Who doesn’t want to buy their investment property in a city with a thriving local economy?

That’s why many people believe it’s only worth buying in big cities, where there are fancy corporate buildings, hi-tech hubs, and lots of suit and tie people in corporate jobs.

As a data-driven buyer’s agency, InvestorKit team look at market data every day, and we know this belief is nothing but a bias. Not every performing local economy needs to look like that.

In fact, it’s not the height of buildings that indicates the performance of an economy, but the underlying factors, such as:

· Job market performance (Unemployment rates & Number of job ads)

· Internal migration trend

· Industry composition

· Infrastructure investment

· Airport passenger movements

· Housing finance commitment trends

If the economic indicators are trending well, the local economy would be thriving. In this blog, we are going to go through these indicators to help you get a better understanding of local economic activity.

Job Market Performance

Job market performance can be measured by two indices, unemployment rate and number of job ads.

a.Unemployment Rates

Availability Level: Statistical Area Level 2 and above; LGA

Frequency: Quarterly

This is the major indicator for the local economic performance. Everyone knows that low or lowering unemployment rate indicates thriving economy. People tend to think that regional cities or smaller cities’ unemployment rates are higher than the major cities, but that’s not necessarily the case. Let’s have a look at two states: New South Wales and Queensland.

We have drawn the unemployment rate trendlines of 3 LGA’s in each state: the capital city (red line), an inland regional city (green line), and a coastal regional city (blue line). It is obvious that the capital cities are not the one with the lowest unemployment rate, and although Wagga Wagga and Townsville have had high levels of unemployment rates in previous years, a declining trend can be seen since 2018 and 2017 respectively.

b.Number of Job Ads

Availability Level: Region

Frequency: Monthly

When unemployment rates are low or lowering, the local job markets would be active, and the job market activity can be reflected by the total number of job ads: growing number of job ads means increasingly active job markets.

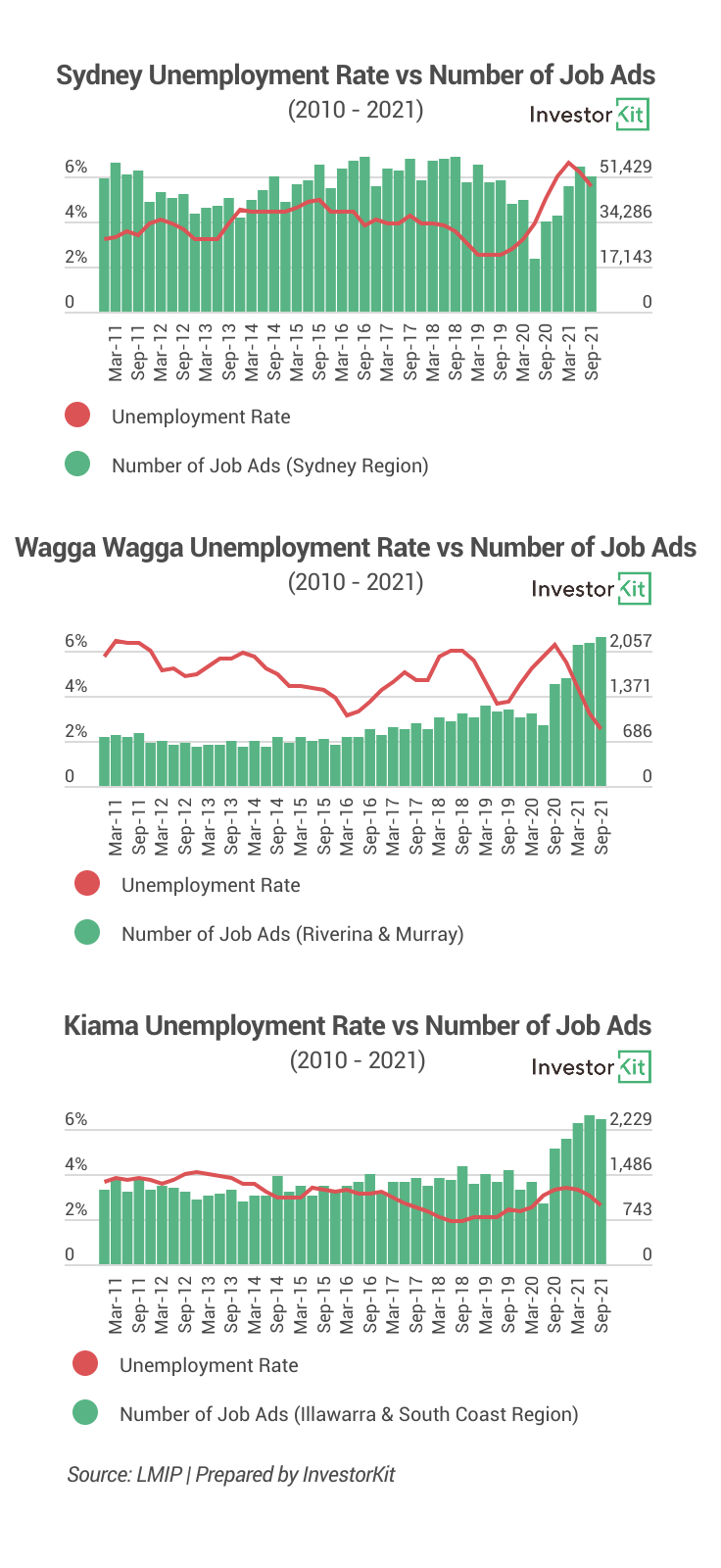

The Australia Government’s Labour Market Information Portal (LMIP) provides a monthly updated report on the total number of internet job ads per region (based on the region division on Australia’s major online job boards). Let’s have a look at how the number of job ads have been changing over time with the NSW cities as an example.

It is true that Sydney region has the most job opportunities (number of job ads). This is reasonable considering its large population. However, there’s an unneglectable trend in regional cities that the number of job ads have been growing since 2016 and accelerated since 2020, reaching a record high at the end of last year. This is in correspondence with the quick recovery of regional NSW economy from the impact of the pandemic.

Internal Migration Trend

Availability Level: Statistical Area Level 2 and above

Frequency: Annually

An Australia Centre for Population report suggests that employment opportunities and affordability are two of the main reasons why people migrate between cities, and the growth of population would stimulate consumption and boost the local economy in return. Therefore, internal migration trend can be a powerful indicator of local economic activities.

Victoria is a good example to illustrate this. The below chart shows Greater Melbourne and regional Victoria’s net internal migration trends and their unemployment rates in the last decade. A trend can be seen that when the number of people they are gaining increases, the unemployment rate would follow and decrease.

Industry Composition

Availability Level: LGA

Frequency: 5-yearly (Census)

Higher industrial diversity indicates amore resilient economy. An ABS report uses an index called National AverageIndex to measure local industrial diversity. The below chart shows eachAustralian region (SA4)’s National Average Index back in 2011.

The below table lists the top 10 and bottom 10 cities in terms of diversity of industrial composition in the above report, along with the house price growth in the following decade (2012-2021). It’s not hard to tell that the performance of the top 10 regions is largely better. However, this trend may only be manifest on the top of either side. Correlations need to be reviewed for many regions in the middle.

Of course, we are not saying that all industrial specialisation is bad. ACT is specialised in public administration and safety, and Sydney is specialised in professional and financial services, yet their property markets are strong. However, if a region’s economy is highly reliant on a more volatile industry, buyer sentiment won’t be too positive around that market. Darwin’s local economy and property market went through a 5-year depression after the end of the mining boom, and one of the main reasons is its heavy reliance on the mining industry.

Infrastructure Investment

Availability Level: State, Region

Frequency: Annually

Infrastructure investments have a great stimulus for the local economy. A 2020 Global Infrastructure Hub study finds that the economic multiplier for public investment (including infrastructure) is 1.5 times greater than the initial investment in two to five years (below chart).

Knowing the impact of infrastructure on the economy, state governments are using infrastructure investments to boost local economic growth/recovery and create jobs, especially in regional areas where economy has lagged the major cities.

The NSW State Government established the Restart NSW Fund since 2011 to enable the funding and delivery of high-priority infrastructure projects. 30% of this fund is committed to regional areas outside of the metropolitan areas of Sydney, Newcastle, and Wollongong over its life. Up until the release of the 2021-22 State Budget, $10.2 billion from Restart NSW has been committed and reserved for programs and projects in regional NSW. This comprises $8.8 billion in commitments and $1.5 billion in reservations for future projects.

The Victorian Government has also been investing heavily in rural and regional Victoria, especially in healthcare, education, and transport infrastructures. Other than that, the government has also been dedicated to increasing regional job opportunities by cutting payroll tax, helping local businesses, boosting regional tourism, etc.

With the regional economies’ recovery, the local property markets have been performing better in recent years. The below charts tell that the house price growth rates of regional NSW have been higher than the capital city since 2016; and the growth rates of regional Victoria in the latest decade have been higher than the decade before, and have exceeded the capital city in the end of 2018.

It needs to be stressed that although infrastructure plays a significant role in economic growth, it alone has no correlation with property growth. Infrastructure spending should also be considered relative to the size of the city, not just the total dollar spent.

Airport passenger movements

Availability Level: All Australian airports

Frequency: Annually

Aviation provides an efficient network for business and tourism. It plays a vital role in facilitating economic growth. Therefore, airport passenger movements (counts) is a good indicator for the local economic activity and consequently property market performance.

The below charts show the correlation between Hobart and Perth’s domestic airport passenger movements and the state’s GDP as well as the city’s median house prices, in the past 2 decades. For Hobart, the growth of passenger movements started to recover in 2011, the house price followed around a year later, and the region’s Gross Regional Product (GRP) started to accelerate in a few years later; For Perth, the growth of passenger movements stopped in 2012, and the house price started to fall at around the same time, and the region’s GRP followed to decline a few years later.

The two cities show that the airport passenger movements can be an early indicator of the local economic activity. The correlation between the airport passenger movements and house price makes us believe that if a city is becoming more attractive in business and tourism, its liveability and attractiveness as a residing destination would be increasing as well. And vice versa.

Housing finance commitment trends

Availability Level: State

Frequency: Monthly

As an economic indicator, housing finance is measured by the value of owner-occupier housing finance commitment. The more thriving an economy, the more confident people are taking housing finance, and the higher housing finance commitment value.

We still use NSW, SA and TAS as examples. The value of owner-occupier loan commitments trend and the house price trend basically correspond to each other with around 6-12month lag. The house prices tend to grow faster when the owner-occupier loan values increase / at a high level; and house prices tend to grow slowly while the owner-occupier loan values are supressed.

In a nutshell, one can tell how a region’s economy is performing by reading the indicators such as the above six. These indicators form part of InvestorKit’s property market analysis process, along with other market indicators such as demographic features, building approval counts, price pressure, rental pressure, etc.

Our latest Whitepaper has identified 5 affordable (<$650k) but performing NSW regions using the combination of economic indicators and market data. Check it out!

By going through the six economic indicators, we just want to show that as long as the local economy is performing, every market is worth investors’ attention, not only the big cities. However, due to the length and depth of this blog, we cannot explore all the factors that have impacts on an economy – retail spending, equipment investment, commodity prices, AUD exchange rates, government policies of different levels, customer confidence survey/index, demographics, international student numbers, to name a few. The InvestorKit team will keep exploring different factors that impact the economy and property markets.

If you would like to know more about identifying performing markets with in-depth analysis, simply book a FREE no-obligation45-minutes consultation with InvestorKit Team now and let’s see what we can do for you!

.svg)