Table of Contents

You’ve probably heard someone say, “Far North Queensland’s growth is temporary. You should buy in a bigger market with a stronger track record.”

Advice like this is common — Many investors believe in “track records”: strong past growth equals strong future growth, and poor past growth signals a red-flag market.

However, is “track record” reliable, or has it been misunderstood?

Let’s dig in — by the end of this blog, you’ll likely see “track record” in a whole new light.

Sydney vs. Darwin: Which Has a Stronger Track Record?

The 2013 Choice

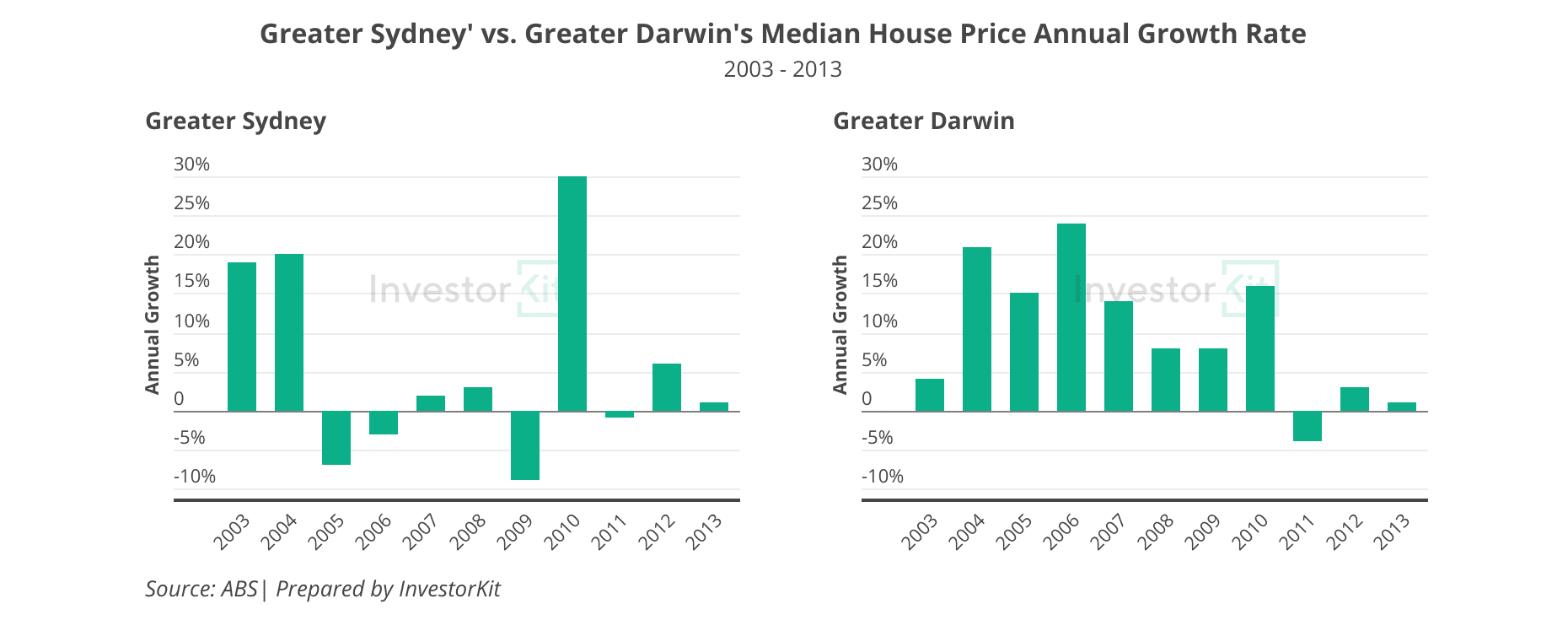

Let’s rewind to 2013, and you’re looking to buy an investment property. With “a strong track record” in mind, which of the two cities below would you choose?

- Sydney’s median house price was $615k at that time. It did boom in the early 2000s and briefly in 2010, but for most of the years in a decade, growth had been low, with four years of decline.

- On the other hand, Darwin, with a median price of $530k, was boosted by the mining boom and has grown robustly for most of the decade. Price dropped slightly in 2011 but returned to growth the following year.

Darwin looked like the clear winner. If you were a “track record believer,” that’s likely where your money would’ve gone.

What happened next?

Sydney boomed by 104% over the next decade. Darwin? It didn’t even reach 10%.

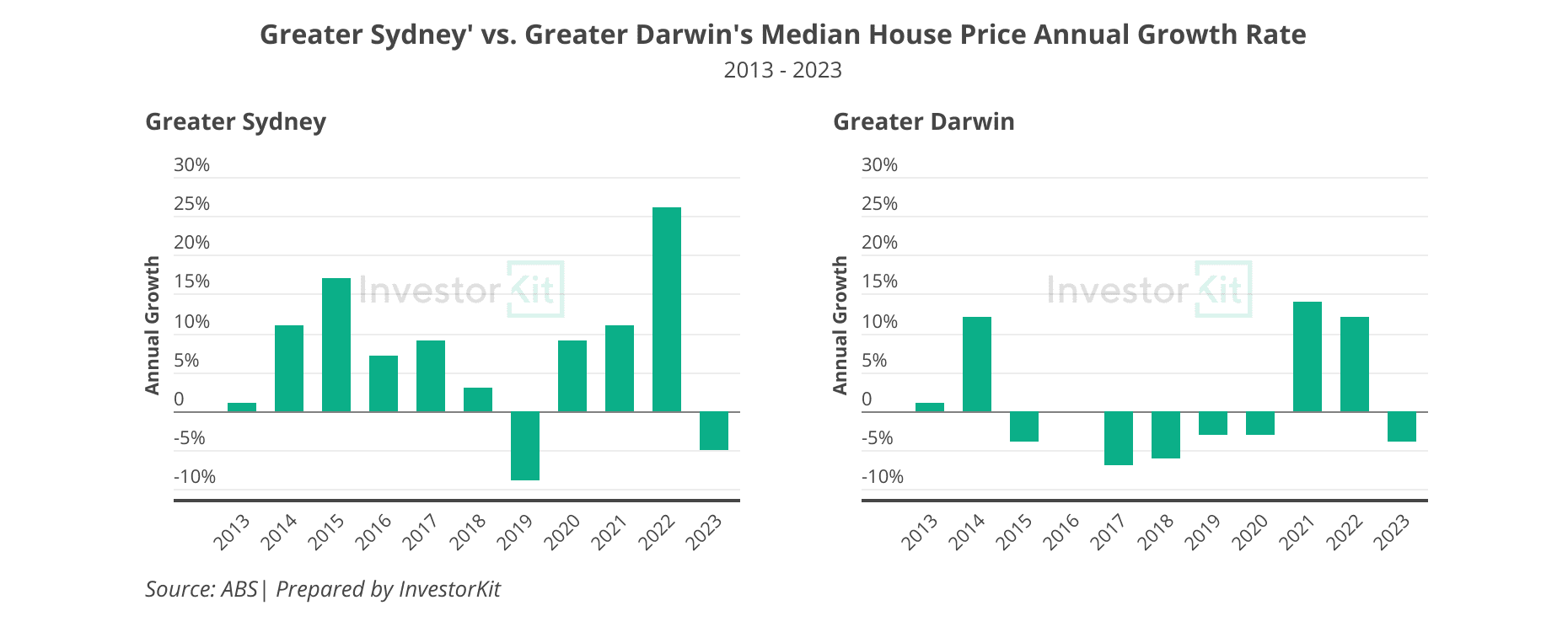

The 2023 Choice

Now fast-forward to 2023. Assuming that you somehow were facing the same choice again between Sydney and Darwin based on the past 10 years’ worth of data. Which city would you consider having a stronger track record?

- Sydney’s house market experienced two very strong cycles over the decade, achieving 104% total growth, one of the strongest across Australian cities. The market was volatile, but the growing years were significantly more than the declining ones.

- On the other hand, Darwin experienced a 6-year decline after a strong 2014, and only made some improvement during the COVID property boom. In a decade, Darwin has achieved a meagre 8.5% growth.

Now, Sydney’s the one with the stronger track record.

So which one should you choose this time?

“Track Records” Can Be Misleading Without Enough Data

What people often refer to as a “track record” is the performance of a certain period, which is usually just 10 years. However, 10-year performance can be misleading.

Take Sydney again; if we look at 2003-2013, when it had a few weak cycles, it would seem to have a weak track record, and if we look at 2013-2023, when it had two strong cycles, it would seem to have an excellent track record.

Same market. Different decade. Totally different impression.

In reality, most markets average out over time. There’s no such thing as a permanently “strong” or “weak” market — only markets that move through cycles.

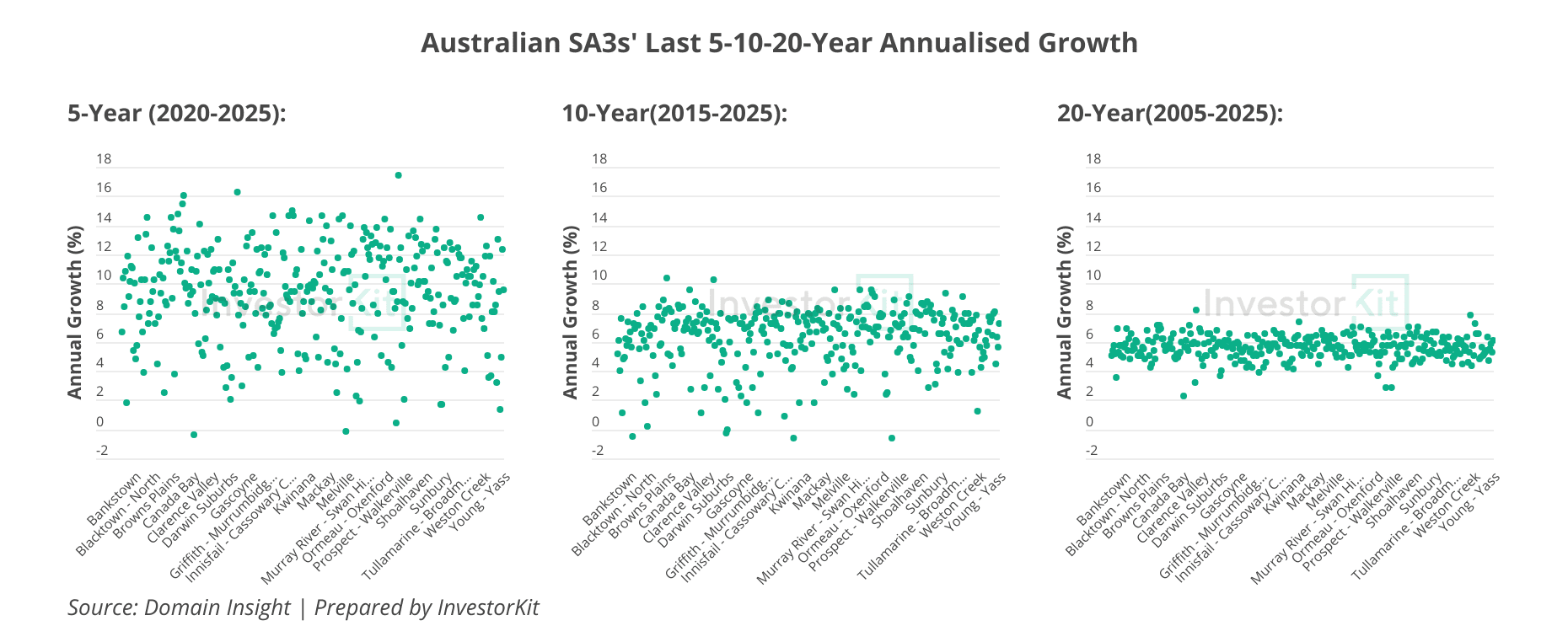

The charts below show the annualised house price growth rates of all Australian SA3s over the past 5, 10, and 20 years. The trend is clear: As the scope extends, growth rates concentrate more and more in the 4.5-7% band.

If we had 30 years of data, the band would narrow further.

“Weak Track Record” Markets Aren’t Always Weak

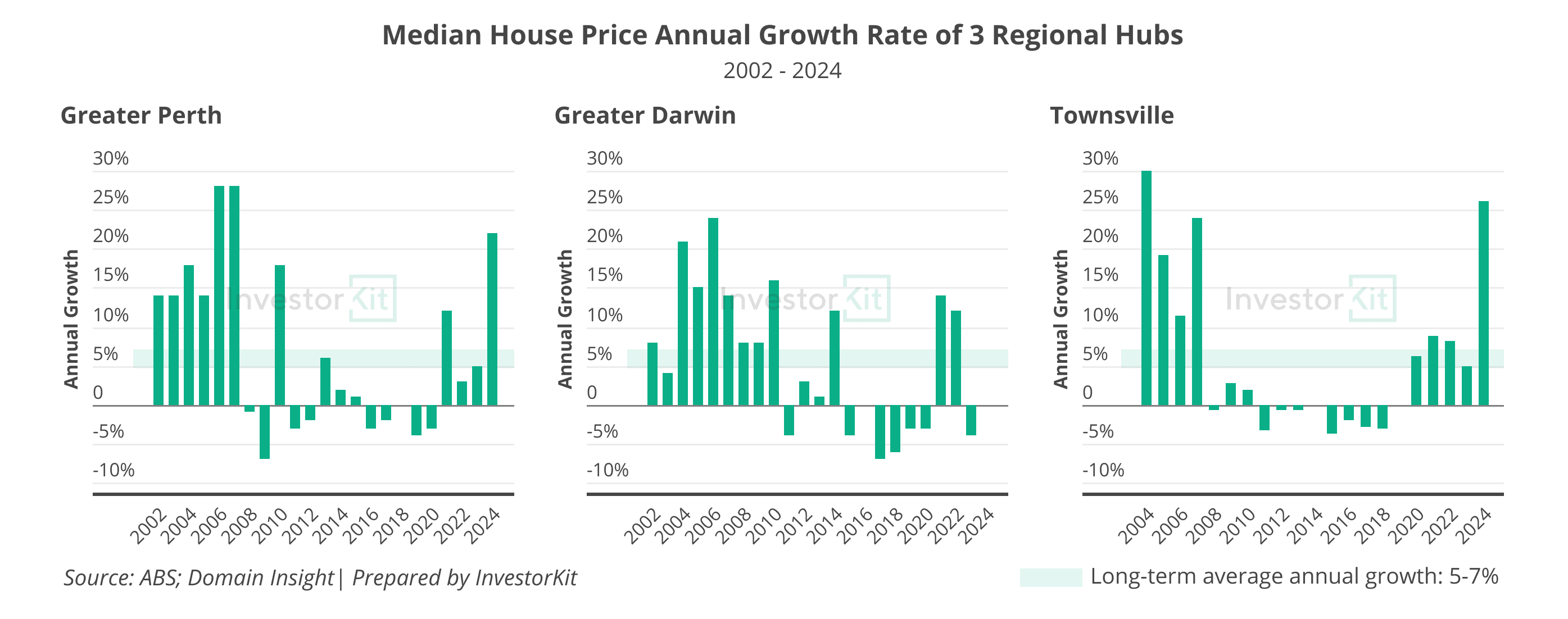

The charts show the annual house price growth rates over the past 20+ years in Perth, Darwin, and Townsville, the three cities that are not seen as having good track records.

Interestingly, their growth cycle patterns are similar: their strong cycles all happened in the 2000s, and growth was extremely low over the 2010s. In the meantime, NSW, VIC, TAS and ACT markets experienced some really impressive growth cycles in the 2010s, giving people the illusion that WA, NT and Northern QLD markets are always weak.

The underperformance of these markets in the 2010s was primarily driven by economic weakness following the end of the mining boom. However, as local economies recover and housing demand returns, today’s price surges aren’t coming out of nowhere — they’re a reflection of improving fundamentals.

Track Records Are Just Snapshots of Cycles

So here’s the real takeaway: Avoiding a market because of a “weak track record” could mean missing your next big opportunity.

What matters more is the current market fundamentals — supply and demand, affordability, job market activity, population shifts, etc. — not how a market performed in the past 10 years.

With that in mind, you’ll find yourself facing so many more market options. Being open to as many markets as possible when growing and diversifying your portfolio can significantly increase your chance of success through more choices within your budget, better rental yields (therefore better cash flow), potentially lower taxes, and higher stability across different market cycles.

There’s no shortage of myths and narratives in property investing. At InvestorKit, we help you cut through the noise using real data, clear insights, and objective analysis.

If you found this blog helpful, check out more of our myth-busting blogs in the News and Insights section! And if you’d like to enjoy more of our support on your property investment journey, book a 15-min FREE no-obligation discovery call and talk to the team!

.svg)