Sunshine Coast: The biggest regional migration winner

“White sand beaches and pristine waterways sit alongside lush rainforests and Heritage-listed national parks, with charming historic villages sprinkled throughout” – Tourism Australia describes Sunshine Coast. No wonder it has become one of the most popular holiday destinations for Australians and the top destination for internal migrants. According to the Regional Movers Index Q2 2024 Report (by CBA – Regional Australia Institute), Sunshine Coast has seen the highest net internal migration over the past year, sharing 14% of the country’s total, and much higher than the 2nd-place city, Greater Geelong (8%). While the city’s population and migration trends have been robust in the past year, its property market isn’t as strong as its neighbours, Brisbane and Gold Coast.

Where is Sunshine Coast going for the rest of 2024? Join us today to explore the city’s current property market conditions and outlook!

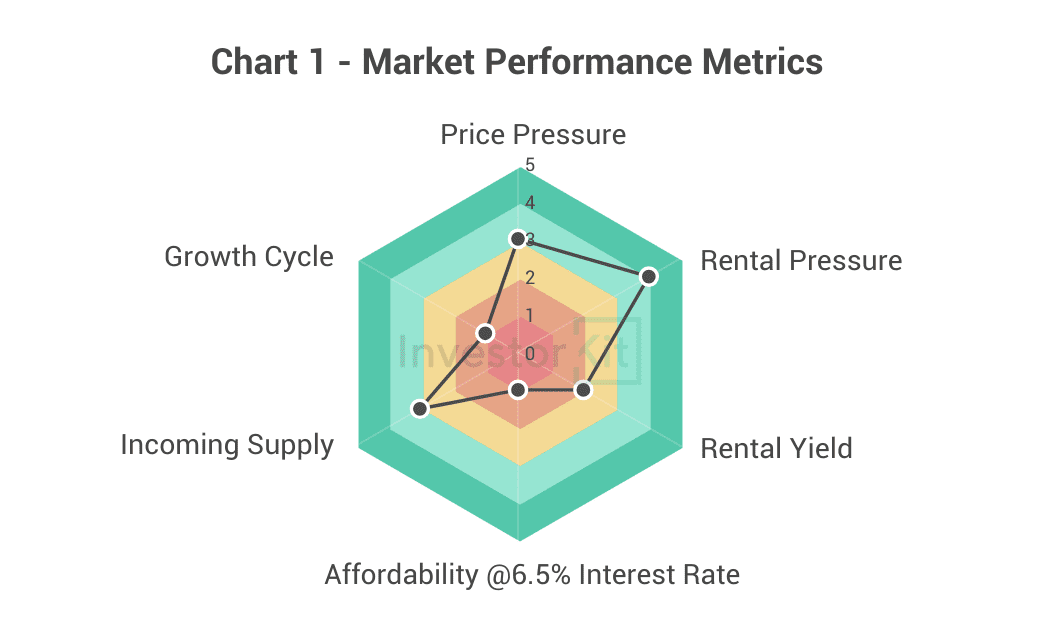

As of July 2024, Sunshine Coast’s House Market Pressure is still balanced while moving towards high.

Among the six metrics InvestorKit uses to measure market performance, Sunshine Coast performs moderately in price pressure, rental pressure and incoming supply while scoring low/relatively low in affordability, growth cycle, and rental yield.

Demographic & Economic Trends

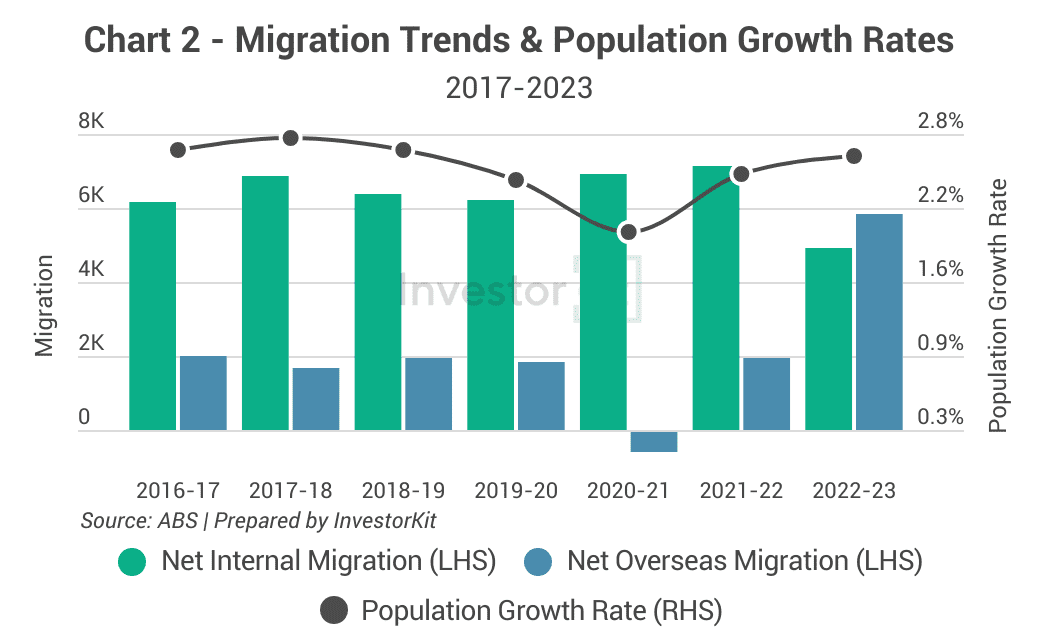

Sunshine Coast’s population has been surging for years. Before the pandemic, its high population growth was primarily driven by internal migration, but after the pandemic, internal migration has declined slightly while net overseas migration has caught up, becoming the main driver of population growth.

While net internal migration has shrunk, Sunshine Coast is still the largest regional city (LGA) in terms of the number of net internal migrants. In the 12 months to March 2024, Sunshine Coast’s net inflow of internal migration represented 16% of the total net number of internal migrants, which is almost 1 in 6!

The high and still increasing population growth will likely boost Sunshine Coast’s housing demand in the coming years.

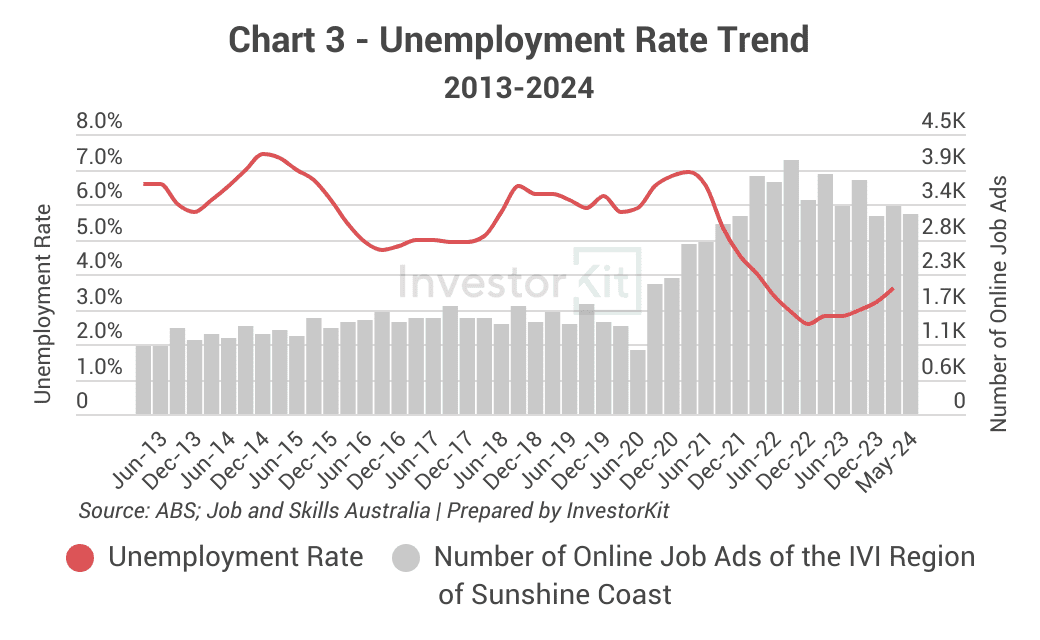

While the unemployment rate in Sunshine Coast is gradually rising as the RBA cash rate remains high, it is still at a low level of 3.6%, well within the lowest range in over a decade.

At the same time, the number of job vacancies has gradually declined since the cash rate started rising. However, it is still approximately double the past 10-year average.

Both indicators show that Sunshine Coast’s job market is at the most active point in history and that the local economy is thriving, providing the property market with a healthy foundation for future growth.

Sales Market Trends

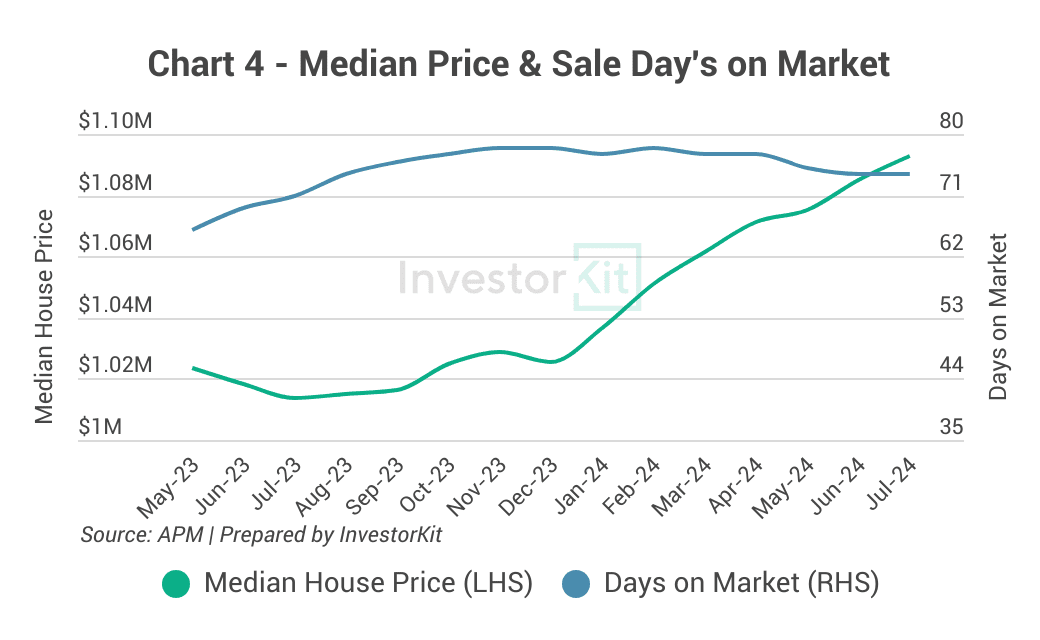

Backed by the high population growth and thriving economy, Sunshine Coast’s house market has been recovering from the post-COVID decline since mid-2023:

- The rise in sale days on market (DoM) slowed down noticeably in Aug 2023 and stopped at the end of the year, and there has been a slight declining trend in recent months.

- House prices started bouncing from the bottom in Aug 2023 as well. Now the median house price, is 7.8% higher than a year ago.

However, the recovery wasn’t as robust as that of its Southeast Queensland neighbours. Brisbane’s median house price is 12.2% higher than a year ago, and the Gold Coast saw an average of 9.4% growth across all sub-regions. Why is that? The following charts may provide some explanations.

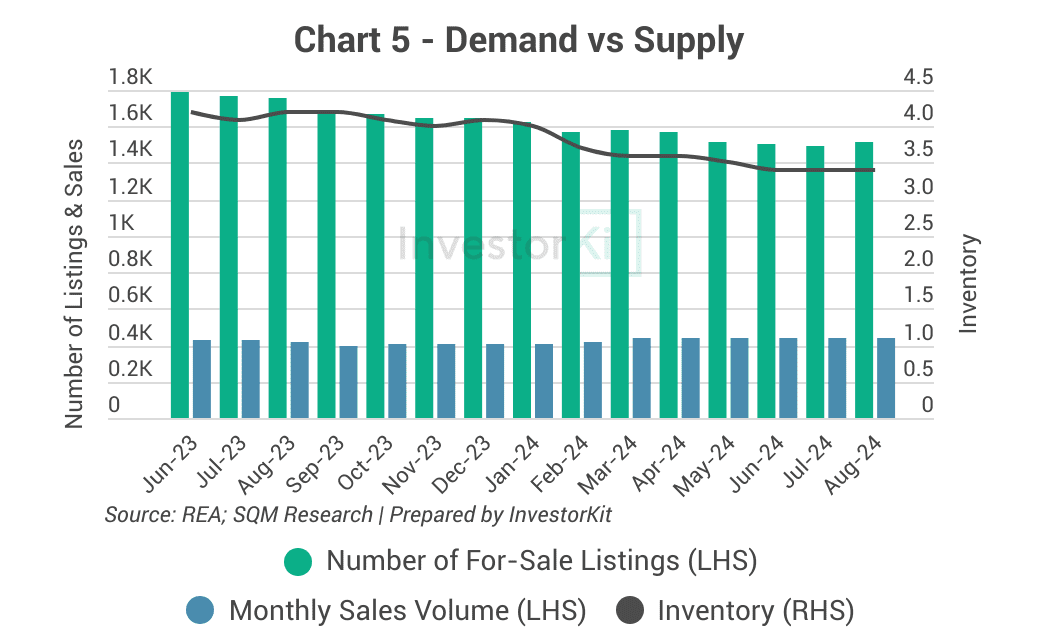

The first possible reason lies in the supply level – Sunshine Coast has more housing supply than Brisbane or Gold Coast. The inventory level reached 4+ months of stock in 2023 (in some sub-regions, even 6+), while Brisbane and Gold Coast have always remained 3 or under, well below the 3-4 balanced threshold.

But the good news is that Sunshine Coast’s inventory level has declined from 4+ to a much more balanced 3.4 months of stock. As the supply level continues decreasing relative to demand, we expect the market pressure to rise and lead to higher growth in the coming year.

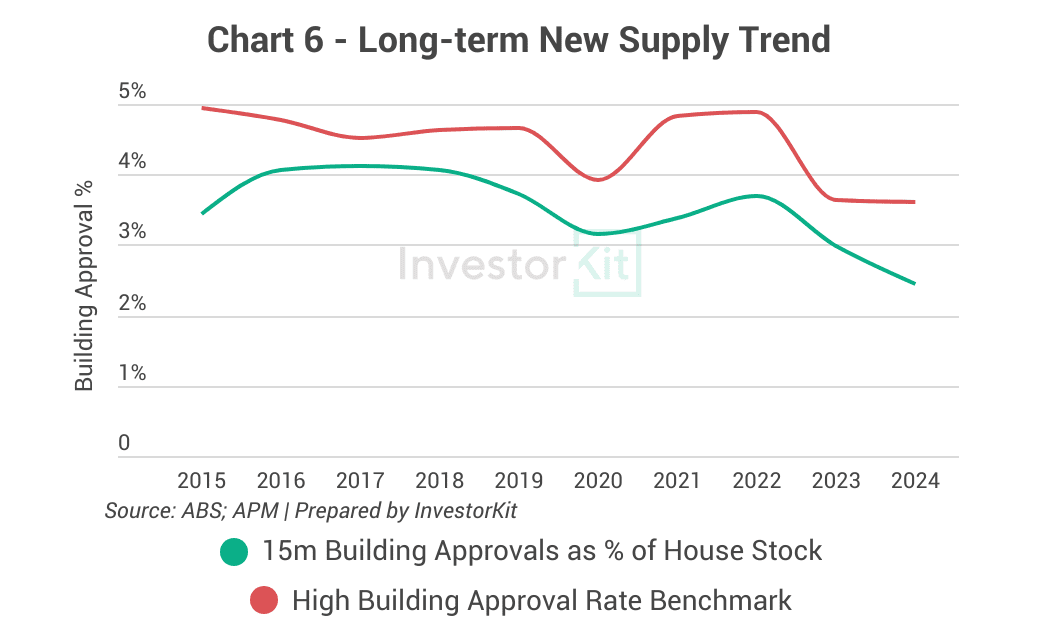

As a relatively new city, Sunshine Coast has more incoming supply than its two neighbours. Sunshine Coast’s average building approval percentage (= the percentage share of new house building approvals in 15 months in the entire house stock) over the past 10 years is 3.51%, compared to Brisbane’s 2.43% and Gold Coast’s 2.38%. The relative abundance of new house supply could be one reason why the Sunshine Coast’s inventory level is higher.

However, the number of houses being constructed has also been declining in recent years. Currently, Sunshine Coast’s building approval percentage is 2.4%, a reasonably balanced level. As housing demand continues to be boosted by migration and new supply decreases, Sunshine Coast’s market pressure is set to increase in the coming 1-2 years.

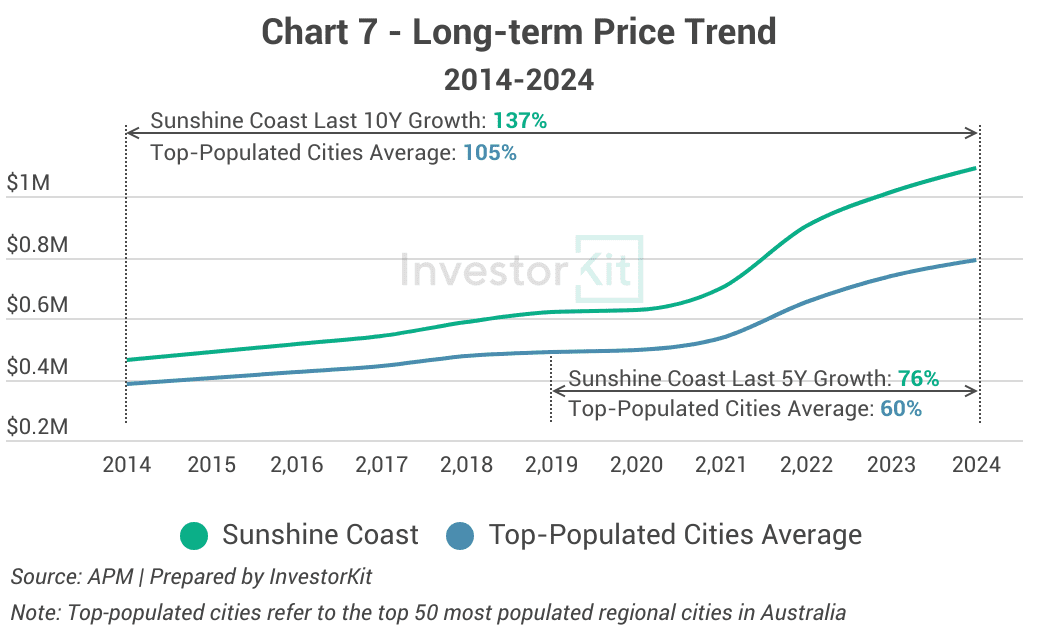

Another possible reason for Sunshine Coast’s slower growth is the market cycle. Sunshine Coast’s house prices increased by 137% in the past 10 years and by 76% in the past 5 years, higher than its long-term average as well as the average of the biggest regional cities. This, combined with its worsening affordability, has likely limited Sunshine Coast’s price growth, and will probably continue doing so in the coming year while interest rates remain high.

Rental Market Trends

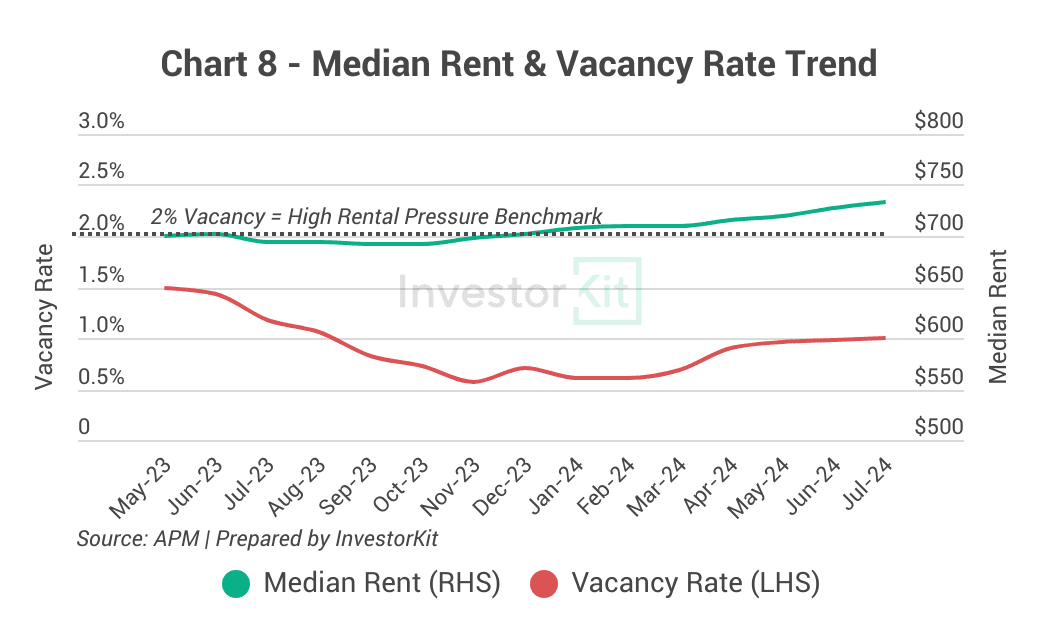

Sunshine Coast’s median rental price briefly declined in 2023 as the vacancy rate spiked. Currently, the vacancy rate is still around a low 1%, indicating relatively high market pressure. Rents increased by a healthy 5.7% over the past year.

It’s worth monitoring the vacancy rate in the coming months. If it continues rising, further rental increases would still be weak, but if it remains at this 1% level or even declines, better rental growth can be expected.

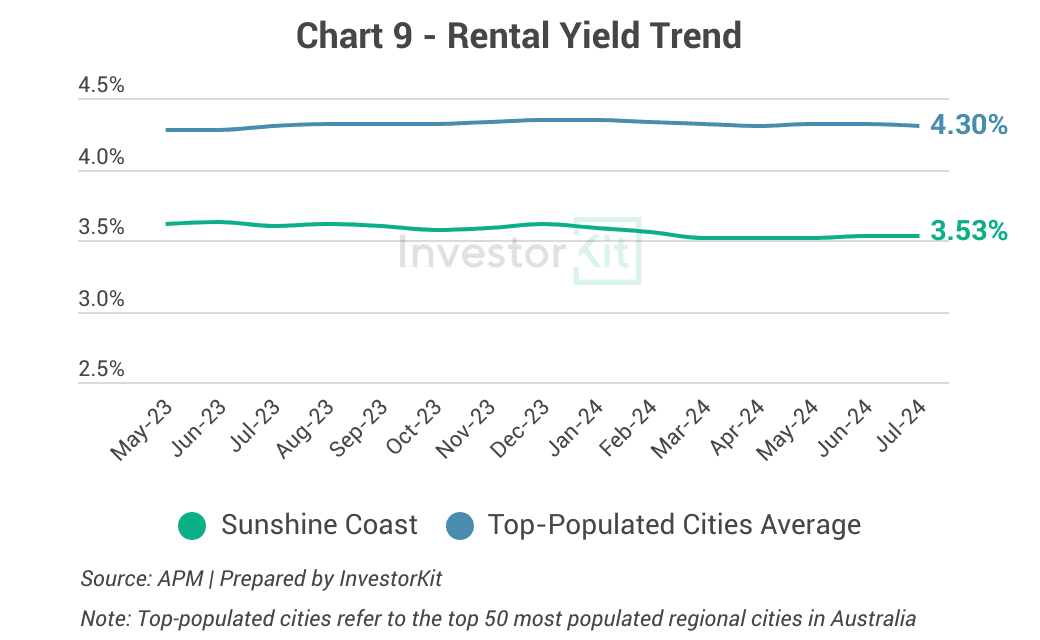

At 3.5%, Sunshine Coast’s rental yield is much lower than the average level of the big regional cities (4.3%) and is not ideal for investors. It is slightly lower than a year ago as rents didn’t grow as much as prices in the past year. In the coming year, as the sales market pressure seems to be rising faster than the rental market pressure, leading to faster price growth than rental growth, rental yields may even go further down.

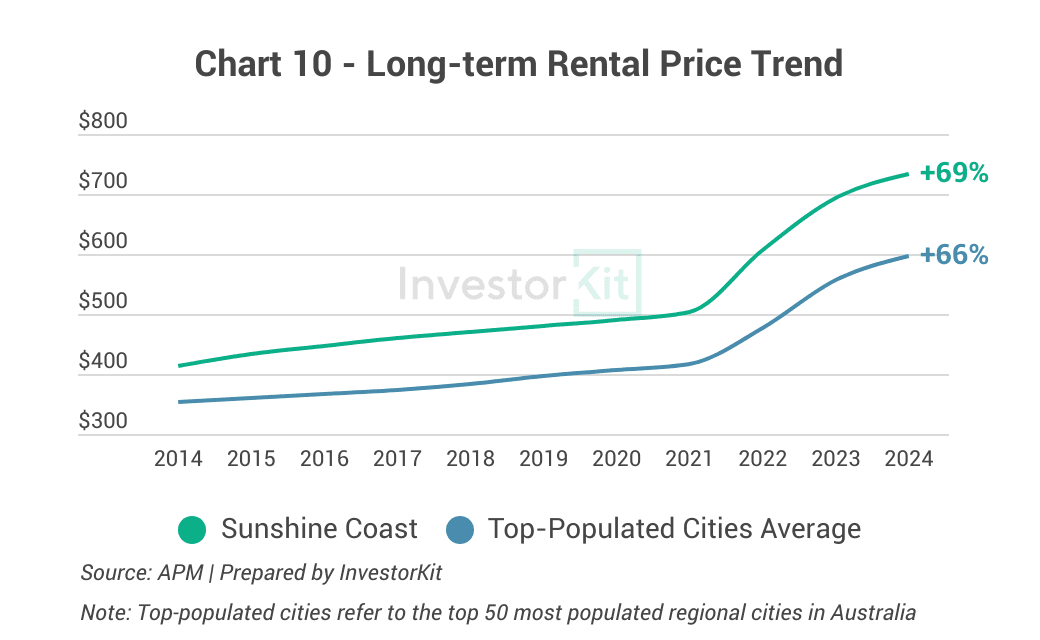

Over the past decade, Sunshine Coast’s rental prices have grown by 69%, in line with the average growth rate of the top-populated regional cities. This allows Sunshine Coast space for further rental growth from an affordability and market cycle perspective, as long as the rental market pressure doesn’t decrease further.

In the next 6-12 months…

Sunshine Coast’s property market is currently under balanced pressure. The sales market pressure shows signs of improvement with declining inventory and days on market, while the rental market is showing signs of pressure relief with increasing vacancy rate. In the coming 6-12 months, we expect Sunshine Coast’s house prices to achieve higher-than-average growth, supported by the increasing market pressure but limited by the low affordability. In the medium term, as both housing demand and supply are expected to remain healthy (fast population growth and a fair amount of new house construction activity), we would expect moderate growth to continue without dramatic decline or surge.

Sunshine Coast is the 4th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)