Melbourne’s median dwelling price increased by 0.4% last month (Feb 2025), the first month-on-month rise in 10 months.

Whilst Melbourne’s property market is on its way to recovery, expecting increasingly better growth in the coming few years, many investors have concerns about the city’s southeast, north, and west, where many new developments remain.

It’s commonly held that large amounts of house-building activities could cause oversupply issues and affect value growth. However, how much supply is oversupply, and how profound would its impact be? Today, let’s dive into Melbourne’s historical data and explore if high levels of home-building activity would impact value growth and to what extent.

The ‘Building Approval Rate’

To measure an area’s home-building activity, we use the metric ‘building approval rate’ – the ratio between the total number of new-house building approvals in the past 15 months and the total number of houses in an area. The more actively an area is building homes, the higher its building approval rate.

Melbourne is massive. We’ll start with a relatively large-scale (SA3 region) level and then zoom into the micro (suburb) level.

Do SA3s with high building approval rates grow more slowly than the well-established ones?

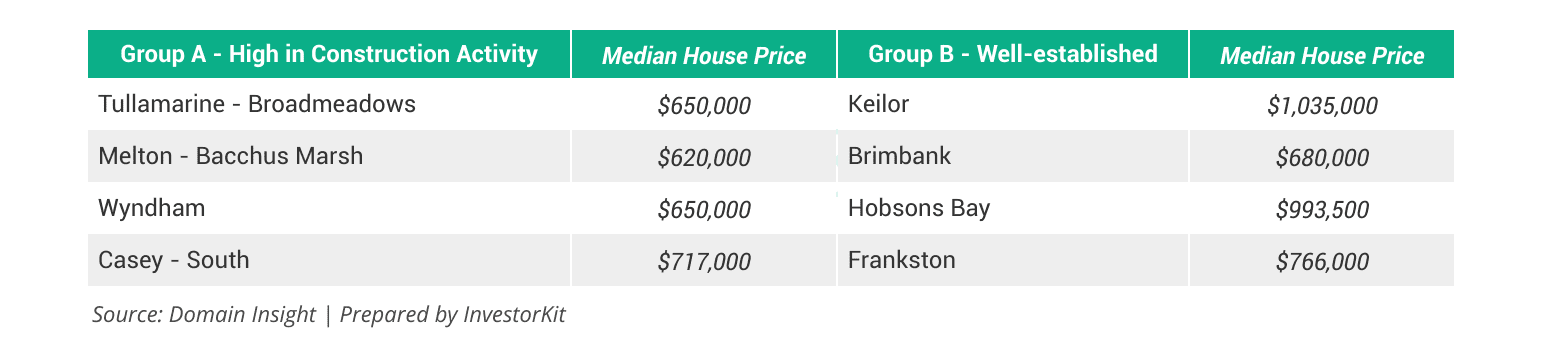

We compare two groups of SA3s:

Group A has been under intense development in the past decade, and Group B is 4 regions adjacent to the Group A regions but was already well established 10 years ago.

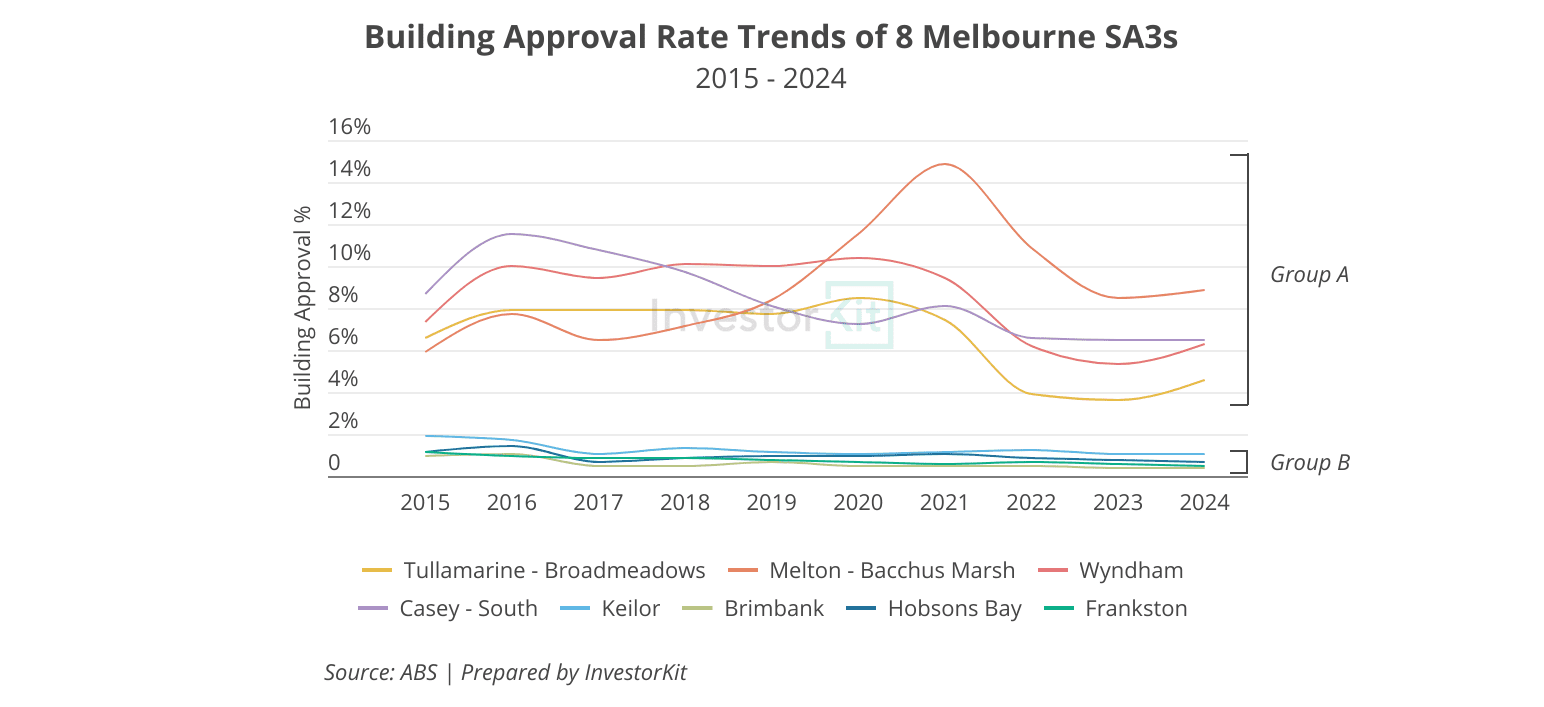

The chart below shows the new house building approval rates over the past 10 years in the 8 SA3s:

If high building approval rates negatively affect growth, the house price growth in the Group A regions should have been much lower than that of Group B.

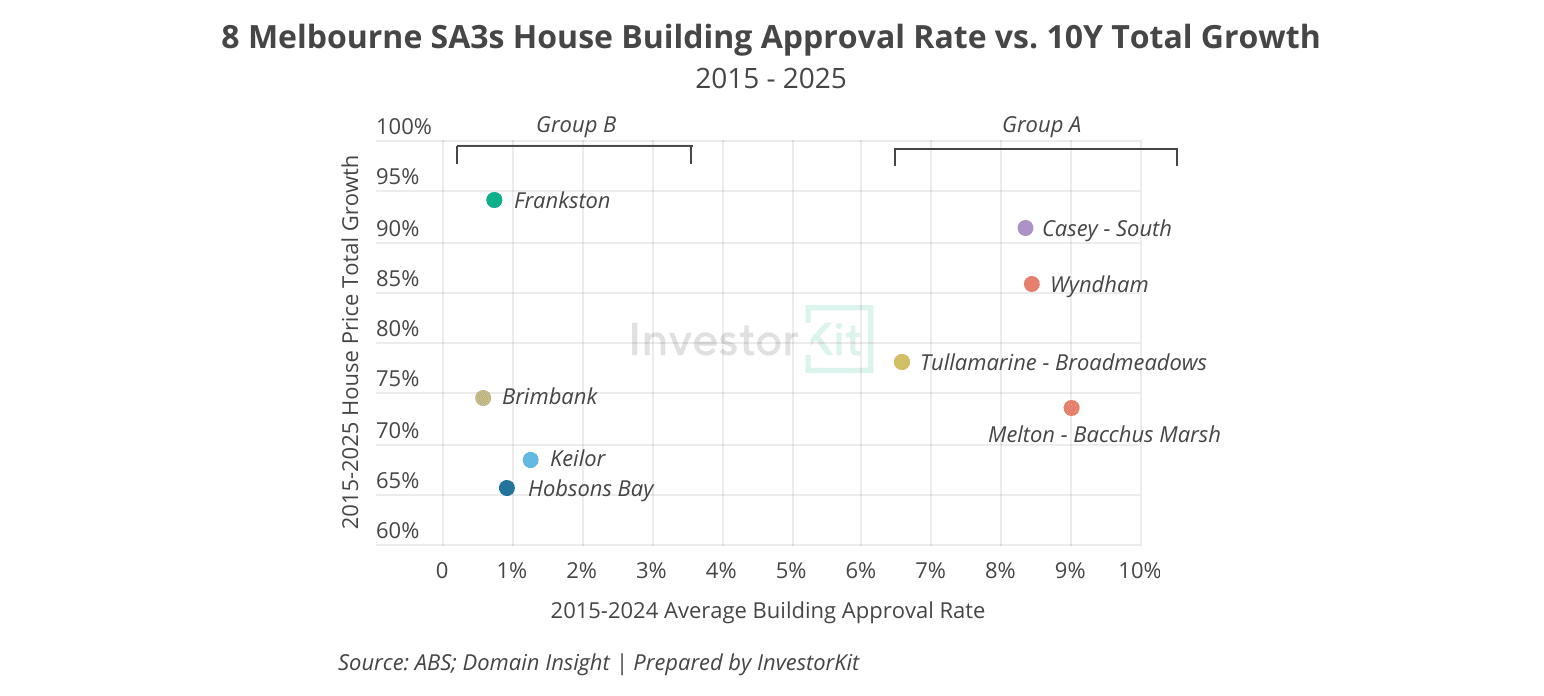

Is that the case? The chart below shows the correlation between building approval rates and last-10-year house price growth in the 8 regions: No clear pattern shows either group outperformed the other. The average performance of Group A regions is even slightly better than that of Group B regions.

The good performance of Group A could be because of the improvement in infrastructure over time, you may argue. Then shall we look at a shorter period, the past 5 years, during which the infrastructure improvement hasn’t been significant?

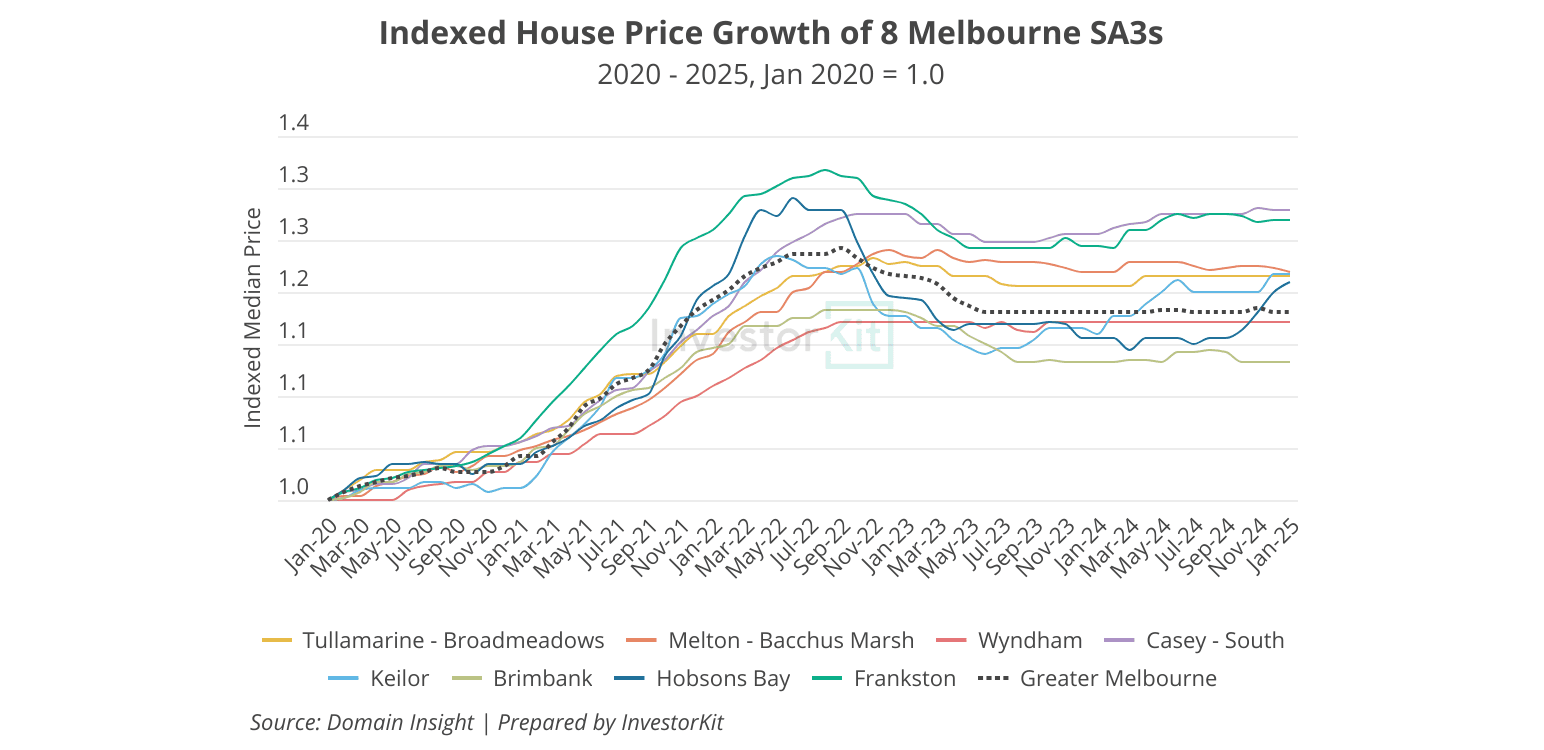

The chart below shows the 8 regions’ house price growth trajectories from Jan 2020 to Jan 2025. Again, there’s no significant difference between the two groups’ performance.

- Casey – South, despite its high building approval rates, has championed the growth rate over the 5 years;

- Brimbank, while seeing extremely low building activity, has grown the slowest among the eight;

- Tullamarine – Broadmeadows, Melton – Bacchus Marsh, Keilor, and Hobsons Bay have performed very similarly to each other, albeit with very different building approval rates.

It’s noteworthy, though, that some well-established regions are more sensitive to demand shifts. In 2021, when housing demand rose, Frankston, Keilor and Hobsons Bay’s prices all experienced a steep surge. That could be attributed to their tighter housing supply and higher liveability.

However, on the other hand, they are equally sensitive to demand falls: Frankston, Keilor, and Hobsons Bay’s prices declined the most from late 2022 to early 2023.

Now that Melbourne’s housing demand is increasing again, Keilor and Hobsons Bay’s prices are among the first to return to growth.

Moving to micro, do suburbs with high building approval rates grow more slowly than the well-established ones?

We have seen that at the SA3 region level, building approval rates do not significantly affect price growth; how about at a micro level, i.e., the suburb level?

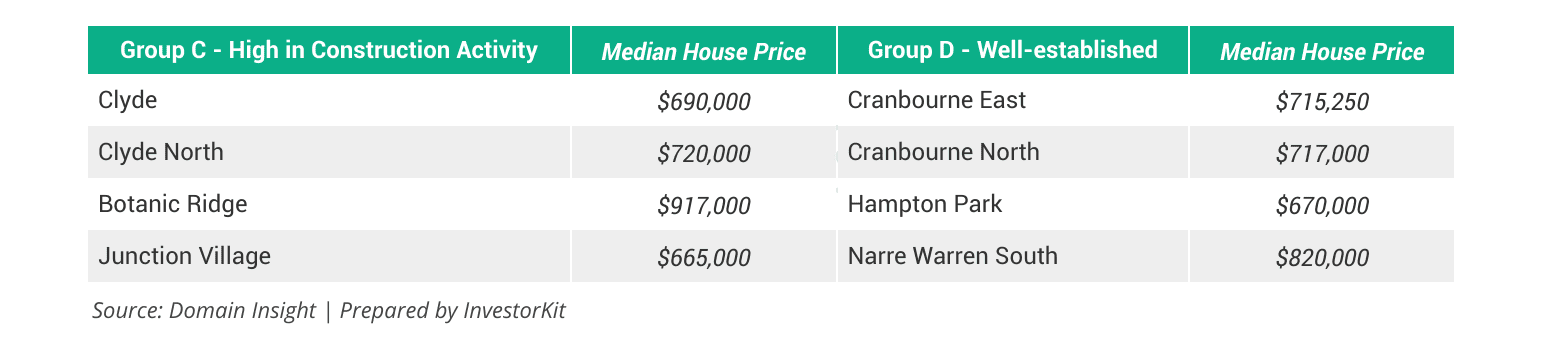

We’ll examine some suburbs in the Casey – South region. Among all the suburbs inside this SA3, we pick 4 suburbs with high building activity (Group C) and 4 well-established ones close to them (Group D).

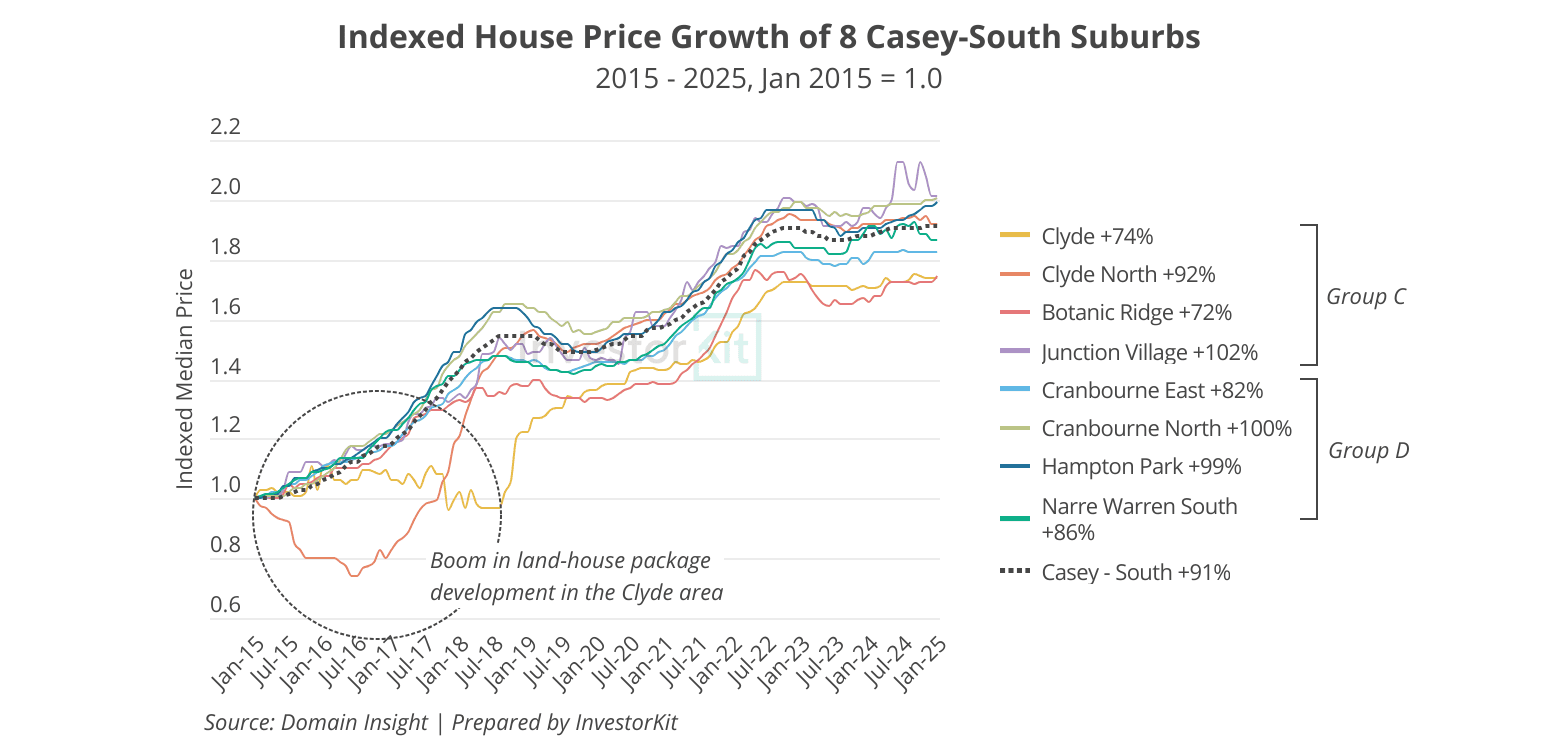

The chart below shows how the 8 suburbs’ house prices have trended over the past decade.

At the suburb level, we start to see some dramatic differences: Whilst most Casey – South suburbs’ house prices were on the rise in 2015-18, Clyde North’s house prices (the orange line) declined sharply in 2015-16, and Clyde’s (the yellow line) declined in 2016-18, before they caught up with the others.

Those two drops were likely a result of oversupply as an enormous amount of land-house package projects flocked to the market around that period.

And how significant was the oversupply’s impact? Interestingly, the impact was limited to the suburbs themselves: When Clyde North and Clyde’s house prices experienced dramatic declines from 2015 to 2018, the growth of their neighbouring suburb, Cranbourne East, was not affected at all, as we can see in the chart above (the sky-blue line).

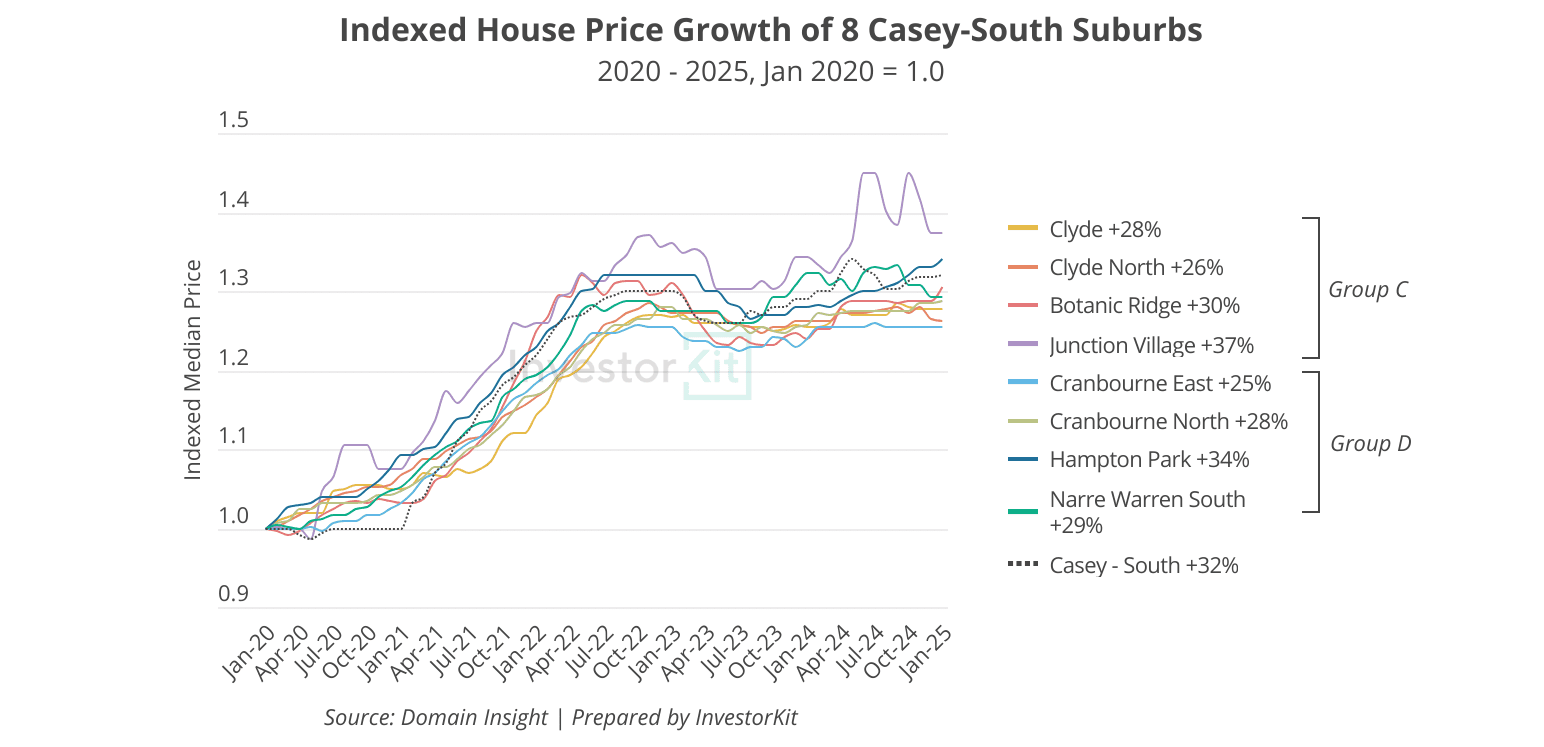

After the peak of that house-land package boom, all the suburbs’ price trends have been moving in line, with no significant difference anymore. To better demonstrate the consistency, I’ve drawn the 5-year growth chart below.

In the past 5 years, Clyde and Clyde North’s house prices have been moving along wth the others, even though many vacant lands are still being developed. It seems that whilst the housing supply has been high, demand has been equally high to absorb the supply.

While long-term growth is unaffected, short-term risks cannot be overlooked.

Although time tends to balance out growth in the long run, it’s crucial to acknowledge the short-term risks associated with high building approval rates. Beyond the potential inverse growth demonstrated above, another key risk is fluctuating rental vacancies.

Recently, we’ve observed vacancy rate surges in several of Melbourne’s outer-ring suburbs — many of which have high building approval rates. A notable example is postcode 3978, encompassing Clyde, Clyde North, and Cardinia, all areas with significant new housing supply. These suburbs have been highly attractive to investors over the past 1–2 years due to their higher affordability and housing availability. However, the surge in rental supply has led to a sharp rise in vacancy rates, which could affect investors’ rental income.

Summary

Historical data shows that high volumes of building activities can have a short-to-medium-term negative effect on price growth at a suburb level only when the supply level is exceptionally high, exceeding demand to a significant extent, like what happened in Botanic Ridge and Clyde during their home-land package peak period.

However, the data also highlights two key points. First, the oversupply impact is not irreversible: In the longer term, growth, even in a once-oversupplied area, will converge to the long-term average. Second, as long as demand remains high enough to absorb supply, high volumes of new supply don’t necessarily slow growth down.

Incoming supply is only one of many factors influencing price performance. On its own, it doesn’t necessarily weaken growth, but it does pose risks to value growth and rental cash flow, making it an essential consideration in risk management.

This Melbourne exercise, again, reminds us of the importance of looking at property markets with a holistic view instead of focusing on isolated metrics.

InvestorKit is a buyer’s agency dedicated to cutting off the noise for investors and helping you focus on what truly matters. We spend hundreds of thousands of dollars each year on data and research to monitor the key factors that have real impacts on the property market’s growth and help you grow your wealth in the most efficient way — Interested in how our research works? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

Table of Contents

- The ‘Building Approval Rate’

- Do SA3s with high building approval rates grow more slowly than the well-established ones?

- Moving to micro, do suburbs with high building approval rates grow more slowly than the well-established ones?

- While long-term growth is unaffected, short-term risks cannot be overlooked.

- Summary

.svg)