The RBA raised their cash rate target again in November to 4.35%, reaching the highest point since the end of 2011.

After 13 cash rate rises in a year and a half, Australia’s housing market has become much less active than at the end of 2021. The number of new home loan commitments for investment properties declined by -27% over two years.

Many investors have paused their acquisition journey, believing that:

- They can afford a better property when their borrowing capacity increases.

- They are not missing out much because the market declines when interest rates rise.

Today, let’s dive into data together and discover if the above are truth or just myths.

“I can afford a better property when my borrowing capacity increases when interest rates are down.” – Truth or Myth?

Since the cash rate started rising, Australians’ borrowing capacity has dropped by more than 25%. This dramatic drop makes some investors believe it’s not a good time to buy when their borrowing capacity is discounted.

Well, it depends. Investing more isn’t a good idea if your personal or business finances have been affected by the interest rate hikes. However, if you are in a healthy financial position but pausing just to wait for “a better time”, the wait is unnecessary.

Can’t afford to buy in that expensive area anymore? Go for a cheaper one. A lower-priced market doesn’t necessarily perform poorer than a pricier one. There are plenty of great options on the affordable end of the price spectrum.

$500k is commonly considered the affordable house price threshold, with which the home loan repayment amount would not exceed 30% of a household’s income in most regions, even with a high interest rate of 6.5%.

As of Sep 2023, 80 SA3 regions across Australia enjoy a median price no higher than $500k, representing 23% of all SA3 regions.

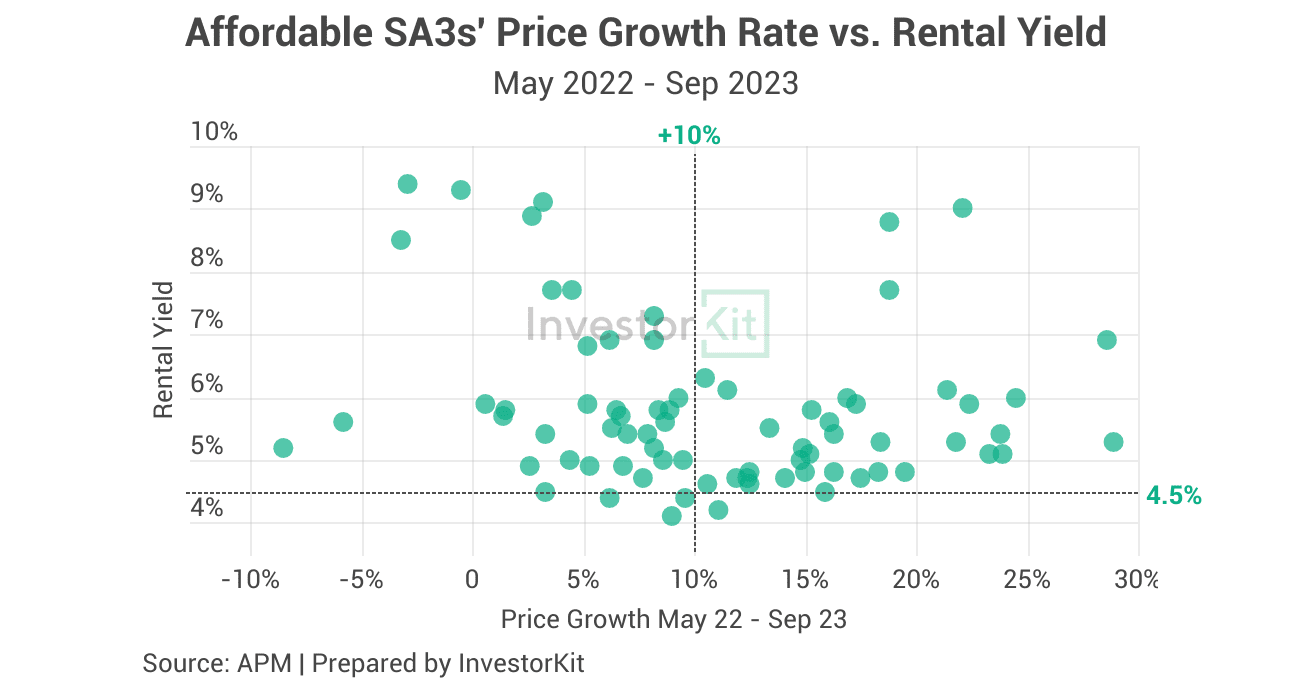

The chart below shows the distribution of these 80 SA3s based on their price growth (May 22 – Sep 23) and current rental yields (Sep 23).

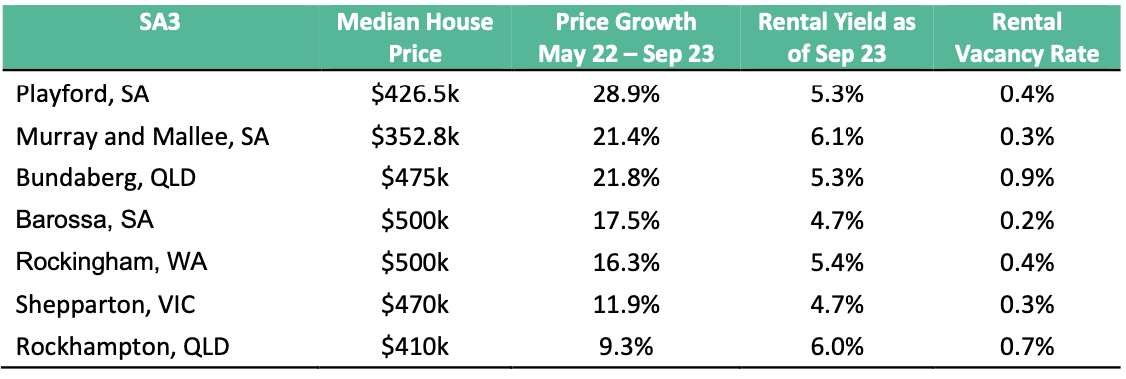

Among the 80 affordable SA3s, 36 have achieved >10% house price growth from May 2022 to Sep 2023 and are currently enjoying a healthy rental yield of >4.5%. Some of them are shown in the below table. Their low rental vacancy rates suggest strong housing demand within these regions, which would fuel further growth in both rental prices and sales prices.

Plus, when your borrowing capacity increases when the cash rate goes down, house prices would have increased as well.

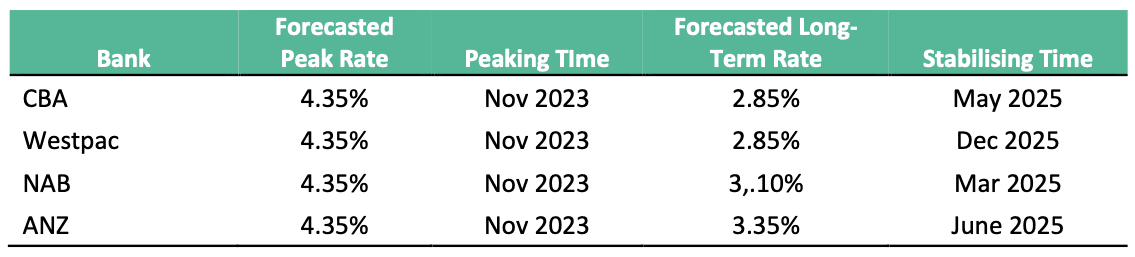

The Big 4 banks forecast the cash rate to decrease by up to 1.5% by as early as mid-2025 (CBA is the most optimistic; see table below), leading borrowing capacity to increase by 10-15%.

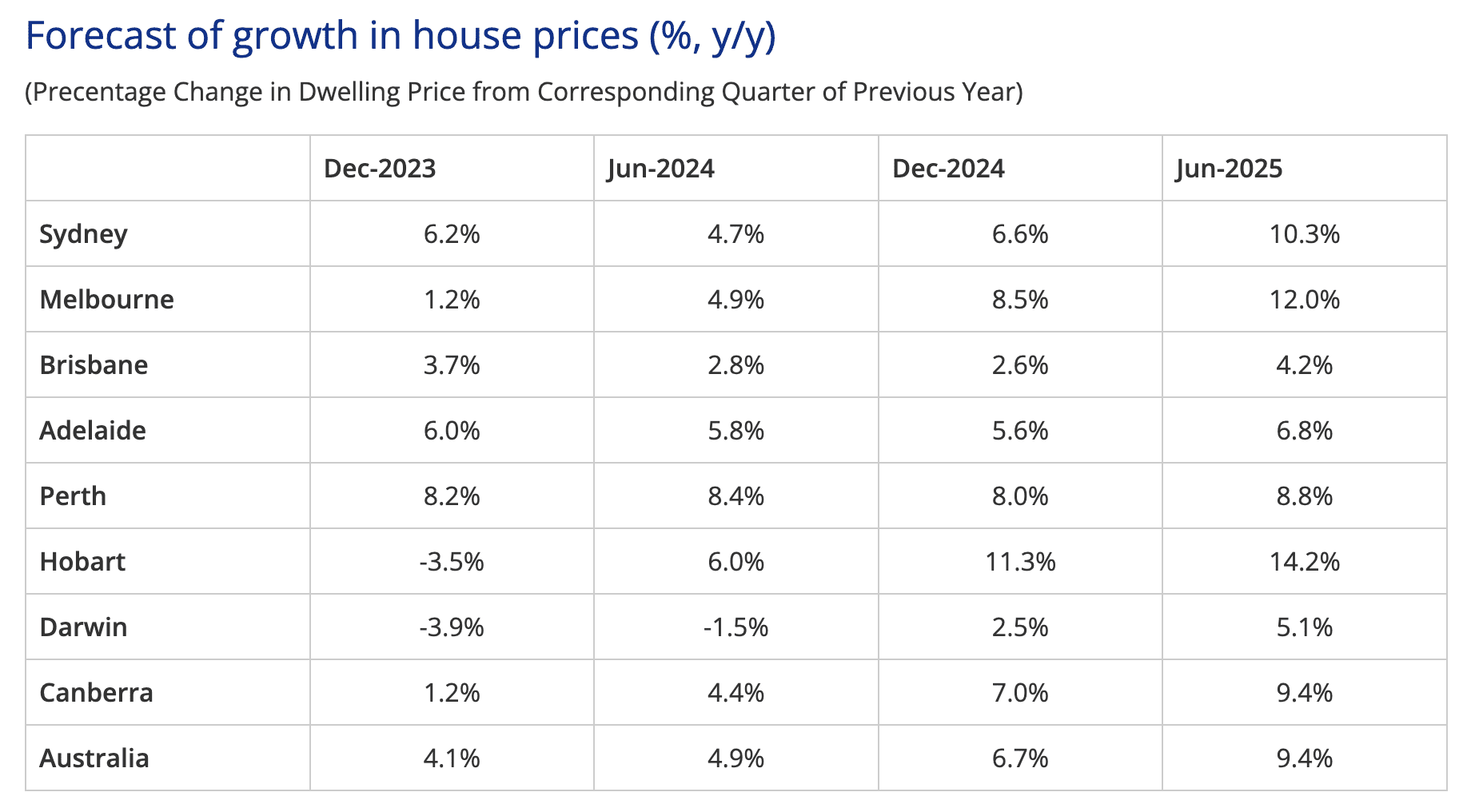

You know what? According to a KPMG forecast, Australia’s house price would have increased by approximately 16% in the two years from mid-2023 to mid-2025 (table below).

So, you can afford a better property when their borrowing capacity increases? That’s a myth.

“I’m not missing out much because the market declines when interest rates rise, and everyone is holding off.”– Truth or Myth?

Only some people are holding off, my friend. Savvy investors would never be influenced merely by the changes in interest rates.

Shall we go back in time and see what history has to say?

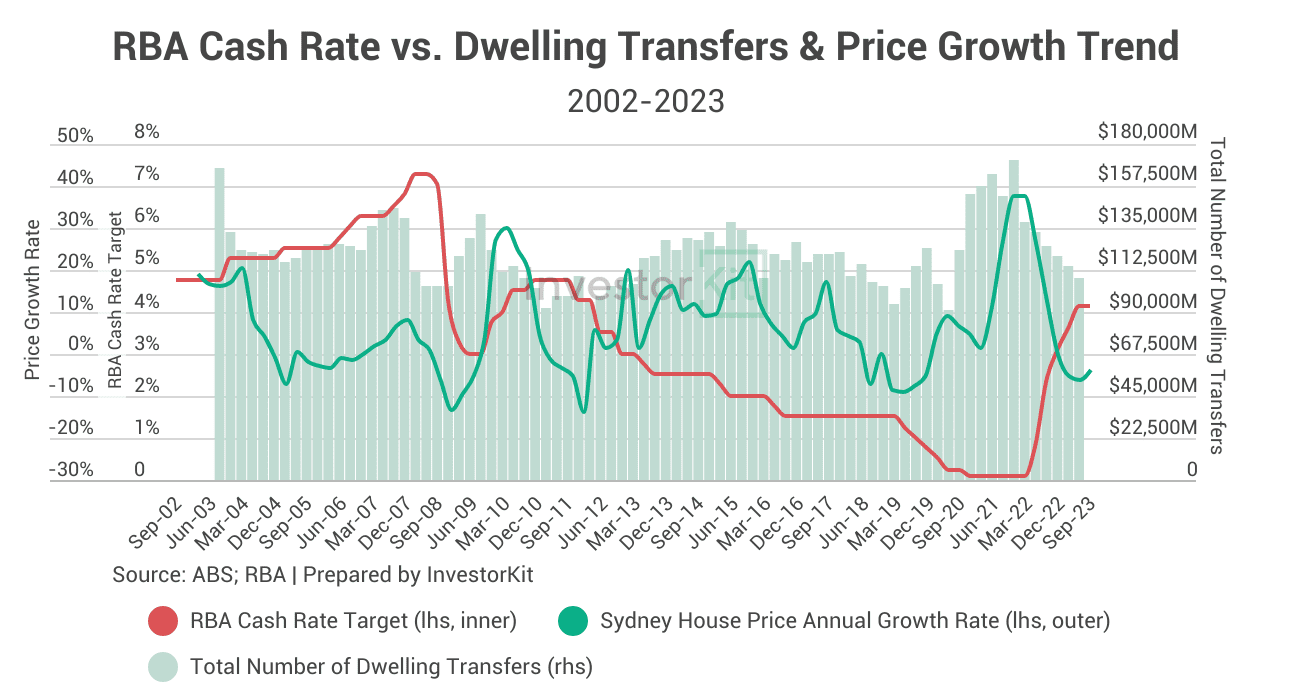

The below chart shows three trends overlaid in the two decades since 2002:

- RBA cash rate trend;

- The total number of dwelling transfers, which indicates the property market’s activity;

- The price growth rate trend of Greater Sydney (Sydney is selected because it has always had the highest prices across Australia’s largest housing markets; hence it’s the most sensitive to interest rates).

Looking closely, you’ll notice that although the cash rate trend certainly influences the property market activity and the price growth trend, it does not correlate with the other two perfectly. For example, the four periods below:

- 2002 – 2008: The cash rate increased from a high 4.25% to a whopping 7.25%. In the meantime, the number of dwelling transfers didn’t decline all along. Instead, it had been trending up since 2004, indicating that the property market was becoming increasingly active, albeit with high interest rates.

- 2009 – 2011: The cash rate surged from 3% to 4.75%. This surge led to a decline in purchaser activity (number of transfers), but didn’t stop Sydney’s house prices from growing: Sydney’s median house price increased by 24% from the 3rd quarter of 2009 to the 4th quarter of 2010.

- 2017 – 2019: While the cash rate had declined to a historical low level, the total number of transfers was trending down, and at the same time, Sydney’s house prices were falling.

- 2023: Despite the cash rate rising to a 12-year high, property prices in many cities have been recovering robustly, including Sydney.

History shows that property market trends and interest rates are not correlated. Savvy investors know that the property market is constantly influenced by many uncontrollable variables besides the interest rate, while the only thing under control is their investment goal. They also know that property investment is a long-term game where holding time and compound growth are more important than timing the purchase. Therefore, they stick to their goal and take any necessary action to achieve it as fast as possible, no matter how the influencers change.

Remember the KPMG forecast we mentioned earlier? While the RBA cash rate stays high, many cities will still achieve double-digit annual growth in the coming 2 years.

So, you are not missing out much by pausing? That’s a myth, too.

What could be stopping you from continuing to purchase?

You don’t want to pause your investment journey by the high interest rates, but there are three things you need to consider before making a purchasing decision. It applies not only to high-interest times but to any circumstances.

- Safety buffer

A cash buffer is a good way to mitigate the risk of buying a property. A general rule is that if you’re an aggressive investor, you need 6-month outgoings’ worth of cash as a safety buffer, including your loan repayment and rental expenses. If you’re more conservative, consider a 9-12-month buffer. So, if you don’t have a proper buffer, think twice before buying. You don’t want to put yourself at high risk.

- Cashflow

The heightened interest rates affect not just home loan repayments but almost everything from daily expenses to business operational costs. If the high interest rates already affect your personal finance or your business’s cashflow, calculate whether another investment property would help with your current cashflow. If not, the purchase can wait.

- Portfolio building phase

For most investors, the portfolio-building journey is usually 20-30 years. It might surprise you that it’s only in the first 5-10 years that you should be actively buying (that’s what we call “the acquisition phase”). Once you have hit your portfolio goal, it would be time to stop buying, get debt to stabilise and enjoy the compound growth of your portfolio. So, if you’re already out of the acquisition phase, you may not want to buy more properties and get more debt (learn more about phasing in this article).

The inspiration for this article is an episode of InvestorKit Podcast Interest Rates are Just a Variable in Your Investing Journey where Arjun tells you the story behind his “insane” decision to take on a high-interest loan back in 2020: why he did it, how he justified it, and the happy ending. Check it out!

InvestorKit is a data-driven buyers’ agency that utilises data to bust myths and identify performing markets that suit our clients’ portfolio requirements no matter how variables change in the property market. Would like to have InvestorKit by your side on your investment journey? Click here and book your 15-minute FREE, no-obligation discovery call!

.svg)