In a world grappling with the growing concerns of climate change, the impact on the property market has become a topic of discussion. But to what extent should you worry about it?

Let’s discuss it in this article.

Note: We’re specifically addressing retail property investments in this article, setting aside institutional investors who deal with buildings and development sites.

Will Extreme Weather Events Affect Your Investment?

One of the foremost concerns regarding climate change is the rise in extreme weather events, such as storms, cyclones, and floods. Investors often wonder whether properties in regions prone to these events will experience slower value growth and higher maintenance costs, impacting their cashflow.

Take, for example, the cities of Far North Queensland (FNQ), where cyclones and floods are not uncommon. Last year, InvestorKit conducted a case study on these cities. The results might surprise you.

Long-term value growth is barely impacted

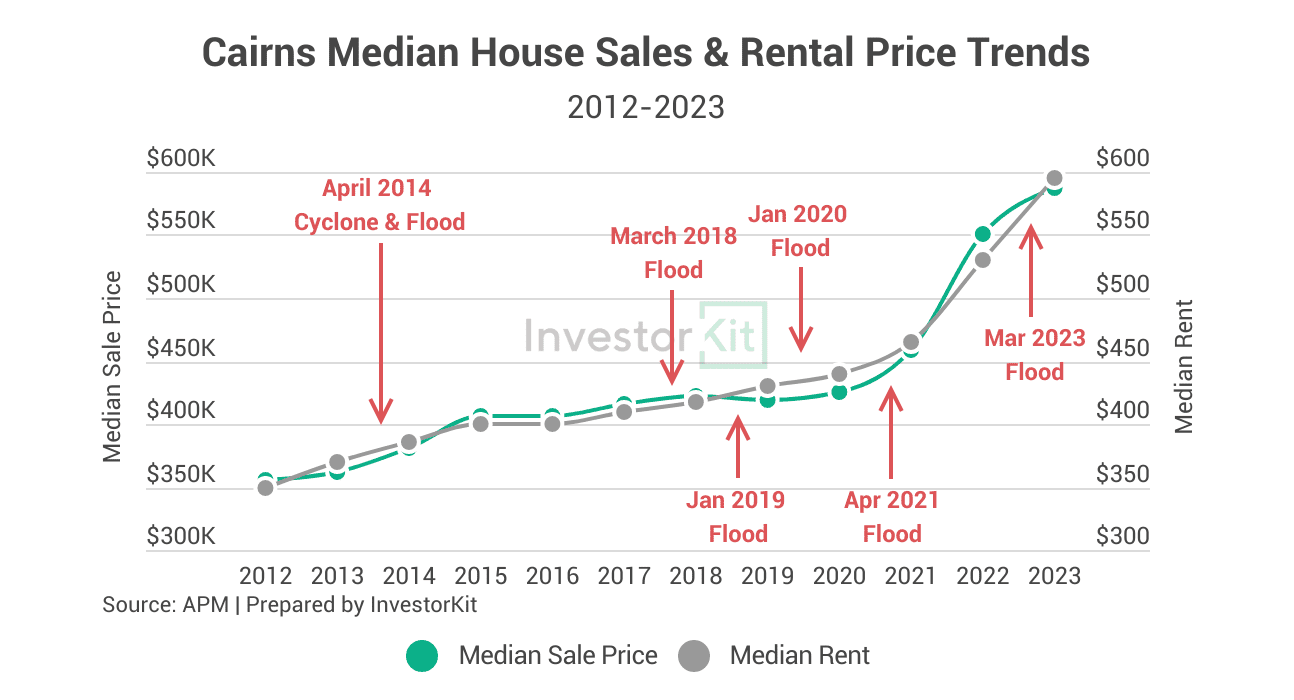

The data reveals that flood events did not correlate with price growth trends. In fact, prices remained largely unaffected by these events.

Using Cairns as an example (see chart below).

- While the city experienced several floods over the years, there was only a minor price decline in 2019;

- Interestingly, the period from 2018 to 2023, marked by higher rainfall, demonstrated stronger price growth in both sales and rental markets compared to the drier 2012-2017 period.

- Over a decade (2013 to 2023), Cairns saw impressive house price growth of 62.5% and rental price growth of 60.8%. This is compared to Brisbane’s 66.9% house price growth and 46.2% rental growth – An impressive performance considering that the end of the Mining Boom had a much more severe impact on FNQ than on Brisbane.

Flood-affected areas do receive less buyer interest

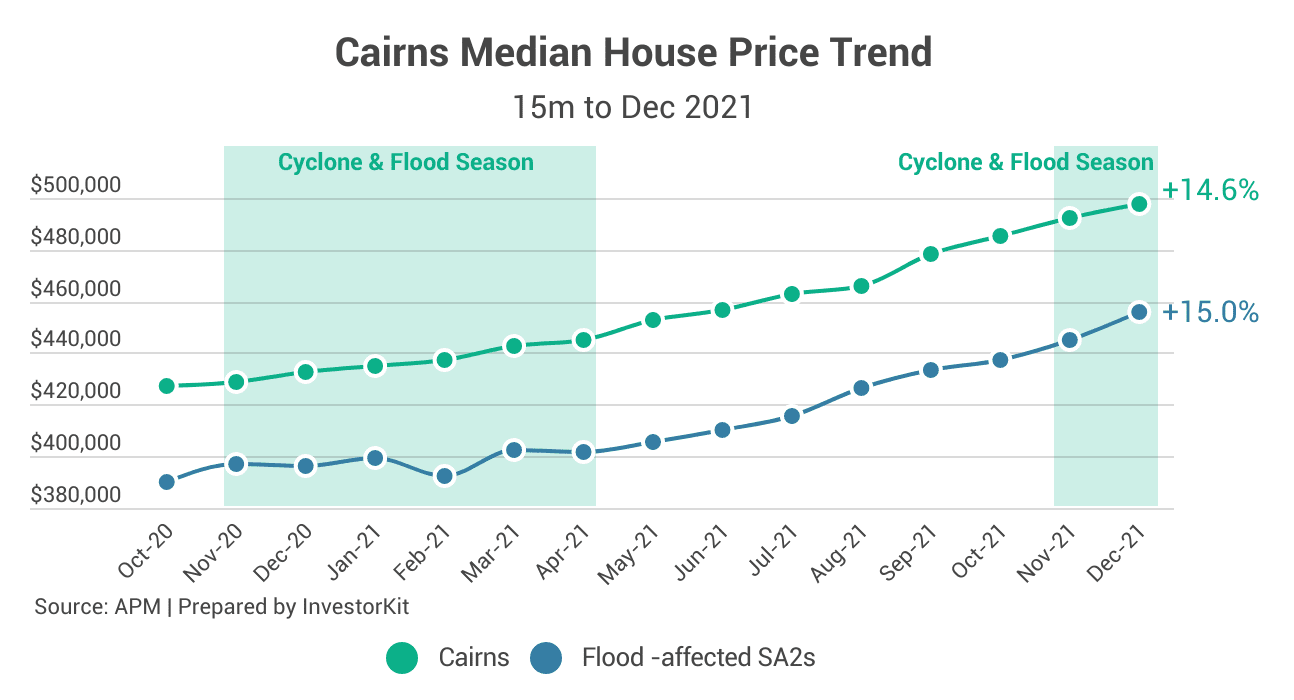

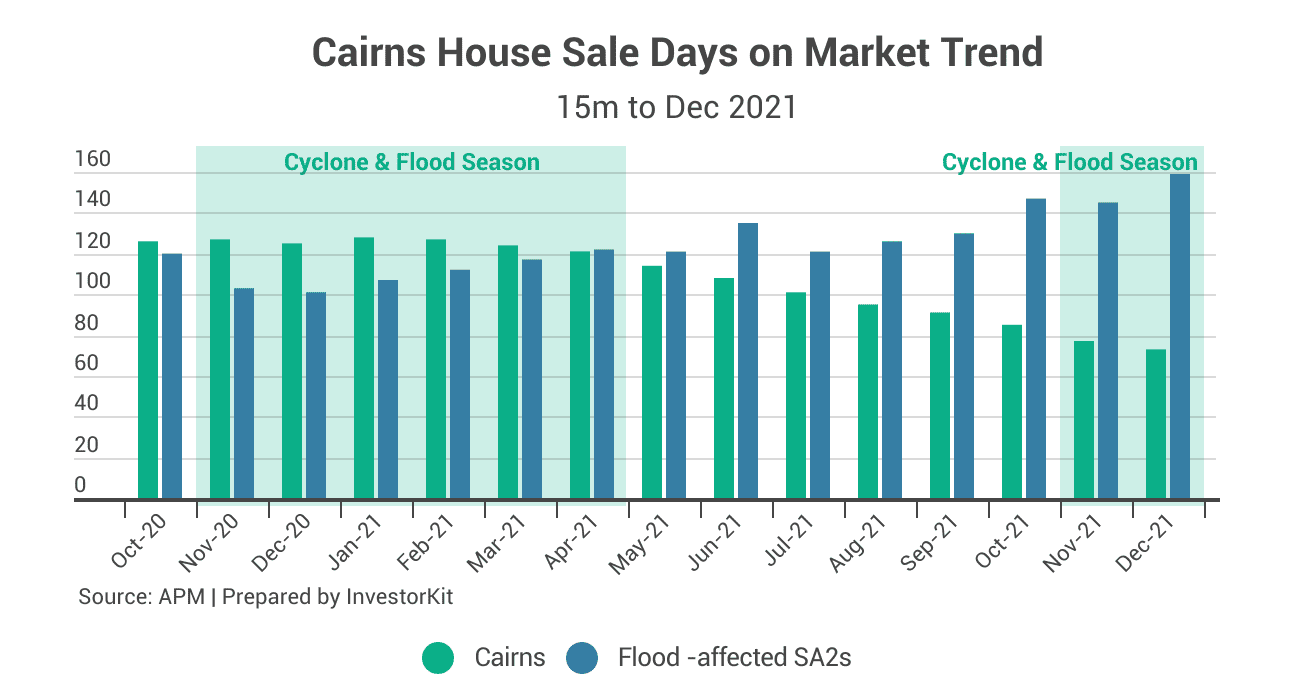

Within the same city, flood-affected areas, although showing similar growth rates with other areas, experienced decreased buyer interest.

Data from the end of 2020 to the end of 2021 in Cairns reveals that houses in flood-prone areas achieved similar value growth with the rest of Cairns, but their sale days on market increased over the year, indicating declining buyer interest.

Meanwhile, Cairns as a whole saw a drop in sale days on the market, showing increasing demand.

Higher Risk, Higher Compensation

Higher-risk areas with a propensity for cyclones and floods come with increased holding costs. This includes higher insurance premiums, potentially more extended vacancy periods, and elevated maintenance costs. However, these higher holding costs are offset by substantial yields.

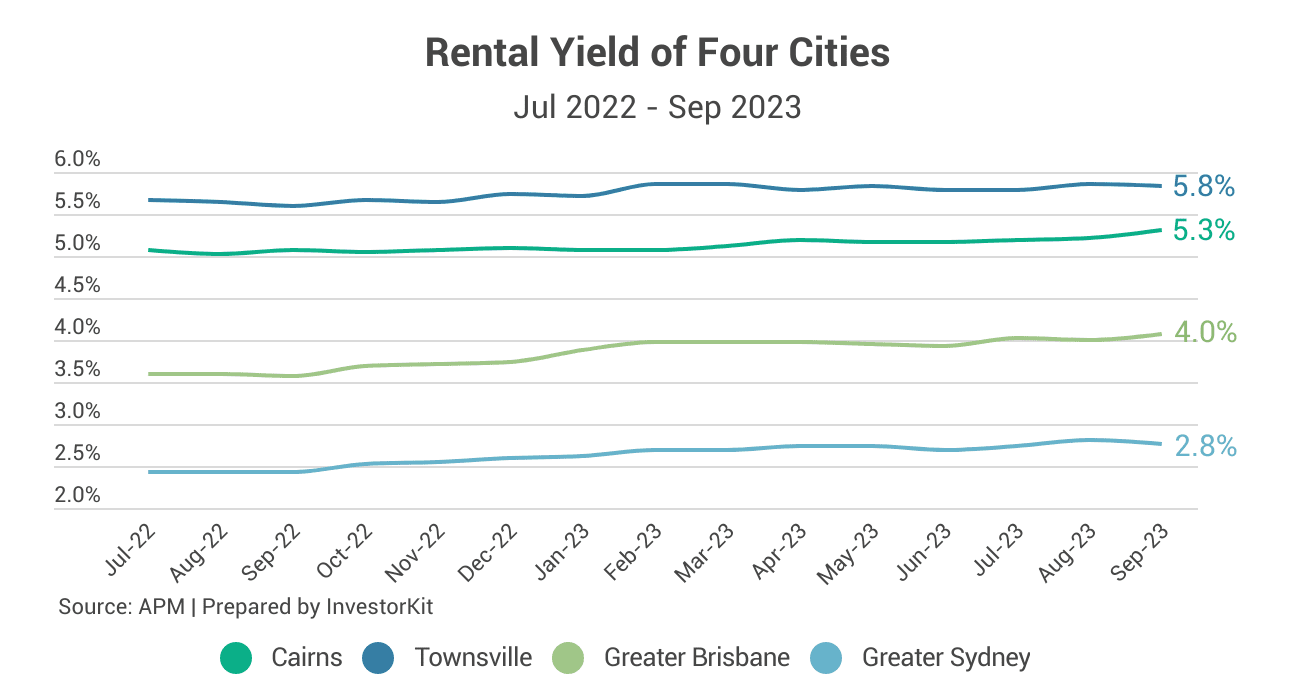

To illustrate this, we compare rental yields between Far North Queensland cities (Cairns, Townsville) and two southern cities (as shown in the chart below). The difference in rental yield is immense.

The Bigger Picture

While extreme weather events do have some impact on property market performance, it’s essential to understand that this is just one piece of the puzzle. Property market performance is a complex interplay of various factors, including:

- Economic conditions

- Finance environment

- Population growth and migration trends

- Taxation systems

- Construction activities

- And more

Extreme weather events, whether linked to climate change or not, are just one of many influencers in the property market. They never work in isolation and must be considered alongside other factors.

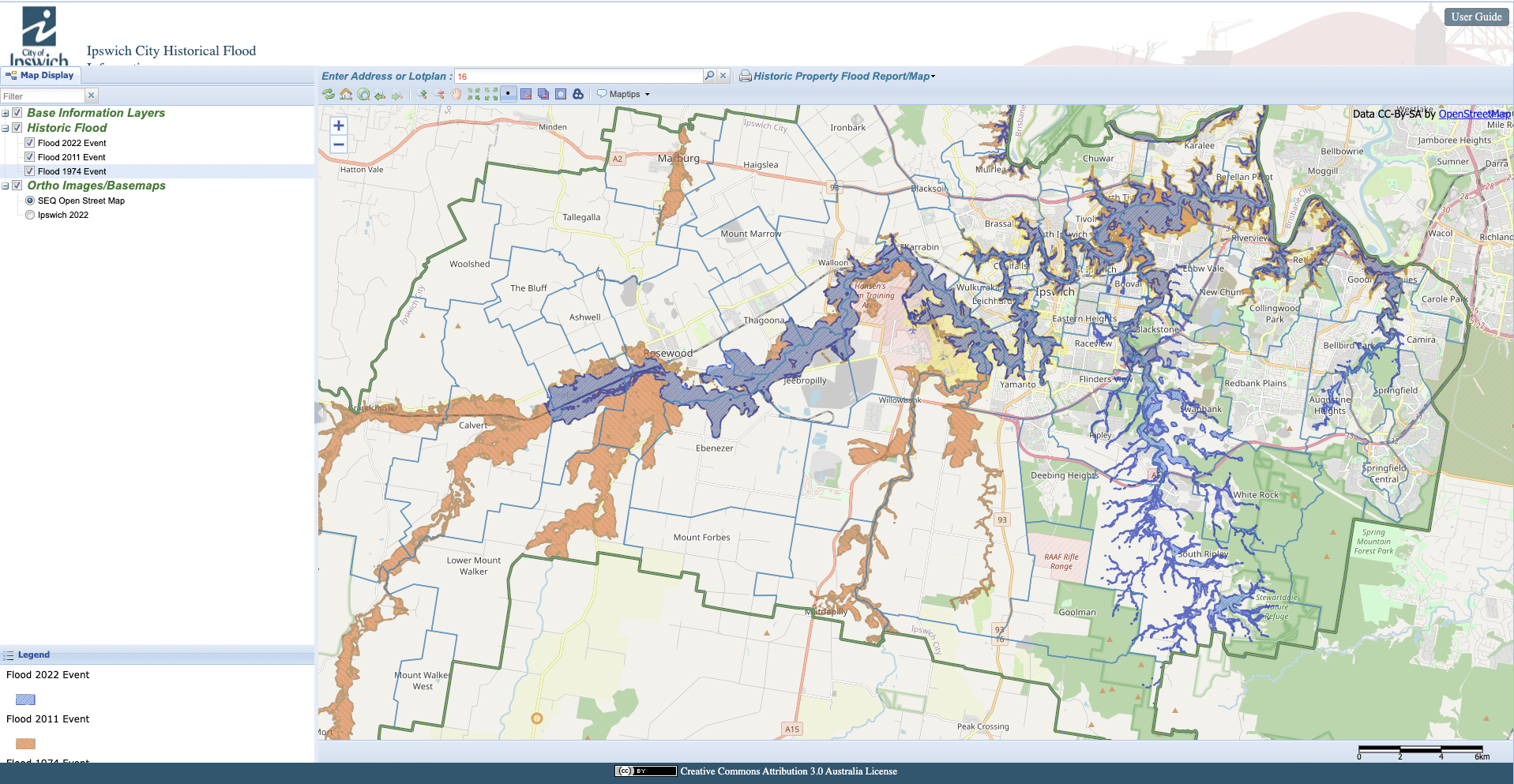

a. Due diligence is the key

While it’s possible for floods and bushfires to occur more frequently, it’s also possible for you to reduce the potential impact of those events on your property. Due diligence plays an essential role. Many online platforms, including council websites offer free interactive maps that show if a certain lot has been historically affected by flood/bushfire or is prone to these disasters based on the local environmental plan. An example is the Ipswich City Historical Flood Map website, of which the interface is shown in the below image. Before putting your money in any property, make sure to check that out, and stay away from any natural disaster affected zones.

b. Quantify the risk

While we understand that extreme weather events barely affect value growth as long as the housing demand and supply relationship looks good, we do care about the cashflow as well. As we mentioned early, one of the factors that justify the property investment in FNQ is their high rental yield being able to compensate the higher holding cost based on calculations. So, if you’re concerned about potential risks caused by climate change, make sure to qualify them by increasing your maintenance costs or holding costs projection and take that into account in your calculations, whether it’s a cost and profit projection sheet or a cashflow projection model.

c. Diversity of your portfolio

Diversification of your portfolio is crucial to mitigate any risks, including climate change. You want to have a portfolio that includes multiple location types and even property types:

- Various states;

- Capital market & Regional market;

- Inland cities & Coastal cities;

- Residential properties & Commercial properties;

- Etc.

Diversity helps your portfolio defy the impact of market downturns, natural disasters, policy changes, and other uncertainties that tend not to occur across all submarkets across the country and protect your overall capital growth and cashflow.

d. Regular review of the portfolio

Whether concerned about the impact of climate change or not, investors are encouraged to review their portfolio regularly to make sure it’s healthy and working the hardest for you (At InvestorKit, we help our clients review their portfolio once every year for free).

How does it work to mitigate climate change risks? We take FNQ properties as an example. Currently the region enjoys strengthening economy, active job market, affordable housing prices, relaxing tropical lifestyle that attract more and more people to move in there, pushing housing demand high. The high housing demand and high rental yield have beaten the high holding costs and persuaded many property investors, to enter that market. If an investor reviews their property performance annually, they would now see healthy capital growth and cashflow and be happy with that.

Let’s assume that in 10 years, floods and cyclones have become more frequent and more severe that this investor notices that holding costs are increasing faster than before in two consecutive annual reviews and are impacting the property’s overall performance. At this point, they might decide to leave the market before more investors do and redirect their money to somewhere offering better performance.

Regular portfolio reviews make sure you identify issues early and take actions early to minimise potential loss.

Still have concerns?

Everyone has their own risk appetite. While risks can be mitigated, some investors still wouldn’t have peace of mind.

Then why torture yourself? If you really don’t like to bear the cyclone/flood risks in tropical cities, coastal suburbs or riverside suburbs, just avoid them (even if they have passed the flood check).

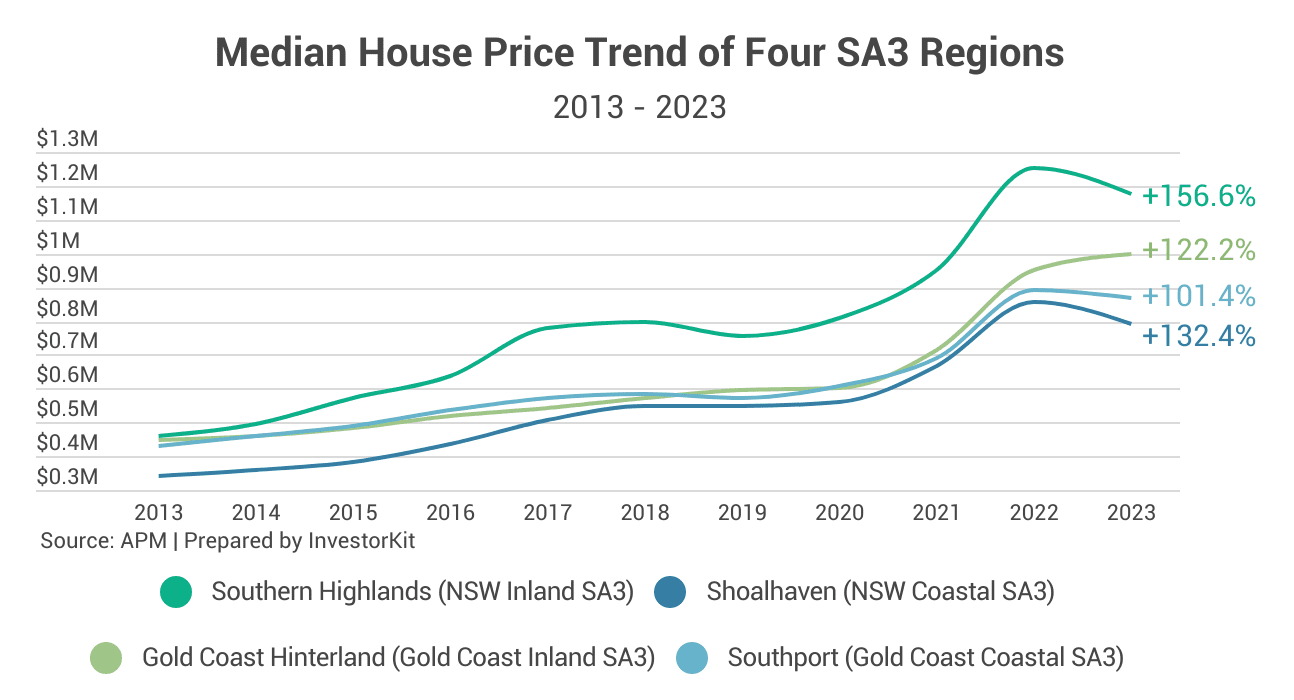

Many non-riverside/seaside regions perform equally well or even better. The below chart shows four SA3 regions as an example:

- Southern Highlands has performed better than its coastal neighbour Shoalhaven.

- Gold Coast Hinterland has grown more than its coastal buddy Southport.

Same applies to tree-change locations that are prone to bushfire risks: You have plenty of other options.

Australia’s property market consists of many sizeable sub-markets that enjoy thriving local economy and healthy property value growth. By avoiding certain regions, you may lose some options, but will never be out of options.

InvestorKit is a data-driven buyers’ agency that utilises data to bust myths and identify performing markets that meet each client’s needs and requirements. InvestorKit is also a client-centred buyers agency that has strictest due diligence criteria, helps each client build and review their portfolios, and always carefully examines cashflow models to mitigate risks for our clients as much as possible.

Would like to have a helper, like InvestorKit, do all the tedious analysis and checks for you on your next purchase? Click here and book your 15-minute FREE, no-obligation discovery call!

.svg)