2,446 homes were burnt down during the 2019-20 NSW bushfire.

More than 20,000 homes were inundated throughout South-East Queensland in the 2022 floods.

When extreme weathers happen more and more frequently, our homes face increasing risks. While we feel sorry for those who lost their homes, what can we do to mitigate risks when we buy our own homes or investment properties?

Among the many things you can do, due diligence is one of the most important.

This blog is all about due diligence in investment properties: What is it? Why is it so important? What are the key things to cover for an investment property?

What is Due Diligence?

Broadly speaking, due diligence is a means for the property buyer to identify risks associated with purchasing a particular property.

For residential properties, we can break it down into three major categories:

1. Finance

How much borrowing capacity do you have? Can you afford your loan repayment if the interest rate is higher (which is what’s happening now)?

2. Market

Is the local economy doing well? Does the property market have growth potential? Is the rental demand high in the region?

3. Property

Is the property in any flood/bushfire risk zones? Are there any building restrictions on the land? Are there industrial facilities nearby? Does the house have any structural issues?

Why is Due Diligence Important?

A thorough due diligence minimises your risks in many ways:

Financial due diligence makes your life easier with loan repayment in case of increasing interest rates.

After five back-to-back RBA cash rate rises, many home loan borrowers who took out their loan during the past 2 years find themselves struggling with the monthly repayment once their fixed-rate term is over. As an investor, you can avoid this situation with strategic financial due diligence.

Financial due diligence is not only figuring out how much you can borrow, but more importantly, setting standards for your purchase, such as price range, yield level, expected annual value/rental growth, etc.

If you have factored in the potential interest hikes during your financial due diligence, you would have chosen to buy in a market with a healthy rental yield and high rental market pressure. This way, you would enjoy a rental income that covers your mortgage repayment, or at least most of it, even when the interest rate rises.

Market due diligence adds more certainty to your property’s capital growth.

Market due diligence is the market research process in your purchase journey.

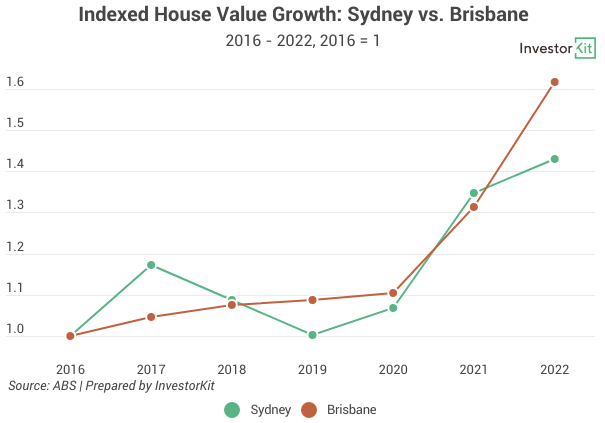

Imagine it was back in 2016, and you decided to buy an investment property. Without market research, you might go for Sydney: It seemed to have the most robust economy among all Australian cities and the house market just surged by 51%over the past 5 years, much higher than the other capital cities (below chart).

However, if you had done your research, you would have noticed the red flag: Sydney’s market was reaching its peak, and there could be a slump ahead. Instead, the Brisbane market, which grew by only 12% over the 5 years to 2016, was showing signs of recovery, making it a great point to enter the market.

It turned out that over the next 6 years to 2022, Sydney’s house value grew by 43%, whilst Brisbane grew by 62% (below chart).

By doing careful market due diligence before choosing your purchasing location, you may have enjoyed 20% more capital growth. We are just talking about 2 capital cities with stable economies here. In some cases, the lack of market research might even lead to capital loss, especially when the value growth is adjusted for inflation.

Property due diligence helps underpin capital growth and enhance rentability.

Even in the same city, different properties can experience various capital growth rates and popularity among renters.

How? Buyers would be reluctant when buying a house that was just flooded or affected by a bushfire; A large piece of land could be more attractive to buyers than smaller pieces; Some renters may want to avoid houses close to a cemetery; Some renters prefer staying away from a noisy motorway…

By examining all key factors that could affect the property’s value growth potential and rentability, you’ll be able to avoid many pitfalls that could sabotage your investment success.

What to Cover in a Due Diligence?

Our previous blogs have discussed a lot about achieving healthy cash flow (financial due diligence) and macro-level market research (market due diligence). Check them out with the links below:

Capital Growth vs Cash Flow? Why not Get Both!

3 Undervalued Markets Even with Interest Hikes

6 Indicators to Better Understand Local Economic Activity

4 Red Flags to Have on Your Investing Radar

Today we focus on something we seldom touched on before – property due diligence: How to ensure an investment property will be popular with both renters and future buyers?

At InvestorKit, we primarily look at the below points. It’s important to note that this list is a general guideline for our property due diligence. There can be other factors to check pending the specific address.

Flood & bushfire risks

We would all prefer a house away from any flood or bushfire-prone areas. How do we check that? One way is to go to the local council’s website and find their flood & bushfire maps. Many cities have developed interactive maps for you to check by address easily.

We take Wagga Wagga as an example. Going to maps.wagga.nsw.gov.au, you’ll find the flooding map & bushfire map of the council as in the two images below. Using the search tool at the bottom, you can check if an address is in any flood-prone zone (blue) or bushfire-prone zone (yellow/orange/red).

Large-scale new developments in the surrounding area

Large-scale new developments can harm your investment goal by causing oversupply, which would affect both value and rental growth. The impact won’t disappear until all new supply is fully absorbed.

If you are not a local of the region you’re investing in, one way to check for new developments is using satellite maps. Search your property in Google maps and zoom out to show the surrounding area. We have two example areas below. Between the two, you would want to buy in the left-hand side area and avoid the right.

Distance to busy roads / rail tracks / power lines /industrial sites / cemeteries / etc.

Many people can’t stand the noise and dust from busy roads, rail tracks, or industrial sites; many think the magnetic fields from HV powerlines or substations would affect their health; many consider cemeteries a taboo… These are all personal preferences, and many people may not care, but you don’t want to lose any prospective renters/buyers. Therefore, it’s better to stay away from these elements.

Land size

InvestorKit uses 375sqm as a general threshold for land size. Larger land size is more attractive in many ways: more spacious rooms / bigger yards / more flexibility when building new, etc. What’s more, the newly released land lots are becoming smaller and smaller. The Urban Development Institute of Australia’s (UDIA) 2022 State of the Land report shows that the median lot sizes in all capital cities, except Perth, are trending down (the below image). As bigger-sized lands become scarce, they could be even more valued by prospective buyers in the future.

In terms of land shape, it’s better to avoid weird-shaped lands that could affect the property’s attractiveness. You may not mind a battle axe block for your owner-occupying house, but for an investment property, a regular-shaped land would work the best for your return.

Title

The title document is usually included in the contract of sale, and/or your conveyancer will conduct a title search before settlement. It’s essential to make sure there are no issues with the current ownership and find out if any encumbrances, easements, caveats, or covenants on the property title could affect your rights.

Structural issues vs. cosmetic issues

Coming down to the house itself, it’s crucial to make sure before settlement that there are no major structural issues such as sagging floor/ceiling, larger-than-superficial cracks, etc., which could cause harm or high-cost repair works in the future. We see many property buyers putting too much attention on cosmetic issues but ignoring structural issues. It’s understandable; Afterall, not everyone is a construction expert. That is why we encourage all property buyers to involve professionals in their building & pest inspection. The service fee paid upfront could save you 10+ times more in the future.

Number of bedrooms

According to the 2021 Census, the most common number of bedrooms in Australian dwellings is 3, while the WFH trend has led 4-bed homes to gain more popularity. Although the number of bedrooms does not affect value growth much, it’s important to know the most popular bedroom number in your target area. For example, in a suburb full of young families, 3-4 bedrooms would be the most sought after. If there is a 6-bed mansion in that area, it may be spectacular and unique, but it might attract fewer prospective tenants or future buyers than the smaller houses due to the local demographics. In addition, it’s important to check if there’s any alleged bedroom that’s not actually usable.

Maintenance requirement

You want to maximise your return on investment (ROI) as an investor. Some features that add value to the property may decrease your ROI due to the lifted purchase price and the high ongoing maintenance costs. One of these features is swimming pool. While it may increase your rental price, the maintenance cost is also high (average $160/month). If the pool can’t raise your weekly rent by at least $40, there’s no point in having it.

Due diligence is critical in minimising the risks on your investment journey. You must have noticed that it’s not as simple as an on-site inspection. Instead, you need to talk to brokers, solicitors, and local agents, and acquire economic, demographic, and property market data.

Sounds like a lot? Yes, it is.

Is there an easier way? Yes! Get yourself a helper!

InvestorKit is the helper you need. We guide you through the investment journey, organising every step of the due diligence for you, from the financial assessment and portfolio planning to market research and detailed property due diligence. Moreover, our experienced buyers’ agents would negotiate for you based on the market trend as well as the due diligence, making sure you’re wasting a cent. Sounds like a great deal? Click here and request your 45-min FREE no-obligation consultation today!

.svg)