Lots going on in the world. No wonder many are always wondering if now is a good time to buy.

We see two types of investors, market-driven buyers, who are always looking for a good time to enter the “Australian Property Market”, and goal-driven buyers, who try to maximise their portfolio in a tight window and let the assets work for them the rest of their lives.

InvestorKit buyers’ agency stands with goal-driven buyers. This blog will explain why.

There is Always Something Going On

In the past 2 decades, Australia’s economy has gone through some major impacts:

· The global financial crisis happened in 2008.

· The mining boom ended in the early 2010s.

· COVID-19 hit in 2020 and has not ended yet.

· The RBA cash rate kept going down to a historic low of 0.1% and then rapidly turned the other way in 2022 (and still going) with inflation at high levels.

· …

In the property market,

· FIRB rules changed several times.

· APRA’s lending rules were also constantly swinging.

· Governments carried out multiple first home buyer initiatives (eg. the First Home Buyer Grant) to tackle the housing affordability issues and also pinged investors with more taxes

· …

Property buyers’ activity has fluctuated in response to these events (chart below).

Although many of the events were not friendly to property value growth, some even meant to suppress it, the property market has performed well. From 2008 to 2022, Australia’s median house price has increased by 94%, which is 8.6% per annum.

We believe this is because Australia’s economy has been stable despite the impacts, housing demand has remained high, and overall supply levels have actually decreased.

Australia’s GDP growth has been stable and higher than the high-income countries’ average from 2008 to 2022, despite the impact of GFC, the end of the mining boom, or COVID-19.

Australia’s population has been growing steadily, while the stock on market has been trending downwards since 2013. The lifted demand and reduced supply have unpinned the strong growth of Australia’s property market.

The historical data shows that Australia’ property market has achieved substantial growth despite all that’s happening. What does that mean for individual investors?

2 Investors’ Portfolio-Building Journey

Now we assume 2 investors, A is a market-driven investor who looks for the good time to buy, when everything is “rosy” amongst the mainstream for housing in Australia; B is a goal-driven investor who builds up their portfolio as fast as possible to hit wealth targets and enjoy a considerable asset base for a longer time to reach passive income numbers.

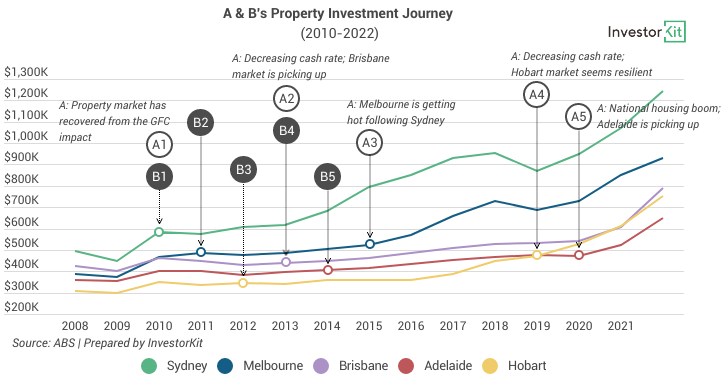

Their investment journey started in 2010, and both have built a 5-property portfolio across 5 major Australian cities. The chart below shows their assumed purchasing time and location over time. A’s reasons for purchasing at each point is also noted in the chart.

– A purchased a median-price house in Sydney, Brisbane, Melbourne, Hobart, and Adelaide in 2010, 2013, 2015, 2019, and 2021 respectively. They took their time and carefully picked the purchasing time and location. Diversifying across various cities was their plan, and picking what seemed to be great macro environments.

– B purchased a median-price house in the five cities in 2010-2014, one property a year. Diversity and acquiring assets was simply their goal.

The table below shows how their properties have grown so far.

Although their portfolios’ current values are the same, B gets a return rate 21% more than A.

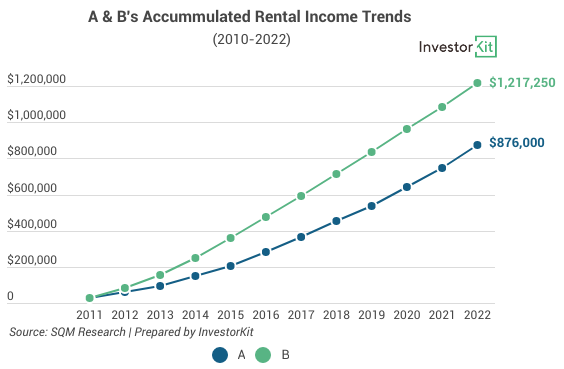

Let’s not forget about the rental income. The below chart shows the two portfolios’ accumulated rental income over time. The annual rental income is calculated based on each city’s median weekly rent that year.

With similar houses in the same cities, B has not only achieved a higher ROI but also received a total rental income 1.4 times of A’s just by adopting a different strategy: buying in a tight window instead of buying “at the right time.”

We are not assuming every investor can be like B, having an unlimited budget and buying one house a year. However, we want to show through A and B’s contrast how much difference it can make by changing your acquisition strategy to focus less on “Macro” conditions for our country and apply your focus to acquiring assets.

Enjoy the Benefit of Asset Size

Australia’s property market is healthy with solid demand and tight supply. As an investor playing in such a market, the compound growth will be much more significant when your asset base is bigger, just as B’s investment journey has proven.

InvestorKit encourages our clients to plan on their portfolio scale in advance based on their investment goal and keep the acquisition window as tight as possible. The longer you hold a bigger asset base, the higher return it will generate for you.

We all have a limited amount of time on this Earth to build wealth and enjoy the benefits of that wealth! Leaving investing to the perfect conditions will only mean you have less compounding time to enjoy what you have worked so hard to build.

Would you like to scale your portfolio with us and achieve your investment goal faster? Click here and request your 45-min FREE no-obligation consultation today!

.svg)