Our Economists overly praise population growth, and many novice property investors think that buying in an area with fast-growing population is a good idea, as population growth means increasing housing demands, a livelier economy and community, thus good capital growth and rental income.

If you or a friend think this way, please do them a favour and remind them to think twice, or simply ask them two questions:

Why does the population grow?

Does population growth indicate higher demand or higher supply?

Why does the population grow?

There are two reasons for population growth.

- Natural growth – More birth than death.

- Migration – More people moving in than out, which can be internal and overseas.

First, we need to remember that a new baby does not always need a new house. They will stay with the family for a good number of years. So, if the population grows naturally, there won’t be significant growth in housing demands, and the market would not consequently become hotter.

Let’s talk about migration. Migration may come from overseas or internally. If most of the new population are from overseas, population behaviour would be worth investigating rather than population growth.

Data has suggested that new international migrants tend to rent in the first few years after arrival before buying their own home. The 2016 Census stats show that about 54% of permanent migrants who arrived in Australia in or after 2000 own or are buying a home, much lower than the national average of 65.5%. According to McCrindle social researcher Geoff Brailey, most of the new migrants consider it important to own a home in Australia, but they have to save during the first years of arrival before getting into the property market.

Auburn is one of the top destination suburbs for new immigrants. The population grew 16.6% from 2012 to 2020, with a higher growth rate than Greater Sydney average each year until the closure of Australian border in early 2020.

Let’s see how the housing market has been growing since 2012.

Sale volumes, which usually indicates housing demands, did not grow in line with the population growth. In the contrary, there has been a rise from 2019 on, when the population was falling.

On the other hand, median house price has grown by 91.7% over the 9 years, just slightly higher than the Greater Sydney average of 89.2%, which is hardly a difference considering the length of the term.

It seems that, just like natural growth, population growth caused by immigrants does not necessarily bring better growth.

Does this mean that if the population growth is primarily caused by internal migrants, the local market would be growing strongly?

Not really. You need to ask the second question –

Does high population growth indicate higher demand or higher supply?

When a person moves to a new town, he or she needs a house. When a large number of people move to a new town in a short time, established houses can never absorb them all. There must have been a large number of new dwellings ready or getting ready to host them.

Chances are, when there is an economic growth stimulator, for example large pieces of infrastructure, planned for a certain area, developers would start acquiring land around it and aim to have new houses ready for when the infrastructure is open or close to open, when the population starts to grow because of the employment opportunities or the convenience the infrastructure brings. Think of how many new residential projects were completed around Sydney’s Northwest Metro Stations just before the line was put into use.

So you see, in many cases higher supply occurs before population growth (higher demand). The problem is, though, it is hard to achieve a balance between supply and demand. On the one hand, every developer would like to maximise their profit by building as many new dwellings as they can on their land; On the other hand, once the population starts to grow, more developers would be drawn here, trying to benefit from the population boom. This way they just build and build until there is oversupply, one of the biggest enemies of capital growth.

It seems that population growth is more of an indicator of existing higher supply rather than upcoming high demand.

Now, we are going to use two suburbs as examples to show how property capital growth is not aligned with population growth.

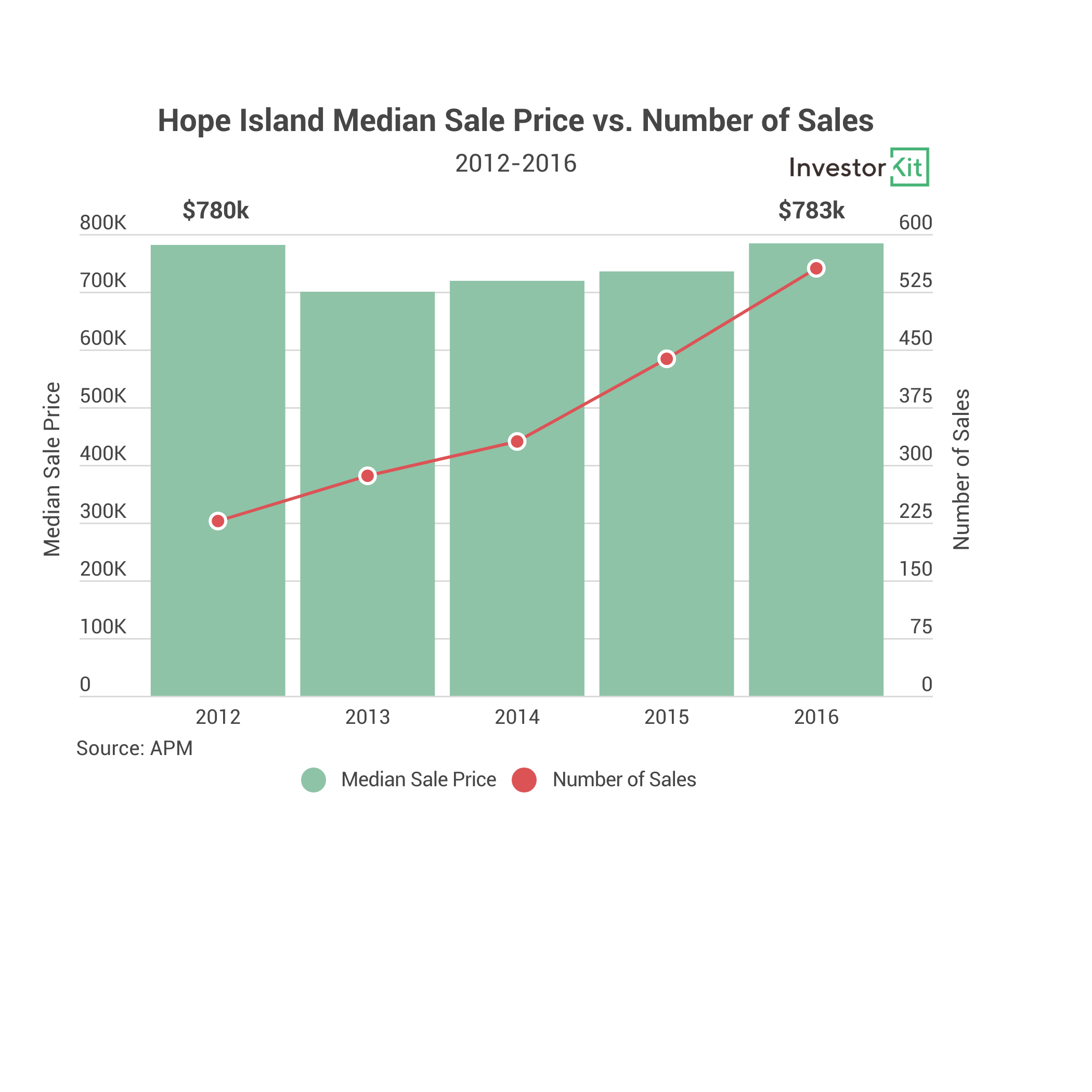

Hope Island is a Gold Coast suburb where a lot of new developments happened during the sprawl of Gold Coast. From 2012 to 2016, hundreds of freestanding houses were built and sold. Its population consequently grew strongly by 31.9% from 2011 (8,483) to 2016 (11,186). However, data show that the property market barely achieved any capital growth over the years (Chart 1).

At the same time, what happened to the areas without much population growth? Let’s move slightly south and look at another Gold Coast suburb, Highland Park. The population just rose 0.2% from 6,561 to 6,574 over the 5 years, but the property price climbed steadily from $367.5k to $465k, achieving 26.5% growth from 2012 to 2016.

The above examples have proven that on a suburb level, population growth is not necessarily in line with capital growth. Some may argue that the suburb level is too small a sample. Perhaps it would make more statistical sense on a macro level?

Good suggestion, let’s test it on a macro level using Greater Capital City Statistical Areas. In the below table, we have listed the population growth rate of each greater capital city from 2012 to 2020, and the capital growth of houses during the same period.

Macro level data points to the same outcome, capital growth rates have very little to do with their population growth rate. Admittedly, the top 4 capital cities with the highest population growth rates all enjoy relatively high capital growth, but they are not linearly correlated. And the other cities? Greater Perth was gaining population at almost the same pace as ACT, but the properties only grew in value by a poor 2.1% over 9 years; Greater Darwin’s property value has even declined despite its 10.6% population growth; Greater Hobart achieved the third highest capital growth with one of the lowest level population growth rates.

Data from both micro and macro levels show that population growth is not a very important market indicator as many think it is, because its correlation with housing demand, supply, or capital growth is not significant.

If not population growth, which indicators are truly important?

Demand Indicators

- Monthly Sale Volume – When supply does not increase dramatically, growing sale volume means higher demand.

- Days on Market – Shorter time on the market means higher demand.

- Asking Price – Growing asking price means higher demand and higher vendor confidence.

- Vacancy Rate – Lower vacancy rate means higher demand for rental properties.

Supply Indicators

- Monthly Listings – Increasing monthly listings number means higher supply.

- Building Approval – High ratio of building approvals to current dwellings means higher supply in the coming 6-18 months.

Demand to Supply Relation Indicator

- Inventory – A current stock vs. average monthly sale volume ratio, indicating the relation between demand and supply. Lower inventory means higher market pressure and higher potential for capital growth.

Inventory is InvestorKit’s leading market pressure indicator, surrounded by other sale and rental market indicators.

.svg)