We prefer describing markets and making purchase decisions based on Market Categorisation.

In categorising markets, we not only look at a location’s position in its market cycle but, more importantly, examine the local economic activity, demand vs. supply trends, and market pressure to estimate its market trends in the next year or so.

This is the second blog of our Market Categorisation Trilogy. Following the Early Adopters last week, let’s talk Hotspots today.

What is Hotspot?

Hotspots are the markets under high pressure and seeing accelerating value growth. You would hear their names repeatedly on media and at BBQ parties. In the long term, their previous long-term growth might be below the average level but is currently surging with solid momentum (as shown in the chart below).

Bundaberg has been a Hotspot since 2021. House prices there didn’t see much growth before 2020; However, the city started gaining strength in 2020-21 and has been surging in the past two years, achieving much better than average performance (below chart).

What do market indicators look like in a Hotspot?

The spiderweb chart below is a brief description of the market conditions and trends in a Hotspot (indicator scores: 1=worst, 5=best):

• Thriving economy

Like Early Adopters, Hotspots also feature improving or thriving local economies, which is usually indicated by heavy infrastructure investment and low/lowering unemployment rates. A thriving economy assures increasing housing demand by boosting consumer confidence and attracting more residents.

Bundaberg’s economy wasn’t robust in the early 2010s, with the unemployment rates hovering around 8-10% until 2018 (chart below). The economy started recovering that year. The unemployment rate was briefly pushed up by the outbreak of the pandemic in 2020 and has been dropping ever since.

The economic recovery is backed by a boom in infrastructure investment and internal migration.

Queensland Government’s infrastructure investment in the Wide Bay region (where Bundaberg is) has surged in the past three years (except for a slight drop in FY2021-22, as shown in the left chart below). In FY2022-23, the per-capita figure for Wide Bay ranks #5 in all Queensland regions (right chart below), slightly lower than the regions in the north but higher than the southern regions.

Meanwhile, we see a robust recovery in Bundaberg’s internal migration trend: The city lost migrants to other regions from 2013 to 2017. It only started winning migrants in 2018, and the growth has accelerated since then (below chart).

The thriving economy and the surge in internal migration have led to high property market pressure.

• High price pressure

Whilst housing demand is lifted, the supply is not increasing as fast. The chart below shows that the gap between total listings and total sales has been shrinking since 2020.

As a result, Bundaberg’s sales market pressure has been staying high since 2021, which can be reflected by the low inventory level (listings-sales ratio) and fast-dropping sale days on market.

Bundaberg’s inventory level has been trending down since 2020, dropping to under 3 months of stock (high-pressure benchmark) in late 2021. Entering 2023, the sales volume is lower than 2 years ago, but inventory remains low as the supply level is declining as well (as shown in the chart above).

As the inventory stays low, the number of days on market for sale has also been declining fast since mid-2021. Now it only takes ¼ of the time as two years ago to sell a house (chart below), the shortest in over a decade.

• High rental pressure

Like Early Adopters, Hotspots also feature tight rental markets/high rental pressure.

Let’s examine Bundaberg’s rental vacancy rate, the leading indicator of rental market pressure. As shown in the below chart, the vacancy rates have been lower than 1.5% since 2019 and declined to a crisis level of under 0.5% in 2020-21. Although there seems to be a slight improvement since 2022, it still sits around the 0.5% line, indicating an extremely tight rental market.

• Low established supply

The number of for-sale listings reflects established supply. Hotspots usually see a much lower number of for-sale than their pre-hot stage.

The below chart shows the total number of for-sale listings in Postcode 4670, which covers Bundaberg’s urban area, from 2010 to 2023. The established supply level has been trending downward since early 2020, when Bundaberg started gaining growth momentum. Being a Hotspot now, Bundaberg’s established supply level is approximately half the past 10-year average.

• Low but increasing incoming supply

A Hotspot’s incoming supply (new construction) level has been low for a considerable amount of time, leading to insufficient housing supply when demand surges, pushing market pressure high, and, as a result, the market becomes a Hotspot.

However, the hotness of the market would trigger a lot more construction activities, both by individual homeowners and developers, trying to take advantage of the robust growth phase. That is why we often see a surge in Building Approvals (a leading indicator of incoming supply) in Hotspots.

The below chart shows a Bundaberg example. In the chart, we use the building approval numbers / total number of houses ratio to measure the incoming supply level: From 2014 to 2020, when Bundaberg wasn’t a Hotspot yet, the city didn’t have too many house-building activities. However, construction activities surged during COVID (partly due to the market getting hot, partly thanks to the HomeBuilder Grant) and are now staying at a much higher level than the past 10-year average despite the skyrocketed building costs.

Who is it ideal for?

Hotspots feature tight supply, high demand, and intense competition. They would be ideal for you if you seek an excellent opportunity for capital growth and are flexible on your budget and cash flow expectations.

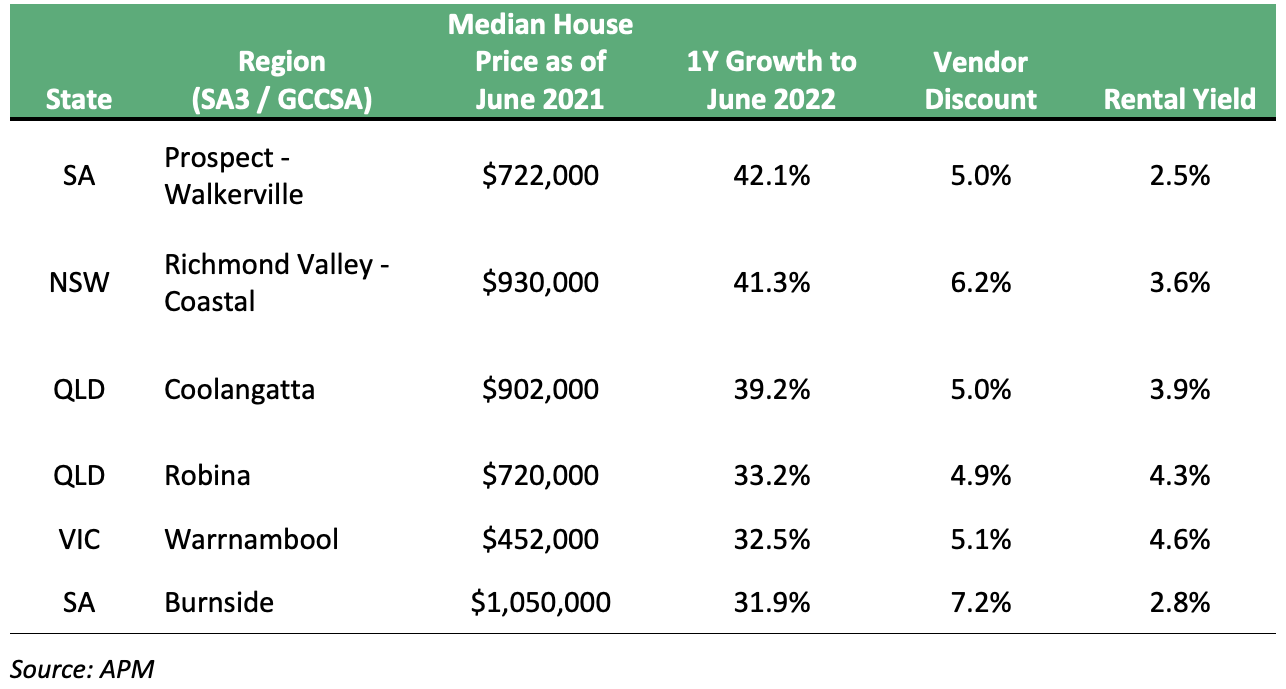

The table below shows some markets identified as Hotspots in March 2021. They were not necessarily affordable, you couldn’t expect ‘great deals’ (low vendor discount) in many of them, and not all of them enjoyed healthy rental yield; However, their impressive short-term (1-year) value growth was a solid enough reason for many investors to buy.

Buying in a Hotspot, you can expect high capital growth in the short term but may need to be prepared for intense competition and prices higher than you expected.

InvestorKit is a buyer’s agency that constantly monitors and tests data to categorise and re-categorise markets to ensure they best suit clients’ needs. Feel like getting to know more Hotspot markets? Talk to us today by clicking here and requesting your 45-min FREE no-obligation consultation!

.svg)