prices have grown by 54%, lower than the average growth rate of the top-populated regional cities. We expect rents to increase further, considering the region’s thriving economy, many job opportunities, and the rental market’s affordability relative to the sales. However, the gap between the two trend lines is unlikely to close anytime soon.

In the next 6-12 months…

The Ballarat housing market will likely stop declining in 2025 but we do not expect a fast recovery as market pressure is still low evidenced by long days on market and high inventory levels. Nevertheless, rental market pressure remains relatively healthy, with further rental growth and rental yield improvement expected.

Ballarat is the 10th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clickinghere and requesting your 15-min FREE discovery call!

.svg)