Reading our blogs, you must have seen “SA3” a lot.

Yes, we conduct our macro market research on the SA3 level.

Wondering what it is and why we use it?

In this blog, we are going to talk about everything about SA3.

What is an SA3?

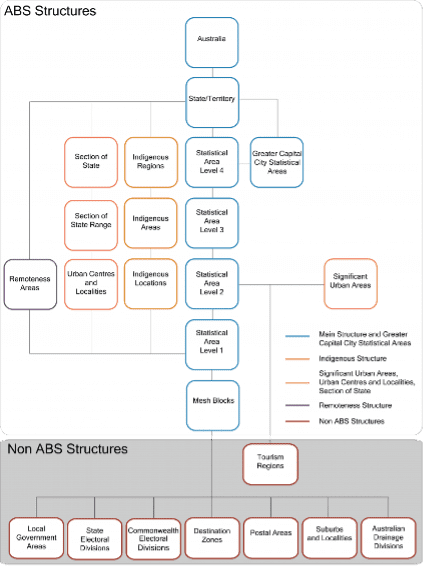

SA3 is short for Statistical Area Level 3. It is one of the geographic levels in the Australian Statistical Geography Standard (ASGS)created by the ABS (Australian Bureau of Statistics).

SA3 is designed for the output of regional data and most have populations between 30,000 and 130,000 people.

In the major cities, SA3s represent the area serviced by a major transport and commercial hub. They often closely align to large urbanLocal Government Areas (eg. Wyndham). In regional areas, SA3s represent the area serviced by regional cities that have a population over 20,000 people (eg.Bundaberg). In outer regional and remote areas, SA3s represent areas which are widely recognised as having a distinct identity and similar social and economic characteristics (eg. Wagga Wagga).

Nationally around 358 SA3s exist. However, there are several Zero SA3s (with a nil/nominal population, such as a large national park) and non-spatial SA3s (for migratory – offshore – shipping purposes). Therefore, in practice, we use close to 336 of them for measuring trends for houses and units.

What’s the Difference Between SA3 and LGA?

SA3 is often compared with LGA when it comes to macro market research. They look similar in some cases, but different in others.

Why do We Like to Use SA3?

We like to use SA3 because of the amount of data available and the perfect sample size it provides.

From the above table we know that ABS and property data platforms provide a wide range of data based on ASGS including the level of SA3. The only category that is not available on SA3 level is the local industry composition, but it’s not fatal as we can easily get a picture with LGA data as a reference.

SA3s are handy to use in the macro research because they are defined based on a combination of criteria including population, function, economy, and socio-culture. The size of SA3 is not too small so we can get plenty of samples; and at the same time, it’s not too large so that the research provides meaningful reference to the micro market analysis and property search.

Let’s have a look at an example.

If just looking at the average growth of 13.6% of the Brisbane LGA, we would be missing the outstanding performers like the inner city and could not avoid the under-performers such as Rocklea – Acacia Ridge. The LGA data provides little help in deciding which specific area in the LGA to buy to achieve greater return.

Why does SA3 Sometimes not Work Well?

As we have seen in the previous sections, regional SA3s are much larger than their capital city cousins. While this helps us understand the areas that have potential impacts on the central city market, it sometimes prevents us from seeing the realistic market trends or spotting outperforming suburbs. When an SA3 covers too many inactive markets, the SA3 level data may not reflect precisely the active markets’ trends. Even worse, when an SA3 contains both well and poorly performing suburbs, it is possible that the overall performance is diluted by the under performers, so that the whole region can’t stand out in the market review.

One example is the NSW SA3 of Wagga Wagga. The SA3 contains 104 suburbs, most of which are agricultural fields. The most active property market of this region lies in the cluster around the suburb of Wagga Wagga. These suburbs include Glenfield Park, Wagga Wagga, Estella, Turvey Park, Tolland, Tatton, Bourkelands, Ashmont, Mount Austin, Lake Albert, and Kooringal.

Indicator values of the whole SA3 are different from those of the central suburbs, where we mainly purchase in. As an investor, you want to base every purchase on the most accurate data. In SA3s like Wagga Wagga, the SA3 level data would seem not as reliable. Which is why we need to dive deeper.

A more dramatic example is the South Australian SA3 of Fleurieu- Kangaroo Island. This region covers the Fleurieu Peninsula and Kangaroo Island, with 87 suburbs in its range as shown in the below image.

The SA3 data shows that the local market is gaining pressure with climbing sale volume and declining number of listings. However, the house value has not grown too impressively considering the property boom since late 2020.

So, is the region of Fleurieu – Kangaroo Island just an average performer that isn’t worth much attention?

Let’s dive into the region and look at individual suburbs. You’ll find that more than half of the 87 suburbs have few transactions in years, and the time on market for some remote locations can be even longer than a year.The most active property market of this region lies in the suburb cluster around Victor Harbour. These suburbs include Victor Harbour, McCracken, Encounter Bay, Port Elliot, Middleton, and Goolwa.

A deep dive into the more active cluster vs Sa3 displays a very different picture.

The house value of this area has grown more than 20% over a year, and the sale days on market is much shorter than the SA3 average. What’s better is that the rental yield is even higher than the SA3 figure. This smaller-scale area is definitely an out-performer that is worth checking out, but it would be ignored if we had just examined the whole SA3.

How do We Get the Best out of SA3?

Now we have discussed about the pros and cons of using SA3 to conduct the macro market research. On the one hand, we do enjoy the available data on the SA3 level, and we feel comfortable working with its size.On the other hand, we want to avoid missing out any outperforming regions disguised by the data of the inactive markets/under-performers in it.

That sounds greedy, but not impossible. We just need a data cleaning via suburb analysis.

How do we do it? We usually look at the satellite map of an SA3, checking if there are outlier suburbs that need to be flagged, closely examined and potentially kicked out. Two typical types of such suburbs are outer ring pockets and suburbs under development.

Outliers

Outliers are usually the rural areas where the property markets are so quiet that there are barely new listings or sales. They are usually in regional areas, such as most of the inland suburbs on the Fleurieu Peninsula, which we have mentioned earlier.

There can be outliers in centric SA3s, too. One example isBurbank in the SA3 of Mt Gravatt in Greater Brisbane. The average monthly number of transactions has never exceeded 2 in the past 15 months, and the average days on market have always been 160+, which is much higher than the average number, 58, of the rest suburbs in the same SA3.

Suburbs under Development

These suburbs are those with large vacant lands, ready to build new communities. Examples include Newport in the Queensland SA3 of Redcliffe. Half of the suburb was vacant back in 2014 and has been filling with new house during the past years.

These suburbs suffer from less reliable market data and oversupply. On one hand, there can be heaps of new houses released to the market this year and none the next, leading to unnatural sales data which doesn’t really reflect the market trends. On the other hand, as the large amount of new supply could slow down the house value growth, we won’t consider such areas when investing anyway, so why bother analysing the area?

Conclusion

SA3 is an ABS statistical area that is defined by population, administrative, economic, and socio-cultural criteria. We find it handy in macro research because the ABS and property data platforms provide very rich data on this level, and the way it is defined makes it stable in sampling to conduct meaningful analysis that best connects to micro analysis, property search, and purchasing decisions.

However, sometimes not all suburbs in an SA3 perform the same, and the under performers’ data could drag down the whole region. That’s when we may miss out performers on the macro level of market research.

To minimise the disadvantages and make the best of SA3s, we need to do a data cleaning activity via suburb analysis and kick out the data-disturbing suburbs such as outliers and suburbs under development.

InvestorKit is a buyers’ agent who is committed to market research. Our macro research approach using SA3 has been proven to be effective in identifying strongly growing regions time and time again.

Do you want your investment to be backed by solid data and research? Are you interested in how we dive into each SA3 and identify the best locations to buy? Simply give us a shout or book a FREE no-obligation 45-min consultation and discuss more!

.svg)