When it comes to property investing, many believe that larger lands grow better than smaller ones.

Is that the truth, or is it nothing but another myth?

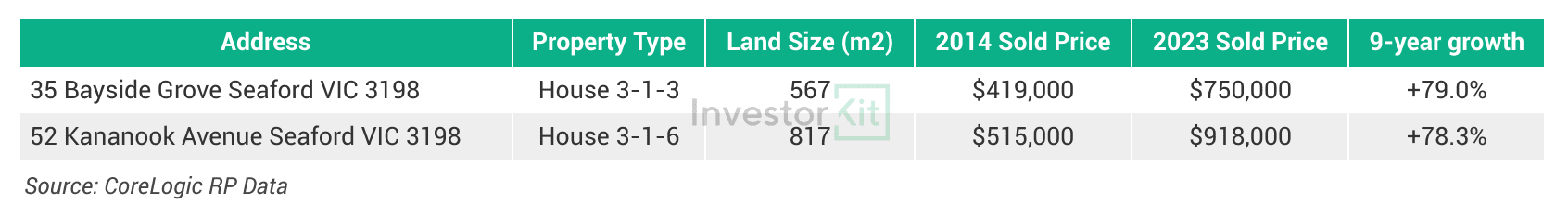

Oliver, a new investor, is excited about his first real estate investment. He comes across two properties in the Melbourne Suburb of Seaford. One house is on Coonara Avenue, with a land size of 584 m², and the other is on a spacious 1,123 m² of land located on East Road.

Instinctively, Oliver is drawn to the larger plot as he believes, “More land must mean more potential, and more potential would lead to more growth.” However, digging deeper into the two properties’ sales histories, he discovers that larger land isn’t always the better performer.

Here is what he sees:

Despite the significant difference in land size, the value growth of the two houses after nine years is similar, with the smaller-land one’s slightly higher. Neither of the two dwellings had any substantial improvements (no extra development, no change in kitchen or bathrooms), only some cosmetic renovation like new painting and change of carpets.

Having seen the difference, Oliver has to reconsider his belief in large lands.

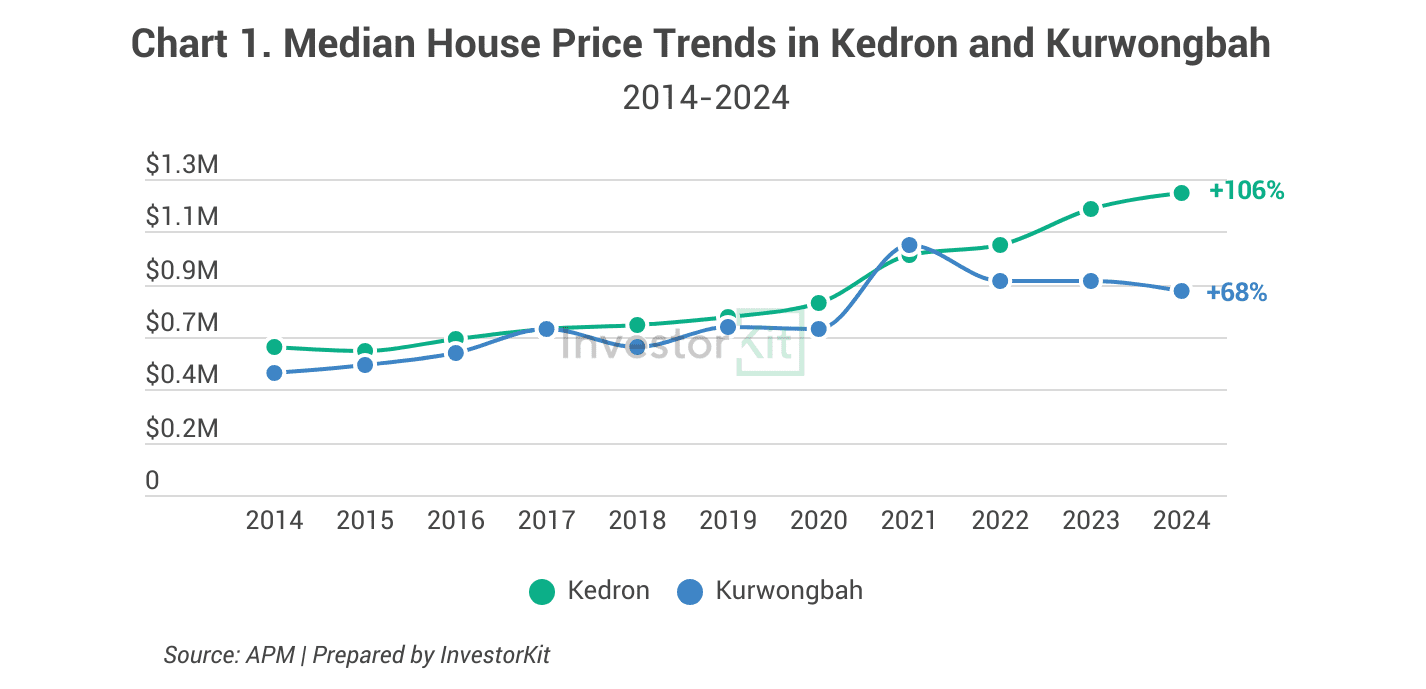

If you think the above is just an isolated event, let’s have a look at two suburbs’ average performance.

- Kedron – an established suburb, about 7 km north of Brisbane CBD. This suburb’s land sizes are typically around 400 to 700 m². Larger plots are available but less common.

- Kurwongbah – a semi-rural suburb in the City of Moreton Bay, about 30 km north of Brisbane CBD. This suburb attracts buyers with its acreage homes featuring large blocks of land, ranging from thousands of square metres to hectares.

The difference in capital growth between these two suburbs over a decade is significant (Chart 1). In the past 10 years, house value in Kurwongbah increased by 68%, while Kedron saw its house value soared by 106%, close to 1.6 times of Kurwongbah’s.

Why could larger lands experience more modest growth?

Not everyone prefers big lands.

Large plots come with higher maintenance costs. They require significant upkeep, whether landscaping, fencing, or general property management, leading to substantial ongoing expenses.

For investors, large land size also means higher purchase price and lower yield (as large land doesn’t increase rental price much).

Furthermore, bigger plots are potentially more sensitive to market fluctuations as demand for them is more volatile.

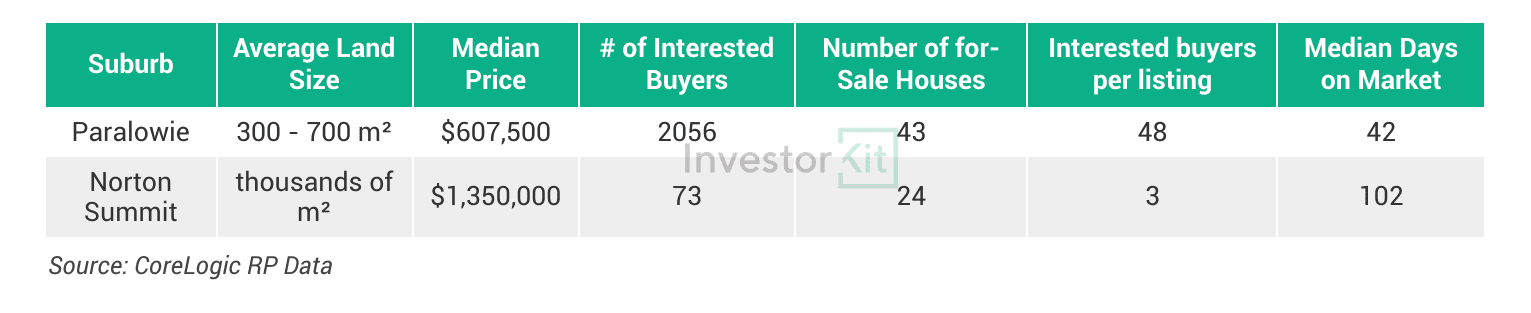

To illustrate the preference difference, we present to you two suburbs in Adelaide.

- Paralowie – a northern suburb, located about 25 km north of Adelaide CBD. The average land size for residential properties in this area is around 300 to 700 m².

- Norton Summit – a semi-rural suburb in Adelaide Hills, about 12 km east of Adelaide CBD. The area is known for its acreage houses.

Before moving into numbers, let’s first discuss how we can tell if a suburb is more preferred. I would say a suburb is more sought-after if:

- There are more interested buyers inspecting properties in the suburb;

- Houses in this suburb are selling fast (low Days on Market)

With these two criteria in mind, let’s have a look at the table below.

- The number of interested buyers in Paralowie per property is substantially higher than in Norton Summit.

- Houses in Paralowie only need 42 days on average to be sold, while those in Norton Summit take 102 days on average to secure a buyer.

It is obvious that the Adelaide property buyers prefer Paralowie to Norton Summit, despite the enormous land size difference.

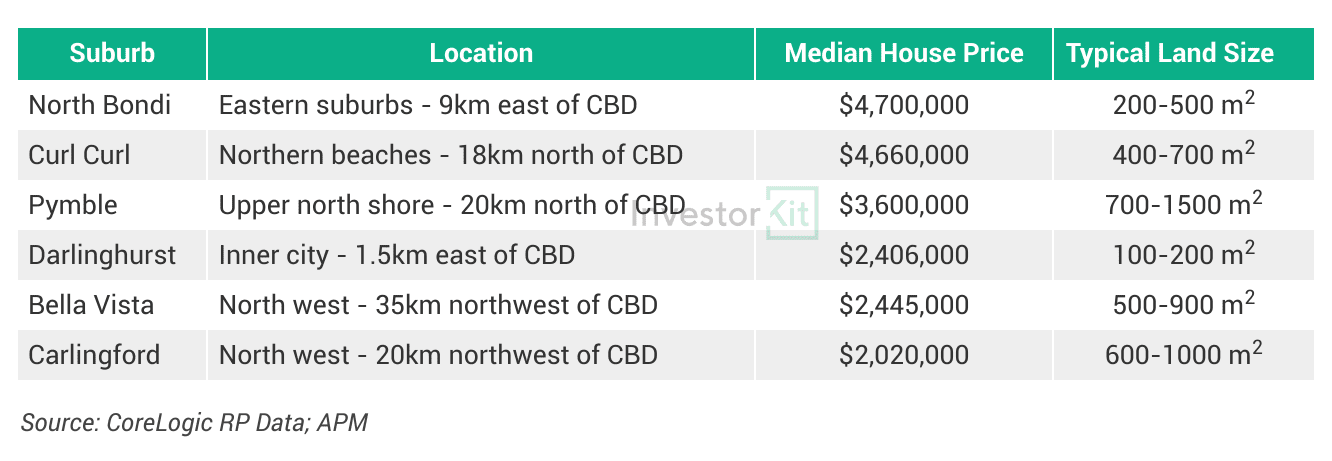

Whilst the above examples have looked at growth for variances. We can also view preferences based on price levels, not growth.

The table lists some Sydney suburbs’ median house prices and their typical land sizes. For those unfamiliar with Sydney, we’ve included a location description section for your reference.

- North Bondi’s typical land size is one the smallest among all these suburbs, yet it’s the most expensive of all.

- Both around 20km north of Sydney, Pymble’s typical land size is considerably bigger than Curl Curl’s, but its median house price is $1m lower.

- Darlinghurst houses have very limited land, but they can be sold for a much higher price than Carlingford houses, with 5 times larger land.

- Both in the northwest, Bella Vista’s typical land sizes are, on average, smaller than Carlingford’s, yet its median house price is higher than Carlingford’s.

- ….

We can go on and on. In each pair, the more expensive suburb’s house prices are higher because, over time, it enjoys higher demand (stronger preference) than the other for various reasons: lifestyle, community culture, facilities, commuting convenience, family and friends, and more. Land size? Not the determining factor.

While we’re only showcasing preference here, it’s important to note that buyers’ preference is just one factor driving a property’s price and value growth. The real estate market is influenced by a multitude of factors, such as the local economic activity, housing supply level, market cycle, affordability, financial environment, etc.

If land size isn’t the best indicator for growth, what should we track?

The answer is market pressure.

It measures the relationship between housing market demand and supply and is a reliable barometer for understanding the current market situation and forecasting future price movement. High market pressure often signals rapid price growth in the short term, while low market pressure usually suggests a price slowdown or decline.

In a high-pressure market, the competition among buyers is fierce; properties are sold quickly (low or lowering days on the market). Sellers hold the upper hand so they don’t need to give significant discounts (low or decreasing vendor discounts). Rental vacancies in these areas tend to be low as well.

In contrast, buyers don’t face much competition in a low-pressure market and can take their time to shop around (high or increasing days on market). They also have more negotiating power to get a better deal (high or increasing vendor discounts).

Check our market pressure review blogs here (Look for titles in this format – Market Pressure Review: XXX in 10 Charts) for how we analyse market pressure and gain insights on each Australian city’s market pressure!

In summary, land size is not a critical determinant of property value or its growth. Growth is determined by many factors, including local economic performance, housing supply level, buyers’ preference, market cycle, affordability, financial environment and, most importantly, market pressure. A comprehensive approach that considers all these factors will yield better investment results than focusing solely on land size.

Further Discussion

Land size should not be the top priority when investing in properties, but that doesn’t mean you can’t do it. It can be a viable option if you are an experienced subdivider. Just be aware of the potential drawbacks of this strategy – We have a podcast discussing them in detail. Check it out!

Last but not least, regardless of the land size you’re considering, it’s essential to pay the right price. If you see an attractive property with a large piece of land, do not get over excited and rush to submit a high offer. Similarly, if you are presented with a small land-size house, do not intuitively have a low price expectation – You might end up overpaying or missing out on good opportunities. Instead, take your time to collect information on recently sold properties with similar characteristics, including land size, and compare them with your target property. This approach will give you a realistic idea of the property’s value and the confidence to make well-informed decisions and effectively negotiate if necessary.

Bigger land, better growth? That’s just a myth. The InvestorKit buyers agency team dedicates ourselves to busting property investment myths and helping property investors avoid mistakes and achieve their investment goals faster. Would you like to understand more about increasing your chance of success? Chat with us today by clicking here and requesting your 15-minute FREE no-obligation discovery call!

.svg)