As Australia’s housing affordability worsens, off-the-plan properties have become an increasingly popular option for both home buyers and investors, especially in major cities such as Sydney, Melbourne, and Brisbane.

One of the key selling points of off-plan real estate is a “better” purchasing price, either through early bird promotions or because of the idea of “buying at the current value, settling at the future value”, assuming the value grows over the construction period. Other benefits of off-plan property investment, such as longer settlement timeframes for financial preparation, the ability to personalise the dream home, stamp duty concessions and tax deduction through negative gearing, sound appealing, too.

However, InvestorKit, as Australia’s No.1 investment property buyer agency, NEVER recommends our clients off-plan property investment.

Why not?

In this blog, we’ll reveal three pitfalls that come with off-the-plan properties. They are:

- Valuation Shortfall

- Delays in Construction

- Uncertainty in Demographics Data

1. Valuation Shortfall

The first risk of buying off-the-plan is: Valuation Shortdall.

Let us explain.

When buying an investment property off-the-plans, you’re not paying for the property’s current value; you’re paying for the developer and builder’s margins, sales agents’ commissions, marketing campaigns, premiums for future market value, incentive costs, and more. That is fine if the market continues to grow as the developer expects during construction. However, markets don’t always grow. In a declining market, you may face valuation shortfalls, which could cause trouble.

Let’s look at a Sydney example here. It’s an apartment complex project in North Ryde. The developer sold hundreds of apartments off-the-plan from November 2016 to early 2020 (settlement). Most of those sold in 2016-18 were extremely expensive since that’s the height of Sydney’s apartment market boom. In early 2020, when the project finally settled, about 84% of all bank valuations were below the sales price. The on-price 16% were sold with lower prices in 2019-20 when Sydney’s apartment market almost bottomed out.

Many buyers who didn’t have enough cash to make up for the valuation shortfall ended up letting go of the deal, losing their deposits. A purchase that was supposed to save money turned out to be a costly mistake.

2. Delays in Construction

How long will it take to finish a development project? The answer is uncertain, as the expected completion date is just an estimated number. Possible delays can occur anytime due to inclement weather, shortage of construction materials, shipment issues, authority approvals, and other unforeseen circumstances.

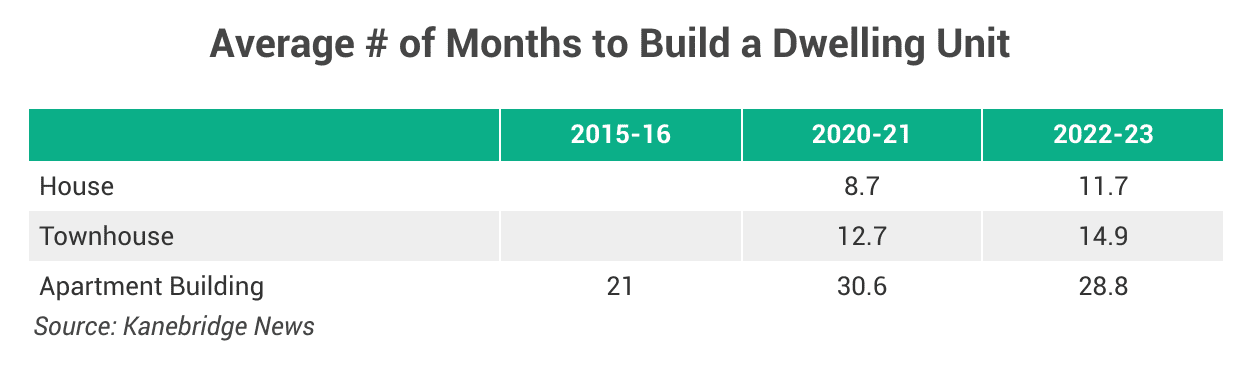

The table below shows the average number of months to complete a development project for three property types: houses, townhouses, and apartments from 2015 to 2023.

Construction time increased by 34% for houses and 17% for townhouses from 2020 and 2023. The reasons behind the delays include the global supply chain disruption and other local conditions during the COVID-19 years. The figure for apartment constructions decreased slightly, but it was still much higher than the 2015/16 level.

What’s the matter with construction delays? Well, the consequences may range from annoying to frustrating.

- If it’s your first home, you would need to extend your current lease for… how many months? The developer can’t tell!

- If it’s your investment property, and the settlement is delayed to late December… You know what I’m saying, right? That’s the worst time for a property to be listed for lease, not to mention you’re competing with tens, if not hundreds, of other new properties! Be prepared for a more extended vacancy period and a lower rental price for the first year.

- In a worst-case scenario, the market declined during the construction delay. Your home loan valuation could have come on price if settling on time but would be under price at the actual settlement time. How frustrating is that?

Here’s another Sydney example of how construction delays have affected home buyers and investors. A skyscraper apartment building in Sydney CBD commenced its off-the-plan sales in 2013. The construction was planned to be completed around 2017/18, but the actual completion was in 2021 (even after the initial sunset date). Home buyers had to wait another three years to move into their new homes, and investors’ portfolio-building journey was delayed by three years. The retail shop investors were the most unfortunate. Their shops were settled in mid-2021, and they couldn’t find a tenant until 2023 due to the pandemic’s impact on Sydney CBD.

Moreover, two years is a long time. Lots can happen during the long gap between the exchange of contracts and settlement: You may have changed your job and don’t need to live in that area any more; the economy may not do well and affect your income; The property market may decline when the construction is completed… There are many unknowns, and as a result, they become your potential risks of buying off-the-plan.

3. Uncertainty in Demographics Data

Last on our list of buying off-the-plan cons is the uncertainty in Demographics data.

Demographics are not absolute determining factors of price growth, but their impacts can still be significant, especially for new areas with changeable data on demographics.

When a region is established, demographics are constant and will only revolve slowly over time, so you know, with confidence, where you are buying in (in terms of demographics), who your potential tenants and their preferences are, etc.

On the flip side, if a region is new, its demographics are still developing, so you would have less confidence in how the community will be in the future, who your tenant group will be, how their preferences will be (depending on their age, household size, household type, etc.), how many for-rent properties will be competing with you, etc.

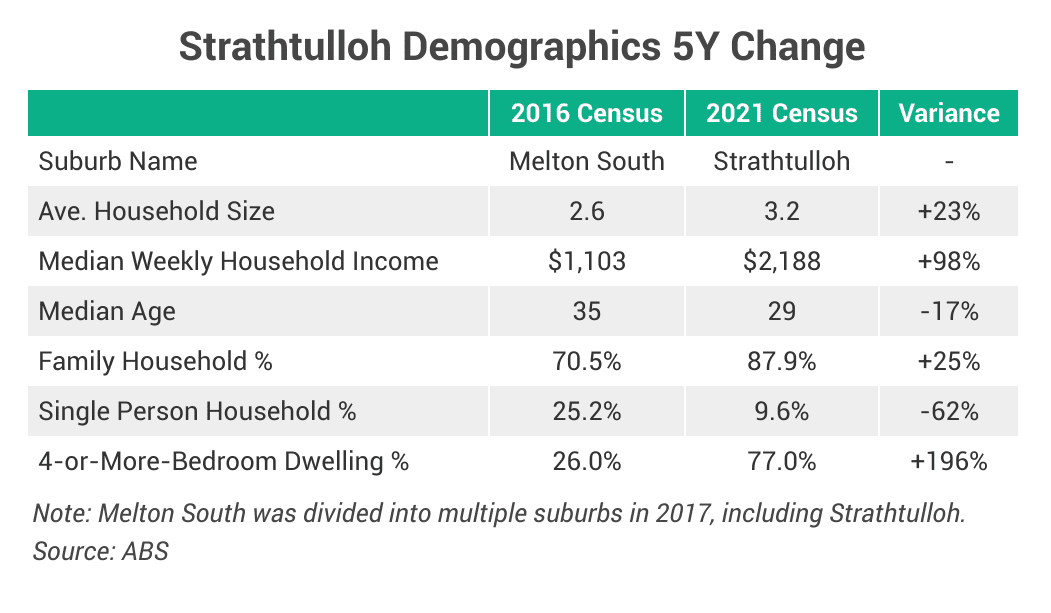

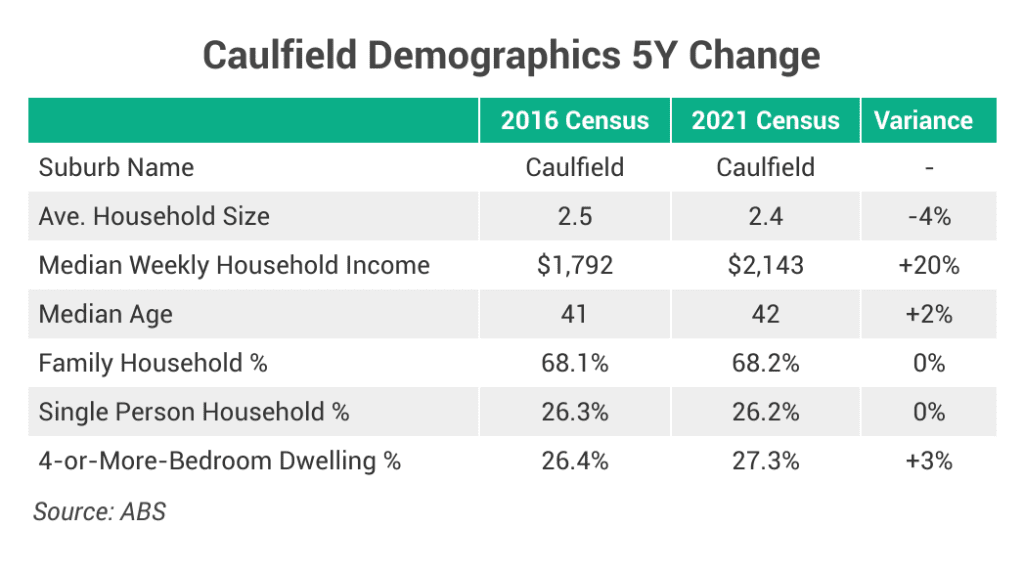

Hard to picture? Check how the demographics of the two suburbs below have evolved over the five years between the two censuses.

- Strathtulloh – a new suburb in Melton.

- Caulfield – a 40-year-old suburb in Glen Eira.

Between 2016 and 2021, the Strathtulloh area experienced significant changes in all listed metrics. In contrast, Caulfield didn’t see many changes, except the median weekly household income, which aligned with Melbourne’s average growth during that period.

Imagining yourself ready to invest in Melbourne, which suburb would give you more confidence in the sense of demographic stability?

Besides more controllable demographics, established suburbs have also demonstrated better short to medium-term growth than new regions due to their more controllable housing supply.

Below are two examples:

- Jimboomba vs. The Hills District (Greater Brisbane)

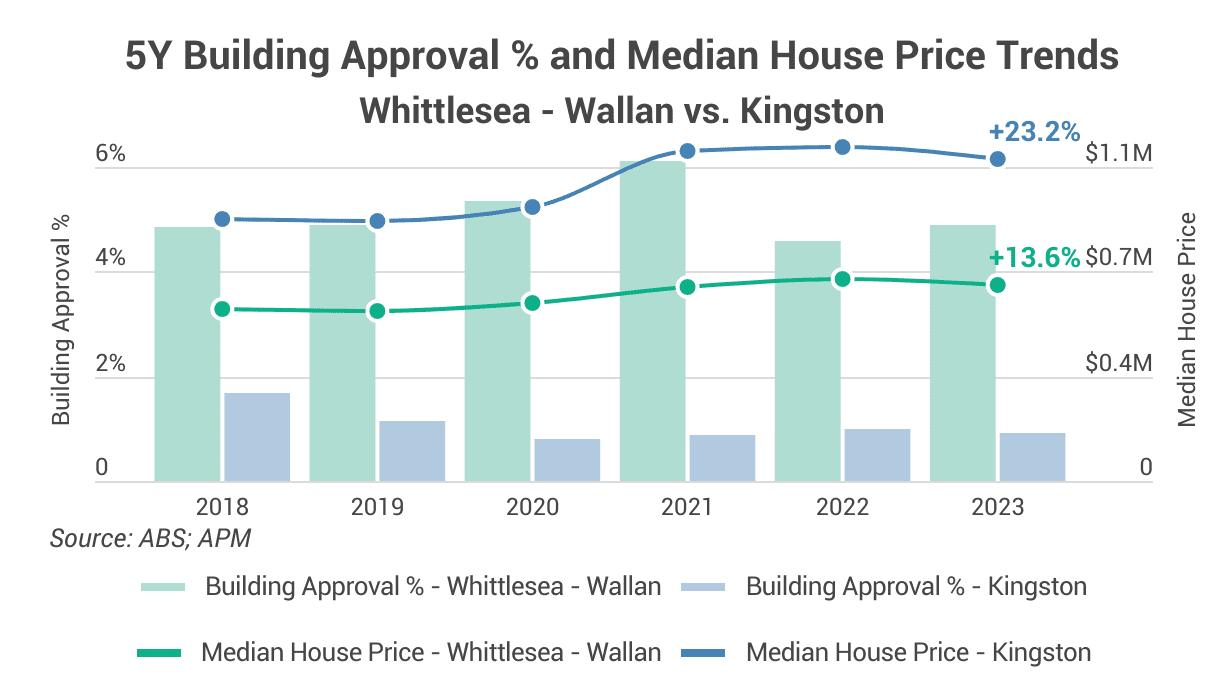

- Whittlesea – Wallan vs. Kingston (Greater Melbourne)

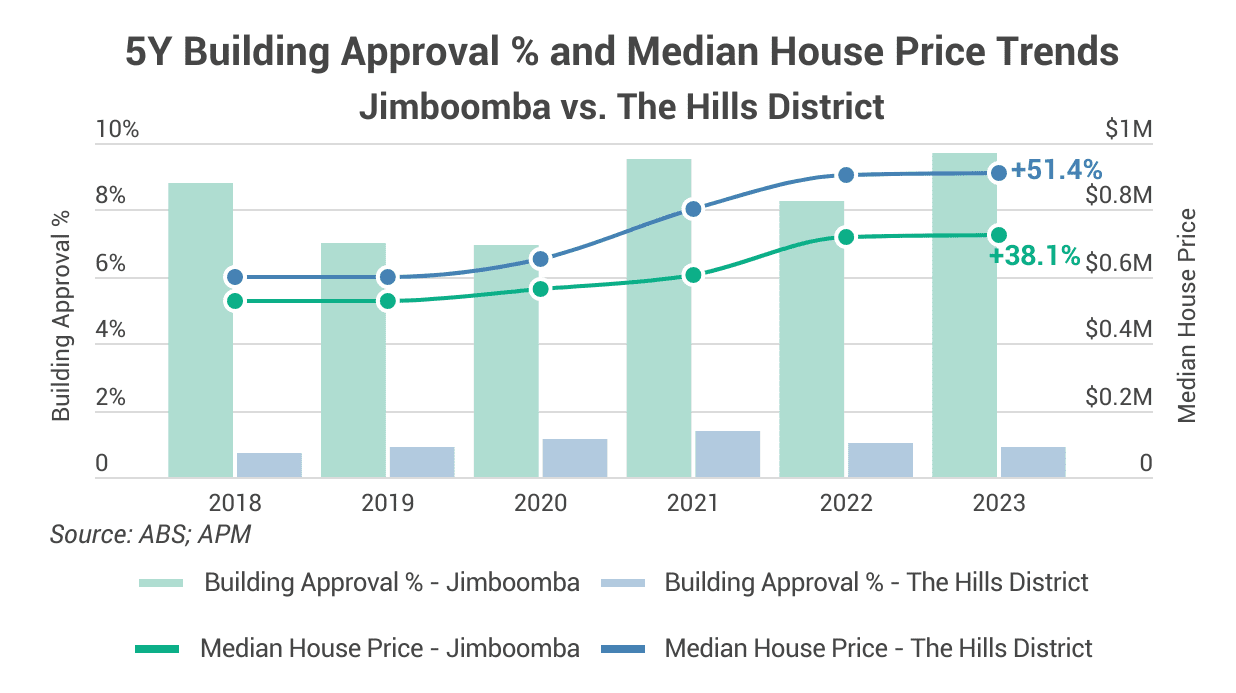

Jimboomba vs. The Hills District

In this pair, Jimboomba is the new region. Look at how high its building approval rate is compared to The Hills District!

In the five years from 2018 to 2023, the Hills District had a solid growth of 51.4%, while Jimboomba had grown by 38.1%.

Whittlesea – Wallan vs. Kington

In Greater Melbourne, Whittlesea – Wallan is the new region, while Kingston is the well-established one. Like the Brisbane pair, the 5-year growth in Kingston was higher than that of Whittlesea – Wallan.

It’s worth noticing that the better performance of the two established areas above was not solely because of the low building approval rates. Our study shows that building approval rates do not correlate with performance, especially in the long term. Many other factors have their say on property market performance, too, such as affordability, economic strength, job market activity, lifestyle preference, etc. It’s essential not to examine building approval in isolation but together with all other key influencers.

Looking back at the three risks of buying off-the-plan properties, you must have noticed they have one thing in common:

They are all uncontrollable.

- Valuation shortfall: the future market value is uncontrollable;

- Construction delays: extreme weather, supply chain disruptions, and other exogenous factors are uncontrollable;

- Uncertainty in demographics data: how the area’s demographics will evolve is not controllable.

Back to the question we started with: Why doesn’t InvestorKit recommend investing in off-plan real estate? They have too many uncontrollable factors and, therefore, less certainty in performance.

So, if you’re considering an off-plan property investment, take a moment to understand housing market predictions and ask yourself these questions first:

- Are the “benefits” offered by the off-the-plan property enough to outweigh the risks of time loss and valuation shortfall, as well as all opportunity costs?

- Do you prefer purchasing based on solid data analysis or gambling on a new area under development without enough data support?

- If you’re after high performance, will you achieve it with or without the risks that uncontrollable factors would bring?

If you’re uncertain about any of these, discuss them with an experienced property consultant.

Conclusion

Off-the-plan is just one of the traps that would hunt more than benefit you on your property investment journey. The InvestorKit buyers agency team dedicates itself to helping property investors avoid every possible trap to achieve their goals faster.

Would you like to understand more about increasing your chance of success?

Chat with us by clicking here and requesting your 15-minute FREE no-obligation discovery call!

Acknowledgement:

This blog was drafted by Grace Nguyen, our Research Analyst.

.svg)