“City dwellers still flocking to the regions.”

That is the first conclusion that Regional Australian Institute (RAI)’s Dec 22 Quarter Regional Movers Index (RMI) Report reaches.

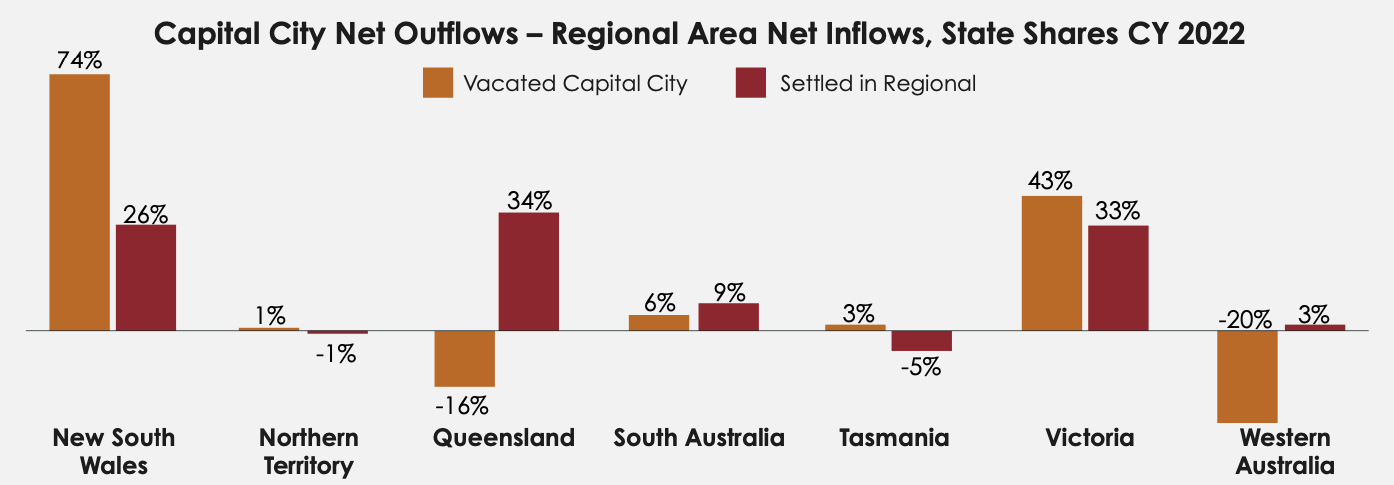

One year into the post-pandemic era, the population flow from capital cities to the regions has remained elevated, as shown in the chart below.

While the total inflow to regions remains high, the net inflow has declined to a point close to 3 years ago (the upper chart below) as migration from regions to the capital cities recover (the lower chart below).

The top 5 internal migration gainers in the latest RMI report are listed in the chart below.

The internal migration inflows have boosted the five cities’ property market, leading to impressive annual growth (Dec 21-Dec 22) in house prices even with back-to-back interest hikes:

· Sunshine Coast – 16.4%

· Gold Coast – 14.0%

· Greater Geelong – 12.2%

· Fraser Coast – 19.8%

· Bundaberg – 22.6%

(Source: APM)

These cities’ robust house price trends have proved that gaining internal migrants benefits the local property market growth a lot. However, is internal migration a must for property market success? If a region is not receiving that many internal migrants or even losing some, is its property market doomed?

We’ll find that out today with 3 cities’ internal migration and property market trends.

Greater Sydney – A city receiving more overseas migrants than losing internal migrants

Greater Sydney has been losing residents to other regions for years and was the no.1 internal migrant source last year (below chart).

However, the loss of residents internally didn’t seem to be a big problem to Sydney’s housing market. In the past 10 years, Sydney’s house prices more than doubled albeit the increasing migrant outflow and achieved its annual growth record (36.4% as of Sep 2021) in 2021 with the worst internal migrant loss (chart below).

In contrast, Greater Brisbane has been a big winner of internal migrants, receiving an increasing number of internal migrants over the past decade. Still, its house prices only achieved circa 75% 10y growth, much lower than Sydney’s.

The internal migrant loss doesn’t impact Sydney’s house price growth much for many reasons. Among the top ones is that overseas migrants constantly strengthen Sydney’s housing demand.

Sydney is one of the two major immigrant destinations in Australia, receiving close to one-third of all overseas migrants every year before the COVID disturbance (below chart). The incoming immigrants make sure of Sydney’s population growth and keep the city’s housing demand high, pushing housing prices to grow.

How about regional areas where overseas migration doesn’t influence the property market much? Let’s turn our eyes to regional cities.

Armidale (NSW) – An economy with a balanced industry structure

Armidale has experienced negative net internal migration for the past decade (below chart).Although ABS hasn’t released its SA3-level internal migration data for 2022, Armidale not making it to RAI’s latest RMI list indicates that its 2022 net internal migration number was either negative or less than 50.

In comparison, the Queensland city Bundaberg has been much more of an internal migration winner in recent years. It has been receiving a positive number of internal migrants for five years and became the no.5 largest net internal migration gainer in 2022.

Having lost residents for a decade, did Armidale’s property market perform poorly?

The chart below shows Armidale’s median house price trend over the past decade compared to Bundaberg’s.

Armidale achieved a higher 10-year growth than Bundaberg and scored an impressive 23.5% annual growth in 2022, compared to Bundaberg’s 22.6%.

Other internal migration losers that performed well in the property market include Wagga Wagga (NSW), Shepparton (VIC) and Launceston (TAS):

– Wagga Wagga has been losing residents internally since 2017 and barely made it into RAI’s Dec 22 RMI list (4th from the bottom); However, its median house price scored a 21.4% annual growth in 2022 and an 85.5% 10y growth.

– Shepparton has been losing residents to other regions since 2011 and didn’t make it to the RMI list (meaning it scored either negative internal migration or less than 50 people inflow in 2022) yet achieved a 16.9% house price growth in 2022 and an 83.7% 10y growth.

– Launceston started losing residents in 2019 and didn’t make it to the RMI list, but its house prices grew by 20.8% in 2022 and 118.9% in the past 10 years.

According to the Australian Government Centre for Population, living costs and job opportunities are among the top reasons for people to move inter cities. For regional cities where life is generally affordable, job opportunities are the leading cause. When one or two industries in an area decline and bring job opportunities down, employees would either change industry or move away, and the latter leads to internal migration outflow. Cities with a balanced industry structure, such as the ones mentioned above, are more resilient to such a situation as they have other industries to keep the economies’ strength or to rejuvenate the economy in a fair amount of time.

However, it’d be different when a region is dominated by a single industry.

East Pilbara(WA) – An economy dominated by Mining Industry

East Pilbara isa perfect example of an economy dominated by a single industry: Mining accounts for 96% of the region’s output and 79% of jobs.

When mineral prices dropped significantly in the mid-2010s, East Pilbara’s experienced a sharp increase in resident outflow, and its median house price followed and declined steeply as well (below chart).

As the mining industry recovers and internal migration loss reduces, the local house prices gradually increase, but it’ll take quite some time to reach the same level as a decade ago.

Having reviewed all the above cities, you must have noticed that while internal migration is important to a local economy and property market, it’s not the only influencer. For Sydney and Melbourne, where overseas migration inflow dominates, the impact of internal migration loss is offset by the constant incoming immigrants; For economies with balanced industry structures, the loss of internal migration is not powerful enough to impact the whole economy and the overall housing demand significantly in a short time; However, economies dominated by a single industry are the most vulnerable to internal migration loss, and can easily suffer from price suppression if they cannot develop a more diverse industry structure.

In InvestorKit, we never examine markets with any isolated indicators. Every location is assessed from all data points – demographics, economics, construction activities, sales and rental market pressure, etc. That is why we do not limit our options to high net internal migration regions (eg. Bundaberg, Toowoomba, Port Macquarie, etc.) and identify growing hotspots with low/negative net internal migration (Wagga Wagga, Shepparton, Armidale, etc.). Would like to work with us and find your next fast grower? Click here and request your 45-min FREE no-obligation consultation today!

.svg)