As property investors, we LOVE positive cash flow.

Without having to take cash out of our own pocket to hold a property, we can save faster and achieve a scaled portfolio sooner. Many investors even hold positive cash flow as a strict purchase criterion.

It was easy a few years ago when interest rates were historically low. In fact, “positive cash flow” became hot in that period. However, in the current high-interest-rate environment, it’s become much more difficult to achieve – so much so that being obsessed with positive cash flow could even harm your investment journey.

How could it be possible? In the first part of this blog series, I have presented two potential traps associated with chasing positive cash flow. Today, let’s uncover the final two traps.

Putting down too much deposit

Suppose you’re not buying in a market with really high yields (>6.5%) and still want to enjoy positive cash flow. In that case, you’ll probably put down a larger deposit to reduce your loan amount and, therefore, the monthly repayment.

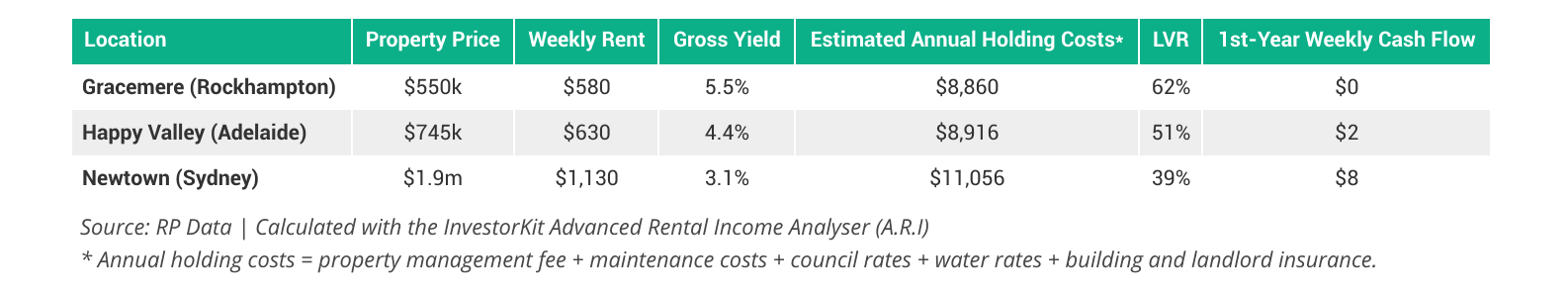

With the help of the Advanced Rental Income Analyser (or “ARI”), InvestorKit’s cashflow calculator, we have estimated the minimum LVR you’ll need in order to achieve positive cashflow in three locations (assuming a 6.25% interest rate and interest-only for the first year). The three locations currently have healthy, moderate, and low yield levels. The estimates are displayed in the table below.

Even in a healthy-yield location like Rockhampton, you must put down more than a 38% deposit to immediately enjoy a positive cash flow.

For a low-yield location like Newtown, an inner-west Sydney suburb, You need a 60%+ deposit, which would be well above $1 million considering the house price level there – Not something we average investors can easily afford.

Even if you had enough savings to afford a high deposit, would that be the best way of using them? Let’s test it with the two scenarios below.

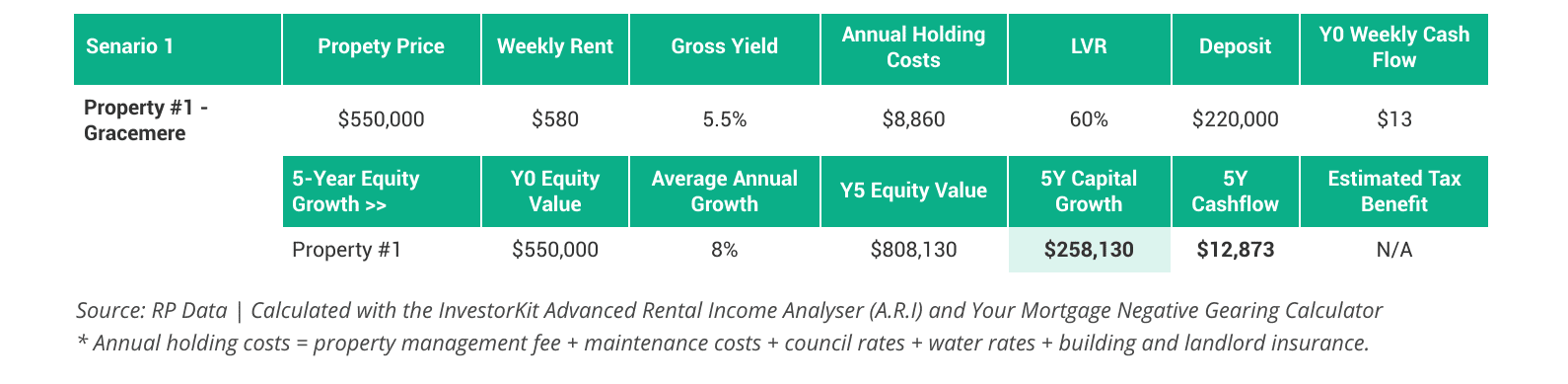

Scenario 1: You buy the Gracemere house mentioned above with a 40% deposit, immediately enjoying a positive cash flow.

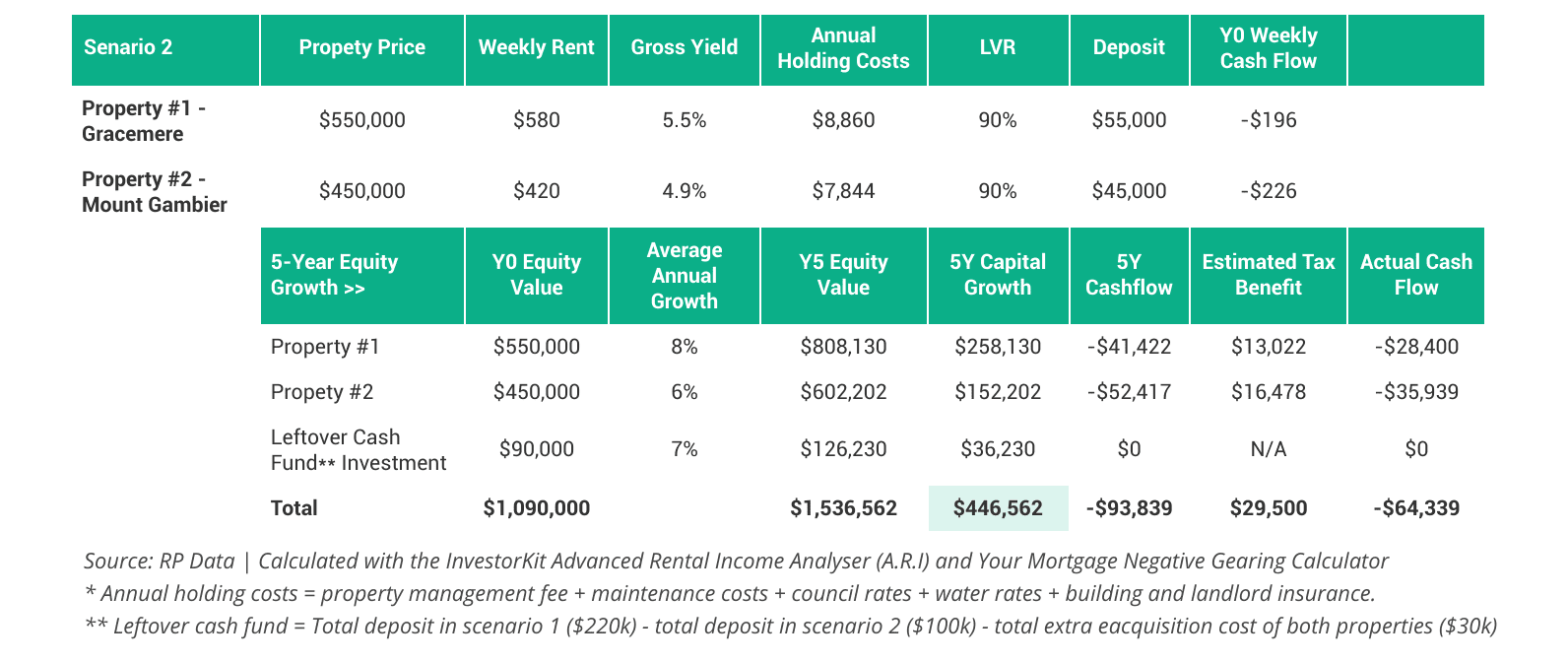

Scenario 2: You buy the Gracemere house with only a 10% deposit. With the rest cash, you buy another house in the South Australian town of Mount Gambier and put what’s left in an ETF (exchange-traded fund).

We’ll compare these two scenarios’ capital growth and cash flow in five years. Below are our key assumptions:

- Gracemere house market average annual growth: 8%;

- Mount Gambier house market average annual growth: 6% (lower than the Gracemere market as it’s now deeper in its growth cycle than Rockhampton);

- ETF average annual growth: 7%;

- ETF doesn’t pay dividends;

- Annual rental growth of all properties: 3%;

- Annual employment income: $120k before tax (for tax benefit calculation).

In scenario 1, the Gracemere house will gain a bit more than $258k in value and circa $13k in cash flow in five years.

In scenario 2, while you’ll lose around $94k in cash flow, you can recover approximately one-third of it through negative gearing. In the meantime, your three investments, in total, will gain around $447k in capital growth.

Comparing the two scenarios: To win $77k in cash flow ($13k+$64k), you’ll lose $189k ($447k-$258k) in capital growth. Which would you choose, scenario 1 or scenario 2?

Also, bear in mind two things.

First, in scenario 2, our assumptions are relatively conservative: we have chosen a less hot market for the second investment property that doesn’t grow as fast as property #1 for growth cycle diversification purposes, and the ETF’s estimated annual growth rate is towards the lower end of ETFs’ average growth over the past decade. By choosing a different market for property #2 and investing in a better-performing ETF, you could achieve even higher capital growth than what we see in scenario 2.

Second, the faster you build a scaled portfolio, the more compound growth you’ll enjoy. In scenario 1, by spending so much cash on one property, you need quite a few more years to save for depositing your second property, significantly stretching your portfolio-building timeline. Whilst in scenario 2, you have immediately achieved two properties at the beginning, and with $90k cash left and higher capital growth, you can get a third and fourth, and even more, much sooner – The time you need to build a scaled portfolio will be considerably shortened.

Moving away from what works

What works in Australia is long-term holding. Buying and holding established houses has been proven a simple yet effective strategy for many, thanks to the country’s steady housing demand increase and low supply.

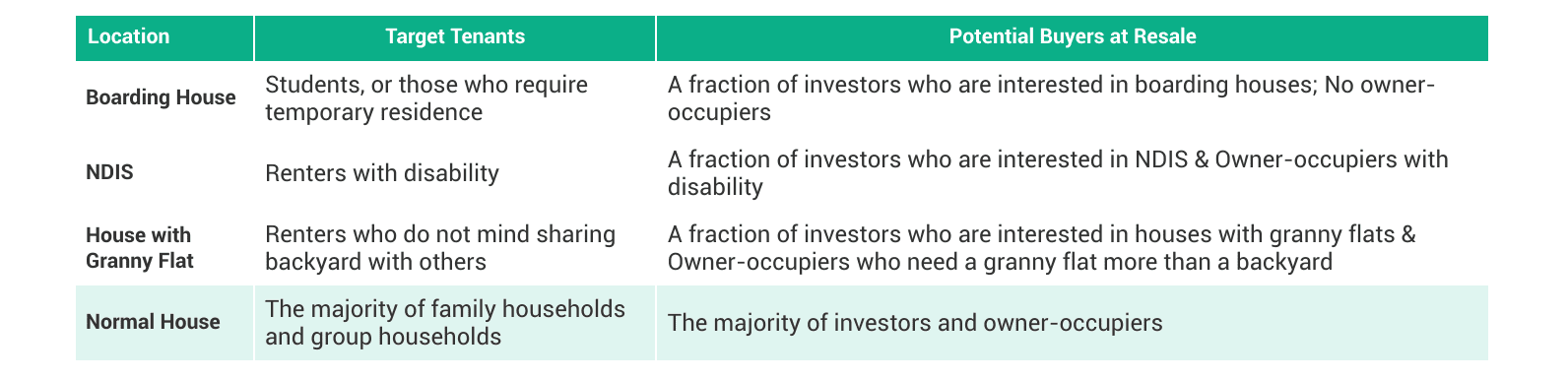

However, in pursuit of positive cashflow, inexperienced investors may go to “shiny objects”, for example, Boarding houses, NDIS (National Disability Insurance Scheme), or homes with granny flats, which usually could double a normal house’s rental yield.

However, they forget how niche those markets are.

As investors, we want to ensure our investments are always easy to lease and resell, meaning we want high demand. However, none of those mentioned above would receive as high demand as normal houses would in both the rental and sales market (table below).

With a smaller tenant pool in renting and buyer pool in reselling, you may suffer from longer vacancy periods and higher sale days on market. Moreover, the money spent on transforming a property, eg. creating boarding rooms and their facilities, adding accessibility facilities, and building granny flats, may not increase the property’s value to the same scale.

Therefore, while going to “shiny objects” can theoretically increase your rental yield, it won’t make the best investment in the long run when considering rentability, resellability, and capital growth.

We have gone through the four potential traps you may fall into in pursuing positive cash flow in a high interest rate environment.

- Chasing the wrong type of assets

- Limiting your market options

- Putting down too much deposit

- Moving away from what works

What do they have in common? They all feed on short-sighted decisions. When you have a clear wealth-building plan and a focus on long-term benefits, these traps won’t trip you up at all.

So, if you can handle the cash flow negatives, here are some bonuses.

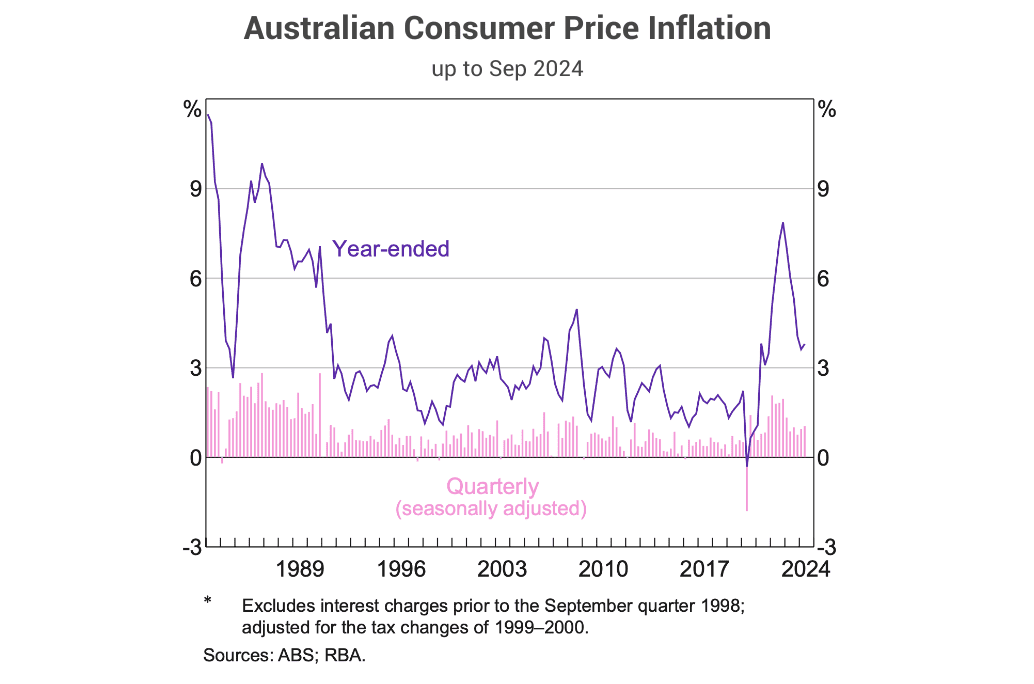

First, interest rate cycles will likely change. Interest rates in Australia do not always stay high. With inflation going down (chart below) and many other factors showing a weakening economy, it’s likely that the interest rate is coming down in the coming year.

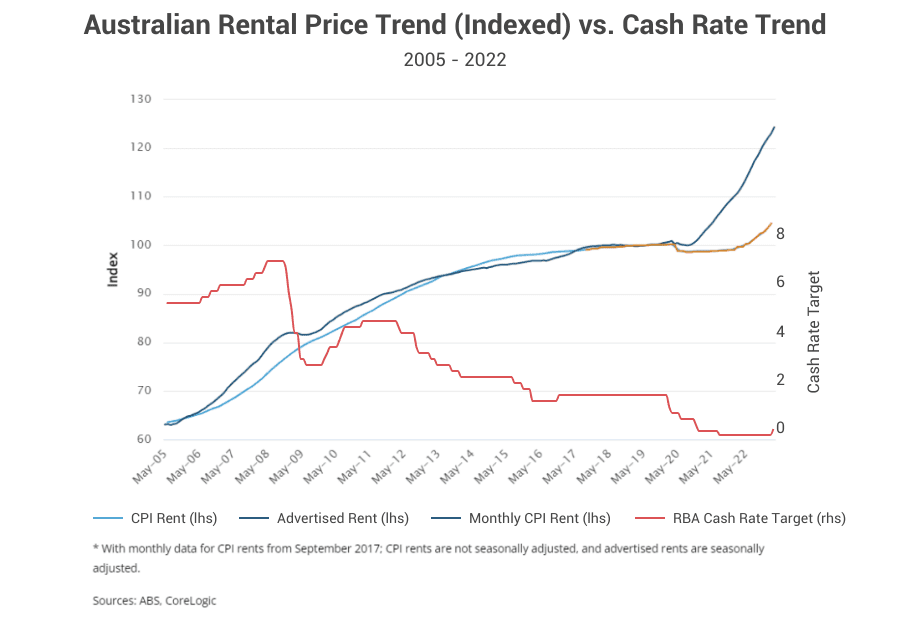

And second, rents continue growing no matter how the interest rate changes (chart below), constantly improving investors’ yield-on-purchase level.

Knowing the above, you’ll be in a position to choose the right asset, have more access to choice, and use more leverage to spread across properties and quickly build a scaled portfolio. As interest rates come down and rents go up at the same time, suddenly, your current “moderate” yield will soon become “healthy” or even “high”, and your cash flow will be a much nicer picture.

In summary, be a long-term investor. Do not just chase high yield or positive cash flow for the moment, because if you go through that way, you might be just on the sidelines in 2022-2024 (potentially even in 2025) during the high interest rate time. Instead, if you’re a savvy investor like InvestorKit investors, you’d know this is just temporary time, having purchased multiple properties using leverage to get ahead while using buffers and adjusted saving strategies to manage cash flow for the short term. Would like to be an InvestorKit investor? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)