I only have a $500K budget. Can I still find a nice investment house with that?”

“What do current property trends in Australia indicate about investment property costs in 2024?”

“My budget is big, but which is the best city to invest in australia with high growth property and where should I invest to make a good profit?”

Property investment can be difficult if you don’t know where to look, no matter your budget.

In this blog, let us show you three property hotspots worth investing in, with three varied investment property costs:

Under $500K: Townsville, Queensland

Under $750K: Toowoomba, Queensland

Under $1M: Campbelltown, South Australia

Our analysis reveals that these three property hotspots are under high market pressure in both the sales and the rental markets, which would lead to further healthy growth in value and rents.

Would you like to take a look at some of the high growth property areas in Australia? Let’s go!

Townsville

Median Price – $430K

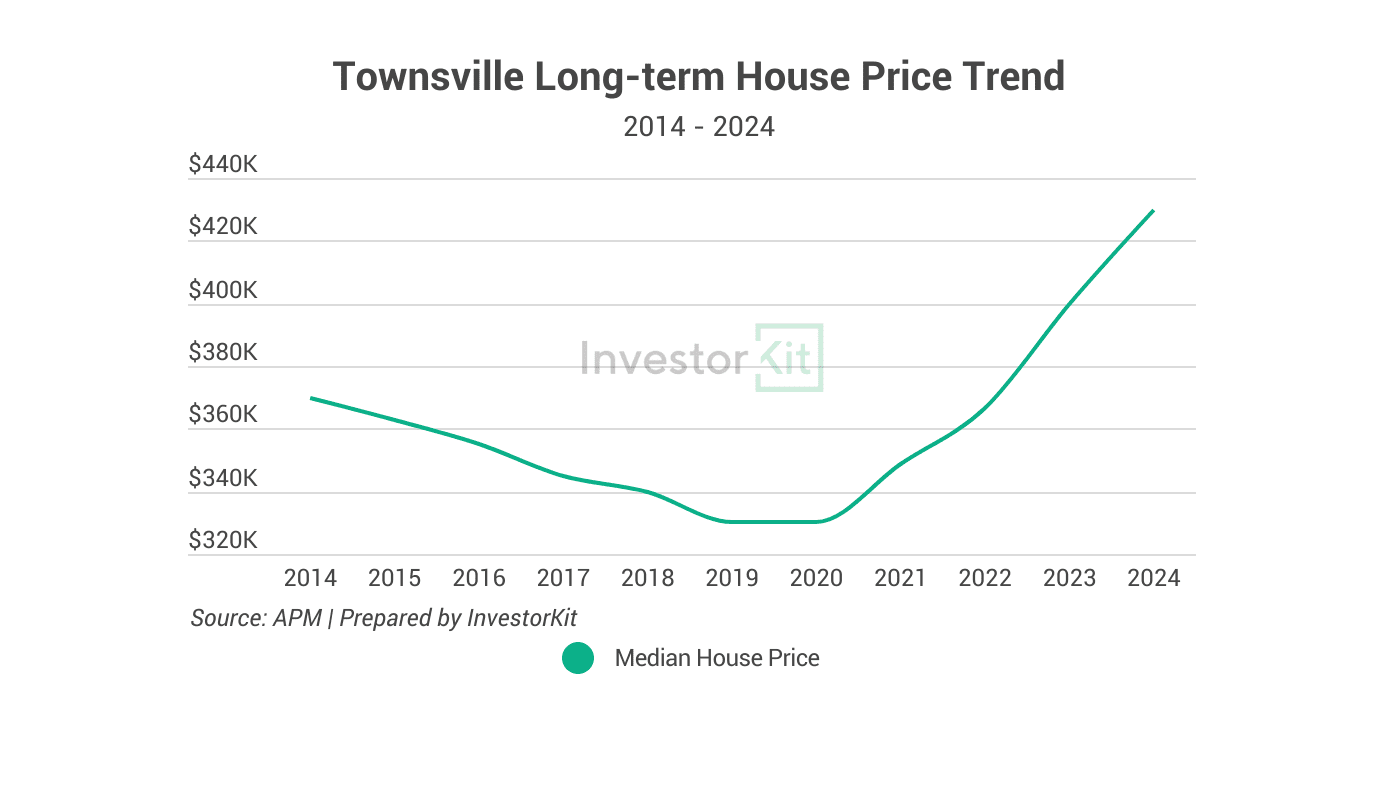

Townsville is known as the “Capital of Northern Queensland” and is located on the northeast coast of Queensland. It is the biggest settlement in North Queensland and Northern Australia, with a population of 201,433 (2023 ERP / estimated resident population). According to the latest property trends in Australia, the housing market has been bouncing back since 2020, after a 6-year plummet in property prices from 2014 to 2019, as the economy began to regain strength.

The thriving economy is backed by numerous large infrastructure projects with a total value of about $11 billion in public and private investment that are either underway or in the pipeline. These include energy, transport, tourism, defence and education projects that would generate thousands of jobs.

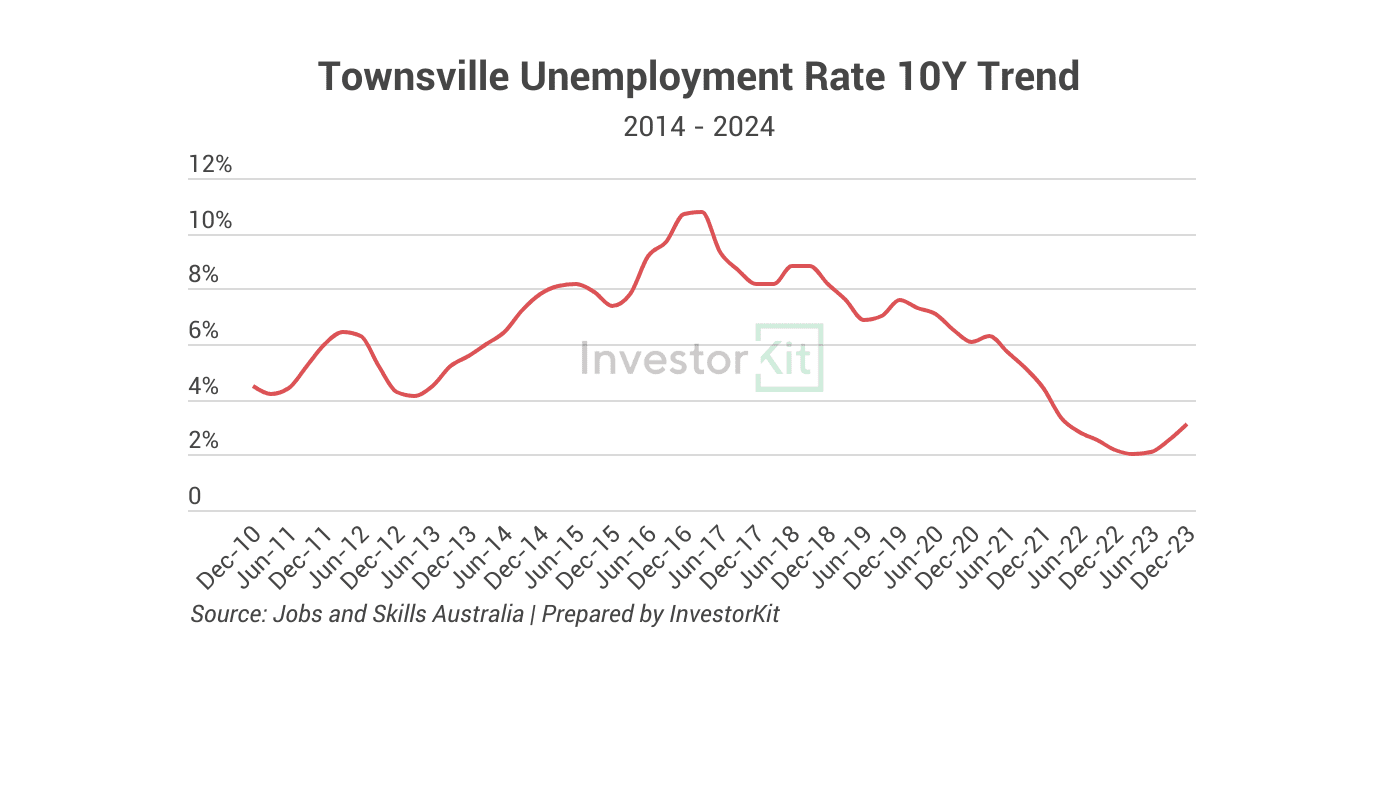

As a result of the active job market, Townsville’s unemployment rate is now 3.1% (chart below), one of the lowest across regional Queensland cities.

High Pressure in the Sales Market

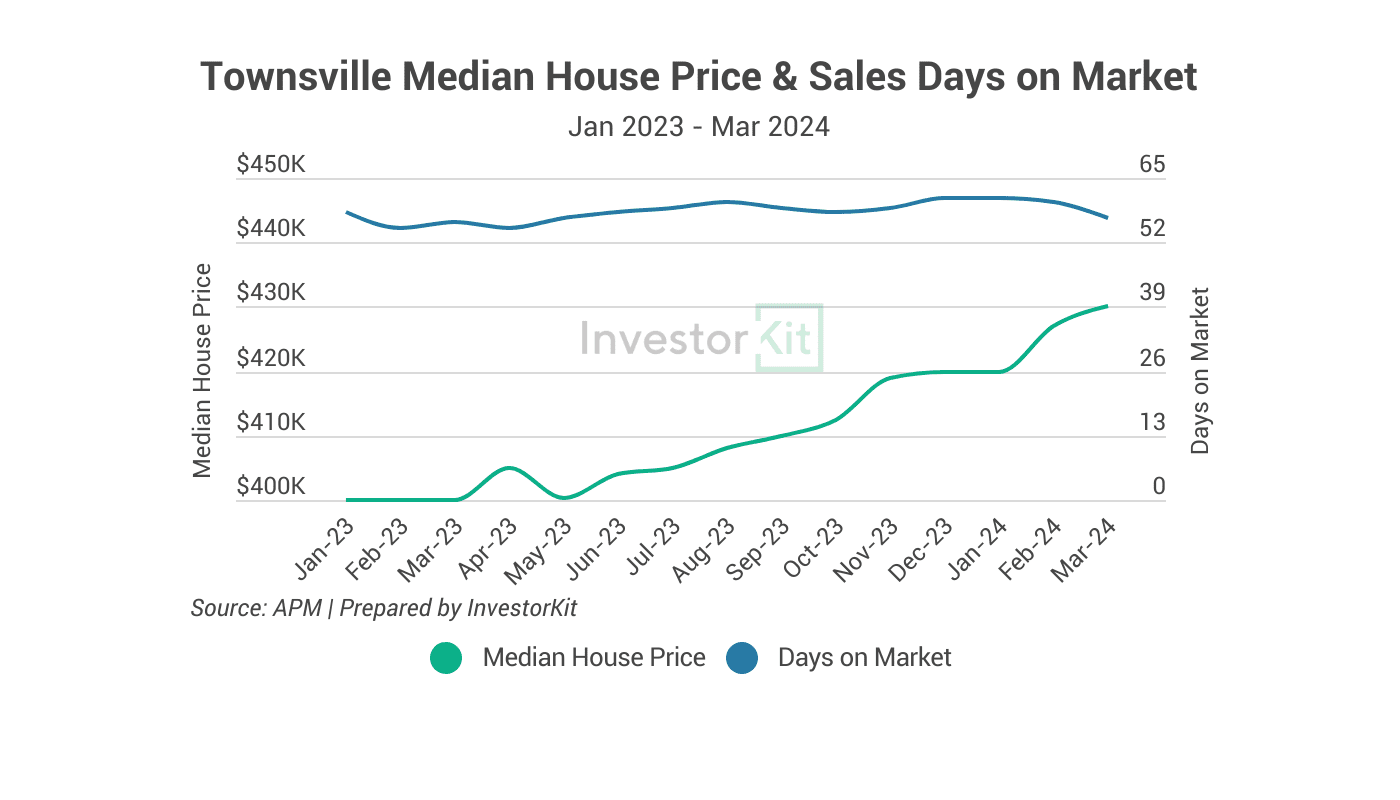

Townsville’s sales market is under high pressure. The median house price has increased steadily over the last 15 months, up +7.5% in a year and currently at $430k. Sale days on market (DoM) has stabilised at around 60 since mid-2023 and is now showing a downward trend (chart below).

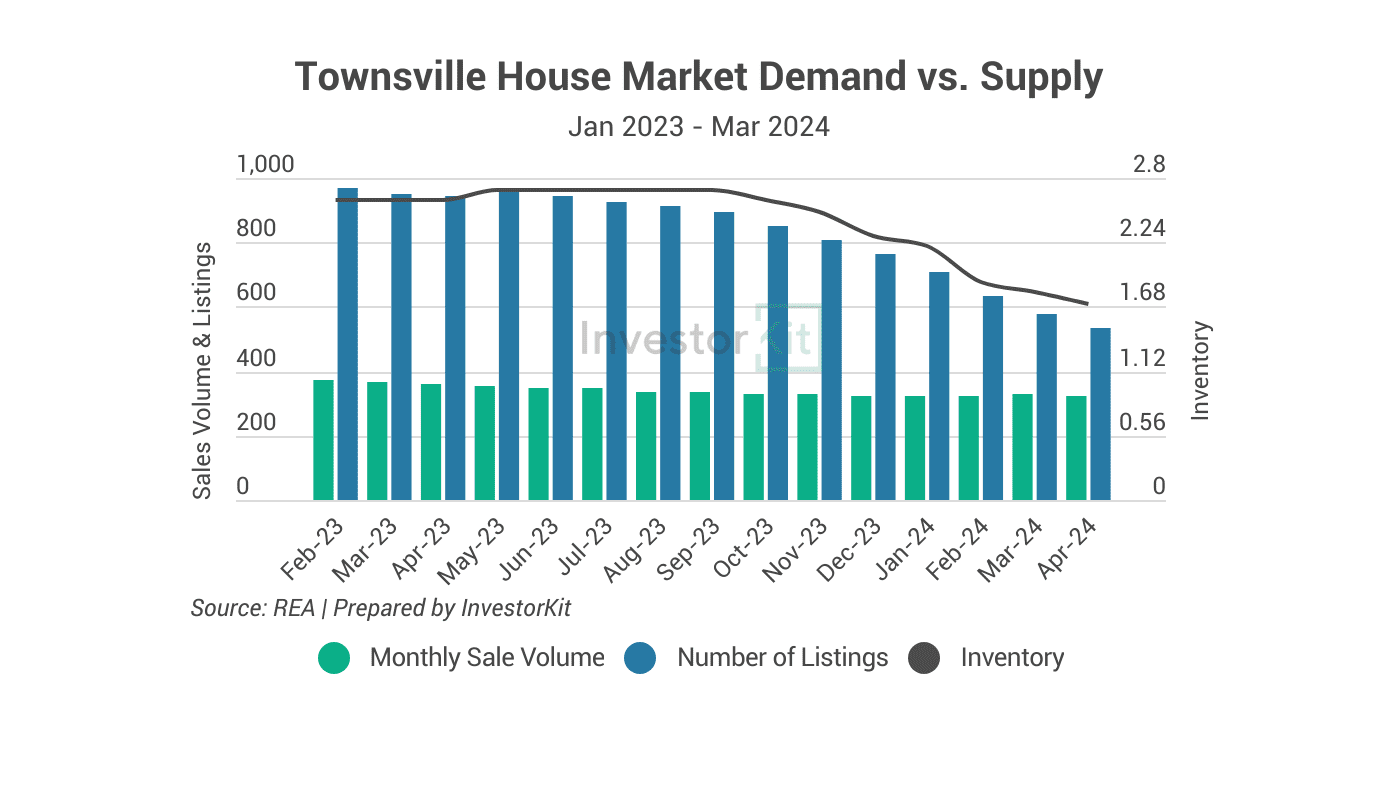

The high market pressure can also be seen in the relationship between demand (monthly sales volume) and supply (number of listings). While the monthly sales volume is lower than a year ago, the number of listings has dropped much more (chart below).

The sharp fall in for-sale stock has led to a 34.6% decline in the inventory level in a year to an extremely low 1.7 months of stock, and there’s no sign that the decline is stopping any time soon.

Market-cycle wise, Townsville is at a relatively early stage of this growth cycle. Compared to a decade ago, house prices only increased by 16.2%. There is much space ahead for further robust growth.

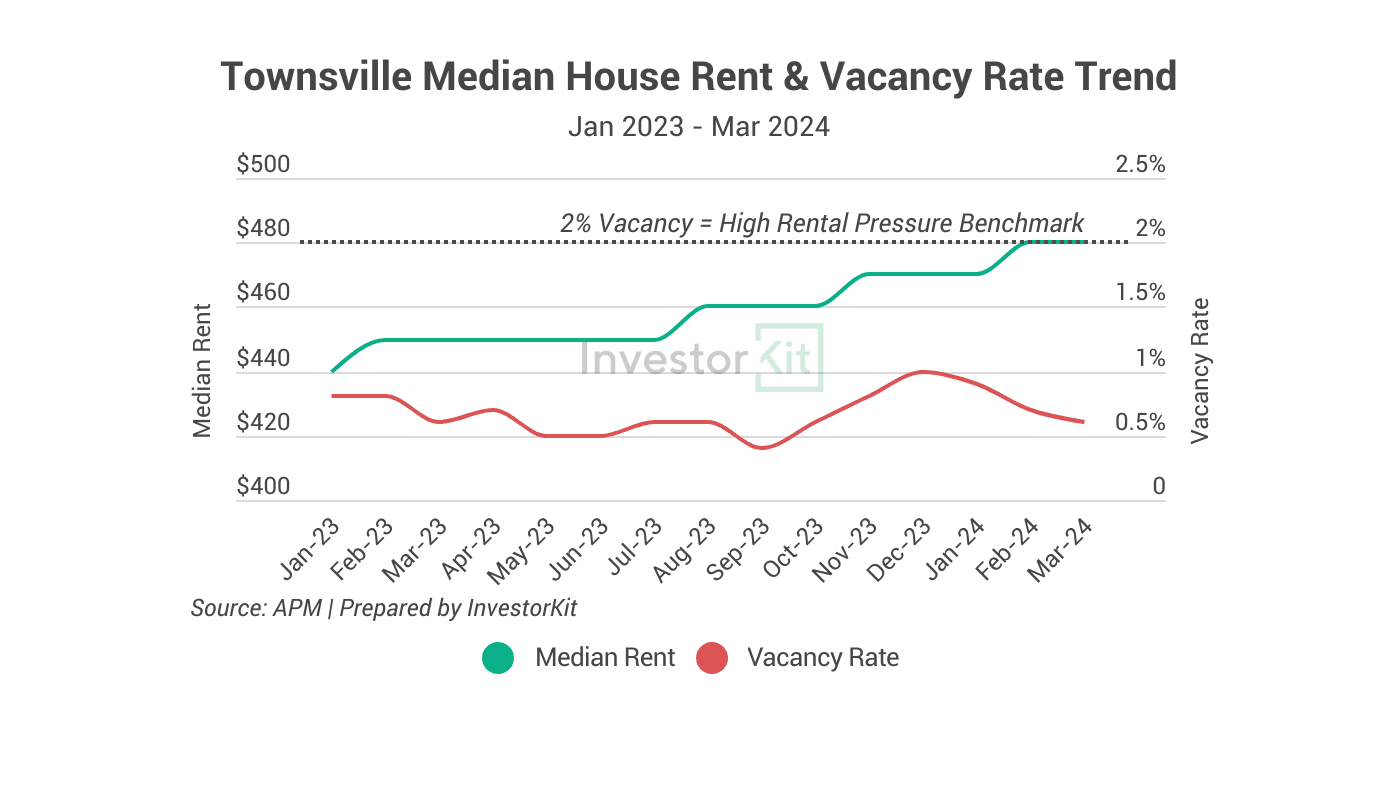

Tight Rental Market

In the rental market, Townsville is also under high pressure. The vacancy rate is at a low level of 0.6%, leading to a 6.7% annual rental growth. As the rental market hasn’t yet shown any relaxation signs, we anticipate further healthy growth in rental prices in the coming year.

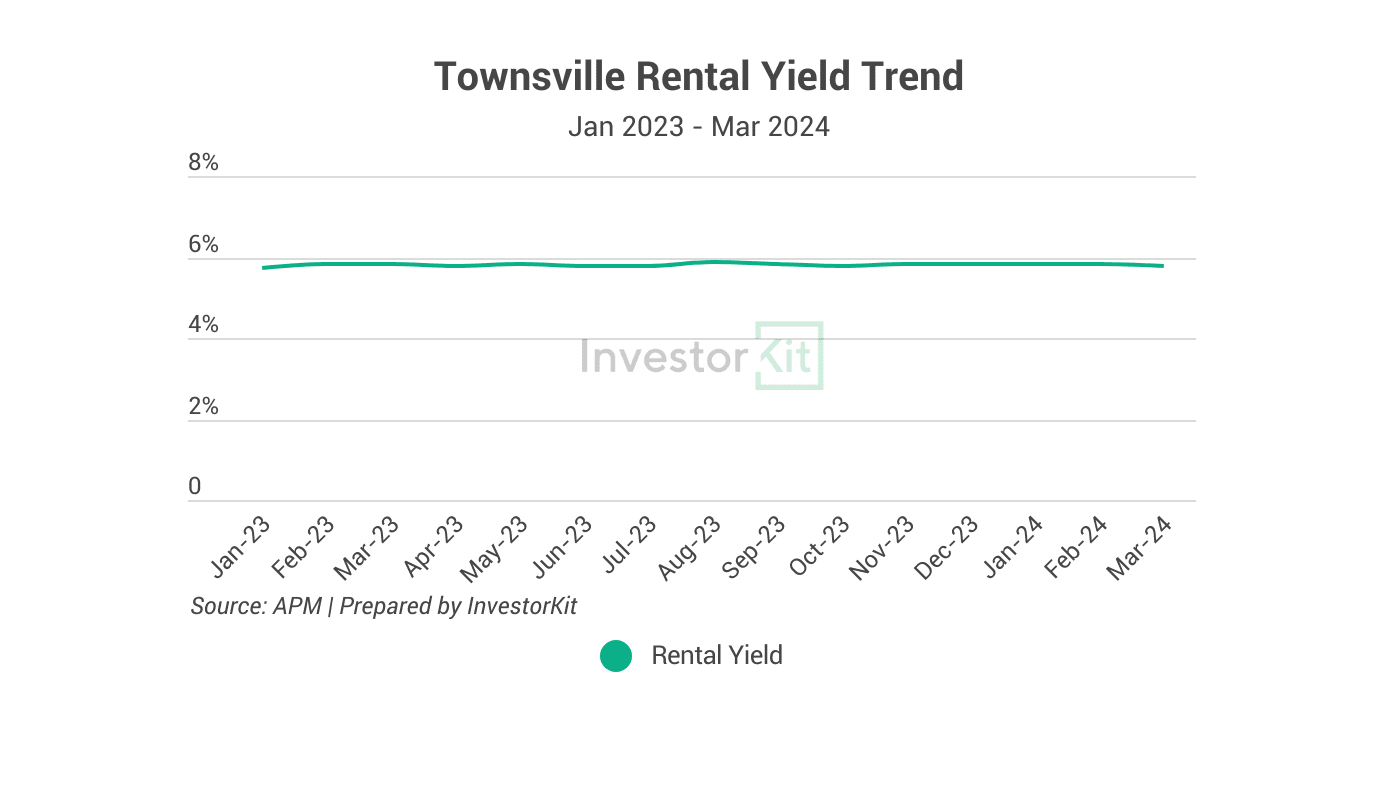

In the meantime, rental yields have remained high at around 5.8%, a quite healthy number in the current high interest rate environment.

Toowoomba

Median Price – $595K

Toowoomba is a city in the Darling Downs region of Queensland, located 125 km west of Brisbane. It is the second-most-populous inland city in the nation, with a population of 181,821 (2023 ERP).

Toowoomba’s local economy has been growing strongly since 2020, making it one of the high growth property areas in Australia. The region’s balanced industry structure supports sustainable economic growth, with Health Care & Social Assistance, Education & Training and Construction being the largest contributions to job creation.

Toowoomba is undergoing a significant transformation through a large number of diverse infrastructure projects, from energy, transport, and logistics to resources. In the coming years, it is expected to become one of the most vibrant and diverse regional communities in Queensland.

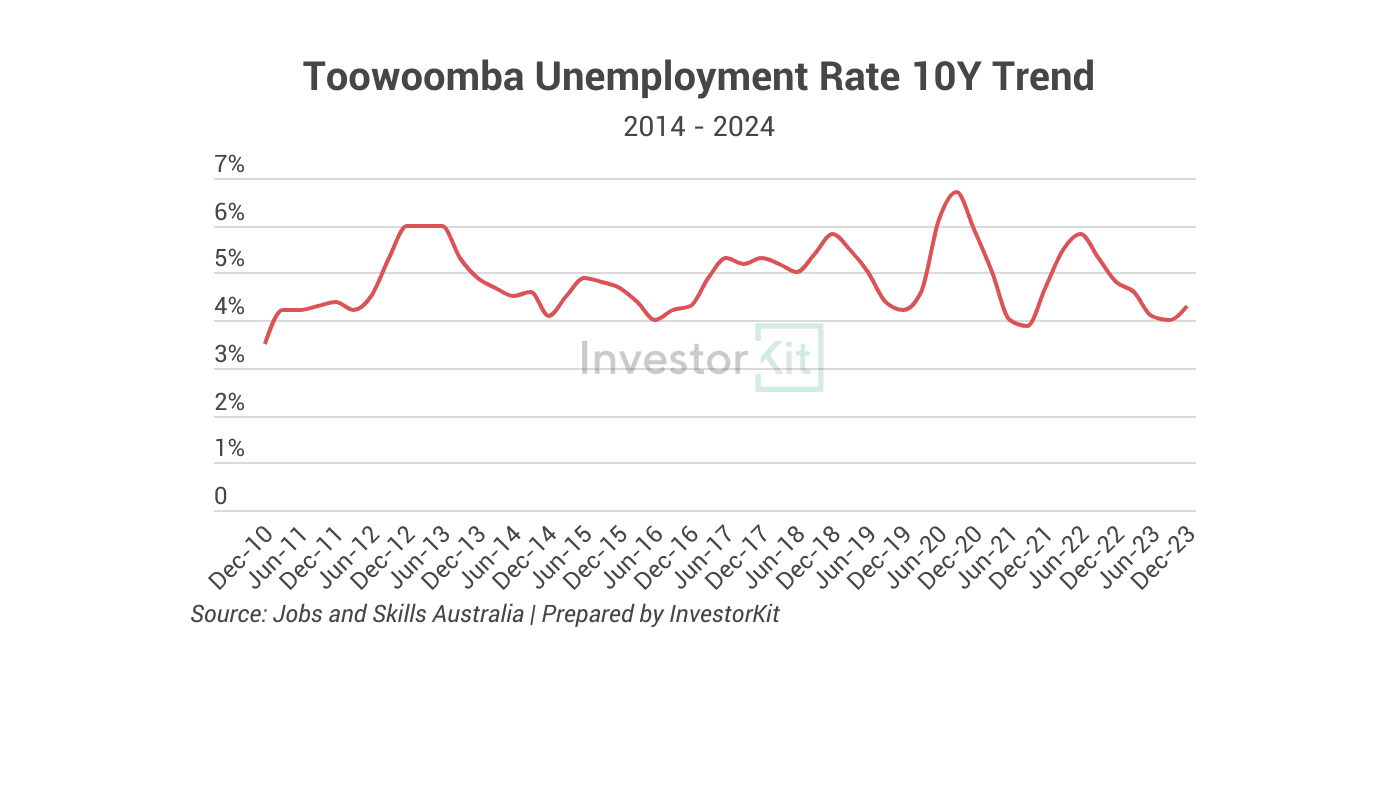

The strengthening economy has led to a healthy unemployment rate, currently at 4.3% (chart below), lower than its past decade average (4.9%).

High Pressure in the Sales Market

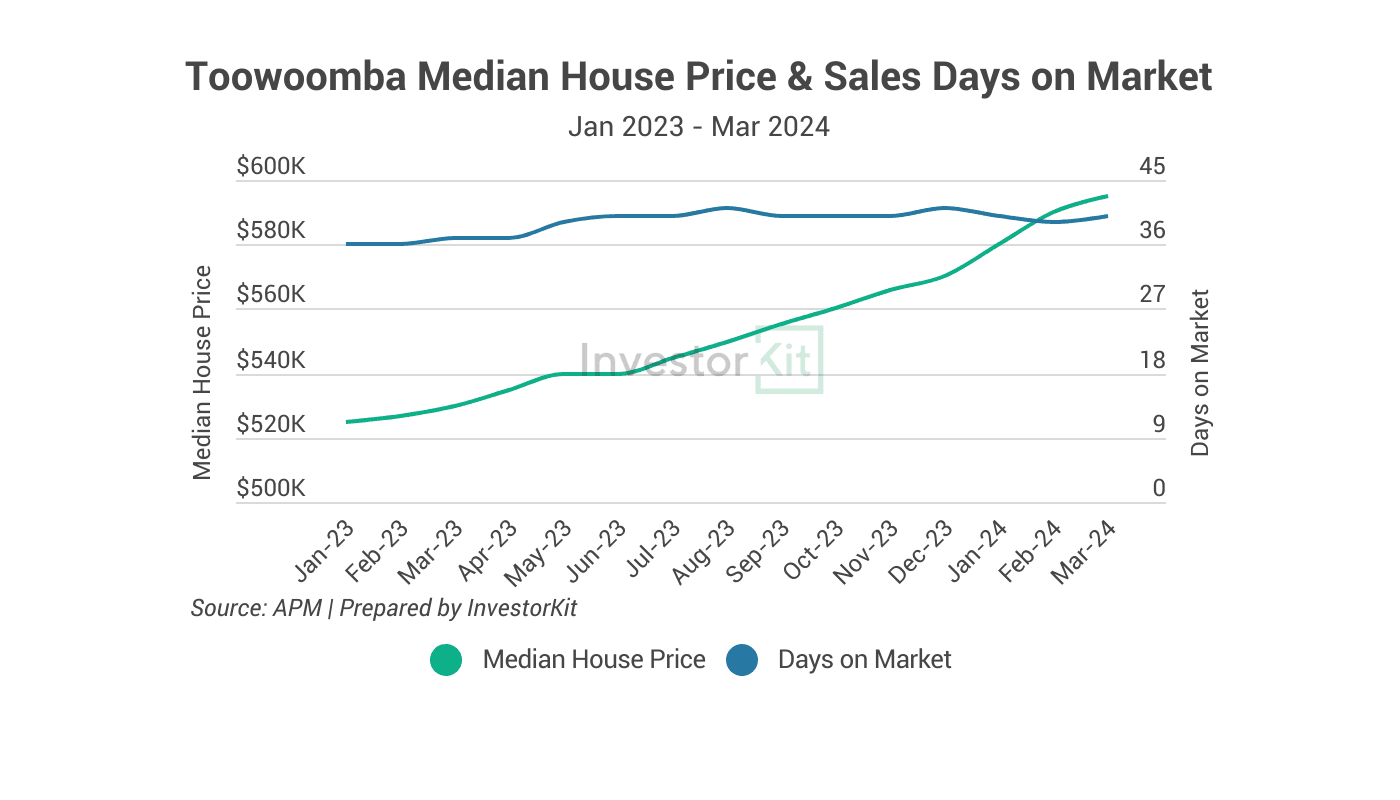

Toowoomba recorded double-digit growth in house value (up 12.3%) over the last 12 months against the rising interest rate headwind. The median house price is $595,000. While sale days on market is slightly lifted compared to a year ago (up about 8.1%), it is stabilised at a relatively low level of around 40 days, with no signs of further increase (chart below).

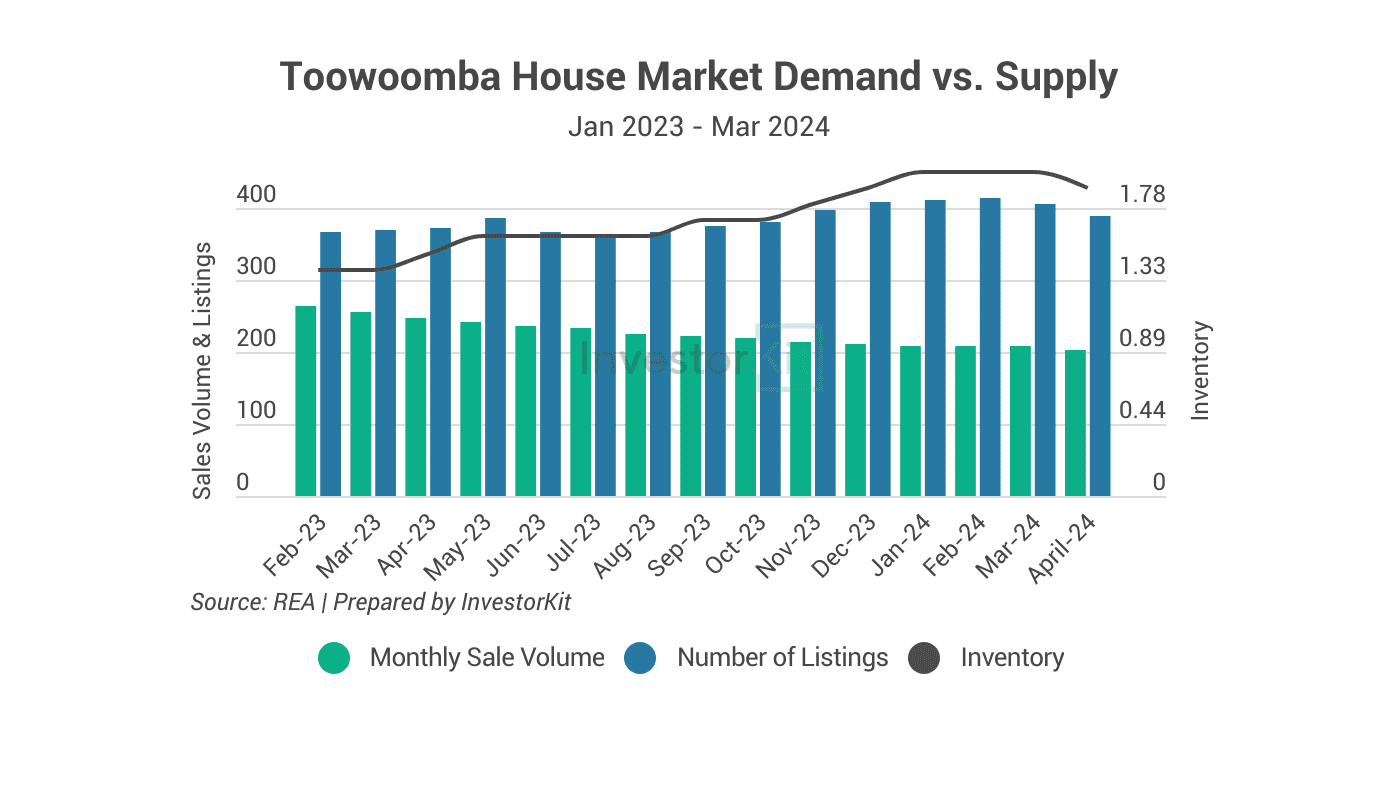

From a supply-demand perspective, the number of listings has increased while sales have decreased. That’s why the inventory level has risen slightly compared to a year ago (chart below). However, the inventory figure is still at a low level of 1.9 and is showing signs of decline, revealing that Toowoomba’s sales market still maintains its heat.

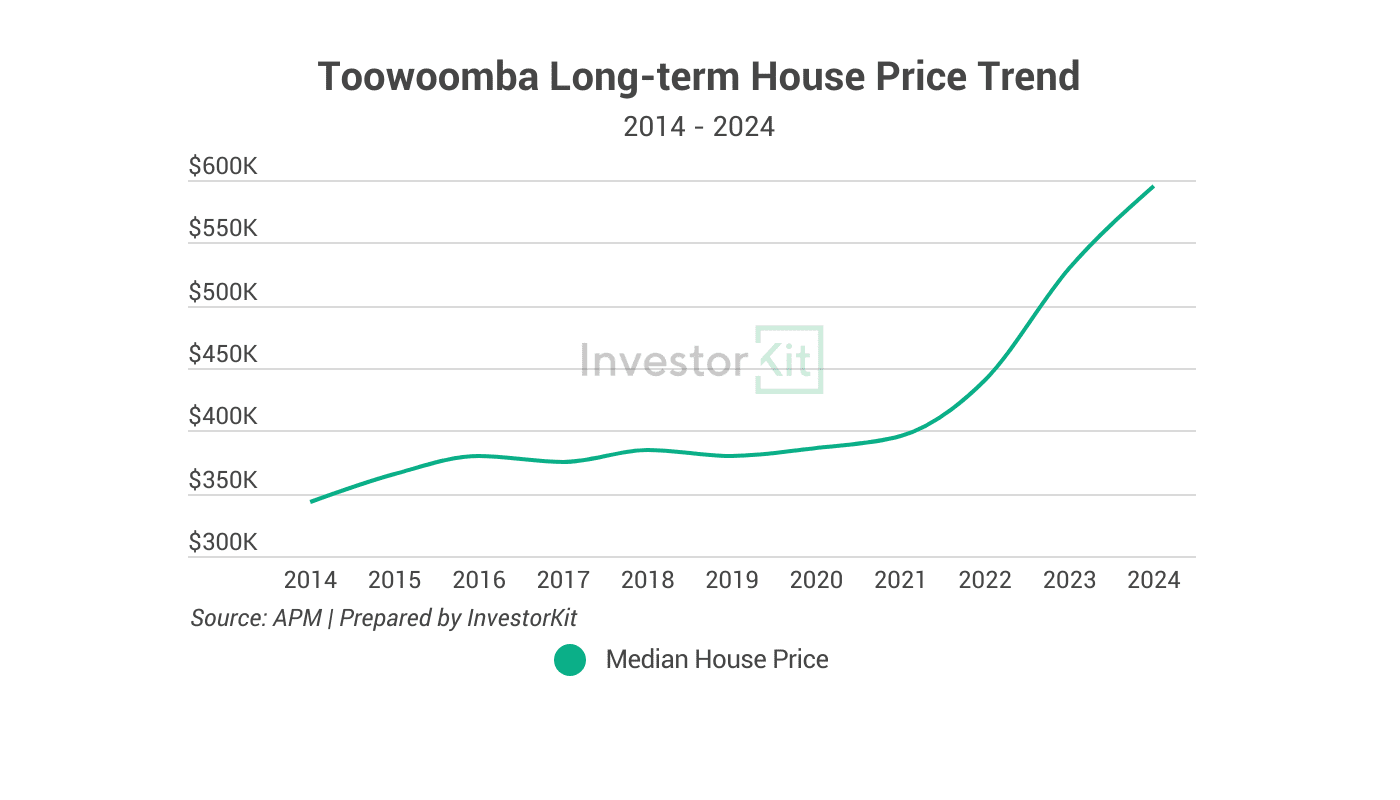

Toowoomba is getting close to the peak of its current growth cycle, with a total of 73.2% 10y growth (chart below). However, the current high market pressure gives us confidence that the city will see further healthy growth before cooling down.

Tight Rental Market

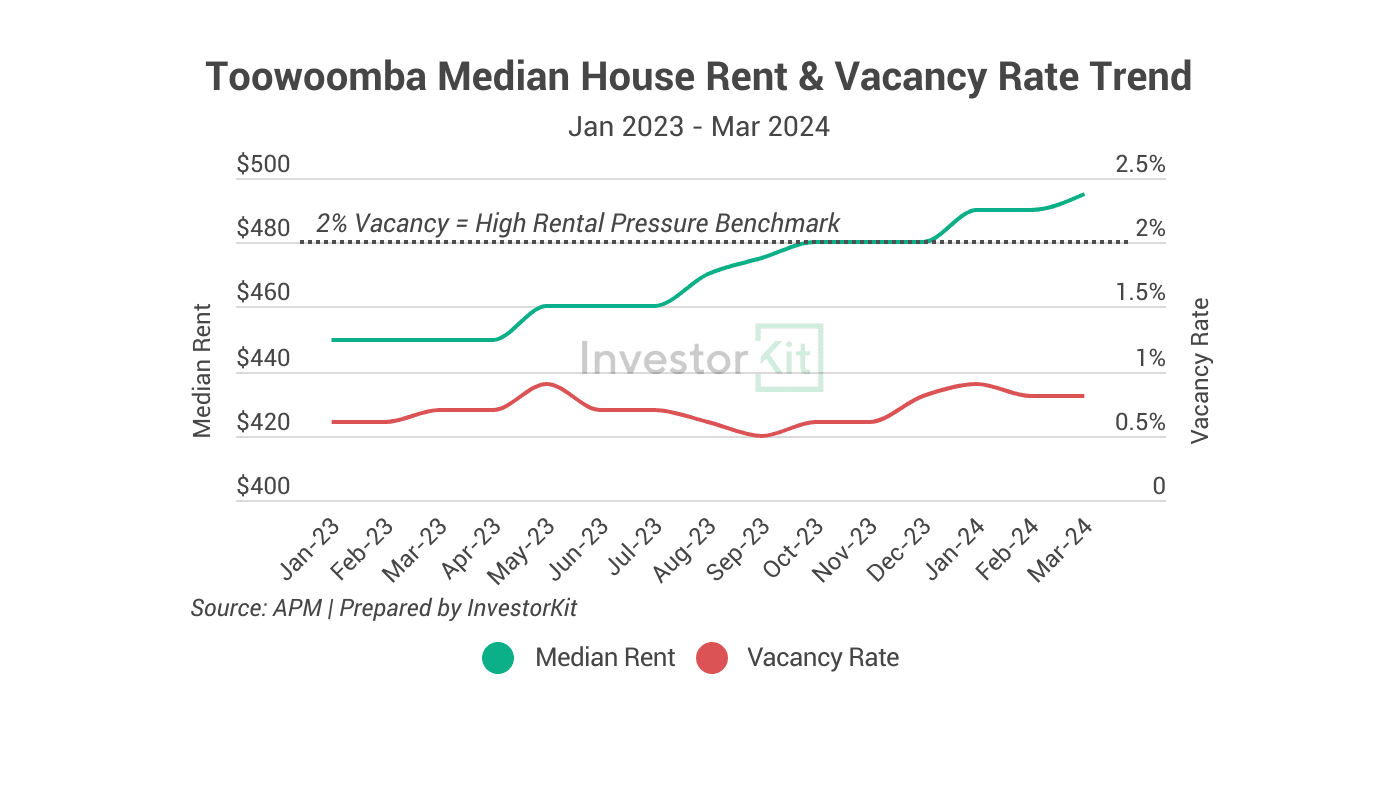

Toowoomba’s rental market is under high pressure as vacancy rates have hovered below 1% over the past 15 months(chart below). The tight rental market has led to a 10% rise in rental prices over the last year.

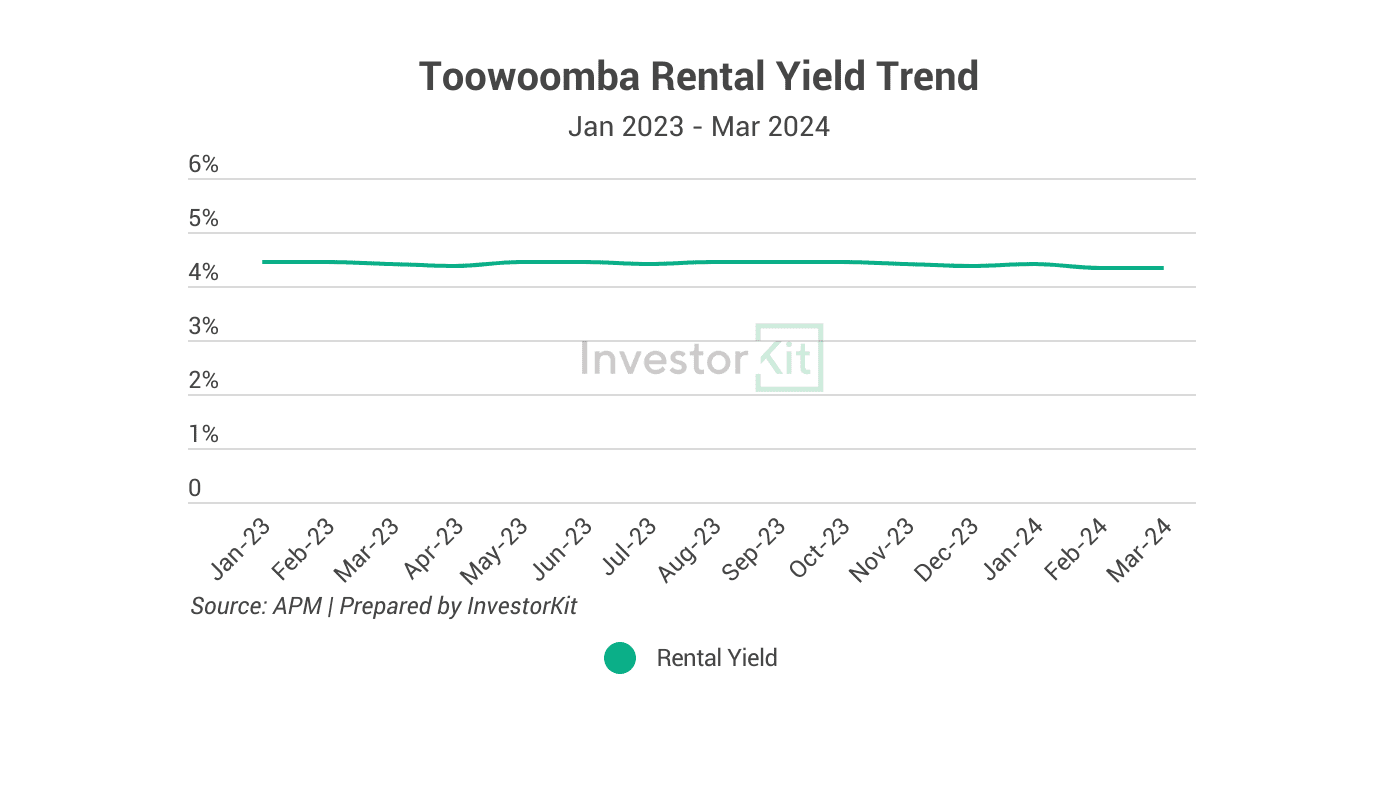

Investors can expect a moderate yield of about 4.3%. However, as the pressure in the rental market remains high, we predict rental prices will continue growing in the coming years and soon improve your yield on purchase.

Campbelltown (SA)

Median Price – $830K

Campbelltown is an LGA in northeast Adelaide, 9km from the city centre, with a population of 57,160 (2023 ERP).

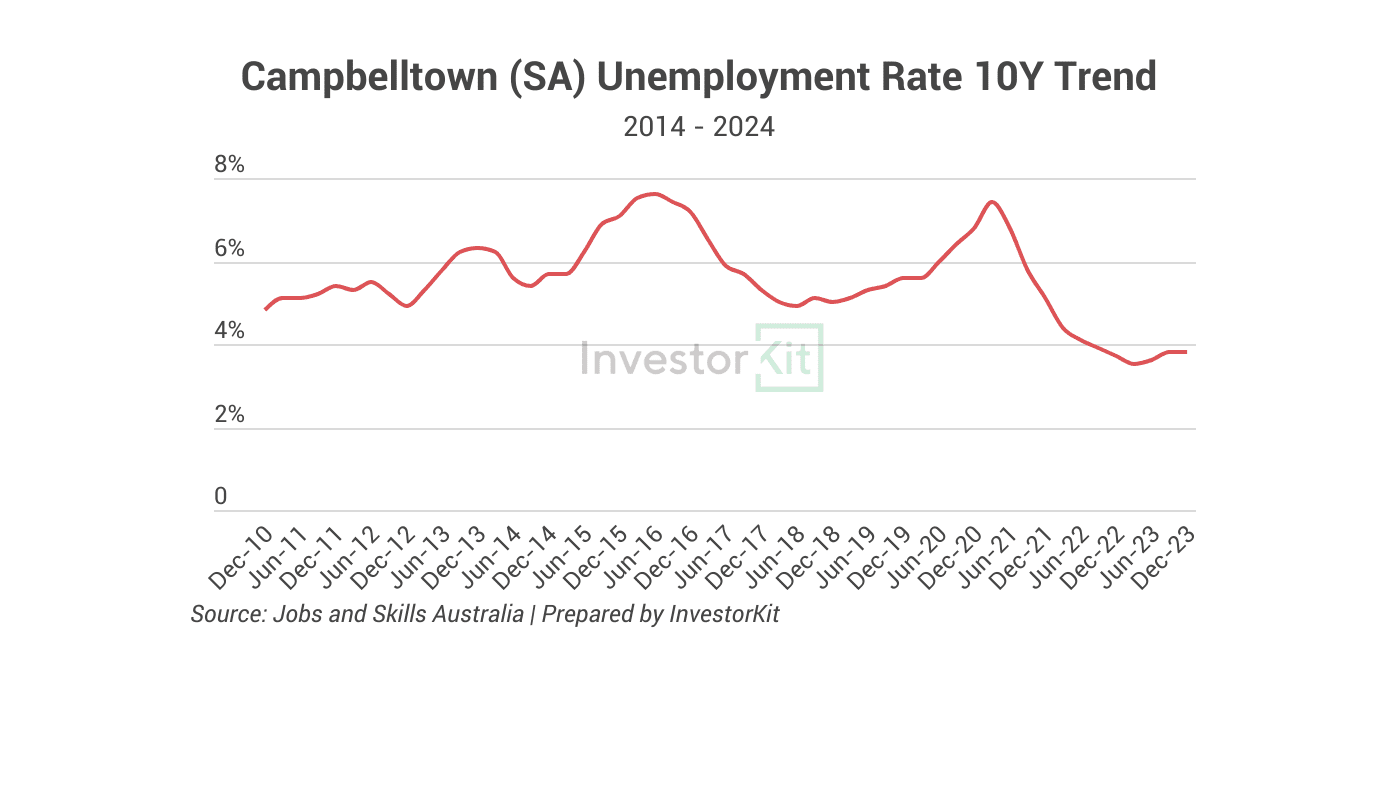

Campbelltown’s economic vitality is evident with a consistent increase in the Gross Regional Product (GRP) since 2008, steady population growth, and a notable drop in the unemployment rate since 2016 (currently at a low 3.8%, below chart). Health Care & Social Assistance, Education & Training, Retail Trade, and Construction are the largest employment sectors, indicating a quite healthy industry structure.

High Pressure in the Sales Market

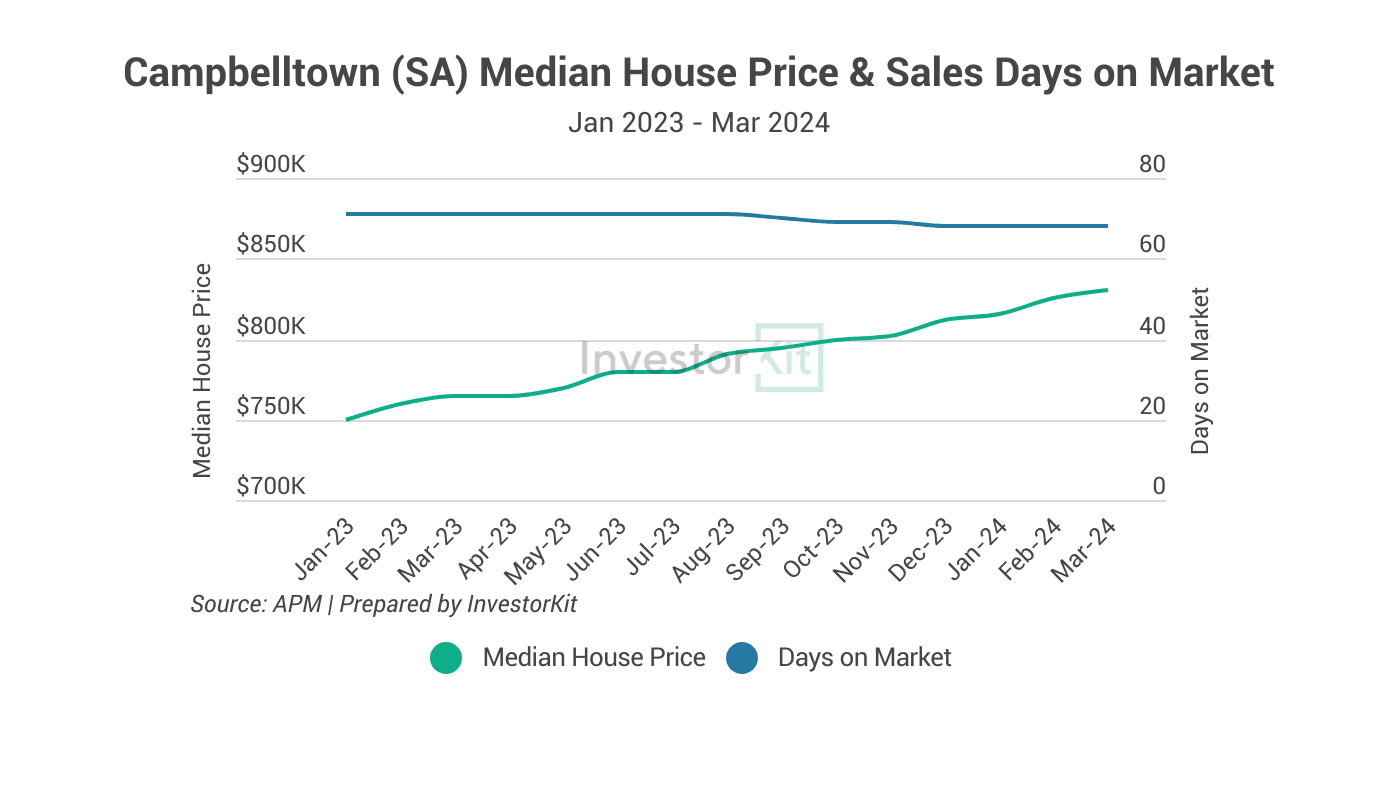

House prices have been growing continuously over the previous 15 months. The median house price now is $830,000, 8.5% higher than a year ago. Sale days on market (DoM) is currently 68 days, -4.2% lower than a year ago, while most regions in Greater Adelaide have experienced an increase in DoM (chart below).

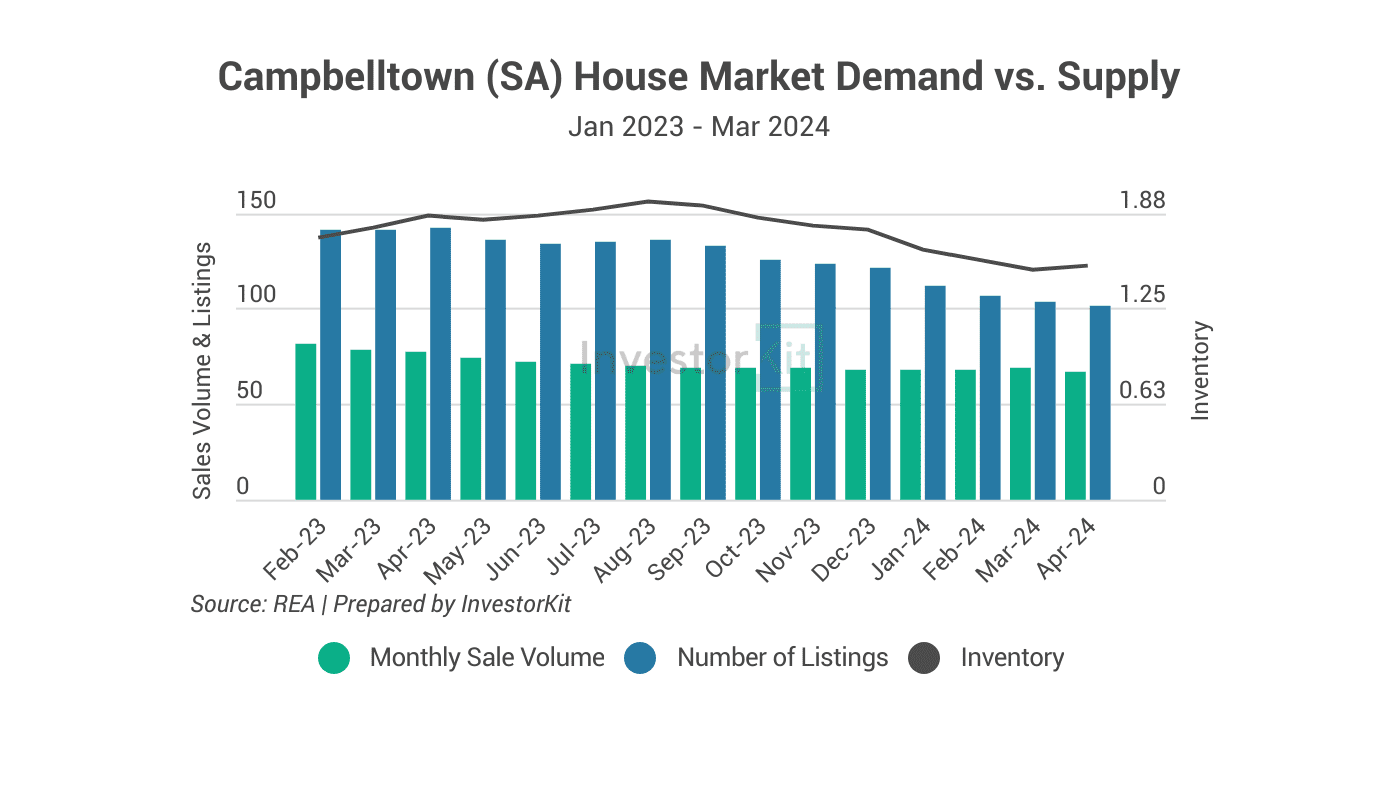

The number of listings (-28% yoy) is declining faster than sales volumes (-13% yoy), resulting in a -17.3% drop in the already low inventory level over the last 12 months (chart below). With only 1.5 months of stock, the region faces high market pressure.

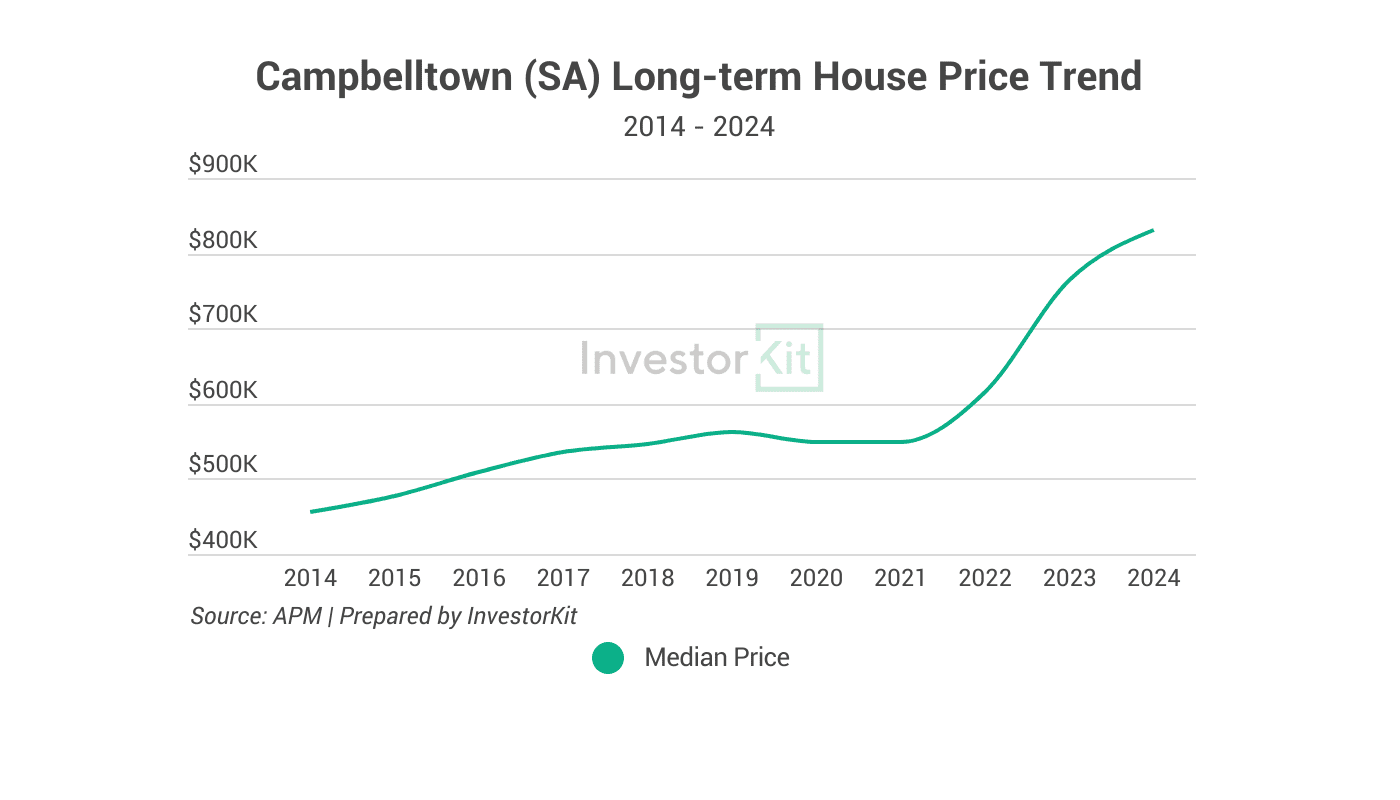

The house price in Campbelltown has risen substantially by 82% over the last 10 years, making the market close to the peak of its current growth cycle. However, considering the high market pressure, we expect further healthy growth.

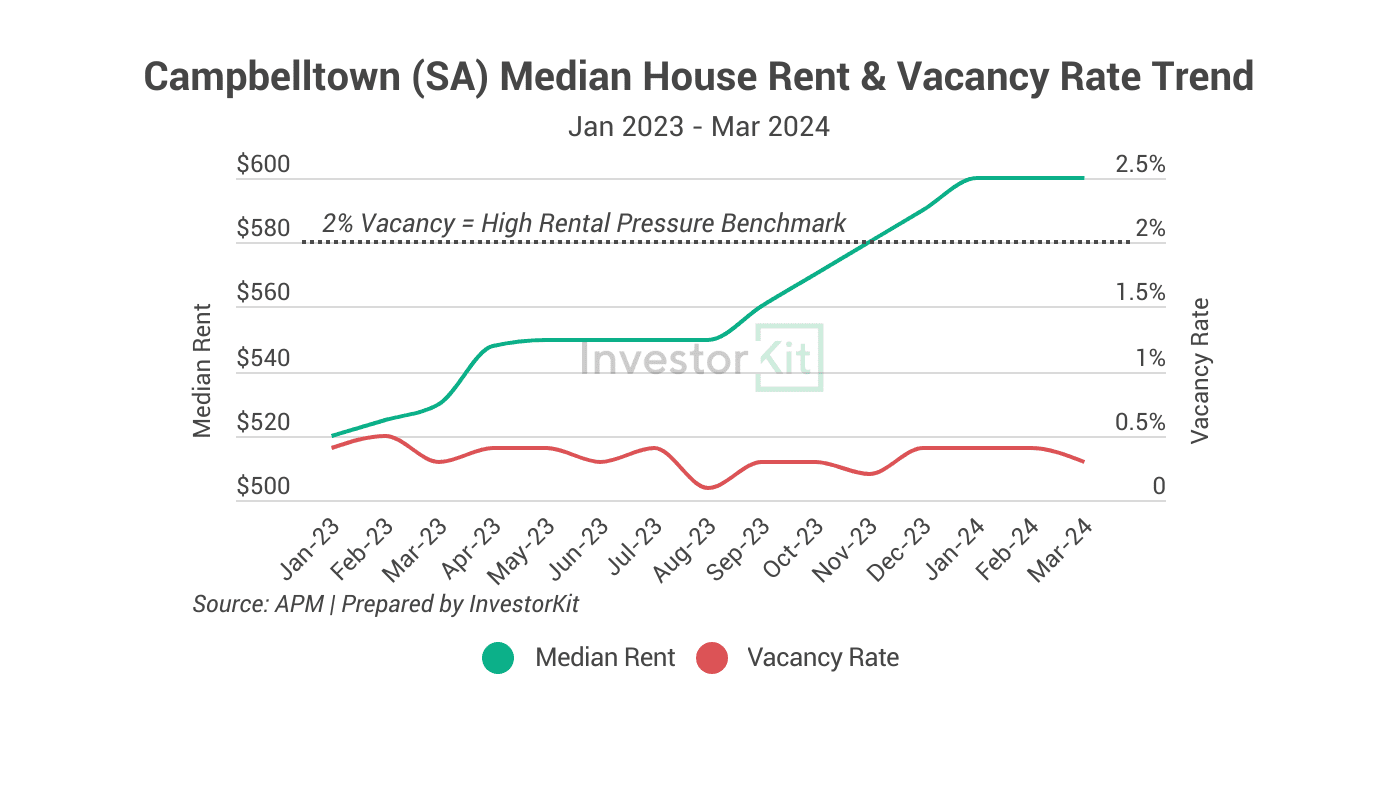

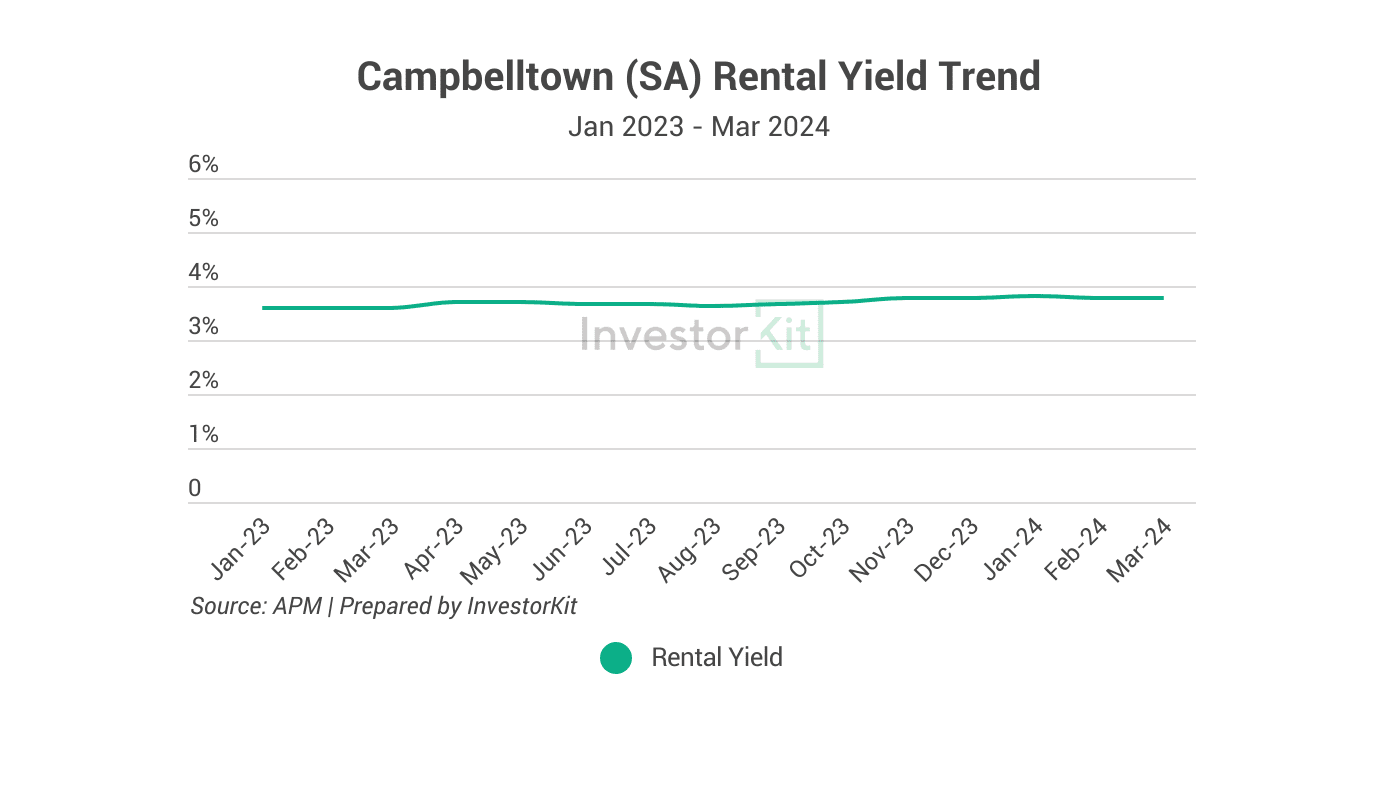

Tight Rental Market

Campbelltown’s vacancy rate has been at crisis levels of under 0.5% since 2021. As a result, the region witnessed consistently strong growth in the past 3 years, with 13.2% annual growth last year.

The current rental yield is only moderate at 3.8%. However, investors should expect their yield on purchase to improve soon once they enter the market, as rents continue to grow fast due to the high rental pressure.

To sum up…

Townsville, Toowoomba, and Campbelltown (SA) are some of Australia’s top high growth property areas. These three property hotspots have been performing well and expect further growth in the coming years.

With average residential investment property cost of under $500k, Townsville has been considered one of the hottest spots for investment. Both sales and rental markets are under high pressure with accelerating price growth, low inventory, low vacancy rates, and high rental yields.

Toowoomba’s housing market is also showing promising prospects reflecting emerging property trends in Australia, with double-digit annual growth in both house prices and rentals. Market pressure indicators such as sales days on market, inventory, and vacancy rate are all at very healthy levels, making Toowoomba a property hotspot for investment with budgets up to $750k.

Last but not least, for investors looking for a property with prices up to $1M, Campbelltown (SA) is worth putting on your list. The market is under high pressure with consistently healthy growth inhouse value and rental prices, extremely low inventory levels, and crisis-level vacancy rates. While the rental yield is not as attractive, the fast-growing rental prices will improve your yield on purchase quickly.

InvestorKit is a data-driven real estate buyer’s agency. We make purchase decisions based on a sophisticated market pressure analysis system. By adopting this methodology, we have helped more than a thousand clients purchase outperforming properties, expediting their wealth-building journey – Interested in our data analysis and buyer’s agent service?

Talk to our buyer’s agent and request your 15-minute FREE no-obligation consultation today!

Acknowledgement:

Thanks to our Junior Research Analyst, Grace Nguyen, for data preparation and drafting.

.svg)