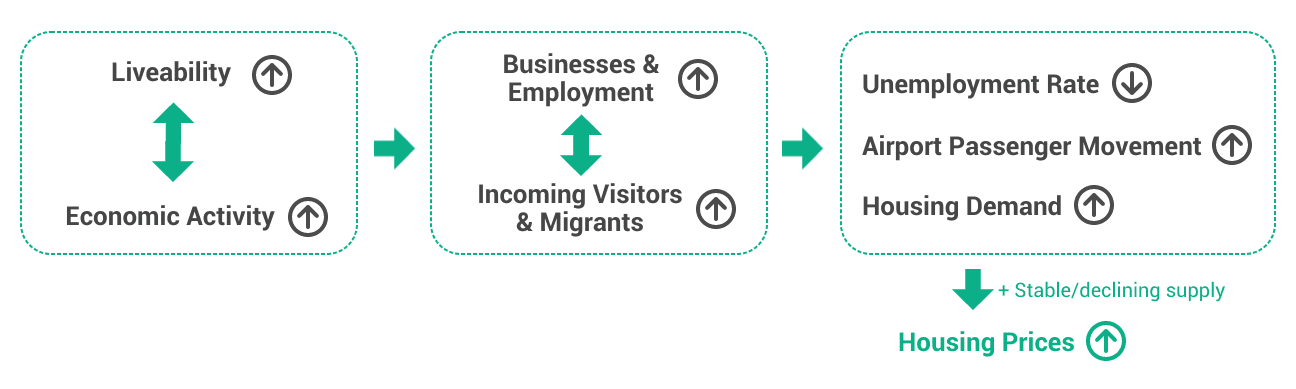

Airport passenger movements correlate positively with local economies and housing price growth.

The diagram below describes this link.

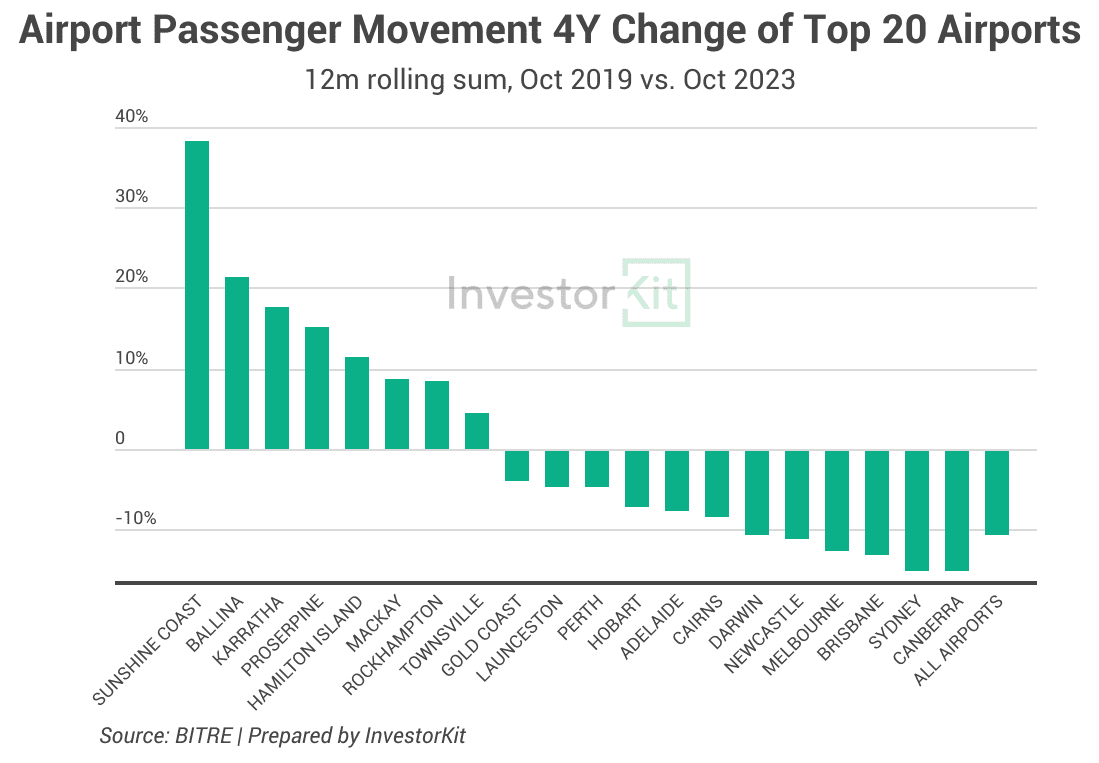

During the pandemic, international and state border closures severely impacted Australia’s aviation industry. As the borders fully reopened in early 2022, we’ve seen a surge in airport passenger movements in every airport.

At the end of 2022, we wrote an article reporting that regional cities were leading the post-COVID passenger movement recovery.

With borders having reopened for approximately 2 years now, how are our airports doing? Let’s take a look.

While many airports still haven’t fully recovered, eight cities are servicing more passengers than pre-COVID. They are:

- Sunshine Coast – +38.3% (above pre-COVID level, the same below)

- Ballina (Byron) – +21.3%

- Karratha – +17.5%

- Proserpine (Whitsunday) – +15.0%

- Hamilton Island – +11.3%

- Mackay – +8.6%

- Rockhampton – +8.4%

- Townsville – +4.5%

There is 1 in NSW, 1 in WA, and 6 in QLD!

That is a clear sign of Queensland’s robust economic growth.

The thriving economy can be seen in many other indicators, too.

Active job markets

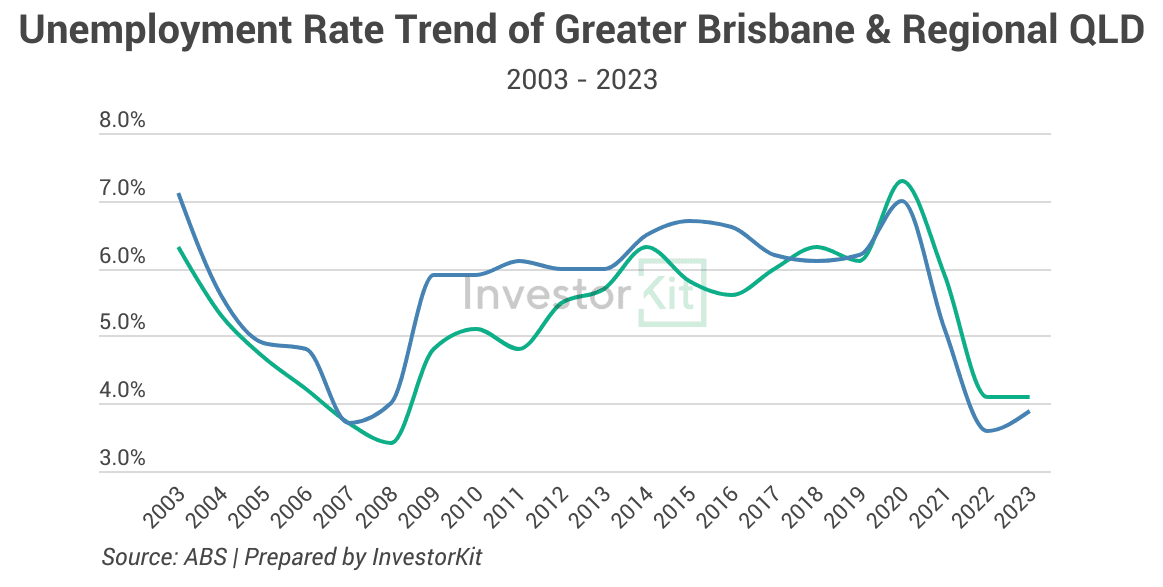

– Low Unemployment rates

Following an economic boom in the 2000s, Queensland’s unemployment rates, both in the capital city and the regional areas, stayed high, with an upward trend from 2009 to 2020. However, they have both declined steeply since the pandemic, reaching the lowest level in more than a decade.

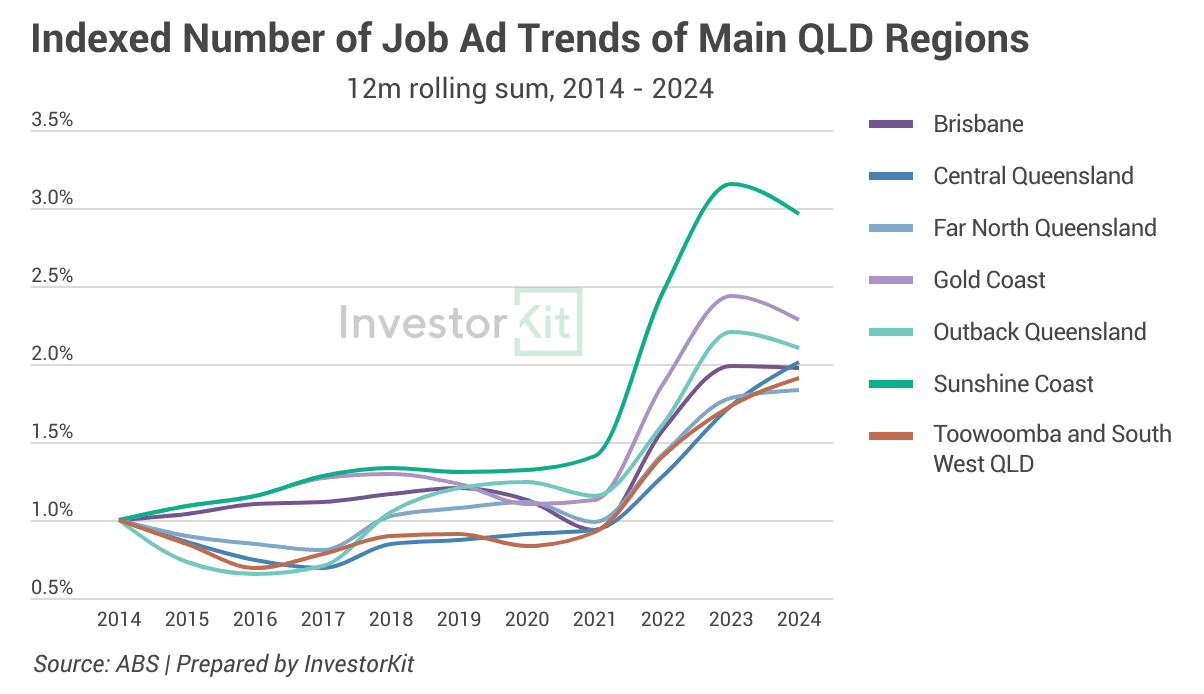

– Lifted number of job opportunities

Like unemployment rates, the number of job ads, showing how many job opportunities are on offer, is also an effective indicator of job market activity. The chart below shows the trend of job ad numbers in each IVI region of Queensland. All regions have enjoyed a notable increase in job opportunities compared to a decade ago. Sunshine Coast, where airport traffic is growing the fastest, has seen a nearly 200% increase in its local job opportunities – A piping-hot job market!

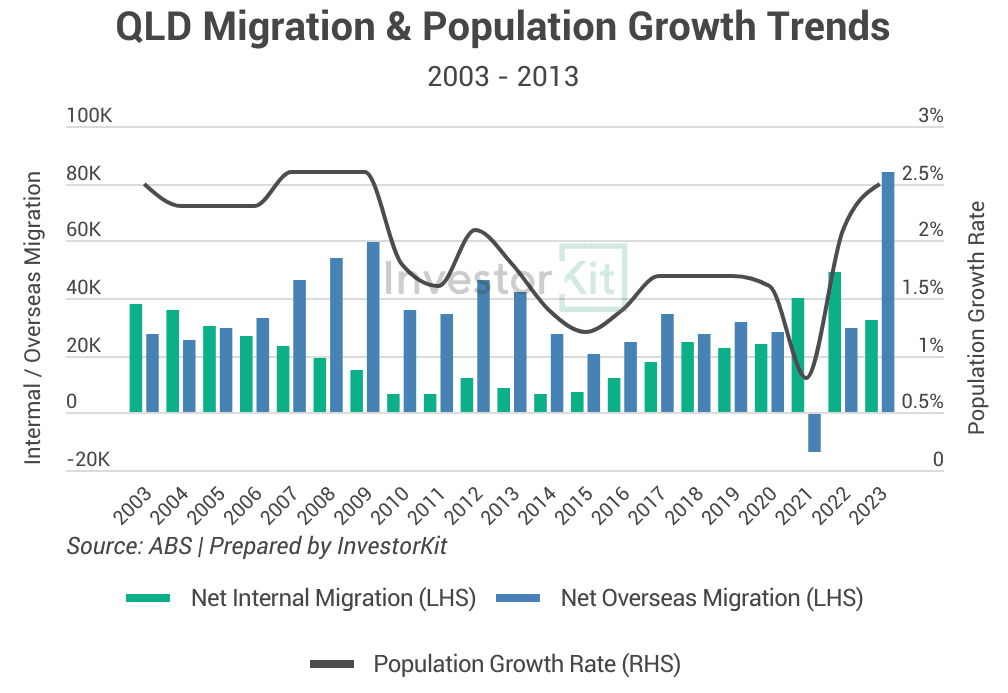

Migration and population growth

More active job markets are companied by a robustly growing population.

The chart below shows that Queensland has been receiving more and more migrants from other states (internal migration) since 2015, while overseas migration has been surging since the international border’s reopening. The surge in net migration numbers has led to a steep rise in population growth, now achieving the highest growth rate since 2009, when the last economic boom ended.

Property Market Benefitted from the Thriving Economy

The robust economy has benefitted Queensland’s property market.

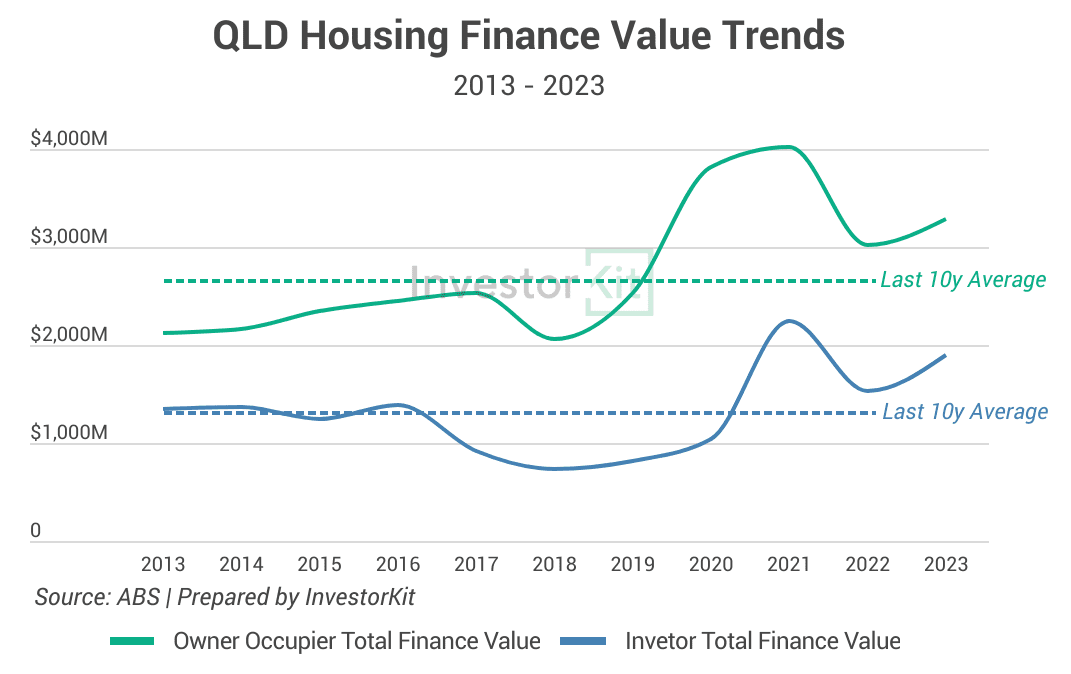

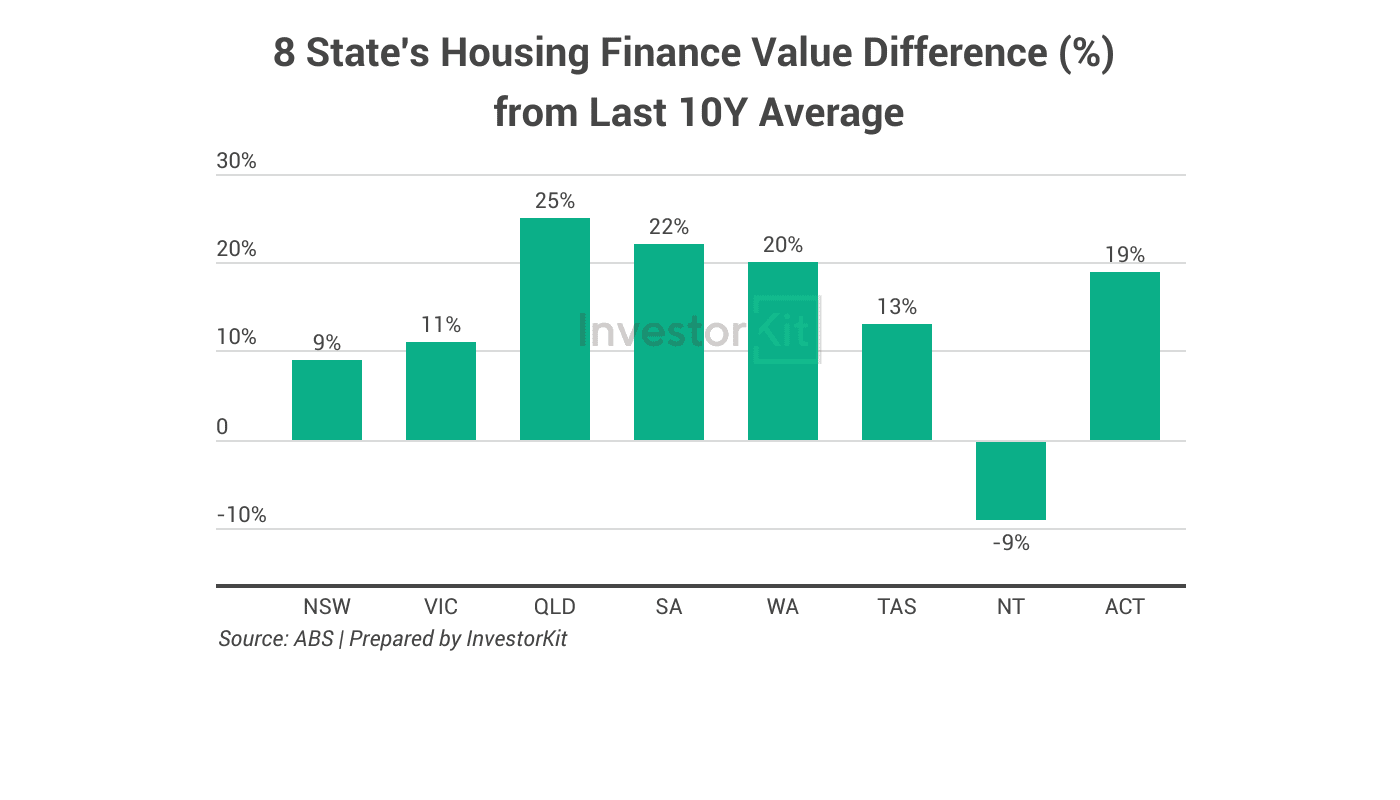

Queensland’s housing finance activities are much more active than in the last decade when the economy was sluggish. In the second half of 2023, Queensland’s total housing finance value (excluding refinancing) was 25% higher than its previous 10y average, with owner occupiers’ housing finance 21% higher and investors’ 50% higher than their last 10y average, respectively (chart above).

Among all eight states/territories, Queensland’s housing finance improvement is the most significant (chart below).

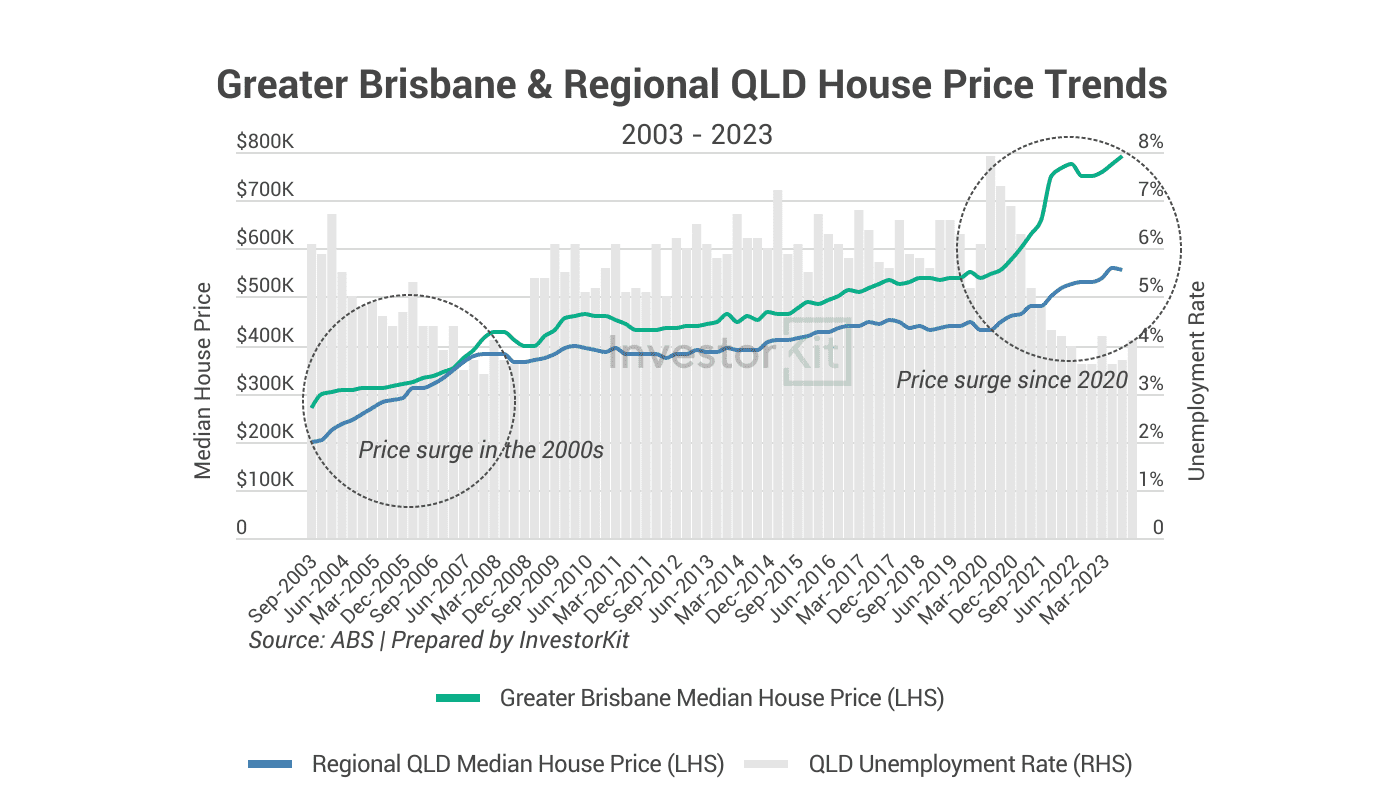

At the same time, house prices in Queensland have grown robustly in the past 3 years.

The chart below clearly shows a surge in house prices in the Sunshine State. While Greater Brisabane’s house price experienced a brief correction in 2022, regional QLD has seen stable price growth over the entire 3 years.

Overlaying house price trends with unemployment rate trends, it’s easy to tell that in the past 20 years, the two price surge periods perfectly match the two economic boom periods (the 2000s and the early 2020s).

Given the economy is still booming across the state, we expect the healthy growing momentum to continue in the coming few years.

In a nutshell…

Queensland has been the biggest winner in Australia’s airport passenger recovery race. The fast airport traffic recovery is one of many signs of the state’s robust economic growth, and the thriving economy has contributed to Queensland’s property market outperformance.

You must have noticed that whilst starting with examining airport passenger movement, we couldn’t conclude that Queensland’s economy was thriving without checking other economic indicators like unemployment rate trends, number of job ads, housing finance activity, etc. It is important to remember that the economy and property markets are influenced by many factors, and no influencer can be looked at in isolation.

Queensland is not only the superstar of economic and property market growth but also one of InvestorKit’s major buying markets. The InvestorKit team, with our data-driven approach, identified Queensland’s economic & property market recovery signs and entered the market long before the pandemic. Our clients have enjoyed the Sunshine State’s high capital growth as well as healthy cashflow for years.

Would like to join us and identify the next superstar property market in advance? Talk to us now by booking your FREE 15-min discovery call!

.svg)