‘Which market is the most undervalued?’

This could be one of the most asked questions in 2025.

While the RBA has begun lowering the cash rate, mortgage rates are expected to remain high over the coming year. Affordable markets will continue to be highly sought after.

In the annually updated ‘Overvalued or Undervalued’ whitepaper, the InvestorKit research team reviews the relative affordability of 33 major cities nationwide based on their house prices and residents’ income levels. The 2025 version indicates that only 7 out of the 33 cities remain undervalued. In today’s blog, let’s uncover 4 of them. The last may surprise you.

Ballarat

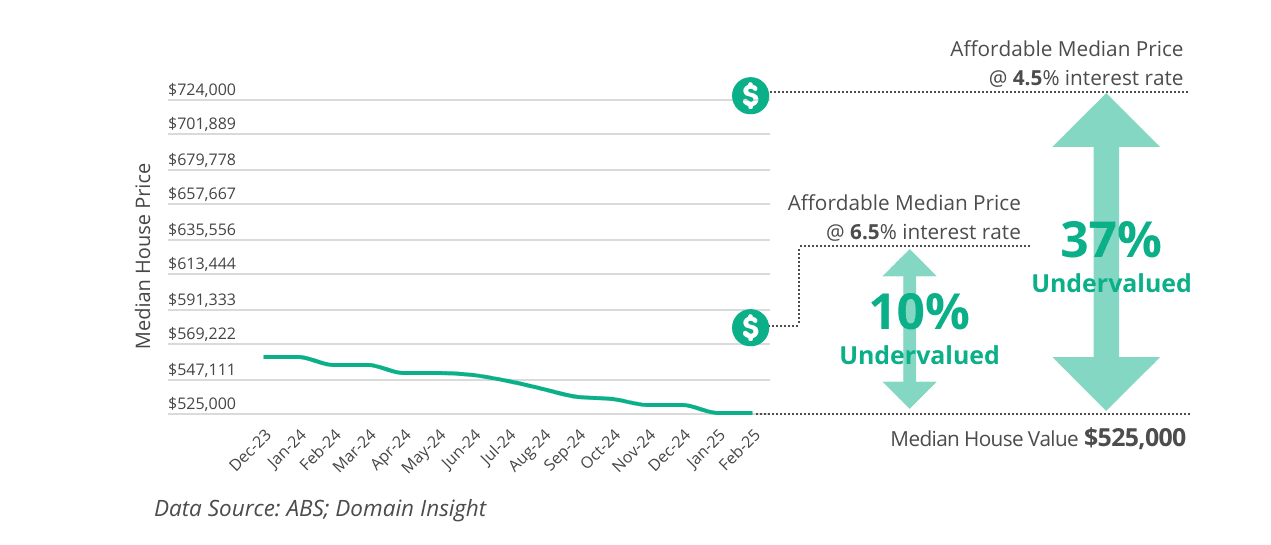

Ballarat’s house prices have been declining since late 2023, causing it to shift from an overvalued city to an undervalued one. Currently, the median price is undervalued by 10% when the home loan interest rate is 6.5% and would be undervalued by 37% if the home loan interest rate were to fall to 4.5% (chart below).

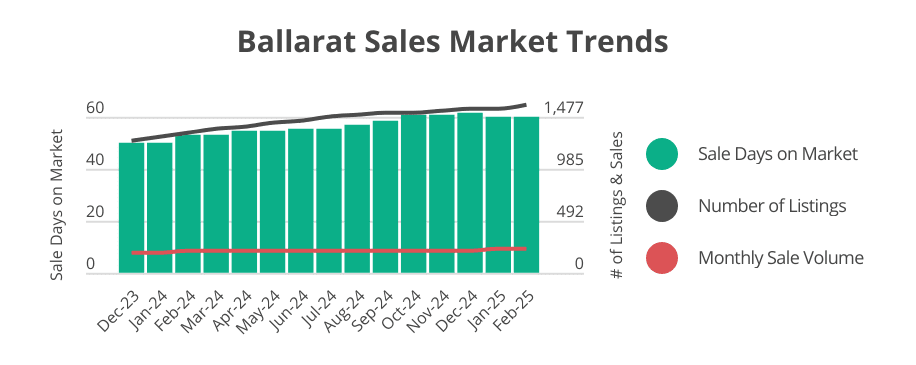

Market pressure has continued to ease over the past year, as evidenced by increasing inventory and elevated days on market (chart below), resulting in a -5.4% annual decline in house prices.

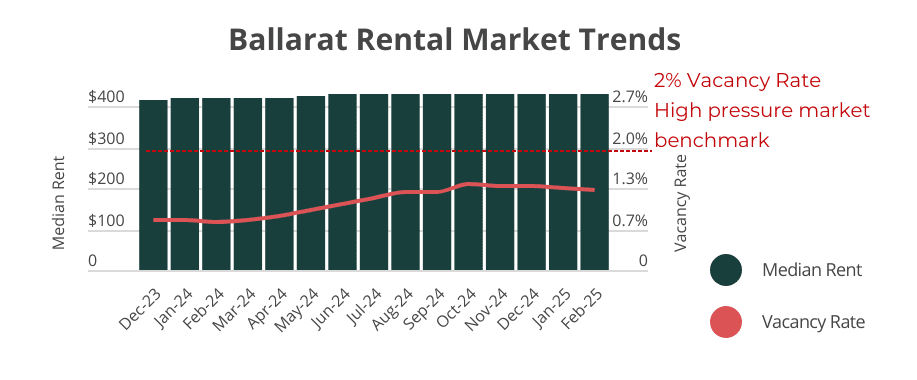

In the rental market, pressure is relatively high, with vacancy rates consistently below 2% (chart below). Investors can expect a moderate yield of 4.3%.

Given Ballarat’s low market pressure, we expect the city to stay low-key for the remainder of 2025, gathering momentum for the next growth cycle.

Greater Darwin

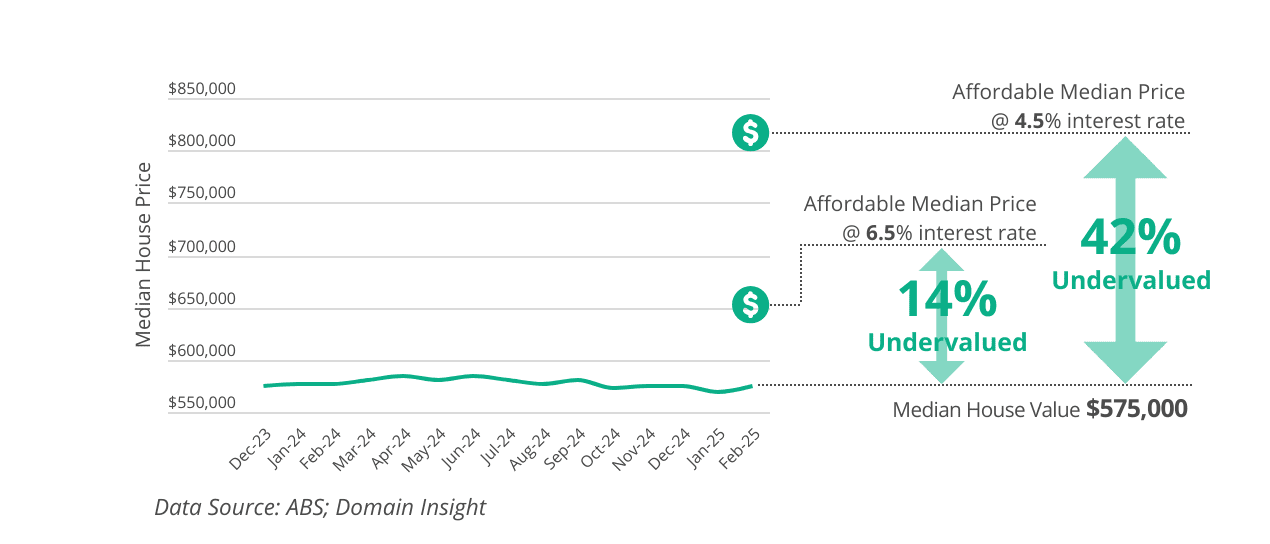

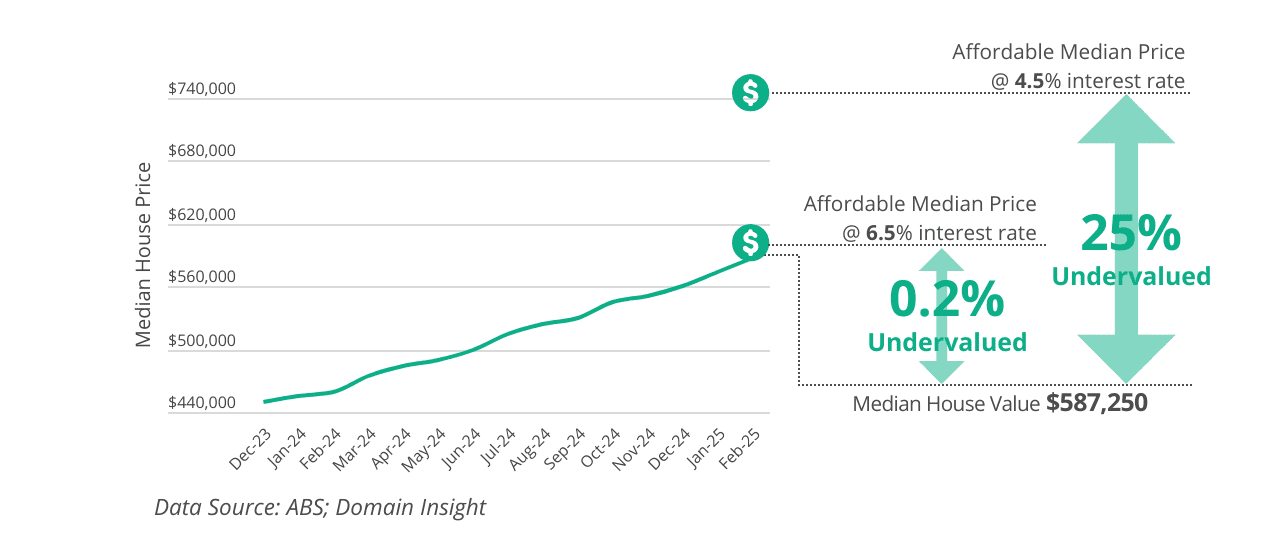

Darwin’s house prices didn’t effectively grow over the past 3 years. It is now the only undervalued capital city in Australia. Its median house price is lower than the affordability level by 14% when the home loan interest rate is 6.5%, and would be undervalued by 42% if the interest rate were to drop by 2% (chart below).

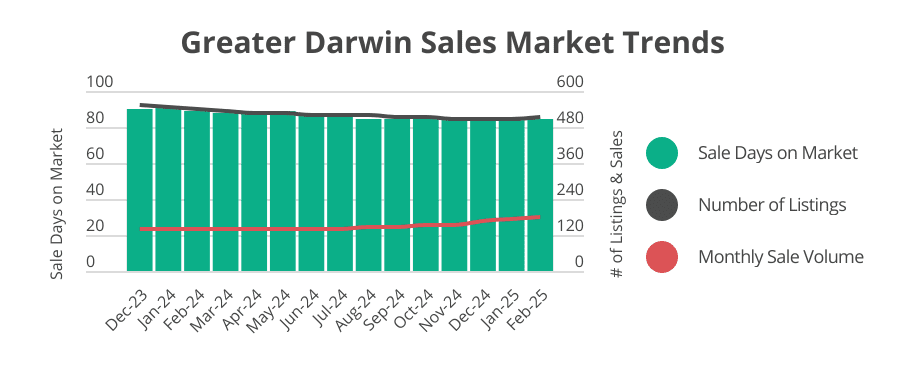

The pressure in Darwin’s sales market is improving, with declining for-sale listings, rising sales volume (especially since the end of 2024) and declining sale days on market (chart below).

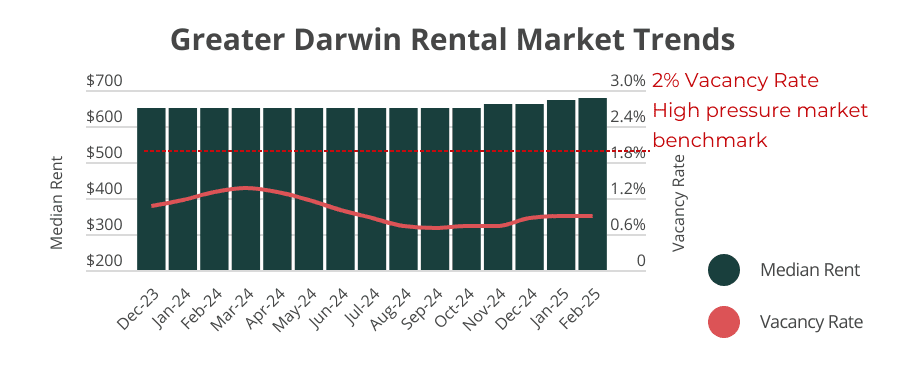

In the rental market, pressure is high, with vacancy rates below 1% (chart below). Investors can expect the highest rental yield among all capital cities – 6.2%.

The improving market pressure suggests that Darwin is expected to grow faster in the rest of 2025. However, it is noteworthy that mining is the dominant industry in the Northern Territory, making the local economy less resilient than the other states.

Bunbury

Having grown by 28% in the past year, Bunbury is quickly losing its affordability. The median house price is now undervalued by just 0.2% at a 6.5% interest rate and would be undervalued by 25% if the home loan interest rate were to decrease to 4.5%.

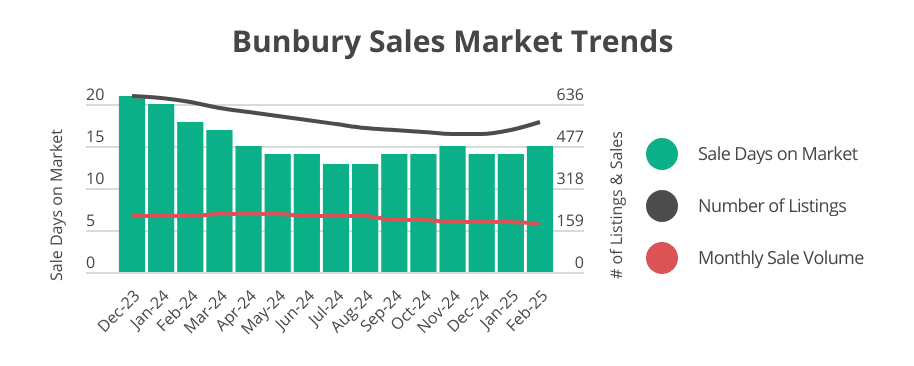

Bunbury sees high market pressure with extremely low inventory levels and sale days on market. However, there have been signs of pressure relief, such as the recent uptick in for-sale listings and the gradual rise in days on market. Growth could gradually slow down in the coming year.

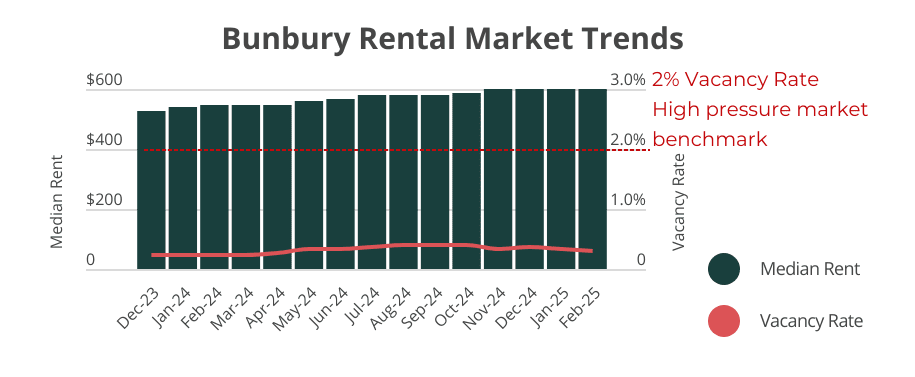

On the rental side, vacancy rates are at crisis levels (0.3%), indicating high pressure. Investors can expect a healthy average rental yield of 5.5%.

Given Bunbury’s high market pressure in both the sales and rental markets, we expect further solid growth in the rest of 2025.

Mackay

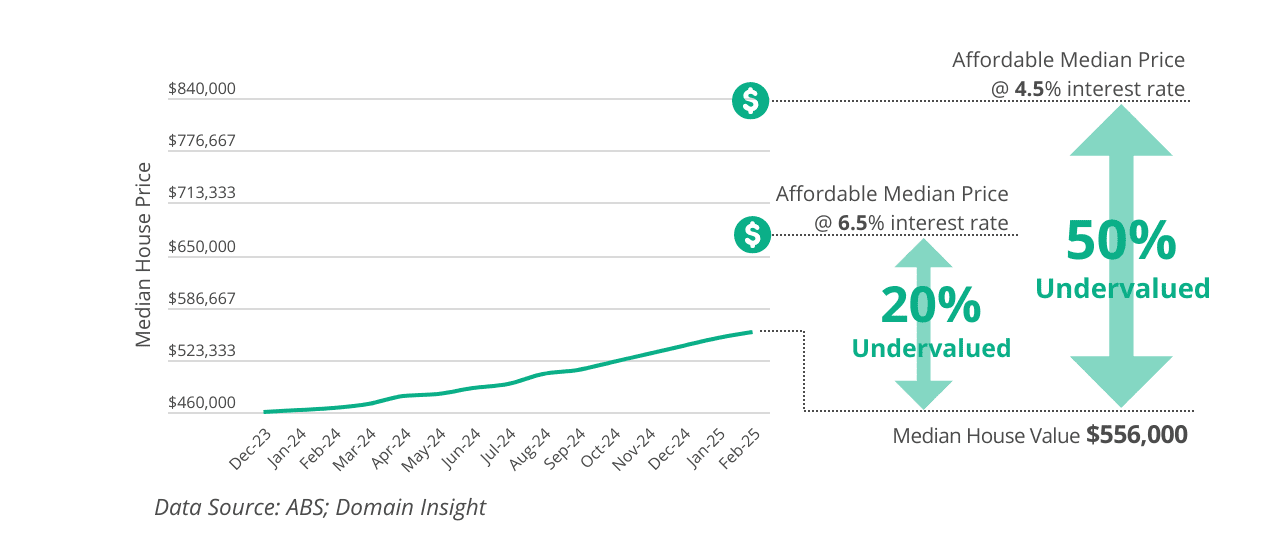

Mackay, along with many other North Queensland markets, is one of the hottest markets now. With 17% growth in the past year, Mackay’s affordability is dropping fast, yet it remains the most undervalued among the 33 cities.

The current median house price is below the affordable threshold by 20% when the home loan interest rate is 6.5%, and would be undervalued by 50% if the home loan interest rate decreased to 4.5%.

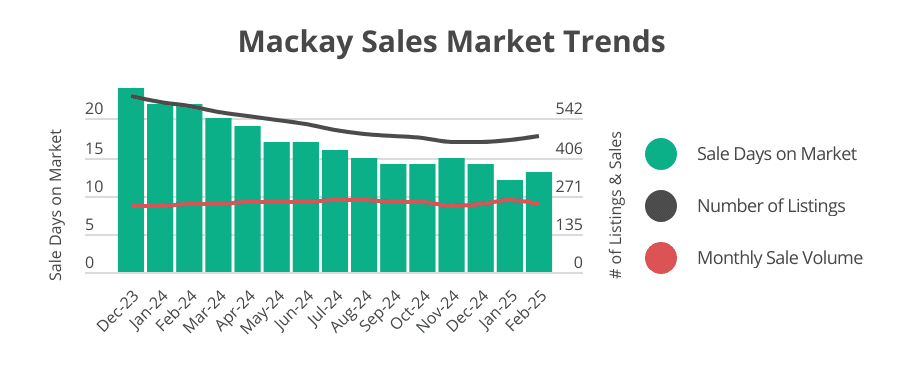

Market pressure has been increasing steadily in 2024, with fast-dropping inventory and sale days on market (chart below).

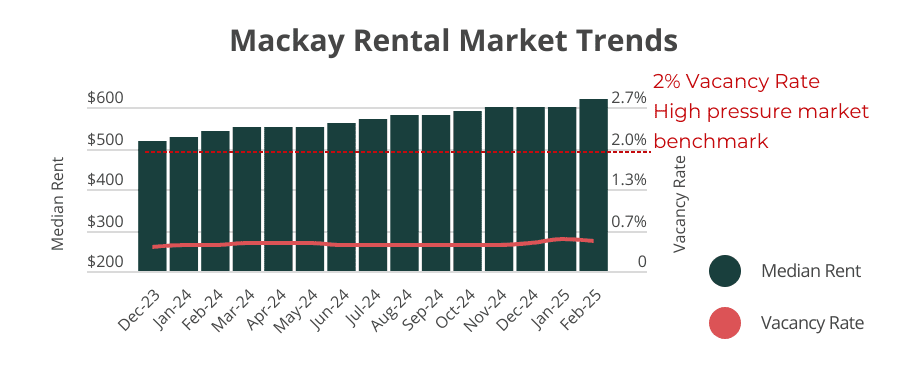

In the rental market, vacancy rates remain at a crisis level of around 0.5%. Investors can expect a high rental yield of 6.2%.

Given the high market pressure, we expect another year of robust growth in Mackay. For investors, Mackay’s downside lies in its weaker economic resilience, which is similar to that of Greater Darwin. Mining contributes to 27% of Mackay’s economic output, higher than Queensland’s average (12%) or the Australian average (10%). The heavier reliance on this single industry makes it less resilient to shocks.

To find more information on relative affordability and market pressure of the 33 top populated cities, check out the whitepaper here: Overvalued or Undervalued? 2025 Edition.

InvestorKit is a data-driven buyer’s agency dedicated to analysing not just the property market trends but also every influencer of the property market, such as relative affordability, to achieve a holistic view of how markets move. Our holistic approach has helped countless clients seize opportunities and achieve their financial goals faster. Would like to have an assistant like InvestorKit for your next purchase? Book your 15-min FREE no-obligation discovery call today!

.svg)