Stamp Duty Concession Victoria

The stamp duty change is good news for home buyers who are okay with off-the-plan and strata-title properties. However, are they the best choice for investors?

Stamp duty is undoubtedly expensive – easily tens of thousands of dollars, so it’s always good to save on it. If you’re a Melburnian who is already planning to buy a new apartment or townhouse as your home, why not take advantage of this concession?

But before doing that, you must fully understand the advantages and disadvantages of off-the-plan properties under strata titles.

👍 Convenience, Affordability, and Brand-new Home

Off-the-plan developments, especially apartments, are typically in the inner-city area and well-serviced by public transport. The Victorian government has recently announced 50 inner-Melbourne “activity centres” where planning rules will be adjusted to allow higher-density developments, including affluent suburbs like Brighton, Malvern, and Toorak. You can live in these areas without spending millions on a house: Sounds suitable for young couples and downsizers.

Moreover, you can enjoy a brand-new home with shiny appliances and modern amenities.

👎 High Holding Costs, Oversupply, and Uncertainty

However, strata-titled properties, especially apartments, suffer from high holding costs and oversupply risks. At the same time, uncertainty is the biggest disadvantage of off-the-plan properties.

- High strata fees: Strata fees can be high if the apartment building has amenities. Here’s an example I just saw on REA. The annual strata fee of a 2-bedroom apartment at 33 Mackenzie Street, Melbourne, is $5700 per year. It is currently leased for $2825 per month, so the strata fee alone equals 2 months’ rental income.

- Ridiculously high special levies: In the case of major maintenance, special levies can be huge. Just check online forums, and don’t be surprised to see stories like this: An apartment building needed to raise a $2.4m special levy among around 50 units to fix the significant damage caused by floods.

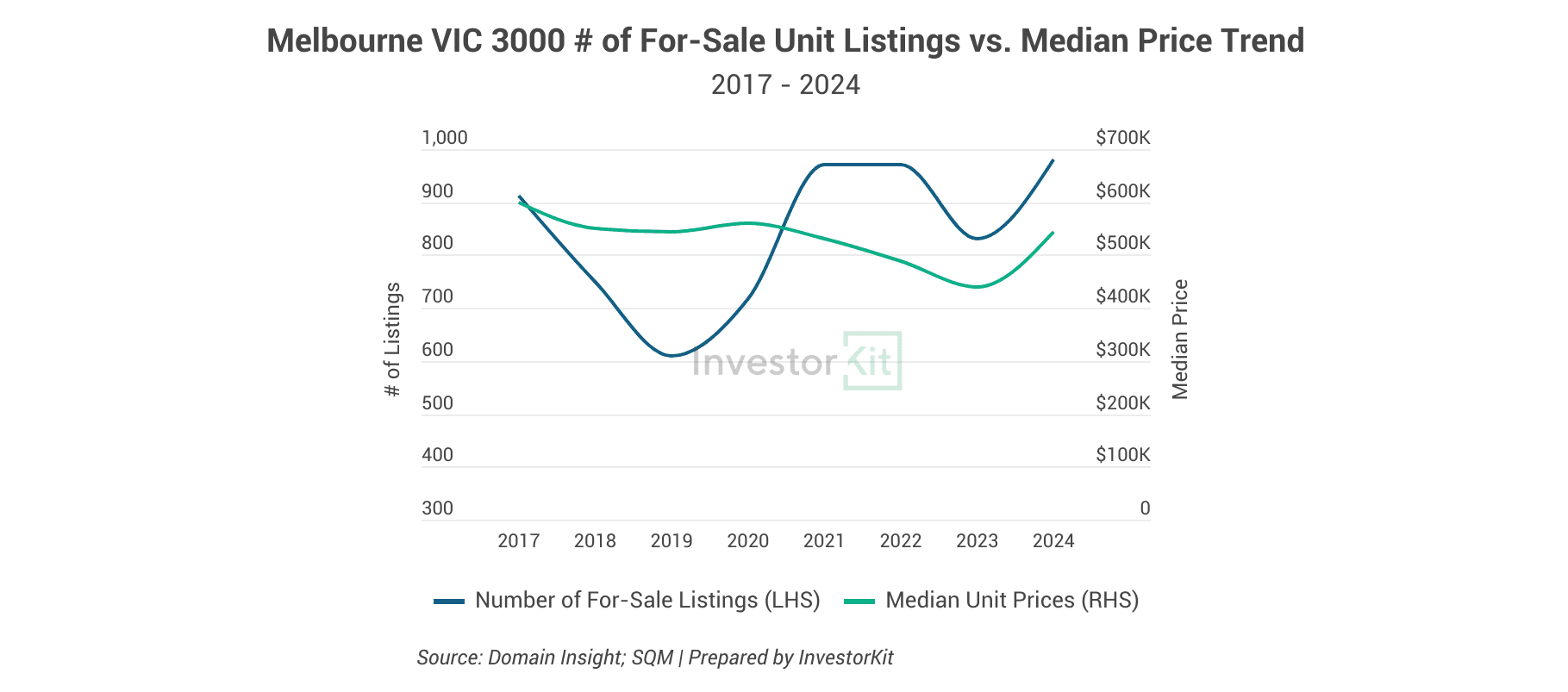

- Oversupply risks: Melbourne’s apartment market is an excellent example of what oversupply can cause to value growth. From 2017 to 2024, Melbourne VIC 3000’s apartment stock for sale increased by 15%. In the meantime, apartment prices declined by -9% (chart below). Townhouses grow better in value than apartments but are still not as good as freestanding houses.

- Uncertainty: Delays are expected in off-the-plan developments due to unpredictable weather conditions, supply chain disruptions, labour shortages, delays in compliance assessment, etc. You never know when the construction will be finished and how the market will be when you settle. For example, in Melbourne 3000 (chart above), if you purchased in 2020 off-the-plan and settled in 2023, you might have to bear a below-price valuation.

* Check these blogs and podcasts out for detailed analyses of apartments and off-the-plan properties:

You Should NEVER Buy A Unit! If You Actually Want To Build Wealth

Is This The Worst Property Choice You Can Make? Don’t Set Your Portfolio Back!

Off-the-plan strata-titled properties are not ideal wealth-building tools due to the above disadvantages. Whilst the concession is attractive to home buyers who emphasise their advantages over disadvantages, investors might want to think twice before rushing into this sector.

The increase in demand for off-the-plan properties may drive prices to grow in the short term. However, how long can the growth last?

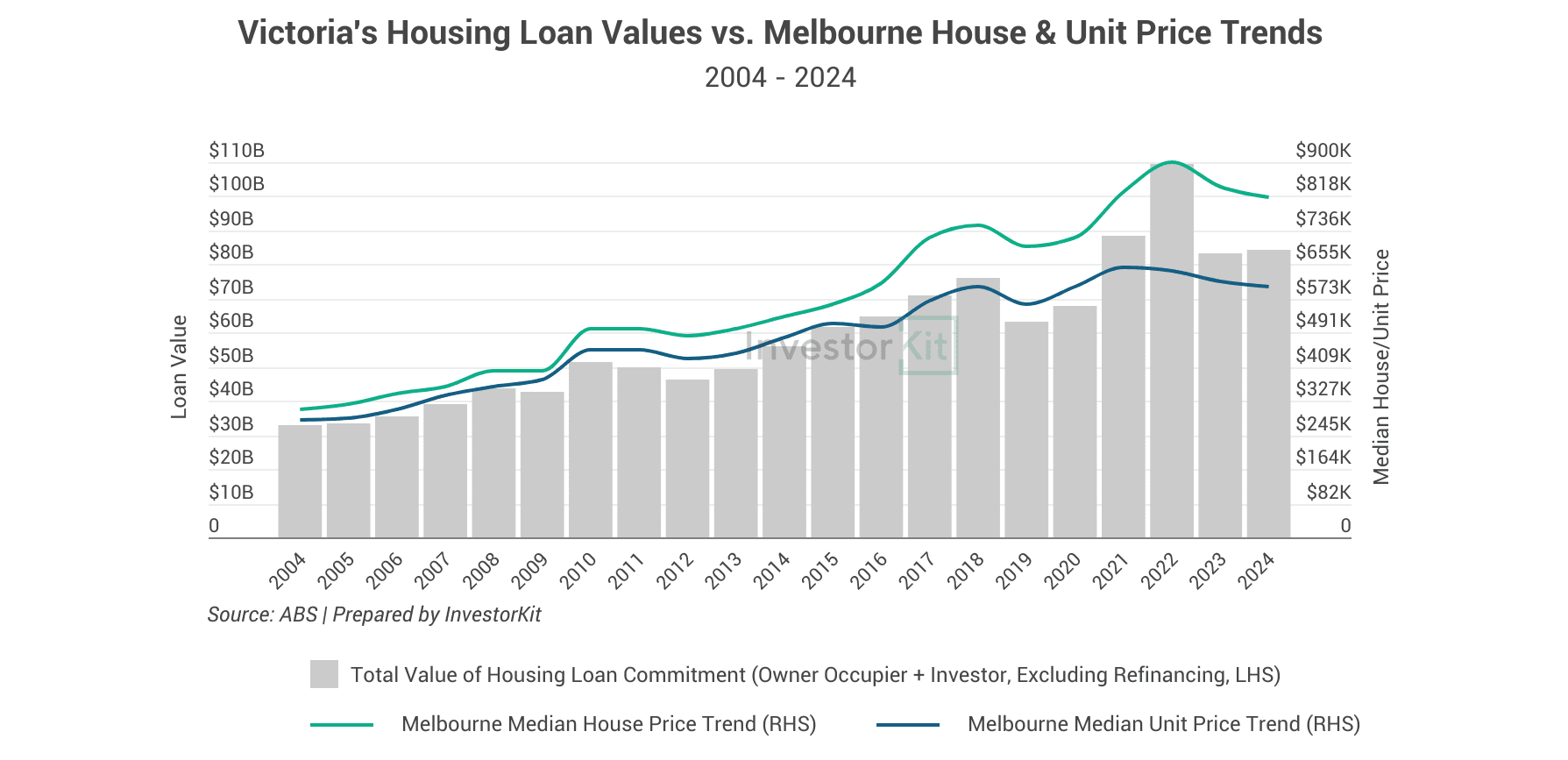

Historical data show a correlation between buyers’ demand and price growth. Below is a Victoria example.

Loan values are a good indicator of buyers’ demand: Higher demand means higher loan numbers and, therefore, higher total value. In the past 20 years, each jump in home loan value has been associated with a notable increase in Melbourne property prices (both houses and units, chart below).

This new stamp duty concession will likely increase the demand for off-the-plan properties in the coming year, and prices, in response to the higher demand, may increase. However, it’s important to note that the current higher demand is leading to higher supply in the future, so in the medium to long term, growth prospects will be compromised.

After all, the purpose of this policy is to increase supply and improve housing affordability, not to increase property values.

What Effect Would These Changes to Stamp Duty Have in Victoria?

Would this stamp duty change boost Victoria’s property market or increase the housing supply effectively? I don’t think so. Here are two reasons.

- Off-the-plan strata-title properties only represent a small portion of the state’s total housing transaction volume.

According to the NSW government, off-the-plan sales (including freestanding houses and strata-title properties) represented 11.5% of all residential sales in FY2016-17, the peak of NSW’s off-the-plan boom. While we can’t find a specific percentage for Victoria now, I would say the off-the-plan sales of strata-title properties wouldn’t make up more than 10% of Melbourne’s total property sales volume, considering the inactivity of developers since the pandemic and suppressed buyers’ demand due to the high interest rates.

By stimulating the demand for less than 10% of the market, it would be hard to make any significant difference in the entire market.

- Financing is not the only barrier for developers to start building.

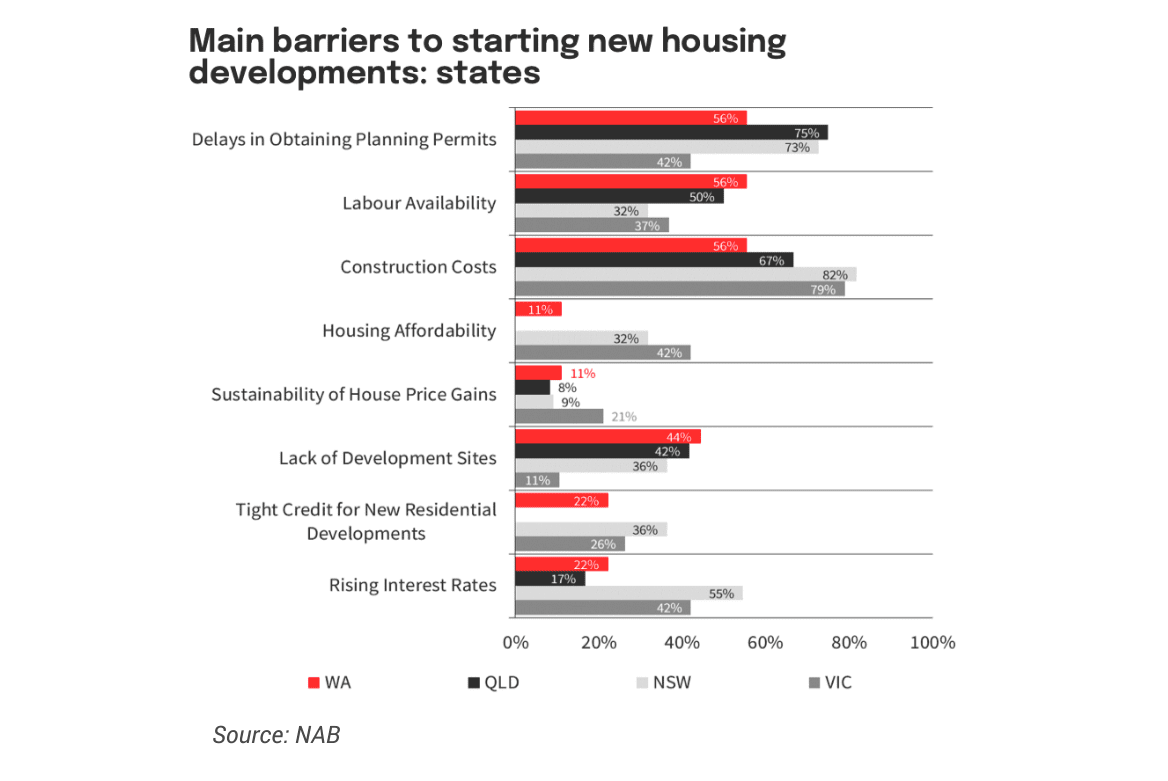

The policy aims to help developers meet lenders’ pre-construction sales requirements faster to get funds and kick-start the construction sooner. However, stricter financing requirements are just one of many factors that make developments unviable.

According to NAB’s latest residential property survey, high construction costs remain the top barrier to starting new housing developments in Victoria (chart below).

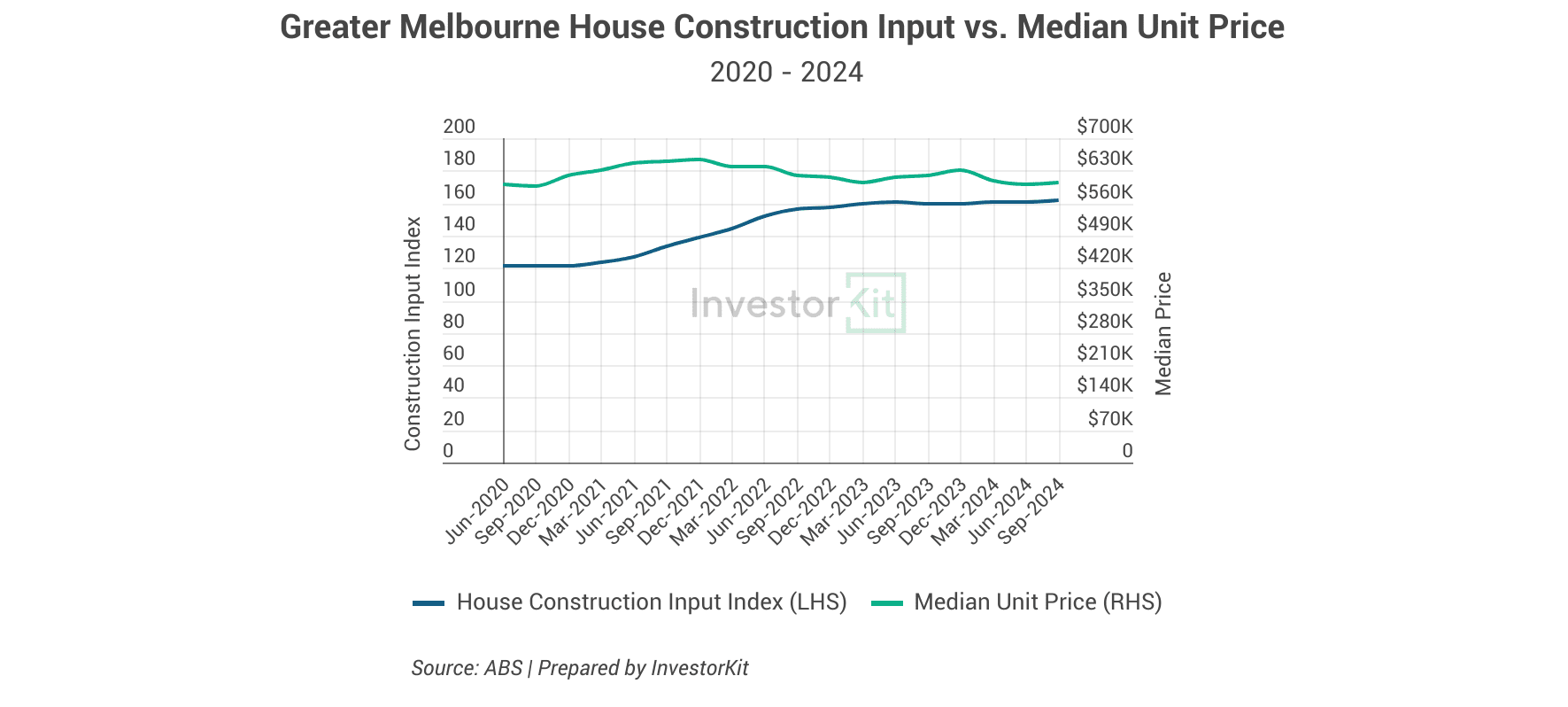

Housing construction costs in Melbourne are now 33% higher than four years ago, while unit prices didn’t change (chart below). The reduced profit margin is the biggest obstacle for many developers, and getting finance faster won’t solve that problem.

Similarly, other main barriers mentioned in the NAB survey, such as delays in obtaining planning permits and rising interest rates, cannot be resolved by a simple stamp duty change.

Therefore, the effectiveness of this concession in increasing housing supply might not be as high as expected.

In summary, Victoria’s stamp duty concession will likely increase the demand for off-the-market strata-title properties and drive their prices up in the short term, but it won’t benefit the owners’ wealth-building in the long term. Besides, its effect will be limited anyway because it only applies to a small portion of the property market and only tackles a fraction of the supply barriers. While some home buyers — especially young couples and downsizers — can happily take advantage of this concession, investors are better off focusing on long-term wealth-building rather than getting swayed by a short-term benefit.

InvestorKit is Australia’s #1 buyer’s agency with a team dedicated to helping Australian property investors make the right decision, based on proven data, to achieve their investment goals faster. Curious to know what and where the InvestorKit team would buy in Victoria and Melbourne? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)