Hey, investors, are you ready for the coming rate cuts?

Interest Rate Cut Expected for the First Half of 2025

Economists at the big four banks expect the current cash rate of 4.35% to be the peak, with rate cuts to happen by the second quarter of 2025. While economists from ANZ, NAB, and Westpac predict the first cuts will occur around May 2025, CommBank forecasts the first cut in February 2025.

Interest rates are one of the key players in the property market, significantly influencing housing demand and prices in some of our largest cities and their surrounding areas. While high rates can slow things down, what would happen when rates drop?

Today’s blog will uncover five potential impacts of rate cuts on Australia’s property market. Curious to find out? Keep reading!

1. Improving Housing Affordability

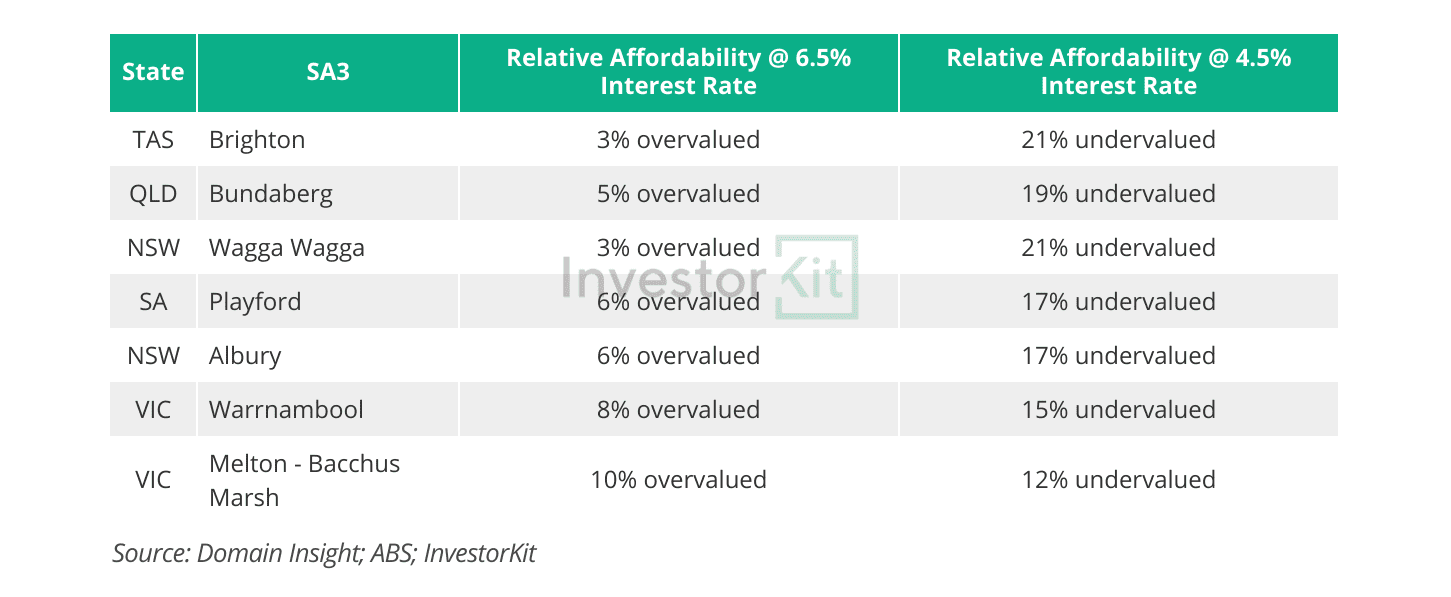

Interest cuts will improve housing affordability by decreasing the cost of borrowing. Lower rates reduce the monthly repayment, turning some unaffordable markets into affordable ones. The table below highlights six regions where house prices are currently unaffordable (overvalued) but would become affordable (undervalued) if interest rates were to decrease by 2%.

While 2% rate cuts won’t happen overnight—most banks expect 1% cuts in 2025—we are using 2% here to highlight the potential impact of rate cuts on affordability.

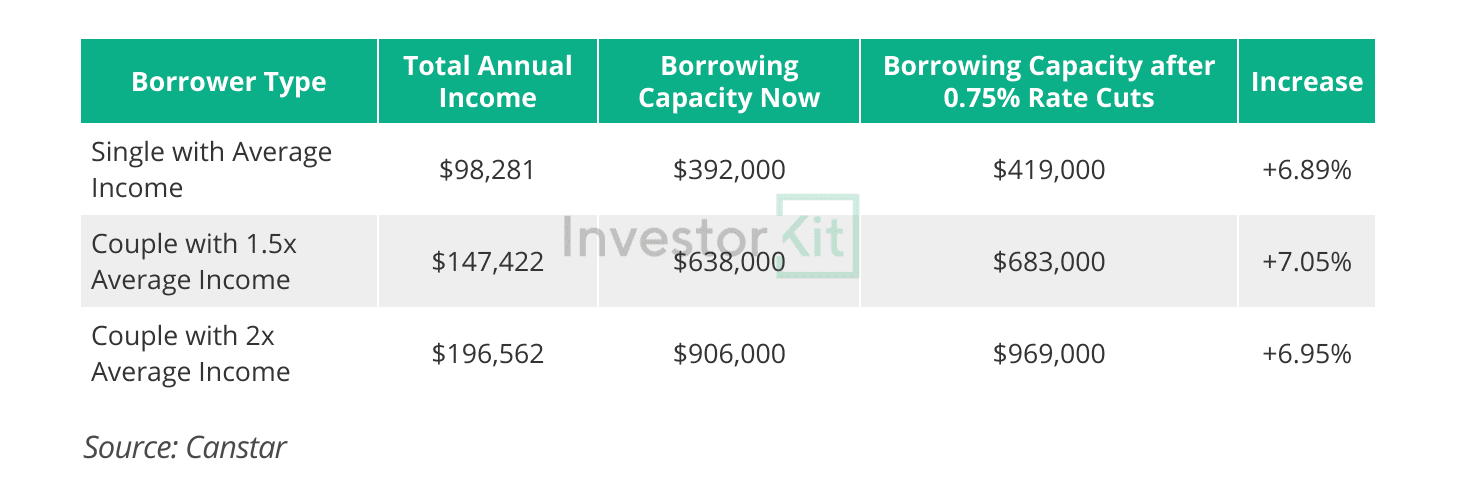

In addition to reducing monthly repayments, rate cuts increase borrowing capacity. With lower rates, buyers can afford larger loans, giving them access to a broader range of markets. According to a Canstar study, a 75 basis point rate cut would boost borrowing capacity by approximately 7% (see Chart below).

An analysis by Confidence Finance found that a 0.25% interest rate cut would increase borrowing power by about 2.5%. Therefore, with a total rate reduction of 1% in 2025, homebuyers could borrow 10% more than they can now. With 2% cuts, the increase could double!

2. Attracting Homebuyers Back to the Market

Over the past two years, many renters have been unable to buy due to limited borrowing capacity and high mortgage repayments. However, as affordability improves with rate cuts, we expect more renters to enter the property market.

This shift is already evident among first-time homebuyers, who are becoming more active in anticipation of better conditions, as well as renters feeling market fatigue from rising rents and a lack of rental supply.

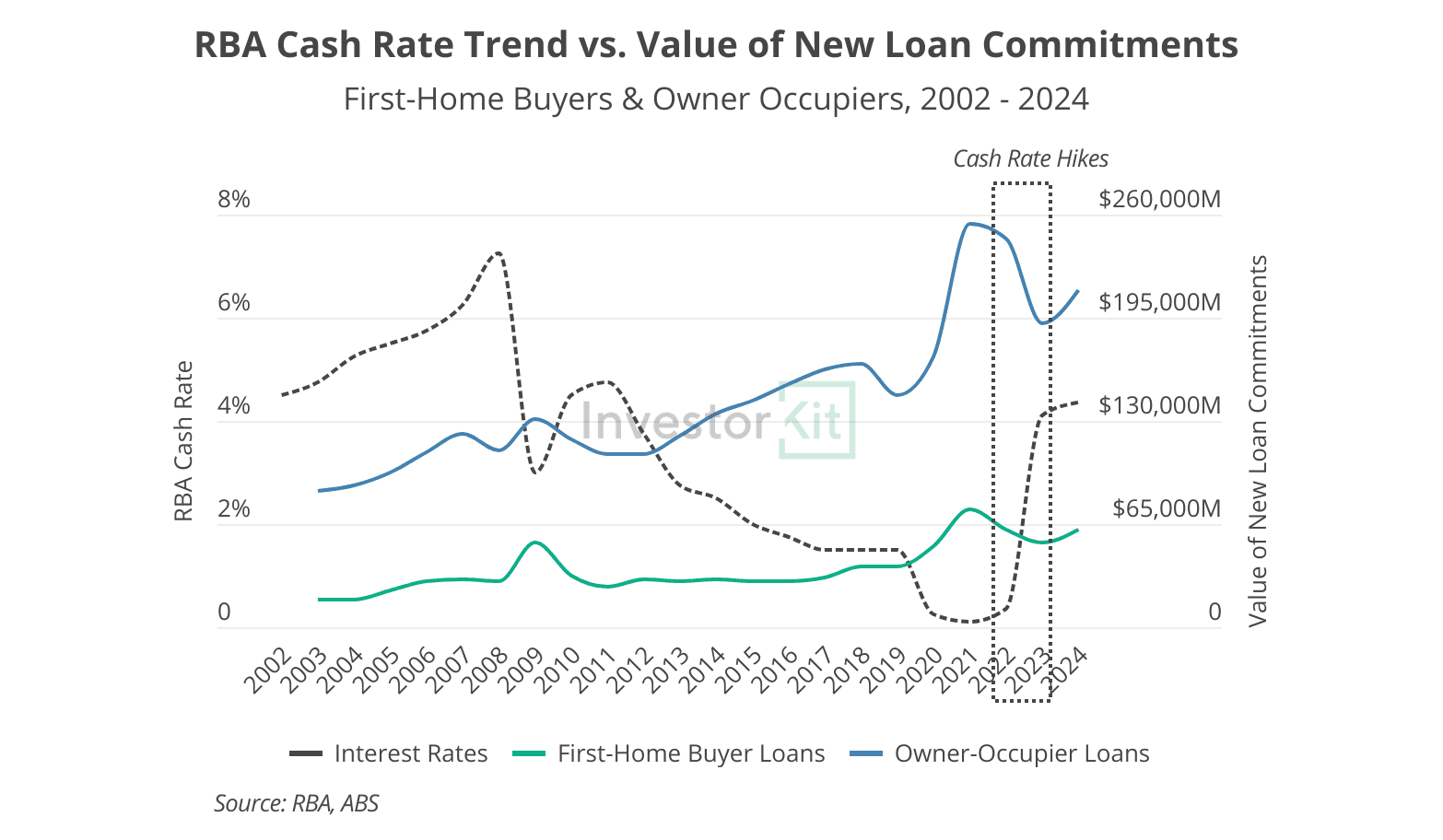

ABS data showed that the cash rate hikes between 2022 and 2023 suppressed the lending activities of both owner-occupiers and first-home buyers (Chart below). However, by Sep 2024, lending activities had shown a modest recovery. We expect the rate cuts to continue to drive this trend, similar to the patterns seen in 2009, 2013, and 2020.

3. Opening Up More Markets for Investors

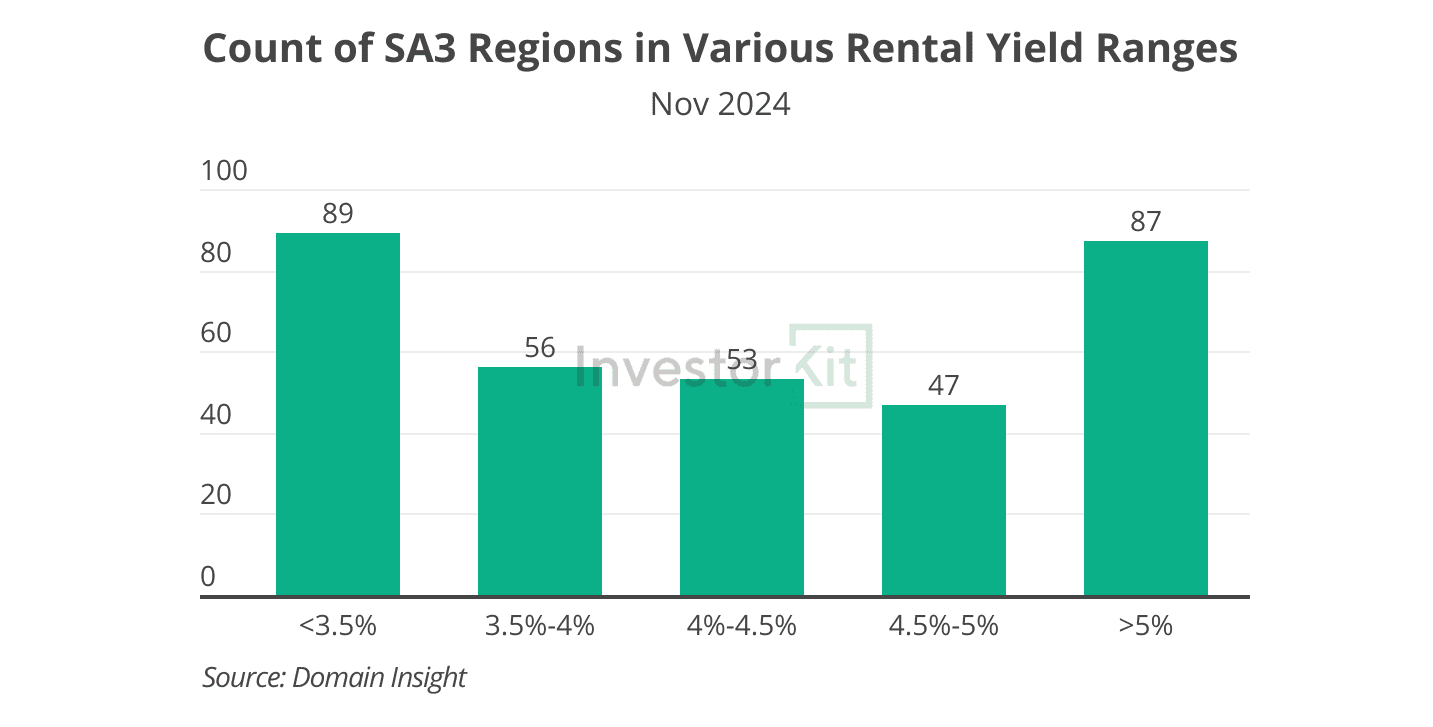

Not only do rate cuts encourage homebuyers to return to the market, but they also attract investors. When interest rates are high, investors heavily target high-yield (5%+) markets to maintain a balanced cash flow. As of November 2024, although 87 out of 330+ SA3 regions across the country had a rental yield of 5% or higher (see Chart below), less than one-third have a healthy, diverse local economy and active property markets.

The interest rate fall will create more options for investors as moderate yields (especially in the 4%—5% range) become healthier and more attractive. Domain Insight data shows that around 100 SA3 regions are within this yield range. This number is expected to increase next year, as rents have risen faster than property prices in many markets, such as Albury–Wodonga and Warrnambool, to name a few.

4. The Emergence of a New Trend: Upsizing!

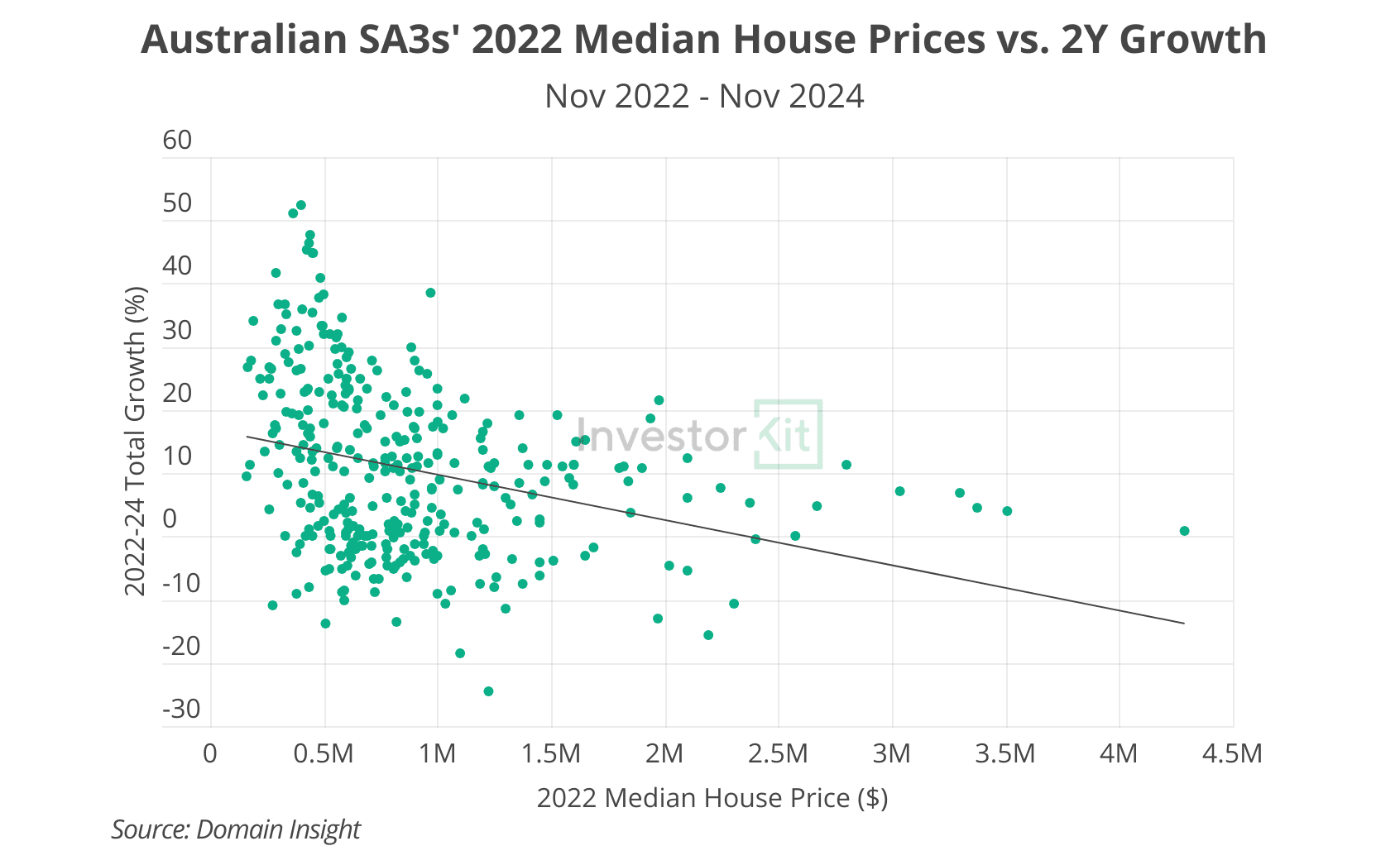

Over the past two years, affordable regions have achieved better growth than less affordable regions. Therefore, we’re seeing this emerging trend in many big cities where homeowners utilise their significant capital gains in more affordable suburbs to purchase larger homes or move to more desirable areas that they previously couldn’t afford.

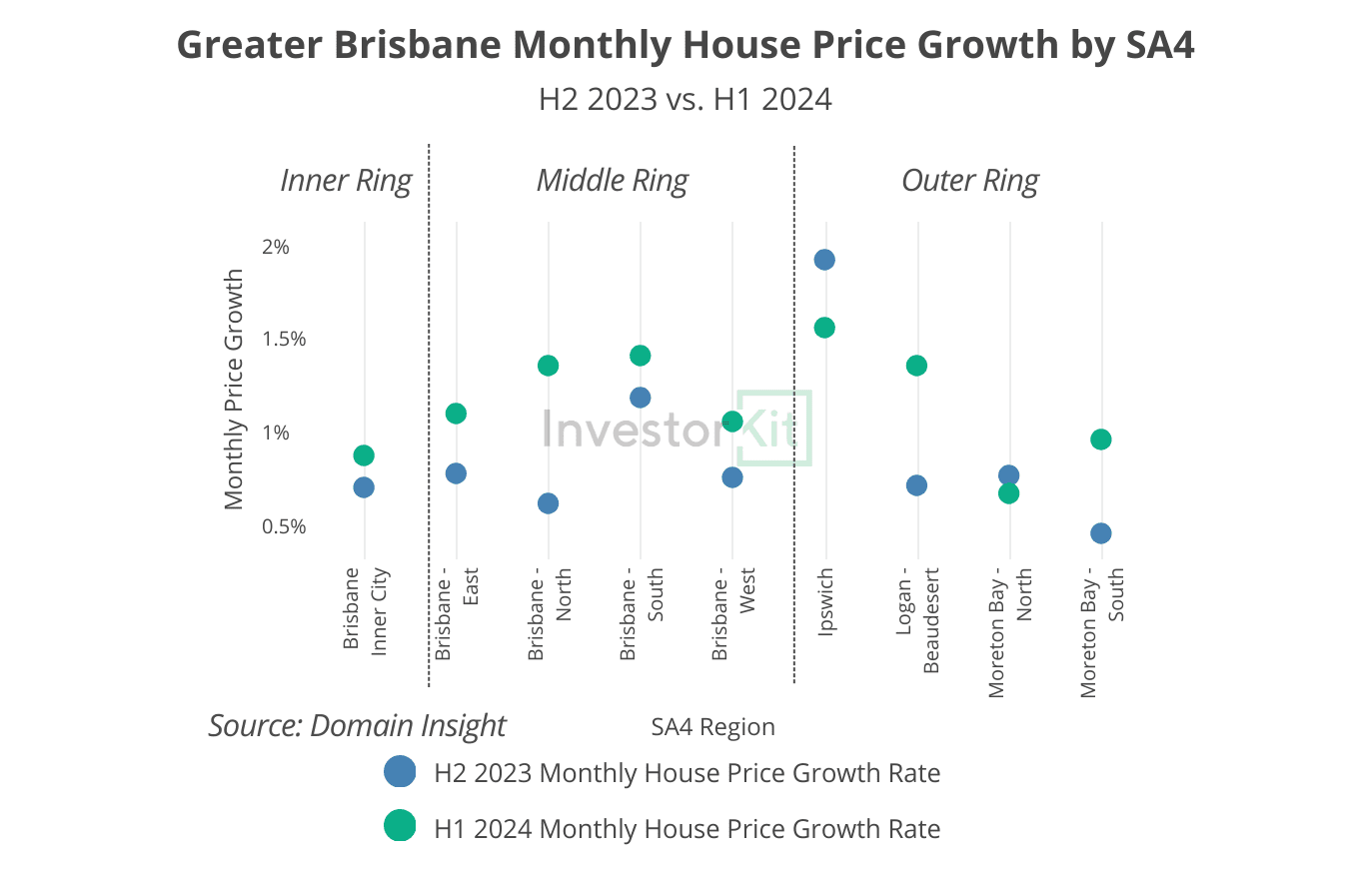

Let’s take a closer look at Brisbane, one of several major cities where this trend has gained momentum. The chart below reveals how monthly house price growth rates in Brisbane’s SA4 regions have shifted from the 2nd half (H2) of 2023 to the first half (H1) of 2024.

- All the inner and middle-ring regions, where house prices are more expensive, are seeing faster growth rates.

- Half of the outer-ring areas (particularly those more affordable ones) are slowing down.

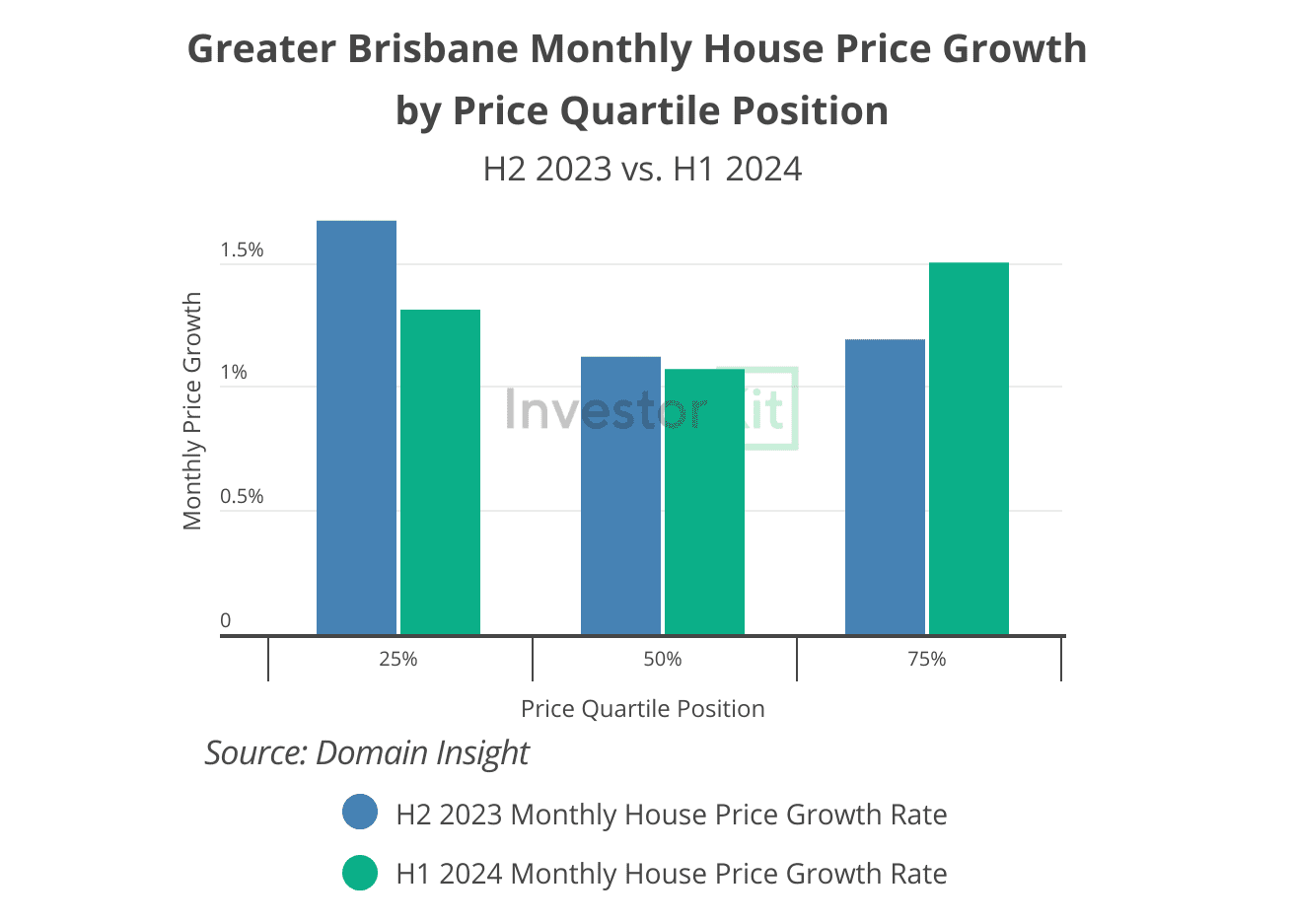

A similar pattern is observed across price ranges, too. House prices on the more expensive end, represented by the upper quartile (75%) price, have gained more growth momentum in H1 2024 compared to H2 2023, while growth in the lower quartile has notably slowed down (see Chart below).

With improved affordability from rate cuts, the upsizing trend is set to gain momentum further and become more widespread.

5. Enhancing Consumer Confidence

Enhancing buyer confidence can boost price growth, particularly in high-priced cities like Sydney and Melbourne, where affordability isn’t a priority in property investment.

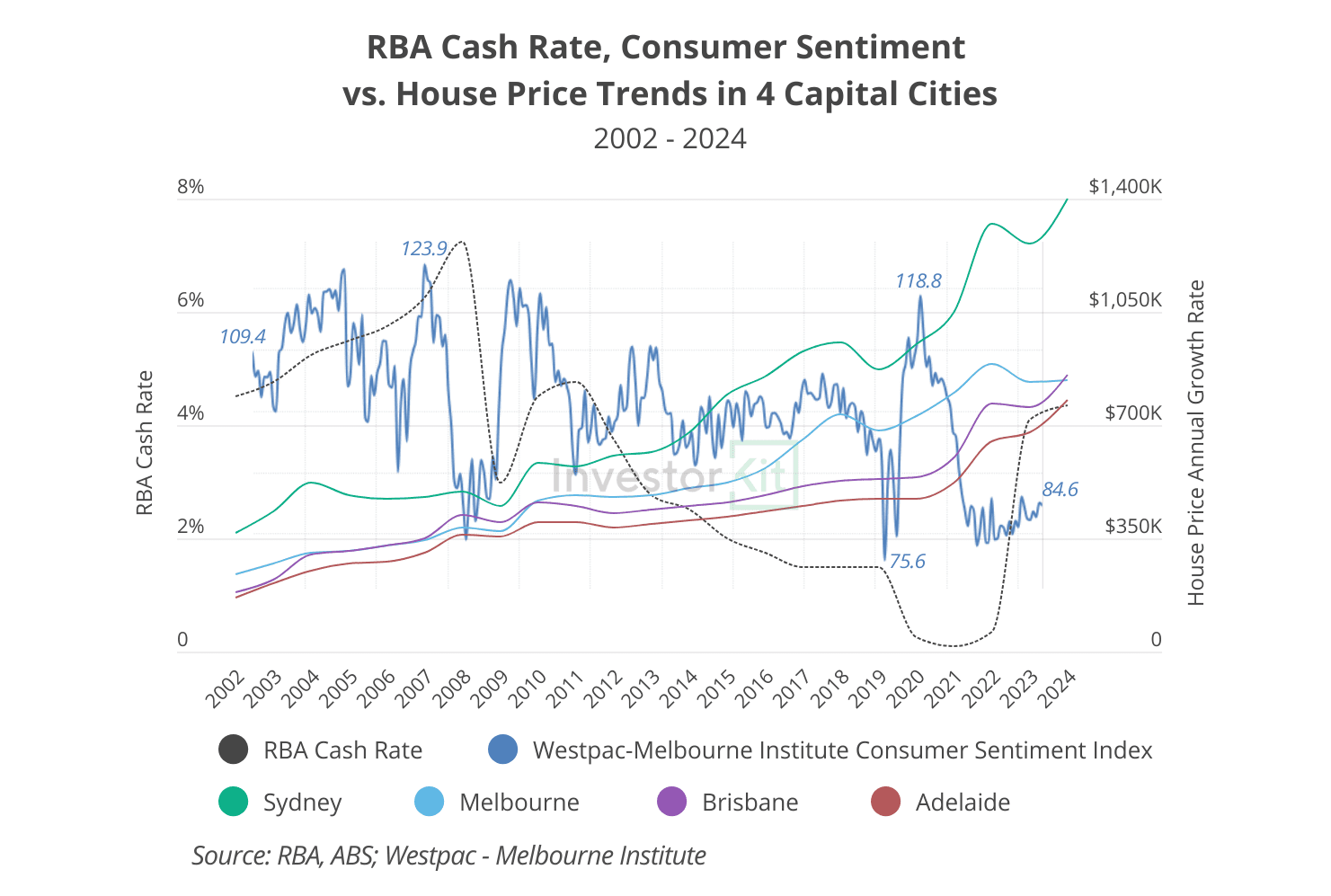

The chart below shows how house prices in four capital cities — Sydney, Melbourne, Brisbane, and Adelaide — have been influenced by the RBA cash rates and Australia’s consumer sentiment over the past twenty years. Sydney’s prices react the fastest and most strongly to changes in the cash rate and consumer confidence. Melbourne is less sensitive but still more affected by these factors than Brisbane or Adelaide.

In a nutshell…

Rate cuts can stimulate property market growth by improving credit availability, affordability, and buyer confidence, therefore attracting more homebuyers and investors. However, it’s important to note that cash rates in isolation will not cause a nationwide property boom. Historical data shows that not all markets respond to interest rate changes, with only those sensitive to rates being impacted.

The InvestorKit research team produced a whitepaper featuring 10 cities that are set to benefit from the rate cuts the most in different ways. To find out which cities they are, check out our whitepaper “10 Cities That Will Benefit from Rate Cuts the Most” by clicking here!

InvestorKit is a data-driven buyers agency dedicated to helping property investors identify and invest in the most suitable markets to their needs and fast-track their property investment journey. Would you like to speed up your portfolio-building process like a pro? Get in touch today for a free, no-obligation 15-minute discovery call!

.svg)