Albury – Wodonga: A Thriving Twin-City Hub along Murray River

Albury, nestled on the northern banks of the Murray River in New South Wales, offers a vibrant mix of rich history, picturesque parks, and cultural attractions. Just across the river in Victoria, Wodonga stands as a dynamic city, known as a home of several large food production companies, a key logistics and manufacturing hub. With a growing population, ongoing infrastructure development, affordable housing, and proximity to major cities (Melbourne and Canberra), these twin cities continue to grow, providing economic stability and an attractive destination for businesses, investors and residents.

Boom to Slowdown – What’s Next?

From 2021 to 2023, Albury – Wodonga’s house prices skyrocketed, surging over 15% each year. However, after this boom period, the market quickly hit the brakes with its last 1-year growth slowing to just 2.6%. What is happening in Albury – Wodonga? Is the market stabilising or setting up for a change? Join us today to uncover Albury – Wodonga’s current market conditions and outlook!

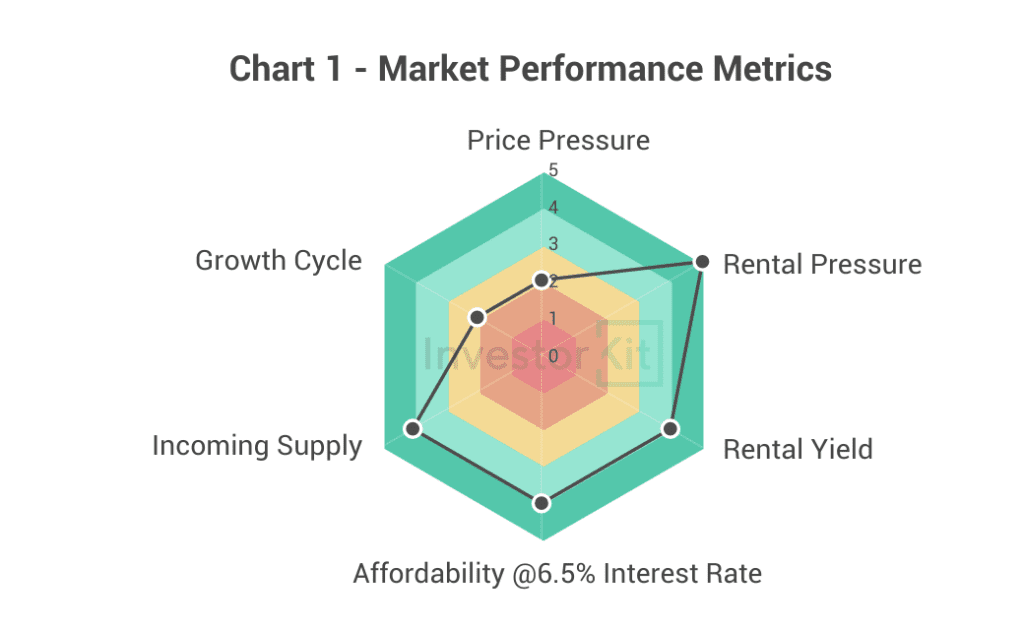

As of March 2025, Albury – Wodonga’s House Market Pressure is relatively low.

Among the six metrics InvestorKit uses to measure market performance, Albury – Wodonga scores the highest (=5) in rental pressure, 4 in yield, affordability and incoming supply, and 2 in price pressure and market cycle position.

Demographic & Economic Trends

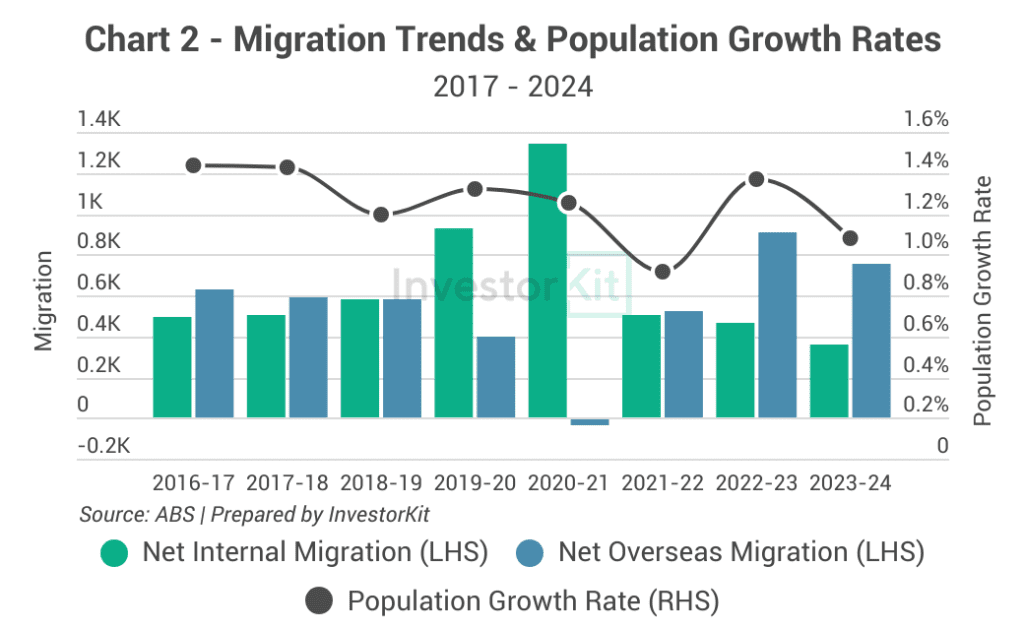

From 2017 to 2022, Albury – Wodonga’s population growth rate dropped, bottoming at 0.92% in 2022. Between 2020 and 2021, net internal migration surged as more people relocated regionally during the pandemic, while overseas migration plummeted due to travel restrictions.

In 2023, the population growth saw a strong recovery due to the surge in overseas migration, but now it has normalised to 1.08% (as of the 2023-24 financial year).

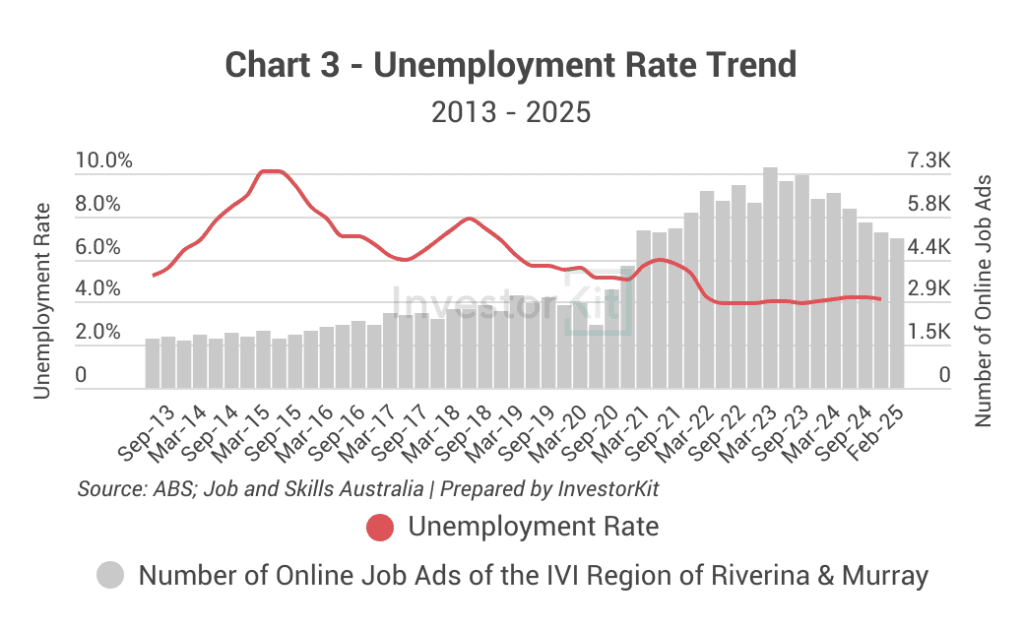

Albury – Wodonga’s unemployment rate fell significantly from 10.1% in mid-2015 to 3.9% in mid-2022. Since then, it has remained stable at around 4.0% and is currently at 4.1%.

Meanwhile, the number of job ads continues to decline, around 18% lower than 12 months ago. Nevertheless, it is still much higher than a decade ago.

Despite the decline in job ads, both indicators suggest that Albury – Wodonga’s job market is healthy and the local economy continues strengthening.

Sales Market Trends

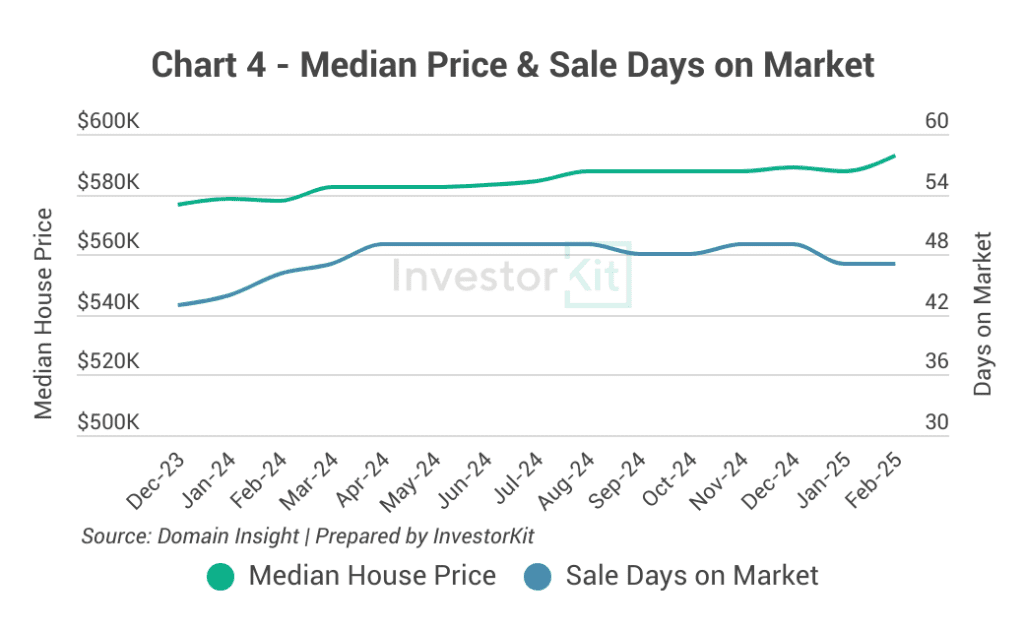

Albury – Wodonga’s house market has grown slowly over the past year. The current median house price is $592.5k, about 2.6% higher than a year ago. Sale days on market are relatively high, hovering around 47 days. This trend suggests relatively low demand, pointing to moderate price growth ahead.

Why are houses in Albury – Wodonga taking long days to sell?

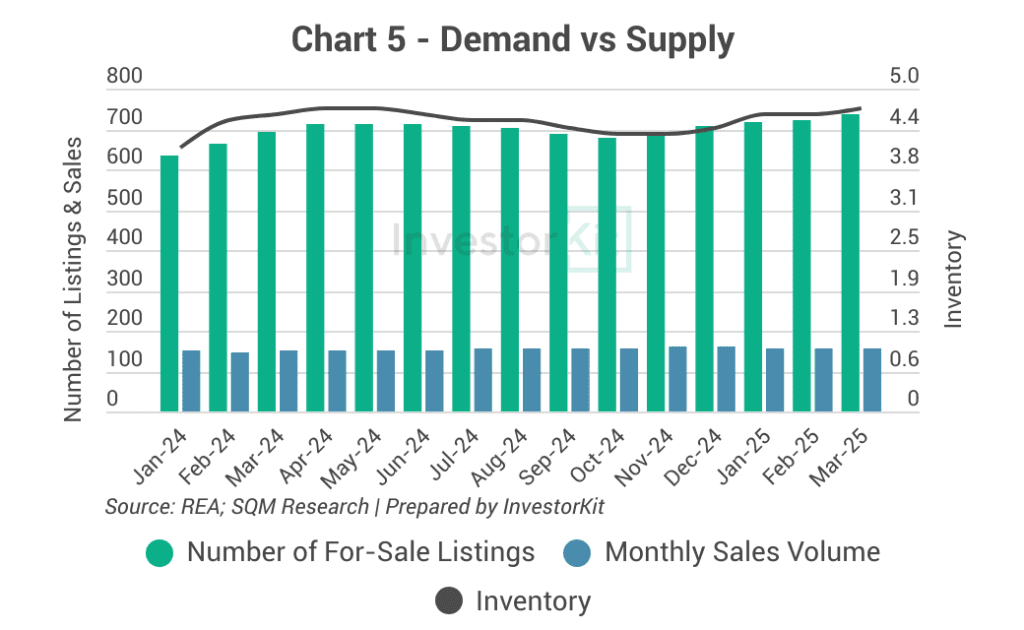

Over the past 12 months, Albury – Wodonga’s number of for-sale house listings has increased by around 7% while the sales volume has remained steady. These trends contributed to a rise in inventory to 4.7 months of stock.

The relatively high inventory level implies that the market in Albury – Wodonga is still relatively cool, resulting in a long time to sell.

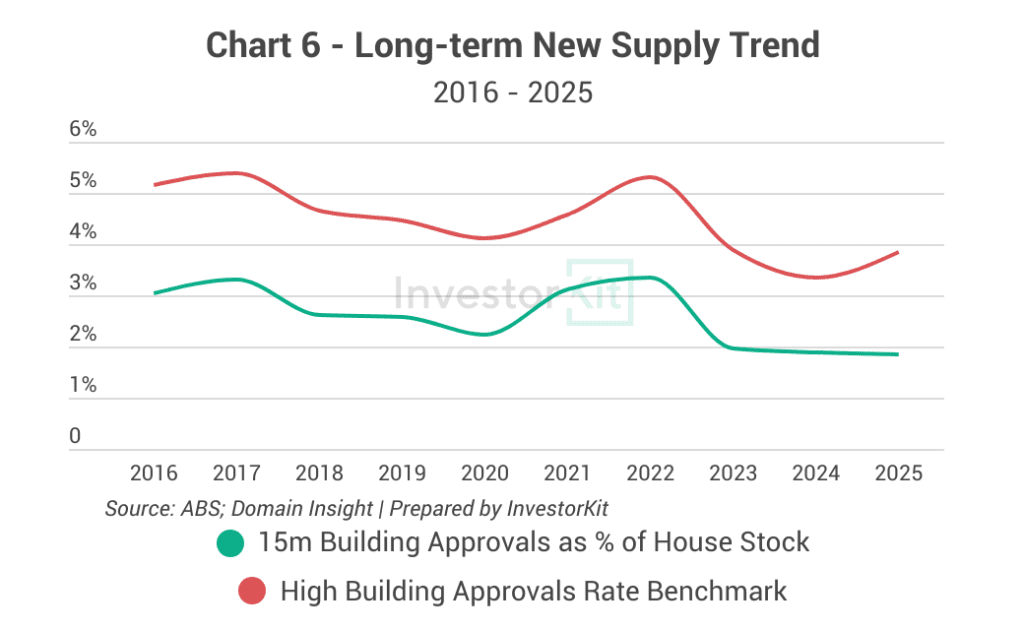

How about Albury – Wodonga’s incoming housing supply prospects?

Albury – Wodonga’s building approval rates have been balanced for the past decade, suggesting relatively low risks of housing oversupply. While there was a surge in construction activity between 2020 and 2021, its building approval rates remained around the balanced benchmark rate of 3%. Albury – Wodonga’s balanced building approval rate is a sign of continued value growth in the coming years.

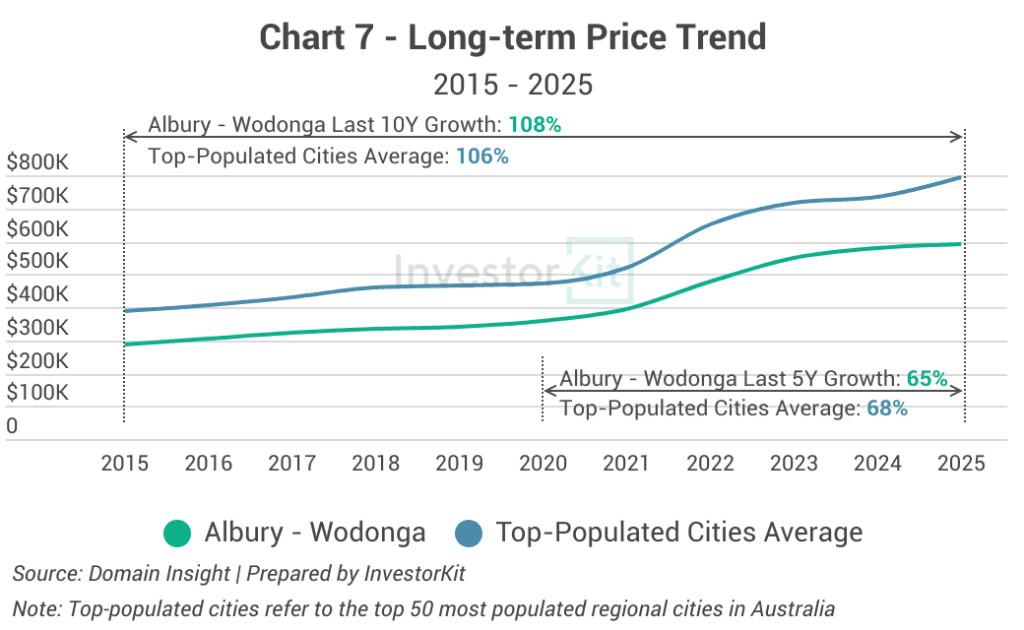

Albury – Wodonga experienced strong growth from 2021 to 2023 (with a yearly growth average of above 15%) and started slowing down in 2024. Over the last 10 years, it rose tremendously, up by around 108%, higher than the average of top-populated regional cities and its long-term growth average. This strong 10-year growth implies that Albury – Wodonga will likely see moderate growth in the medium term.

Rental Market Trends

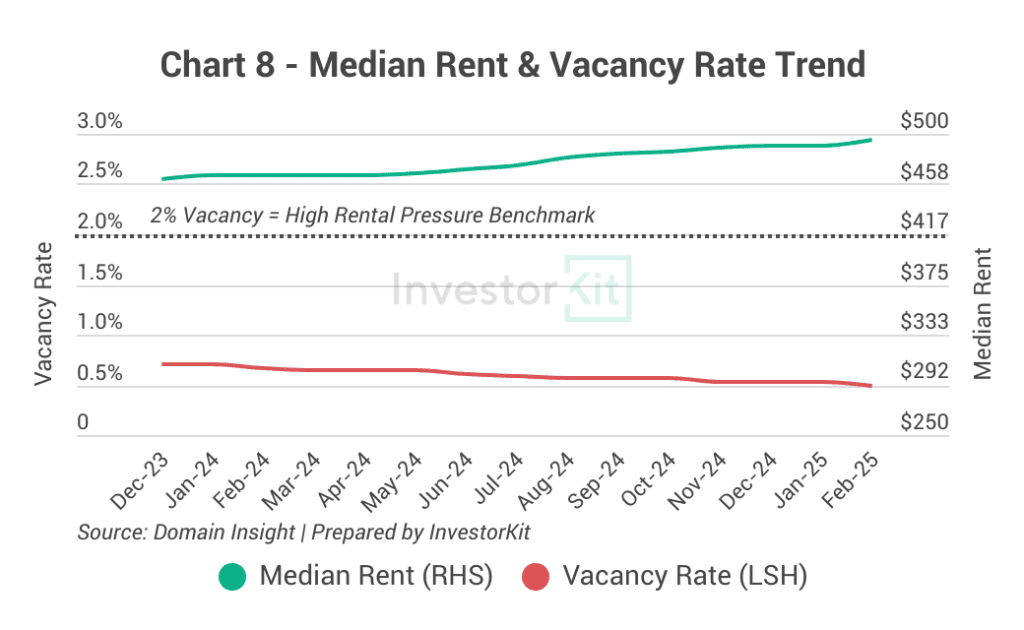

In contrast to the low sales market pressure, Albury – Wodonga’s rental pressure is high. The vacancy rate has declined to a crisis level of around 0.5%. Rent increased by 6.5% over the last 12 months. Given its high rental market pressure, we expect more rental growth in the coming year.

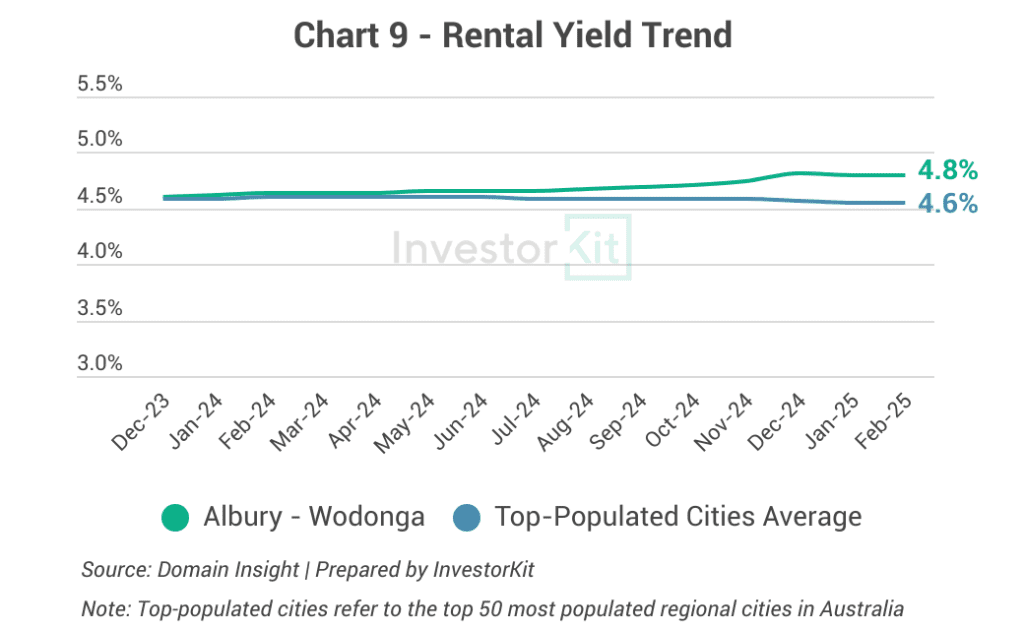

Albury – Wodonga enjoys a healthy rental yield of 4.8%, slightly higher than the average of the top-populated cities. Since sales prices have grown slower than rental prices, yields have improved since mid-2023. Given its low sales pressure and high rental pressure, we expect rental yields to remain healthy in the coming months.

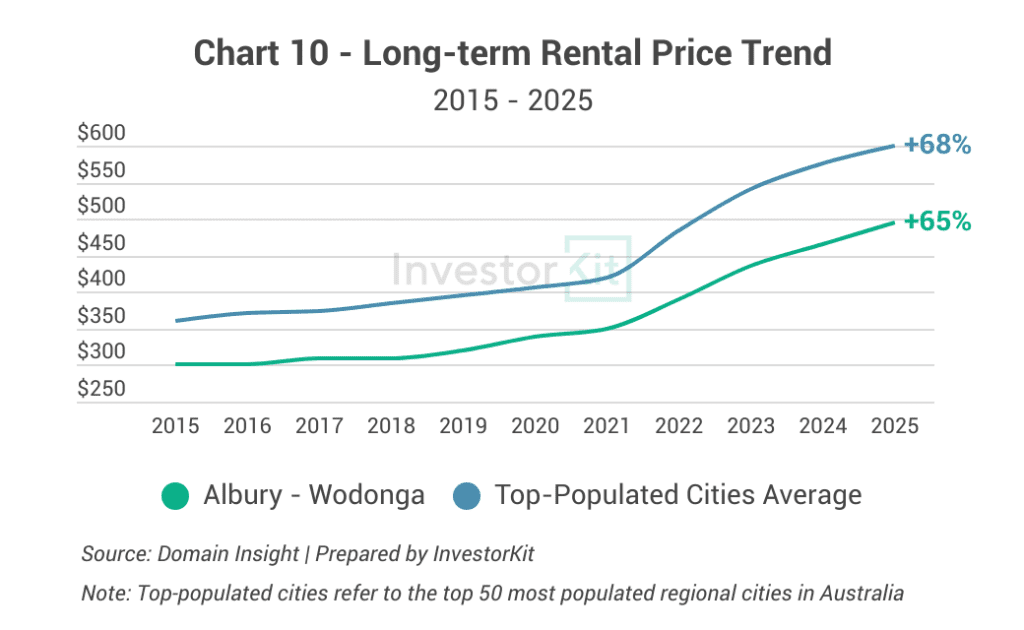

Over the past decade, Albury – Wodonga’s rental prices have grown by 65%, just slightly lower than the average growth rate of the top-populated regional cities. We expect this to increase further, considering the region’s increasing housing demand driven by the improving local economy and high rental market pressure.

In the next 6-12 months…

Albury – Wodonga’s housing market is experiencing low pressure due to high and increasing supply relative to demand. Therefore, in the coming 6-12 months, we expect house prices to continue their slow growth. In contrast, the rental market remains tight, with further rental growth to occur.

Albury – Wodonga is the 11th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)